5 Essential Do's And Don'ts: Succeeding In The Private Credit Market

Table of Contents

Do's for Success in the Private Credit Market

Successfully navigating the private credit market requires a strategic and cautious approach. Here are some crucial "dos" to maximize your chances of success:

Thoroughly Due Diligence: Understanding Your Investments

Due diligence is paramount in private credit investment. Before committing capital, conduct a comprehensive review of the borrower and their financial health. This involves:

- Conducting comprehensive due diligence on borrowers and their financials: Scrutinize financial statements, tax returns, and other relevant documents to assess creditworthiness and identify potential red flags. Utilize financial modeling to project future cash flows and assess repayment capacity.

- Verifying collateral values and assessing potential risks: Independently verify the value of any collateral offered, potentially engaging professional appraisal services for real estate or other complex assets. Analyze potential risks, including interest rate risk, default risk, and market risk.

- Utilizing professional valuation services when necessary: For complex assets or situations, engaging experienced professionals to provide independent valuations ensures accuracy and reduces potential bias.

Effective due diligence in private credit investment is crucial for mitigating risk and making informed decisions. Thorough borrower analysis and collateral valuation are vital components of a robust due diligence process.

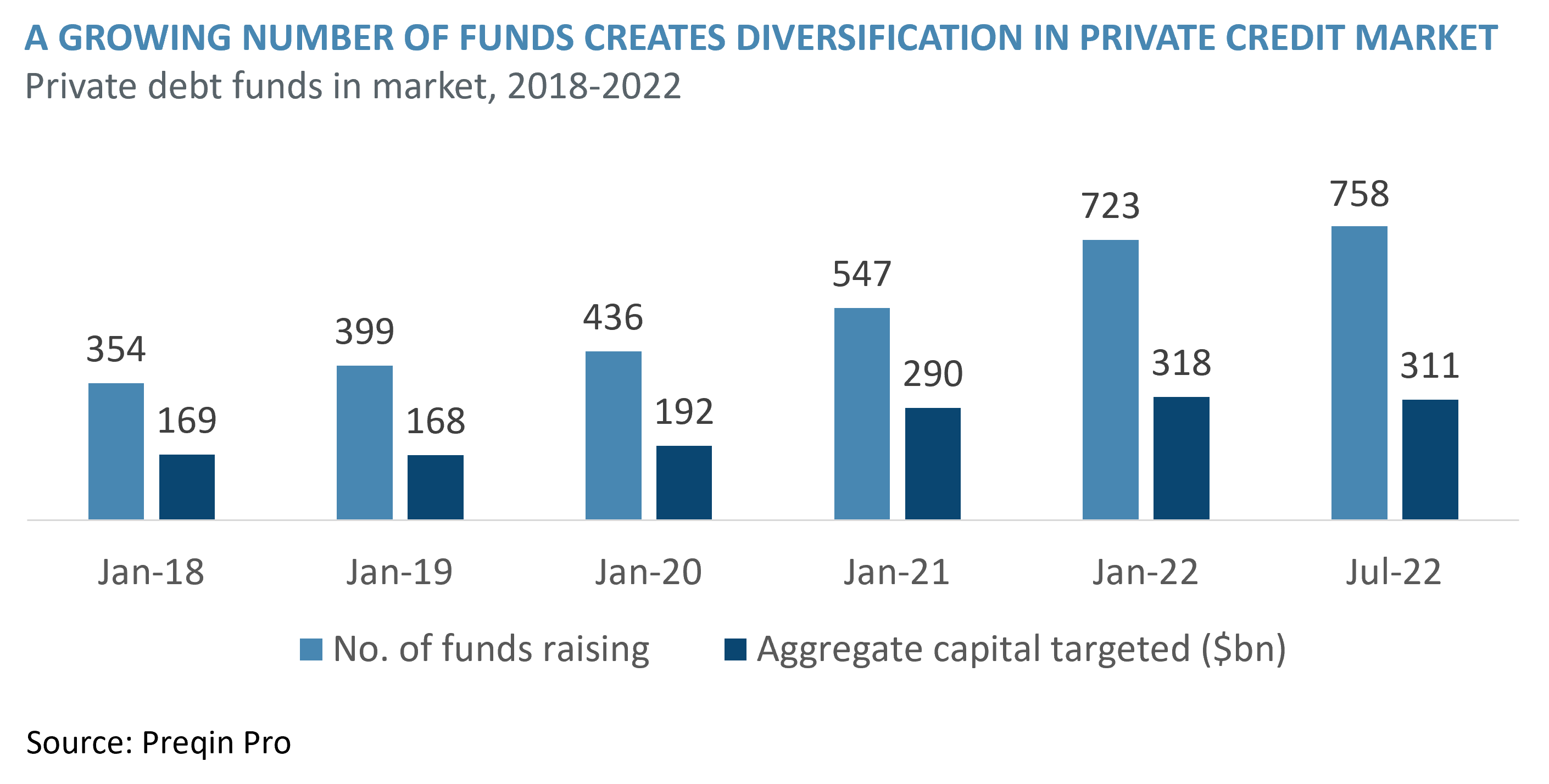

Diversify Your Private Credit Portfolio

Diversification is a cornerstone of risk management in any investment strategy, and the private credit market is no exception. Effective portfolio diversification involves:

- Spreading investments across various sectors, geographies, and borrower types: Don't put all your eggs in one basket. Diversify your private debt investments across different industries, geographical locations, and types of borrowers to reduce exposure to sector-specific downturns or regional economic shocks.

- Avoiding over-concentration in any single asset or borrower: Limit your exposure to any single borrower or investment to avoid catastrophic losses should that specific investment fail.

- Considering different private credit strategies (e.g., direct lending, fund investing): Explore various investment strategies to achieve optimal diversification and risk management within your private credit portfolio.

Proper asset allocation and risk mitigation are key to building a resilient private credit portfolio.

Build Strong Relationships with Borrowers and Sponsors

Strong relationships are critical for success in the private credit market. This involves:

- Fostering open communication and trust with borrowers: Maintain regular communication, demonstrating a willingness to understand their business challenges and support their growth.

- Networking within the private credit industry to expand opportunities: Attend industry events, build connections with other investors and lenders, and leverage your network to identify promising investment opportunities.

- Understanding the borrower's business model and future plans: A deep understanding of the borrower's operations, market position, and long-term strategy is essential for assessing risk and making informed investment decisions.

Developing strong relationships within the private credit industry can significantly enhance your investment opportunities and success.

Secure Legal and Tax Expertise

Navigating the legal and regulatory complexities of private credit investments requires expert guidance.

- Engage experienced legal counsel to review all documentation: Ensure all loan agreements, security documents, and other relevant paperwork are thoroughly reviewed by experienced legal professionals specializing in private credit transactions.

- Consult tax professionals to optimize your tax strategy: Understand the tax implications of private credit investments and work with tax advisors to develop a tax-efficient strategy.

- Understand the tax implications of private credit investments: Different structures and jurisdictions have varying tax treatments, so it's crucial to understand these implications before investing.

Effective legal and tax planning is essential for compliance and maximizing returns in the private credit market.

Employ Sophisticated Risk Management Techniques

Robust risk management is crucial in the private credit market. This requires:

- Regularly monitoring your investments and assessing risk factors: Establish a system for regularly tracking your investments, monitoring key metrics, and assessing emerging risks.

- Developing contingency plans for adverse events: Prepare for potential scenarios such as borrower defaults or economic downturns. Having contingency plans in place minimizes the impact of unexpected events.

- Utilizing robust credit scoring and modeling techniques: Employ advanced credit scoring and financial modeling to assess borrower creditworthiness and predict potential defaults.

Proactive risk management is critical for long-term success in the private credit market.

Don'ts for Success in the Private Credit Market

Avoiding certain pitfalls is as important as following best practices. Here are key "don'ts" to keep in mind:

Avoid Unsecured or Undercollateralized Loans

Prioritize loans with sufficient collateral to mitigate potential losses. Unsecured loans carry significantly higher risk.

Neglect Thorough Market Research

Conduct thorough market research to identify promising investment opportunities and understand the competitive landscape before making any investment decisions. Stay informed on market trends and economic forecasts to make well-informed choices.

Overlook Legal and Regulatory Compliance

Ensure compliance with all relevant legal and regulatory requirements. Ignoring this can lead to substantial penalties and legal issues.

Ignore Professional Advice

Rely on the expertise of seasoned professionals in finance, law, and taxation. Don't solely rely on your own judgment, especially in complex situations.

Underestimate Liquidity Risks

Private credit investments can be illiquid. Factor this into your investment strategy and diversify to manage liquidity risk.

Conclusion: Mastering the Private Credit Market

Successfully navigating the private credit market requires a balanced approach. By diligently following the "dos"—thorough due diligence, portfolio diversification, cultivating strong borrower relationships, securing legal and tax expertise, and employing sophisticated risk management—and avoiding the "don'ts," investors can significantly increase their chances of success. Ready to navigate the complexities of the private credit market successfully? Start by implementing these dos and don’ts today. Learn more about private credit investing strategies and resources [link to relevant resource].

Featured Posts

-

Navigating The China Market The Challenges Faced By Bmw Porsche And Others

Apr 26, 2025

Navigating The China Market The Challenges Faced By Bmw Porsche And Others

Apr 26, 2025 -

The Ripple Effect A Rural School 2700 Miles From Dc And Trumps Presidency

Apr 26, 2025

The Ripple Effect A Rural School 2700 Miles From Dc And Trumps Presidency

Apr 26, 2025 -

American Battleground Confronting The Worlds Richest Man

Apr 26, 2025

American Battleground Confronting The Worlds Richest Man

Apr 26, 2025 -

Ray Epps Sues Fox News For Defamation Over Jan 6 Coverage Key Details

Apr 26, 2025

Ray Epps Sues Fox News For Defamation Over Jan 6 Coverage Key Details

Apr 26, 2025 -

Trump Casts Doubt On Ukraines Nato Aspiration

Apr 26, 2025

Trump Casts Doubt On Ukraines Nato Aspiration

Apr 26, 2025