Analysis Of Musk's X: Debt Sale Impacts And Corporate Changes

Table of Contents

The Impact of X's Debt Sale on Financial Stability

Musk's acquisition of Twitter was heavily leveraged, relying on a substantial debt sale to finance the deal. The scale of this debt burden is a significant factor influencing X's current financial health. While the immediate cash infusion allowed Musk to take control, the long-term consequences are less clear.

The benefits of the debt sale were immediate: it provided the capital necessary for the acquisition and subsequent operational changes. However, the drawbacks are considerable. X now faces a substantial debt repayment schedule, leading to potentially higher interest payments that could strain its cash flow. This increased financial pressure could limit X's ability to invest in product development, marketing, and other crucial areas.

- Specific figures regarding the debt sale: While precise figures are constantly shifting and may not be publicly available in full detail, it's widely reported that the acquisition involved billions of dollars in debt financing.

- Potential impact on X's credit rating: The high debt levels have undoubtedly put pressure on X's credit rating, making it more expensive to secure future financing.

- Analysis of Musk's strategy in securing the debt: Musk likely leveraged his personal wealth and his companies' resources to secure the necessary funding, perhaps taking on more personal risk than typical in such acquisitions.

- Comparison with debt levels of similar companies: Compared to other social media giants, X's debt-to-equity ratio is likely significantly higher, posing a greater financial risk.

Corporate Restructuring and its Effects on X's Operations

Since Musk's takeover, X has undergone a radical corporate restructuring. Mass layoffs, leadership changes, and alterations to organizational structure have fundamentally altered the company's operational landscape. This transformation has had a multifaceted impact on the platform's efficiency, product offerings, and overall performance.

- Key leadership changes and their potential implications: Significant changes in executive leadership have reshaped the company's strategic direction and decision-making processes. The impact of these changes on long-term strategy is still unfolding.

- Impact on product development and innovation: Layoffs and restructuring have potentially hampered product development and innovation, leading to slower feature updates and a potential decline in overall product quality.

- Changes in marketing and communication strategies: The shift in marketing and communication strategies under Musk's leadership has been dramatic, with significant changes in the company's public image and messaging.

- Analysis of employee morale and retention: The rapid changes and mass layoffs have undoubtedly affected employee morale and retention rates, making it more challenging to retain skilled and experienced professionals.

The Strategic Goals Behind Musk's X Transformation

Musk's vision for X extends beyond a simple social media platform. His public statements suggest an ambition to transform X into a "everything app," integrating various functionalities beyond its traditional core. This ambitious goal requires significant changes in infrastructure, operations, and revenue streams.

- Musk's public statements and pronouncements regarding X's future: Musk has repeatedly expressed his desire to create an all-encompassing platform integrating payments, communication, and possibly even more diverse features.

- Analysis of the changes in relation to market competition: Musk's vision is directly competing with established tech giants, and it remains to be seen whether X can successfully gain market share in this hyper-competitive landscape.

- Possible expansion into new markets or revenue streams: The restructuring likely aims to open up new revenue opportunities, potentially through integrated payment systems or other expanded services.

- Examination of Musk's overall business philosophy and its application at X: Musk's approach to business, characterized by rapid innovation and a disruptive mindset, is evident in the drastic changes implemented at X.

Regulatory Scrutiny and Legal Challenges Facing Musk's X

The changes at X have not gone unnoticed by regulators. The company is facing various legal challenges and regulatory scrutiny, primarily focused on issues of content moderation, data privacy, and potential antitrust concerns.

- Specific legal challenges X is currently facing: X is facing potential investigations and lawsuits related to content moderation practices, data security breaches, and other regulatory compliance issues.

- Potential financial consequences of legal outcomes: Adverse legal outcomes could lead to significant financial penalties and further strain X's already precarious financial position.

- Impact of regulatory changes on X's future operations: Future regulatory changes and rulings could significantly impact X's operations, potentially limiting its ability to implement certain features or practices.

- How Musk is responding to these challenges: Musk's response to these challenges has been varied, ranging from defiance to attempts at compliance, the long-term consequences of which remain uncertain.

The Future of Musk's X: Navigating Debt, Change, and Uncertainty

The transformation of Musk's X is far from over. The combination of high debt, a dramatic corporate overhaul, and significant regulatory scrutiny presents a complex and uncertain future for the platform. While Musk's ambitious vision holds potential, the path to realizing it is fraught with challenges. The success or failure of X hinges on the company’s ability to navigate these challenges effectively, improve its financial health, and maintain a balance between innovation and regulatory compliance. The coming months and years will be crucial in determining whether Musk's X can thrive in this rapidly changing digital landscape.

Stay tuned for further analysis of Musk's X as it continues to navigate this period of significant change. Subscribe to our newsletter to receive updates on the latest developments.

Featured Posts

-

Cassidy Hutchinson Memoir Expected Release Date And Jan 6 Details

Apr 28, 2025

Cassidy Hutchinson Memoir Expected Release Date And Jan 6 Details

Apr 28, 2025 -

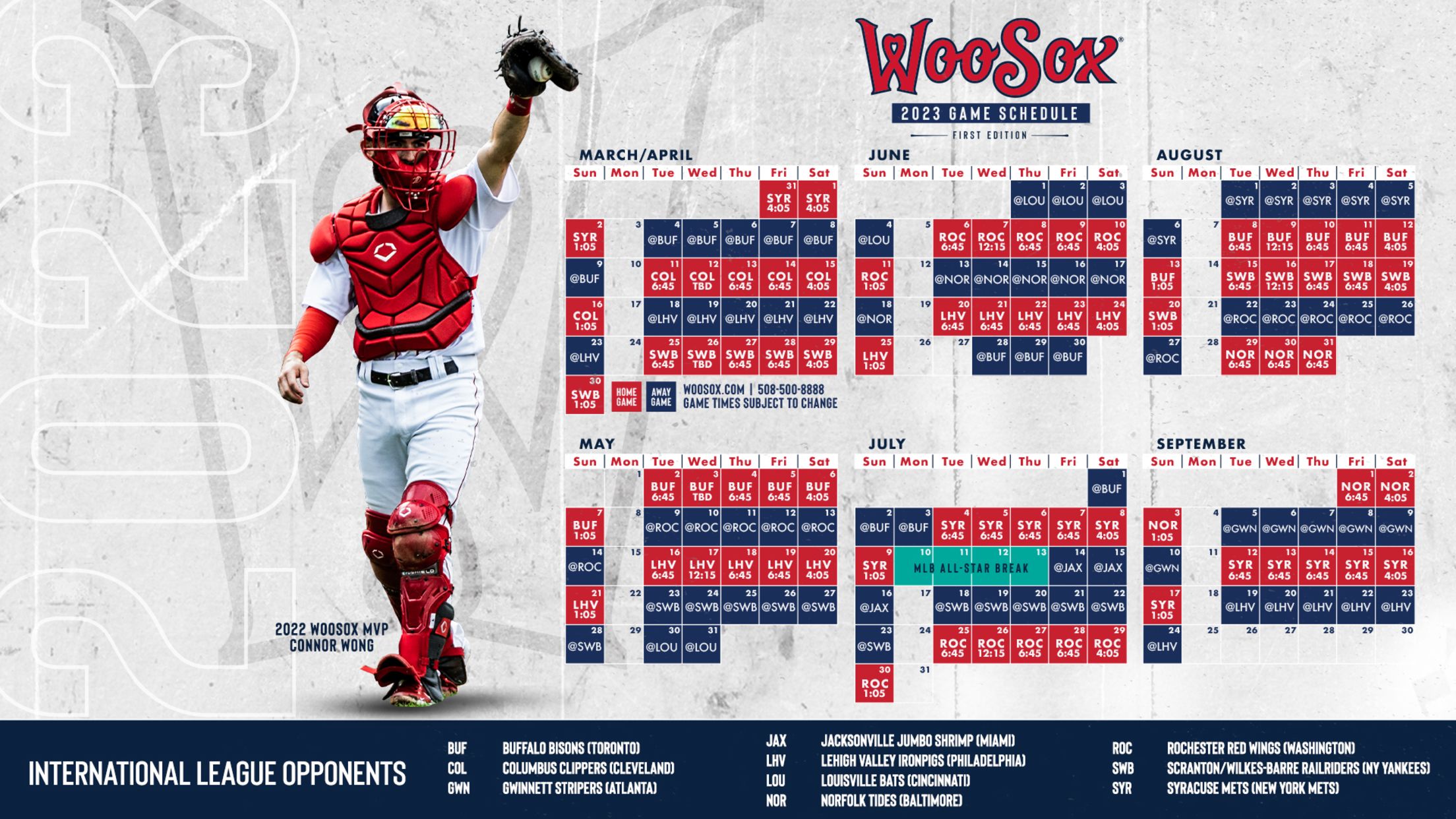

Red Sox 2025 Season Espns Prediction And Analysis

Apr 28, 2025

Red Sox 2025 Season Espns Prediction And Analysis

Apr 28, 2025 -

Federal Charges Millions Stolen Via Office365 Executive Account Compromise

Apr 28, 2025

Federal Charges Millions Stolen Via Office365 Executive Account Compromise

Apr 28, 2025 -

Alex Coras Lineup Choices Red Sox Doubleheader Game 1

Apr 28, 2025

Alex Coras Lineup Choices Red Sox Doubleheader Game 1

Apr 28, 2025 -

Gpu Prices Soar Are We Facing Another Crisis

Apr 28, 2025

Gpu Prices Soar Are We Facing Another Crisis

Apr 28, 2025