Analyzing Market Swings: Professional Vs. Individual Investor Behavior

Table of Contents

Professional Investor Behavior During Market Swings

Professional investors employ a fundamentally different approach to market swings compared to individual investors. Their strategies are rooted in data, rigorous analysis, and a long-term perspective.

Data-Driven Decision Making

Professionals rely heavily on quantitative analysis, utilizing sophisticated models and algorithms to predict and react to market fluctuations. This data-driven approach allows them to make more objective decisions, minimizing the influence of emotions.

- Utilize advanced market indicators: Professionals leverage tools like RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands to identify trends and potential turning points in the market. Understanding these indicators helps them anticipate market swings and adjust their portfolios accordingly.

- Employ fundamental and technical analysis: They combine fundamental analysis (evaluating a company's financial health) with technical analysis (studying price charts and trading volume) to form a comprehensive picture of investment opportunities. This dual approach allows them to identify undervalued assets and navigate market swings more effectively.

- Diversify portfolios across asset classes: Professionals understand the importance of diversification in mitigating risk. They spread investments across various asset classes (stocks, bonds, real estate, commodities) to reduce the impact of negative market swings on their overall portfolio.

- Access to exclusive research and data: Professional investors often have access to proprietary research, exclusive data feeds, and sophisticated analytical tools that are unavailable to individual investors. This information advantage helps them to identify emerging trends and navigate market swings with greater confidence.

Long-Term Perspective and Risk Management

Professional investors typically adopt a long-term investment horizon, viewing short-term market swings as temporary fluctuations in the overall market trend. This perspective allows them to weather short-term volatility without making rash decisions.

- Implement hedging strategies: They utilize hedging strategies, such as options or futures contracts, to protect their portfolios against potential losses during adverse market swings.

- Utilize stop-loss orders and other risk management techniques: Stop-loss orders automatically sell an asset when it reaches a predetermined price, limiting potential losses during sharp downward market swings. Other sophisticated risk management techniques further protect their investments.

- Employ sophisticated portfolio optimization strategies: Professional investors utilize advanced portfolio optimization techniques to maximize returns while minimizing risk, taking into account the potential impact of market swings.

- Focus on value investing: Instead of chasing short-term gains, they often focus on value investing, identifying undervalued assets with long-term growth potential. This strategy helps them to navigate market swings and capitalize on long-term opportunities.

Individual Investor Behavior During Market Swings

Individual investors, lacking the resources and expertise of professionals, often react differently to market swings, frequently leading to less favorable outcomes.

Emotional Decision-Making

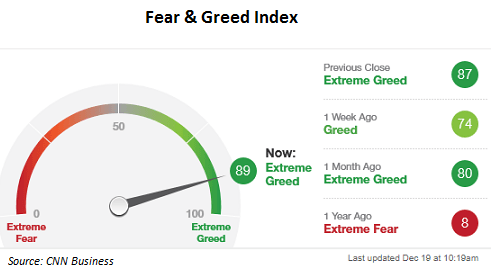

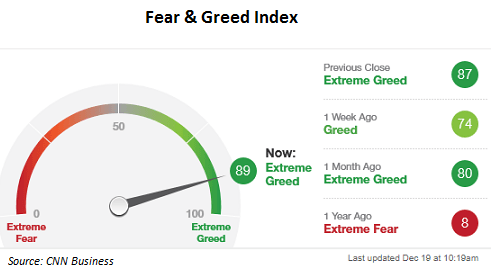

Individual investors are often influenced by emotions like fear and greed, leading to impulsive decisions during market swings. These emotional reactions can significantly impact investment success.

- Prone to panic selling: During market downturns, fear can lead to panic selling, locking in losses at the worst possible time.

- Likely to chase trending stocks: During market upturns, greed can lead investors to chase trending stocks, often buying at inflated prices near the peak of a rally.

- Less likely to diversify portfolios effectively: Individual investors may concentrate their investments in a limited number of assets, increasing their vulnerability to negative market swings.

- Heavily influenced by market sentiment and news headlines: They may react emotionally to short-term market news and sentiment, leading to poor investment decisions.

Shorter-Term Focus and Limited Resources

Individual investors often have shorter investment horizons and limited access to sophisticated tools and information. This can make it challenging to navigate volatile market swings effectively.

- Often lack the experience and expertise: They may lack the experience and expertise to accurately assess risk and make informed decisions during volatile market periods.

- May rely on anecdotal evidence: Instead of conducting thorough research, they may rely on anecdotal evidence or tips from unqualified sources.

- Less likely to engage in in-depth research: They may not have the time or resources to perform in-depth research or due diligence on potential investments.

- May struggle with consistent investment discipline: Maintaining consistent investment discipline during periods of market volatility can be challenging for individual investors.

Key Differences Summarized

| Feature | Professional Investor | Individual Investor |

|---|---|---|

| Decision Making | Data-driven, analytical, objective | Emotionally driven, reactive, subjective |

| Risk Tolerance | Higher, with sophisticated risk management strategies | Lower, often leading to impulsive risk-averse actions |

| Investment Horizon | Long-term | Often short-term |

| Resources | Extensive research, data, and analytical tools | Limited resources and information |

Conclusion

Understanding the differences in how professional and individual investors navigate market swings is essential for improving investment outcomes. Professional investors' data-driven approach, long-term perspective, and sophisticated risk management strategies stand in contrast to the often emotionally driven, short-term focus of many individual investors. By learning from these contrasting behaviors, individual investors can strive to make more rational and informed decisions, mitigating the impact of market swings on their portfolios. To further enhance your understanding of market swings and refine your investment strategy, consider seeking professional financial advice tailored to your individual needs and risk tolerance. Remember, consistent education and disciplined planning are key to successful long-term investment, regardless of the market swings.

Featured Posts

-

Boone On The Yankees Lineup Addressing Aaron Judges Position

Apr 28, 2025

Boone On The Yankees Lineup Addressing Aaron Judges Position

Apr 28, 2025 -

Bubba Wallaces Inspiring Visit To Austin Teens Before Cota

Apr 28, 2025

Bubba Wallaces Inspiring Visit To Austin Teens Before Cota

Apr 28, 2025 -

Michael Jordans Denny Hamlin Endorsement You Boo Him That Makes Him Better

Apr 28, 2025

Michael Jordans Denny Hamlin Endorsement You Boo Him That Makes Him Better

Apr 28, 2025 -

Data Breach Settlement T Mobile Pays 16 Million For Three Year Lapses

Apr 28, 2025

Data Breach Settlement T Mobile Pays 16 Million For Three Year Lapses

Apr 28, 2025 -

Exploring The Views Of Luigi Mangiones Supporters

Apr 28, 2025

Exploring The Views Of Luigi Mangiones Supporters

Apr 28, 2025