Are High Stock Market Valuations A Concern? BofA Says No.

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Red Flag

BofA's optimistic outlook on high stock market valuations rests on several key pillars. They argue that current prices are not necessarily unsustainable, given the prevailing economic climate and corporate performance. Their reasoning includes:

-

Low Interest Rates: Historically low interest rates significantly impact stock valuations. Lower borrowing costs make equities more attractive relative to bonds, supporting higher price-to-earnings (P/E) ratios and overall market valuations. BofA's analysis likely incorporates the effect of near-zero interest rates in their calculations of discounted cash flows and future earnings.

-

Robust Corporate Earnings: Strong corporate earnings growth, particularly in specific sectors, justifies higher stock prices for many companies. BofA's report likely highlights companies demonstrating strong revenue growth and healthy profit margins, supporting their claims that current valuations are justifiable. This is a key element of their overall assessment of the market's intrinsic value.

-

Positive Economic Outlook: A positive economic outlook, characterized by low unemployment and consumer spending, bolsters investor confidence and fuels further stock price increases. BofA's macroeconomic forecasts likely play a crucial role in their assessment of future market performance and the sustainability of current stock valuations.

-

Technological Innovation: Technological advancements are driving innovation and productivity growth, creating new opportunities for investment and contributing to higher market valuations. BofA's analysis likely accounts for the impact of disruptive technologies and the potential for future growth in high-growth sectors. Specific examples from their report would highlight this factor.

Counterarguments and Potential Risks: Examining the Other Side

While BofA presents a compelling case, it's crucial to acknowledge opposing viewpoints and potential risks associated with high stock market valuations. These include:

-

Market Correction or Crash: High valuations inherently increase the risk of a market correction or even a crash. A sudden shift in investor sentiment or an unexpected economic downturn could trigger a significant decline in stock prices. This is a major risk investors should consider.

-

Sector-Specific Overvaluation: While the overall market might appear justifiable, specific sectors could be significantly overvalued. Careful analysis of individual sectors and companies is crucial to avoid concentrated risk. Identifying bubbles or unsustainable growth in specific industries is critical to mitigating potential losses.

-

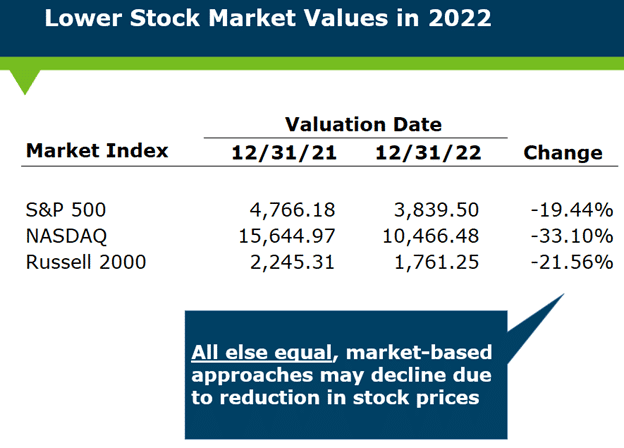

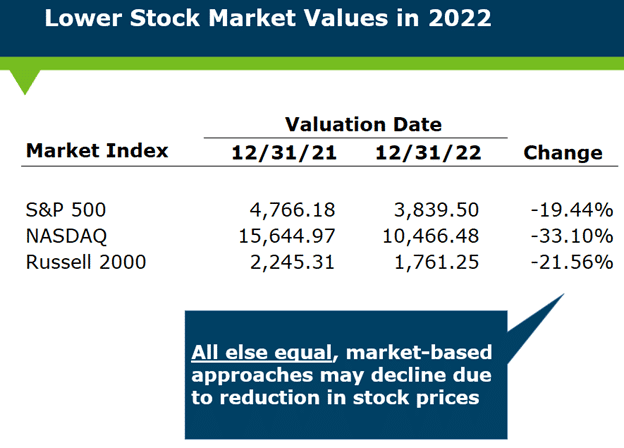

Inflation and Rising Interest Rates: Inflation and rising interest rates can significantly impact stock valuations. Higher interest rates make bonds more attractive, potentially diverting capital away from equities and leading to lower stock prices. This directly contradicts the BofA's low-interest-rate argument and presents a significant counterpoint.

-

Geopolitical Risks: Geopolitical uncertainty and instability can negatively impact market sentiment and stock prices. Global events, such as trade wars or political crises, can introduce significant volatility and uncertainty. These exogenous shocks are not always factored into market valuation models.

Analyzing BofA's Methodology and Assumptions

Critically evaluating BofA's methodology is essential to assess the validity of their conclusions. Several key aspects warrant closer examination:

-

Data Points: Understanding the specific data points used by BofA, including earnings estimates, economic forecasts, and valuation metrics, is vital to evaluating their analysis. The sources and accuracy of the data are essential to assessing the reliability of their conclusion.

-

Underlying Assumptions: Identifying the underlying assumptions in BofA's model, such as future economic growth rates and interest rate trajectories, is crucial. These assumptions can significantly influence the results, and deviations from these assumptions may lead to inaccuracies.

-

Limitations and Biases: Recognizing potential limitations and biases in BofA's approach, such as potential selection bias or reliance on specific economic models, is important for a balanced perspective. Comparing their findings with those of other valuation models would be important.

-

Comparison with Other Models: Comparing BofA's valuation model and conclusions with those of other prominent financial institutions and analysts provides a broader perspective and highlights potential discrepancies or areas of consensus.

Practical Implications for Investors: How to Navigate Uncertain Markets

Based on the information presented, here's practical advice for investors navigating these uncertain markets:

-

Diversification: Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) and sectors minimizes risk and protects against significant losses.

-

Risk Mitigation: Employing strategies to mitigate risk in a high-valuation market, such as hedging techniques or stop-loss orders, is crucial. This requires advanced knowledge and appropriate risk management practices.

-

Long-Term Perspective: Adopting a long-term investment horizon allows you to weather short-term market fluctuations and benefit from long-term growth.

-

Professional Advice: Seeking advice from a qualified financial advisor provides personalized guidance based on your individual financial goals and risk tolerance.

-

Market Awareness: Staying informed about market trends, economic indicators, and geopolitical events is essential for making informed investment decisions.

Conclusion: High Stock Market Valuations: A Balanced Perspective

BofA's optimistic outlook on high stock market valuations highlights several positive factors, including low interest rates and strong corporate earnings. However, counterarguments emphasize the risks associated with high valuations, such as market corrections and the impact of inflation. Understanding these varying perspectives is crucial. A balanced approach involves considering various viewpoints, conducting thorough research, and critically evaluating the methodologies used in different analyses. High stock market valuations present both opportunities and challenges. Remember that careful market analysis and diversified investment strategies are paramount to managing risk and maximizing returns. Understanding high stock market valuations is crucial for making informed investment decisions. Continue your research and develop a strategy that aligns with your risk tolerance. Don't hesitate to seek professional advice to navigate these complex market dynamics.

Featured Posts

-

The Future Of Nordic Security A Collaborative Approach By Sweden And Finland

Apr 22, 2025

The Future Of Nordic Security A Collaborative Approach By Sweden And Finland

Apr 22, 2025 -

Blue Origins Rocket Launch Abruptly Halted Investigation Underway

Apr 22, 2025

Blue Origins Rocket Launch Abruptly Halted Investigation Underway

Apr 22, 2025 -

Bof A Reassures Investors Why Current Stock Market Valuations Arent A Threat

Apr 22, 2025

Bof A Reassures Investors Why Current Stock Market Valuations Arent A Threat

Apr 22, 2025 -

Ray Epps Sues Fox News For Defamation Over January 6th Claims

Apr 22, 2025

Ray Epps Sues Fox News For Defamation Over January 6th Claims

Apr 22, 2025 -

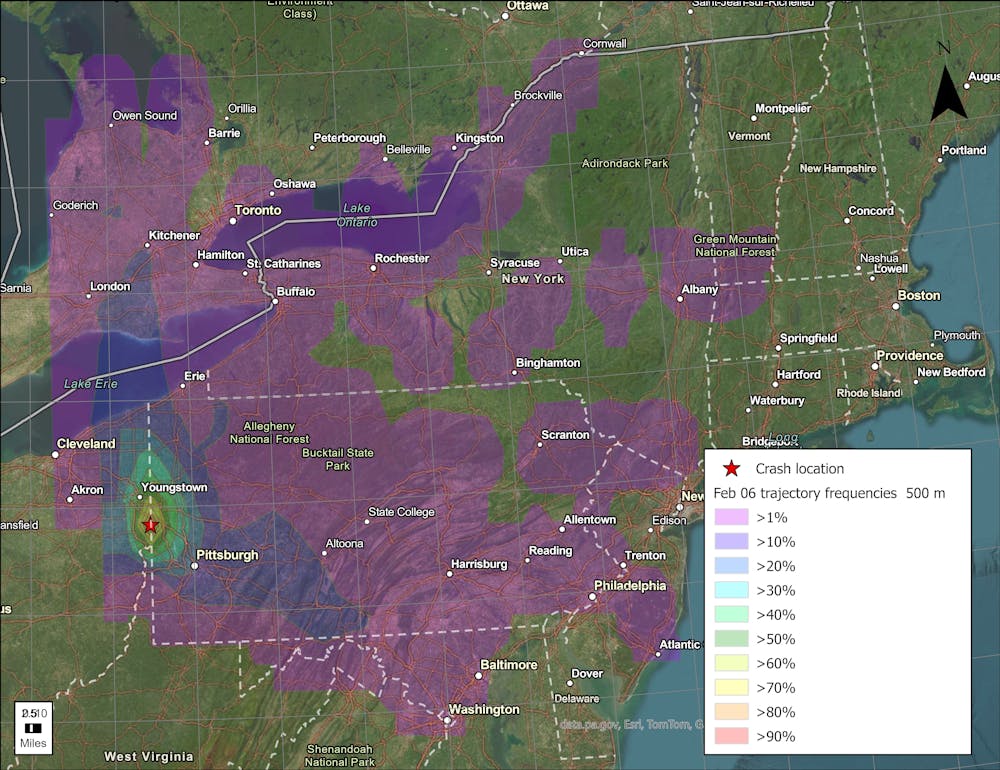

Investigation Reveals Lingering Toxic Chemicals From Ohio Train Derailment

Apr 22, 2025

Investigation Reveals Lingering Toxic Chemicals From Ohio Train Derailment

Apr 22, 2025