Are Higher Stock Prices Sustainable? Investors Face Difficult Choices

Table of Contents

Economic Factors Influencing Stock Market Sustainability

Several macroeconomic factors significantly impact the sustainability of higher stock prices. Understanding these dynamics is crucial for informed investment decisions.

Inflation and Interest Rates

Rising inflation and subsequent interest rate hikes by central banks represent major headwinds for stock market sustainability.

- Higher borrowing costs: Increased interest rates make it more expensive for companies to borrow money, potentially hindering expansion plans, slowing growth, and reducing investment in research and development. This can negatively impact future earnings and stock valuations.

- Impact on consumer spending: Inflation erodes purchasing power, leading to decreased consumer spending. Reduced demand can negatively impact corporate revenues and profits, ultimately affecting stock prices.

- Attractiveness of bonds: Higher interest rates make bonds more attractive to investors seeking fixed income, potentially diverting capital away from the stock market. The rise in bond yields creates a competing investment opportunity, drawing funds from equities.

Geopolitical Risks and Uncertainty

Geopolitical events introduce significant uncertainty into the market, impacting investor confidence and stock valuations.

- War and political instability: Conflicts and political instability in various regions of the world can disrupt supply chains, increase commodity prices, and negatively impact global economic growth, thus affecting market sentiment and stock prices. The Russia-Ukraine war serves as a recent example of such disruptive events.

- Increased risk aversion: Geopolitical uncertainty often leads to increased risk aversion among investors, causing them to shift their portfolios towards safer assets, such as government bonds, at the expense of riskier equities. This can trigger sell-offs and downward pressure on stock prices.

- Sector-specific impacts: Geopolitical events can disproportionately affect specific sectors. For example, sanctions or trade wars can severely impact companies operating in targeted industries or regions.

Supply Chain Disruptions and Commodity Prices

Lingering supply chain disruptions and volatile commodity prices continue to impact corporate earnings and stock performance.

- Increased production costs: Supply chain bottlenecks and higher commodity prices increase production costs for companies, squeezing profit margins and potentially impacting earnings growth. This can negatively affect stock valuations.

- Inflationary pressures: Supply chain issues contribute to inflationary pressures, further exacerbating the challenges outlined above regarding interest rate hikes and consumer spending.

- Industry-specific vulnerabilities: Certain industries, such as manufacturing and technology, are more vulnerable to supply chain disruptions than others. This uneven impact shapes the overall market performance.

Company-Specific Factors Affecting Stock Price Sustainability

While macroeconomic factors set the stage, the sustainability of higher stock prices also depends heavily on individual company performance.

Earnings Growth and Profitability

Consistent earnings growth and strong profit margins are fundamental to supporting higher stock valuations.

- EPS growth: Earnings per share (EPS) growth is a key indicator of a company's profitability and is directly related to stock price appreciation. Sustained EPS growth is crucial for justifying higher stock prices.

- Strong balance sheets: Companies with healthy balance sheets, characterized by low debt and ample cash reserves, are better equipped to weather economic downturns and continue delivering growth, thus supporting higher stock valuations.

- Dividend payouts: Consistent dividend payouts can also attract investors seeking income, helping support higher stock prices.

Valuation Metrics and Market Sentiment

Valuation metrics and market sentiment play a vital role in determining stock prices and their sustainability.

- P/E ratios: High price-to-earnings (P/E) ratios can indicate overvaluation, suggesting that a stock price may be unsustainable in the long term. Investors need to carefully assess the valuation of companies relative to their earnings.

- Market capitalization: A company's market capitalization reflects investor perception of its value. Rapid increases in market capitalization without corresponding growth in fundamentals can signal a speculative bubble.

- Market speculation and hype: Market hype and speculation can drive stock prices significantly beyond their intrinsic value, leading to unsustainable price levels and subsequent corrections.

Technological Disruption and Innovation

Technological advancements are powerful drivers of market trends, significantly impacting industry leaders and shaping stock market performance.

- Disruptive technologies: New technologies can create new market leaders and disrupt existing industries, leading to significant shifts in stock valuations. Examples include the rise of e-commerce and the impact of artificial intelligence.

- Adaptability and innovation: Companies that can adapt to technological changes and invest in innovation are more likely to maintain sustainable growth and higher stock prices.

- Competitive landscape: Technological disruption intensifies competition, requiring companies to continually innovate to stay ahead. Companies failing to adapt may see their stock prices decline.

Investor Behavior and Market Psychology

Investor behavior and market psychology significantly influence stock market dynamics and the sustainability of higher stock prices.

Risk Tolerance and Investment Strategies

Different investor risk profiles dictate investment strategies and impact market dynamics.

- Value investing vs. growth investing: Value investors focus on undervalued companies, while growth investors prioritize companies with high growth potential. These differing approaches affect market demand and price levels.

- Herd behavior: Market participants often follow trends, leading to herd behavior, which can amplify price swings and contribute to both unsustainable booms and busts.

- Market timing: Attempts to time the market are often unsuccessful, emphasizing the importance of a long-term investment strategy rather than trying to predict short-term fluctuations.

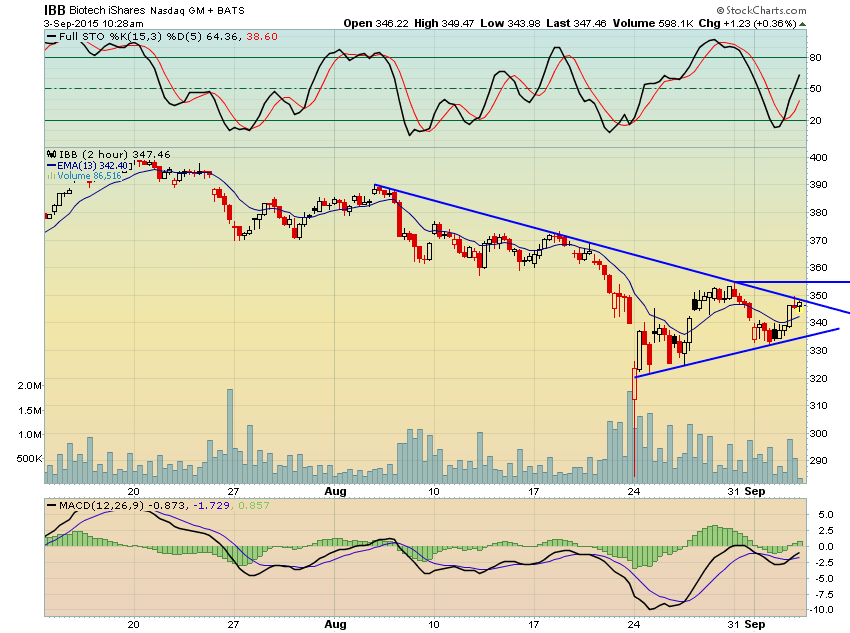

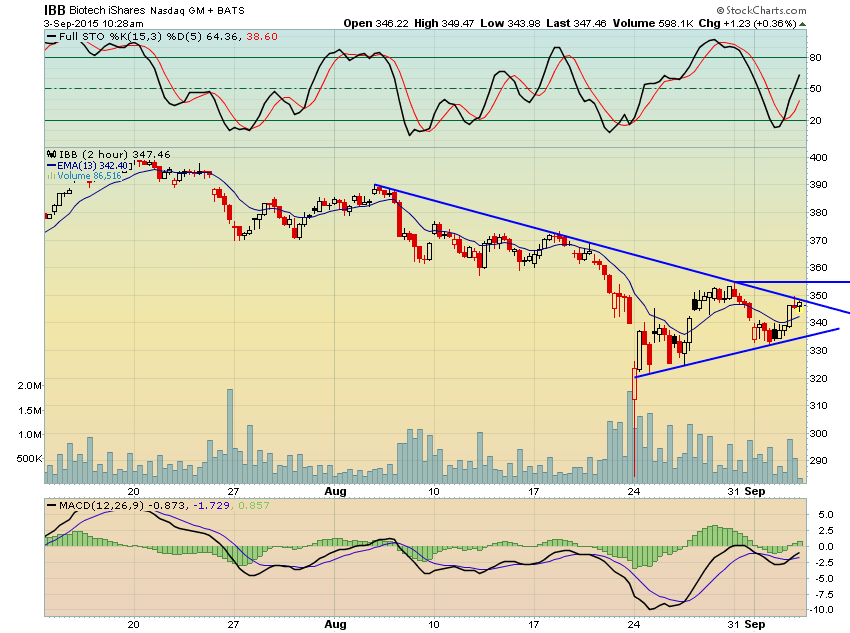

Market Volatility and Correction Risks

Market corrections are a normal part of the market cycle, and understanding their potential is crucial for risk management.

- History of corrections: Studying past market corrections helps investors understand the typical causes and the potential impact on their portfolios. History demonstrates that corrections are inevitable.

- Diversification: A diversified portfolio reduces risk by spreading investments across different asset classes, sectors, and geographies. This mitigates the impact of market corrections.

- Long-term investment horizon: A long-term investment horizon allows investors to ride out market fluctuations and benefit from long-term growth, reducing the impact of short-term volatility.

Conclusion: Making Informed Decisions About Higher Stock Prices

The sustainability of higher stock prices hinges on a complex interplay of economic conditions, company performance, and investor behavior. Economic factors such as inflation, interest rates, and geopolitical uncertainty create a backdrop that either supports or undermines market growth. Company-specific factors like earnings growth, valuation, and technological adaptability determine individual stock performance. Finally, investor sentiment, risk tolerance, and market psychology shape overall market trends.

Understanding these interconnected factors is crucial for making informed investment decisions. While the potential for further growth exists, the risks associated with unsustainable price increases are significant. Conduct thorough research, diversify your portfolio, and consider seeking professional financial advice to develop a long-term investment strategy aligned with your risk tolerance before making decisions about whether higher stock prices are truly sustainable.

Featured Posts

-

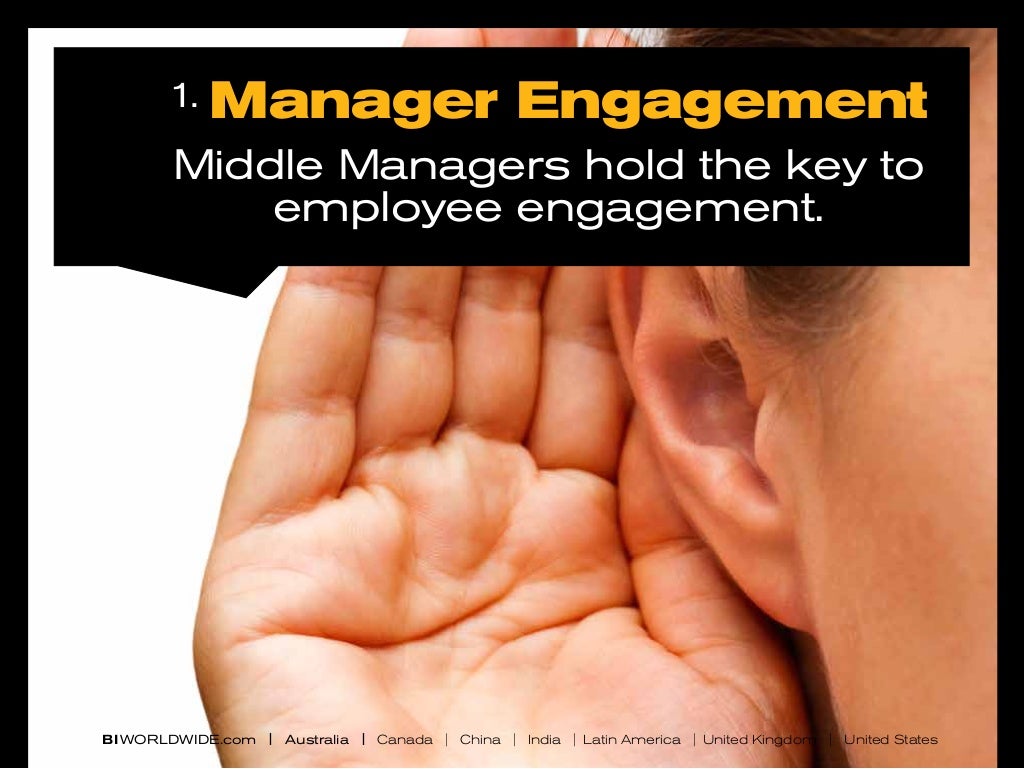

How Middle Management Drives Company Productivity And Employee Engagement

Apr 22, 2025

How Middle Management Drives Company Productivity And Employee Engagement

Apr 22, 2025 -

Chinas Impact On Bmw And Porsche Sales Market Headwinds And Future Strategies

Apr 22, 2025

Chinas Impact On Bmw And Porsche Sales Market Headwinds And Future Strategies

Apr 22, 2025 -

Hollywood Strike Actors Join Writers Bringing Industry To A Standstill

Apr 22, 2025

Hollywood Strike Actors Join Writers Bringing Industry To A Standstill

Apr 22, 2025 -

Dealerships Intensify Fight Against Electric Vehicle Mandates

Apr 22, 2025

Dealerships Intensify Fight Against Electric Vehicle Mandates

Apr 22, 2025 -

Open Ai Under Ftc Scrutiny Chat Gpts Future Uncertain

Apr 22, 2025

Open Ai Under Ftc Scrutiny Chat Gpts Future Uncertain

Apr 22, 2025