Are Minnesota's Film Tax Credits Competitive Enough?

Table of Contents

Current State of Minnesota Film Tax Credits

Minnesota offers film tax credits to incentivize movie and television production within the state. However, the question remains: are these credits competitive enough to attract major productions?

Credit Amount and Eligibility Requirements

The Minnesota film tax credit currently offers a [Insert Current Percentage]% credit on qualified production spending. To be eligible, productions must meet several criteria:

- Minimum Spending in Minnesota: Productions must spend a minimum of [Insert Dollar Amount] within the state. This threshold is crucial and directly impacts smaller productions' eligibility.

- Local Hiring: A certain percentage of the crew must be hired from within Minnesota to qualify for the full credit. This promotes job growth within the local workforce and strengthens the Minnesota film industry's talent pool.

- Specific Production Types: Only [Specify qualifying productions: feature films, television series, commercials, etc.] are eligible for the credit. Specific guidelines might further restrict eligibility based on genre or budget.

Compared to other states, Minnesota's minimum spending requirements might be [higher/lower/comparable] than those in [mention specific states]. This significantly impacts a production's decision-making process, especially for smaller independent films with lower budgets.

Types of Productions Covered

Minnesota's film tax credit program covers a range of productions, including feature films, television series, commercials, and potentially other forms of screen media. While this broad scope is beneficial, there might be limitations on the types of genres or production scales eligible for the full tax credit.

Successful productions that have leveraged Minnesota's film tax credits include [Insert Examples – if available; otherwise, mention lack of high-profile examples]. The lack of high-profile examples could indicate a need for increased competitiveness in the state's incentive program. These examples could showcase the successes and limitations of the current tax credit framework.

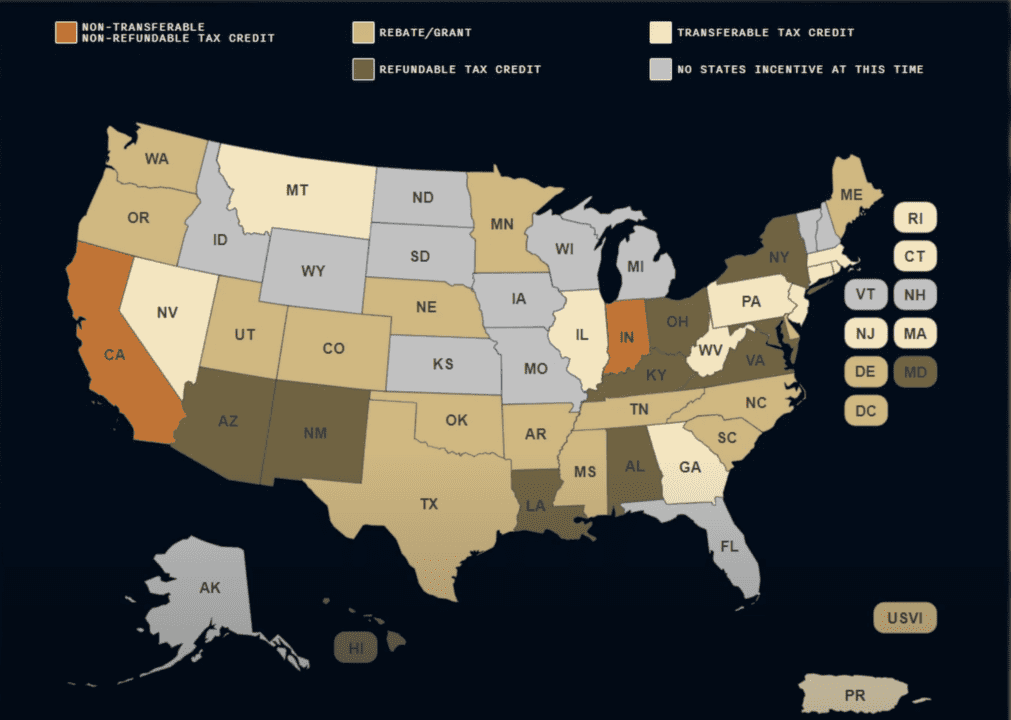

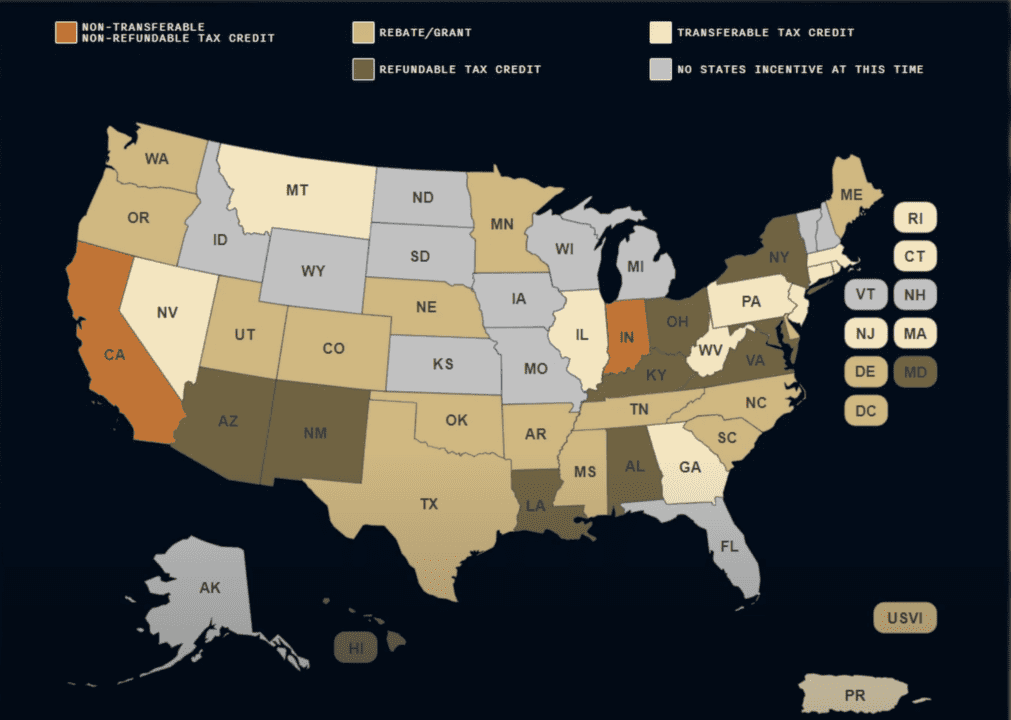

Comparison with Other States' Incentives

To gauge the competitiveness of Minnesota's film tax credits, a comparison with other states is crucial.

Benchmarking Against Competing States

Minnesota's film tax credit program needs benchmarking against states like Wisconsin, Iowa, North Dakota, and major film production hubs such as California, Georgia, and New York.

| State | Credit Percentage | Cap Amount | Additional Incentives |

|---|---|---|---|

| Minnesota | [Insert Percentage] | [Insert Amount] | [List Incentives] |

| Wisconsin | [Insert Percentage] | [Insert Amount] | [List Incentives] |

| Iowa | [Insert Percentage] | [Insert Amount] | [List Incentives] |

| North Dakota | [Insert Percentage] | [Insert Amount] | [List Incentives] |

| California | [Insert Percentage] | [Insert Amount] | [List Incentives] |

| Georgia | [Insert Percentage] | [Insert Amount] | [List Incentives] |

| New York | [Insert Percentage] | [Insert Amount] | [List Incentives] |

The table highlights that [State X] offers a significantly higher credit percentage and/or a larger cap amount compared to Minnesota. This disparity directly impacts the attractiveness of Minnesota as a filming location for large-scale productions.

The Impact of Competing Incentives

The more generous incentives offered by other states directly influence the decisions of film production companies. Many productions might bypass Minnesota due to more favorable incentives elsewhere. This results in a loss of potential economic benefits for the state. For instance, [cite a specific example of a production choosing another state due to better incentives]. This lost opportunity highlights the need for a more competitive Minnesota film tax credit program.

Economic Impact of Film Tax Credits in Minnesota

Analyzing the economic impact of the current film tax credits is crucial in assessing their effectiveness.

Job Creation and Revenue Generation

Film productions generate significant employment opportunities, both directly through crew positions and indirectly through related services. [Insert Data and Statistics – if available; otherwise, explain the lack of readily accessible data and its implications]. The economic multiplier effect, where initial investment in film production stimulates further economic activity in related sectors, should also be quantified.

Supporting Local Businesses and Infrastructure

Film productions significantly boost local businesses, particularly in hospitality, catering, equipment rentals, and transportation. [Insert specific examples; e.g., "The filming of [Movie Title] led to a 15% increase in revenue for local restaurants"]. Furthermore, film productions can contribute to infrastructure improvements, though this impact may be less direct. The potential for long-term economic growth and diversification through a robust film industry is significant.

Conclusion

Minnesota's film tax credit program, while contributing to job creation and supporting local businesses, currently faces challenges in attracting major productions due to less competitive incentives compared to other states. The data suggests that a reevaluation of the current program is warranted. To ensure Minnesota remains a viable location for film production and attracts significant investment, an increase in the credit percentage, a higher cap amount, or additional incentives to attract large productions is necessary. To secure a thriving future for the Minnesota film industry and maximize its economic potential, a more competitive film tax credit program is crucial.

Featured Posts

-

Minnesota Faces Attorney General Pressure Over Transgender Athlete Ban

Apr 29, 2025

Minnesota Faces Attorney General Pressure Over Transgender Athlete Ban

Apr 29, 2025 -

Nba Fines Anthony Edwards 50 000 For Vulgar Remarks To Fan

Apr 29, 2025

Nba Fines Anthony Edwards 50 000 For Vulgar Remarks To Fan

Apr 29, 2025 -

Anthony Edwards Paternity Case Custody Awarded To Ayesha Howard

Apr 29, 2025

Anthony Edwards Paternity Case Custody Awarded To Ayesha Howard

Apr 29, 2025 -

Mets Starting Pitcher Contender Pitchers Name S Prospects

Apr 29, 2025

Mets Starting Pitcher Contender Pitchers Name S Prospects

Apr 29, 2025 -

Minnesota And The Ccp United Front A Comprehensive Analysis

Apr 29, 2025

Minnesota And The Ccp United Front A Comprehensive Analysis

Apr 29, 2025