Bank Of Canada Rate Pause: Expert Analysis From FP Video

Table of Contents

Understanding the Bank of Canada's Rate Pause Decision

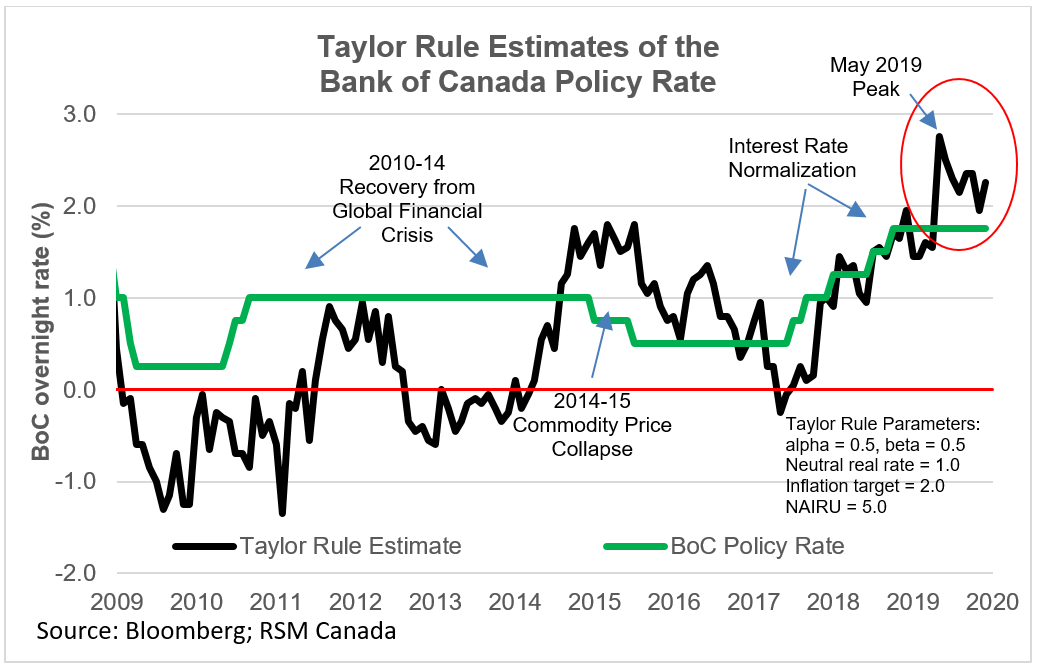

The Bank of Canada's decision to pause interest rate increases comes after a period of aggressive rate hikes aimed at curbing inflation. Several factors influenced this pivotal shift in monetary policy. The central bank carefully weighs various economic indicators before making such crucial decisions.

- Current Inflation Figures and Their Trend: While inflation remains above the Bank of Canada's target of 2%, recent data suggests a slowing trend, indicating that the previous rate hikes are starting to have the desired effect.

- GDP Growth Projections: Economic growth forecasts have been revised downwards, suggesting a potential slowdown in the Canadian economy. This reduced growth outlook contributed to the decision to pause rate increases.

- The Bank of Canada's Mandate and its Goals: The Bank of Canada's primary mandate is to maintain price stability and promote sustainable economic growth. The rate pause reflects a delicate balancing act between these two key objectives.

- Comparison to Previous Rate Decisions: This pause represents a significant departure from the previous series of consecutive rate hikes. The Bank of Canada is clearly adapting its strategy in response to evolving economic conditions. This demonstrates the dynamic nature of monetary policy and its responsiveness to real-time economic data.

Expert Opinions from FP Video: Diverse Perspectives on the Pause

The FP Video offers a fascinating discussion featuring several prominent economic experts, each providing unique insights into the Bank of Canada's rate pause. These diverse perspectives highlight the complexities of economic forecasting and the various interpretations of the available data.

- Expert 1's View (Name/Title): [Insert Expert 1's name and title here] argued that the pause is a necessary precaution given the softening economic outlook and the potential for a deeper recession. They emphasized the importance of carefully monitoring inflation and economic growth in the coming months.

- Expert 2's Contrasting or Supporting View (Name/Title): [Insert Expert 2's name and title here], on the other hand, [insert expert 2's view, whether supporting or contrasting with Expert 1's view]. They highlighted [insert specific data points and reasoning used by Expert 2].

- Differing Opinions on the Future Direction of Interest Rates: The experts presented differing opinions regarding the likelihood of future rate hikes or cuts, underscoring the uncertainty surrounding the economic outlook. Some experts believe further rate hikes are likely, while others foresee potential rate cuts in the near future.

- Specific Data Points Used to Support Their Arguments: The discussion in the FP Video relies heavily on specific data points, including inflation rates, GDP growth figures, and unemployment statistics, to support the experts' arguments. These data points are crucial for understanding the rationale behind their differing opinions.

Potential Impacts of the Rate Pause on the Canadian Economy

The Bank of Canada's rate pause will have far-reaching consequences for the Canadian economy, both in the short term and the long term. Its effects will be felt across various sectors, presenting both opportunities and challenges.

- Impact on Housing Market: The pause could provide some relief to the overheated housing market, potentially slowing down price increases or even triggering a slight correction. However, the full impact will depend on other factors such as housing supply and consumer confidence.

- Effect on Consumer Spending: Lower interest rates can stimulate consumer spending, boosting economic activity. However, persistent inflation may still constrain consumer confidence and limit spending increases.

- Influence on Business Investment: The rate pause could encourage businesses to invest more, fueled by lower borrowing costs. This increased investment could drive economic growth and job creation.

- Potential Risks and Opportunities Associated with the Pause: The rate pause presents both risks and opportunities. While it could stimulate economic growth, it also carries the risk of fueling inflation if it is not carefully managed. The opportunity lies in navigating this period of economic uncertainty to promote sustainable growth.

What to Expect Next: Future Interest Rate Predictions

The experts in the FP Video offered varying predictions for future Bank of Canada rate decisions, highlighting the uncertainties in the current economic climate.

- Probability of Future Rate Hikes or Cuts: The probability of future rate hikes or cuts depends heavily on upcoming economic data and the evolution of inflation. Some experts anticipate further rate hikes, while others believe that rates may remain on hold or even be reduced.

- Factors That Could Influence Future Decisions: Future Bank of Canada decisions will likely be influenced by factors such as inflation, economic growth, unemployment rates, and global economic conditions.

- Time Horizon for Potential Changes: The time horizon for potential changes in interest rates remains uncertain, with some experts predicting shifts in the coming months, while others foresee a longer period of stability.

- Advice for Consumers and Businesses Based on Expert Predictions: Consumers and businesses should carefully monitor economic indicators and adapt their financial strategies accordingly, considering the range of possible outcomes presented by the experts. This includes diversifying investments and planning for potential changes in interest rates.

Conclusion: Staying Informed About the Bank of Canada Rate Pause

The Bank of Canada's decision to pause interest rate hikes represents a crucial turning point in Canadian monetary policy. The FP Video analysis provides valuable insights from leading economic experts, highlighting the diverse perspectives and potential impacts of this decision. The range of outcomes – from further rate hikes to potential cuts – underscores the uncertainty inherent in economic forecasting and the importance of continuous monitoring of key economic indicators. To gain a comprehensive understanding of the Bank of Canada rate pause and its implications for the Canadian economy, watch the full FP Video for a detailed analysis and expert insights on interest rates. Understanding the Bank of Canada's decision is crucial for navigating the current economic climate.

Featured Posts

-

Strong Bullpen Performance Leads Royals To Victory Over Brewers Cole Ragans Contribution

Apr 23, 2025

Strong Bullpen Performance Leads Royals To Victory Over Brewers Cole Ragans Contribution

Apr 23, 2025 -

Brewers Postseason Hopes Addressing Two Critical Early Season Issues

Apr 23, 2025

Brewers Postseason Hopes Addressing Two Critical Early Season Issues

Apr 23, 2025 -

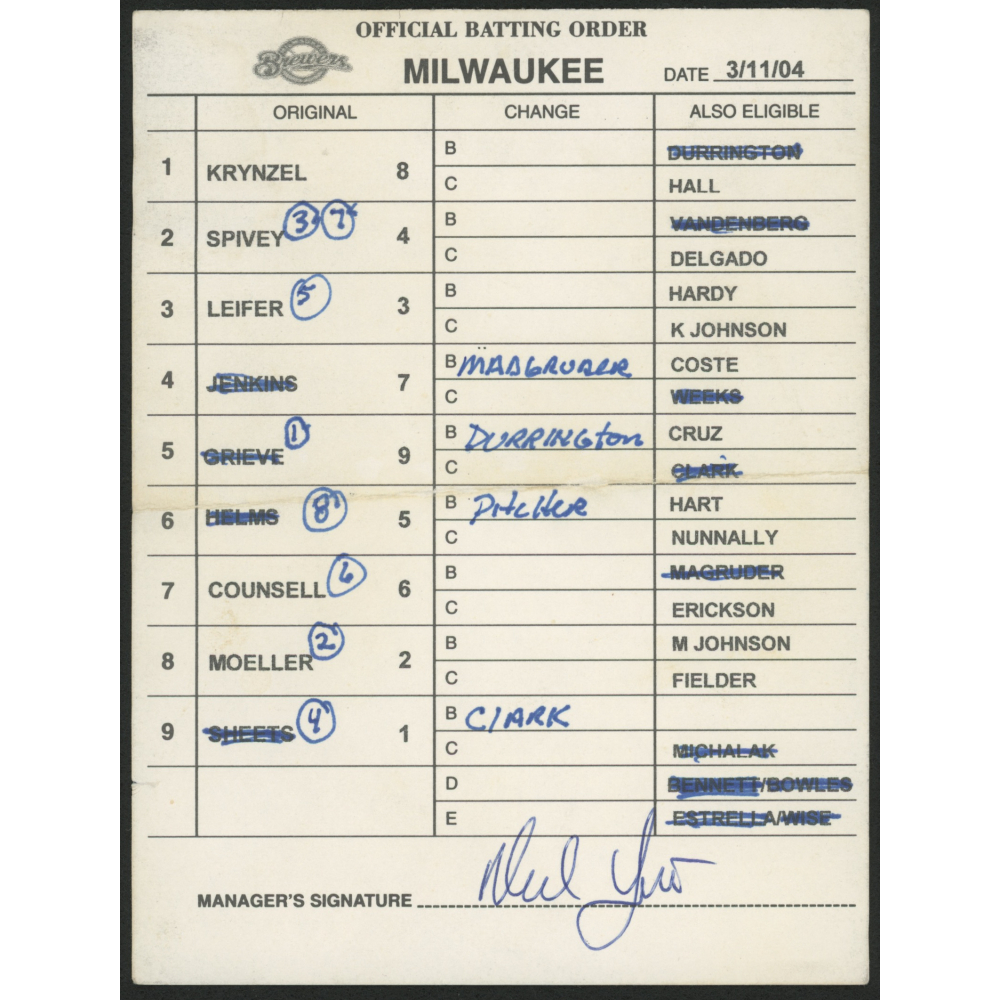

Brewers Batting Order Shakeup Addressing Offensive Inconsistency

Apr 23, 2025

Brewers Batting Order Shakeup Addressing Offensive Inconsistency

Apr 23, 2025 -

Spartak Rostov 23 Tur Rpl Krupnaya Pobeda Krasno Belykh

Apr 23, 2025

Spartak Rostov 23 Tur Rpl Krupnaya Pobeda Krasno Belykh

Apr 23, 2025 -

Cincinnati Reds Break Scoring Drought In Brewers Game

Apr 23, 2025

Cincinnati Reds Break Scoring Drought In Brewers Game

Apr 23, 2025