Bill Ackman's View: Time's Role In The US-China Trade Conflict

Table of Contents

Ackman's Investment Philosophy and its Relevance to the US-China Trade War

Bill Ackman is renowned for his long-term value investing approach, a strategy characterized by meticulous due diligence, patient capital allocation, and a focus on identifying undervalued assets. This contrasts sharply with short-term market speculation and aligns well with the drawn-out nature of the US-China trade conflict.

- Focus on Long-Term Value: Ackman’s emphasis on long-term value creation suggests he likely views the US-China trade dispute not as a transient issue, but as a prolonged struggle with no quick solutions. He would prioritize understanding the fundamental shifts in the global economic order rather than reacting to short-term market fluctuations.

- Risk Assessment: His rigorous risk assessment methodology necessitates a comprehensive analysis of the potential upsides and downsides. The inherent uncertainty surrounding the US-China relationship would necessitate a careful assessment of risk, possibly influencing investment decisions in related sectors.

- Geopolitical Considerations: Ackman, known for his macro-level investment perspectives, would undoubtedly consider the geopolitical ramifications of the conflict's duration, forecasting potential escalations or de-escalations and their effect on global markets. His insights would likely incorporate considerations beyond simple economic indicators.

The Time Factor in Decoupling and Technological Competition

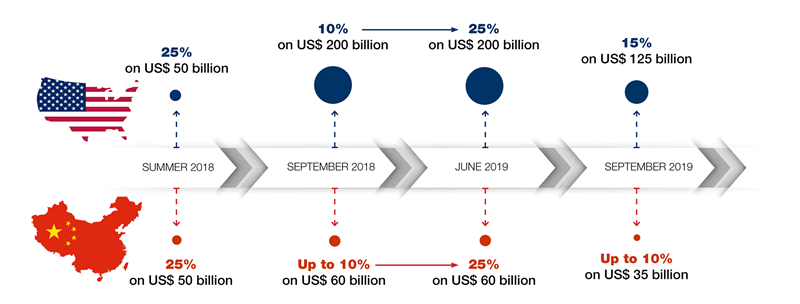

The US-China trade conflict extends far beyond simple tariffs; it's a battle for technological supremacy and a strategic push towards decoupling. The element of time plays a pivotal role in this broader struggle.

- Technological Advancement: The rapid pace of technological innovation is a crucial factor. A prolonged conflict might accelerate investments in self-reliance by both nations, potentially leading to parallel technological development and a bifurcation of global technological standards. This could create both opportunities and challenges for investors.

- Supply Chain Diversification: Restructuring global supply chains away from China is a monumental undertaking that requires substantial time and investment. Ackman would undoubtedly analyze the timeline for successful diversification, assessing its impact on various industries and companies. This timeframe would be a key determinant in his investment strategy.

- Strategic Investments: The extended timeframe necessitates long-term strategic investment decisions from both governments and corporations, a perspective directly aligned with Ackman's investment horizon. He would likely focus on companies best positioned to navigate this shifting global landscape.

Economic Impacts and the Long-Term Perspective

The economic repercussions of the US-China trade conflict are not immediate or easily quantifiable. Ackman’s perspective would likely emphasize the drawn-out, cumulative consequences.

- Inflationary Pressures: Disruptions to global supply chains contribute to inflationary pressures. Ackman’s evaluation would encompass the long-term impact of these inflationary trends on global markets and investment strategies. He’d likely seek investments that can weather or even benefit from such inflationary environments.

- Investment Decisions: The persistent uncertainty generated by the conflict significantly influences investment decisions. Ackman would undoubtedly factor in this prolonged uncertainty, prioritizing companies with resilience and adaptability in his portfolio.

- Global Market Volatility: The ongoing trade conflict contributes to global market volatility, presenting both opportunities and risks. His long-term viewpoint would allow him to identify opportunities amidst the turbulence, focusing on companies well-positioned for the long game.

Predicting Ackman's Stance: A Hypothetical Analysis

While we cannot definitively state Ackman’s precise viewpoint, based on his established investment philosophy, we can hypothesize his likely perspective on the time element in the US-China trade conflict.

- Cautious Optimism: He might adopt a cautiously optimistic stance, acknowledging the inherent challenges while believing that both nations will eventually find a path toward a more stable, albeit potentially redefined, relationship.

- Strategic Patience: He'd likely emphasize strategic patience, understanding that a swift resolution is improbable. His investment choices would reflect this understanding of the drawn-out nature of the conflict.

- Opportunities Amidst Challenges: Ackman might identify investment opportunities within the disruption, focusing on companies adept at navigating the complexities of a redefined geopolitical landscape. This would require a deep understanding of the evolving dynamics.

Conclusion

Bill Ackman’s perspective on the US-China trade conflict likely centers on the critical role of time. His long-term investment philosophy suggests an understanding of the conflict's extended timeline and the importance of strategic patience. The protracted nature of this dispute, involving technological decoupling and significant economic restructuring, demands a thorough assessment of both risks and opportunities. While a rapid resolution seems unlikely, Ackman likely views this as a long-term game with substantial investment opportunities emerging over time for those with a clear understanding of the dynamics and strategic implications of this evolving geopolitical and economic landscape. To gain further insights into Bill Ackman’s View: Time’s Role in the US-China Trade Conflict and its effects on global investment strategies, continue monitoring reputable financial news sources and expert analyses.

Featured Posts

-

Nebraska Jeweler Aids Nfl Players Career Transitions In Mc Cook

Apr 27, 2025

Nebraska Jeweler Aids Nfl Players Career Transitions In Mc Cook

Apr 27, 2025 -

20

Apr 27, 2025

20

Apr 27, 2025 -

Debunked Autism Vaccine Link Under Scrutiny Hhs Taps Anti Vaccine Advocate

Apr 27, 2025

Debunked Autism Vaccine Link Under Scrutiny Hhs Taps Anti Vaccine Advocate

Apr 27, 2025 -

Blue Origin Postpones Launch Investigation Into Subsystem Issue

Apr 27, 2025

Blue Origin Postpones Launch Investigation Into Subsystem Issue

Apr 27, 2025 -

Professional Stylists Behind Ariana Grandes Stunning Hair And Tattoo Makeover

Apr 27, 2025

Professional Stylists Behind Ariana Grandes Stunning Hair And Tattoo Makeover

Apr 27, 2025