Bitcoin's Positive Movement: Analyzing The Impact Of Trade And Federal Reserve Actions

Table of Contents

The Impact of Global Trade Uncertainty on Bitcoin's Value

Global trade uncertainty significantly impacts Bitcoin's value, influencing its price trajectory and investor behavior. This uncertainty stems from various factors, including trade wars, geopolitical instability, and shifts in international economic relations.

Safe-Haven Asset Status

Bitcoin is increasingly viewed as a safe-haven asset during periods of geopolitical and economic uncertainty. When traditional markets experience volatility due to trade disputes or global tensions, investors often seek refuge in assets perceived as less susceptible to these fluctuations. This flight to safety contributes to Bitcoin's positive movement.

- Increased demand for Bitcoin as a hedge against inflation and currency devaluation: Uncertainty in traditional markets can erode confidence in fiat currencies, leading investors to seek alternative stores of value like Bitcoin.

- Diversification strategies pushing investors towards cryptocurrencies: To mitigate risk, sophisticated investors are increasingly incorporating cryptocurrencies like Bitcoin into their portfolios, diversifying away from traditional assets.

- Reduced trust in traditional financial institutions boosting Bitcoin adoption: Concerns about the stability and trustworthiness of traditional financial institutions can fuel the adoption of decentralized alternatives like Bitcoin.

Decoupling from Traditional Markets

Bitcoin's price is showing increasing signs of decoupling from traditional markets, indicating its growing independence as an asset class. This decoupling is partially attributed to the uncertainty surrounding global trade agreements. As investors seek refuge outside traditional market volatility, Bitcoin's inherent decentralization makes it an attractive option.

- Analysis of Bitcoin's price correlation with major stock indices: Studies show a decreasing correlation between Bitcoin's price and major stock indices, suggesting a weakening link to traditional market fluctuations.

- Examination of Bitcoin's price behavior during periods of heightened trade tensions: During periods of heightened trade tensions, Bitcoin has demonstrated a tendency to hold its value or even appreciate, highlighting its safe-haven characteristics.

- Discussion of the factors contributing to Bitcoin's relative price stability during market downturns: Bitcoin's decentralized nature, limited supply, and growing adoption contribute to its relative price stability even during broader market downturns.

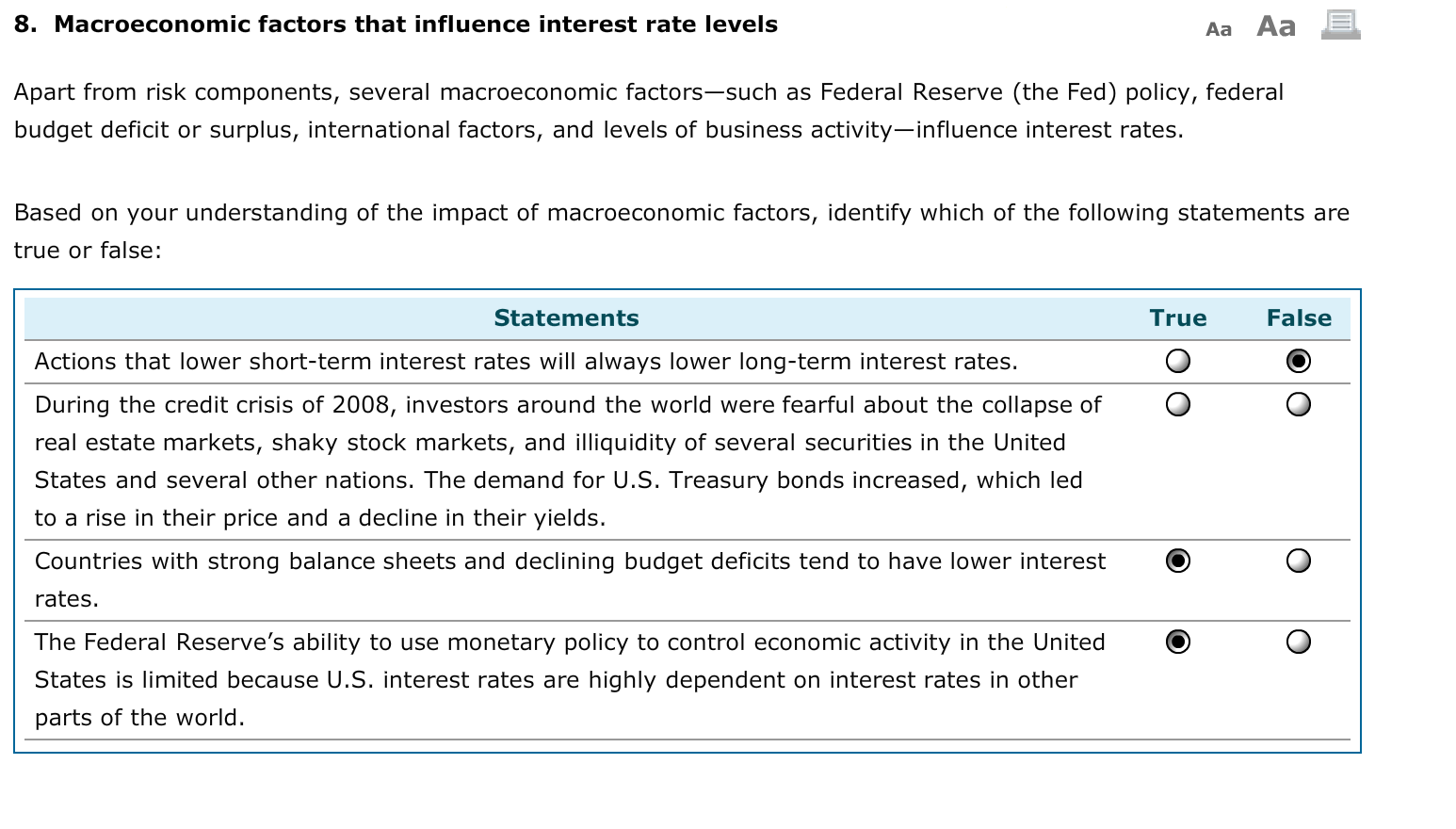

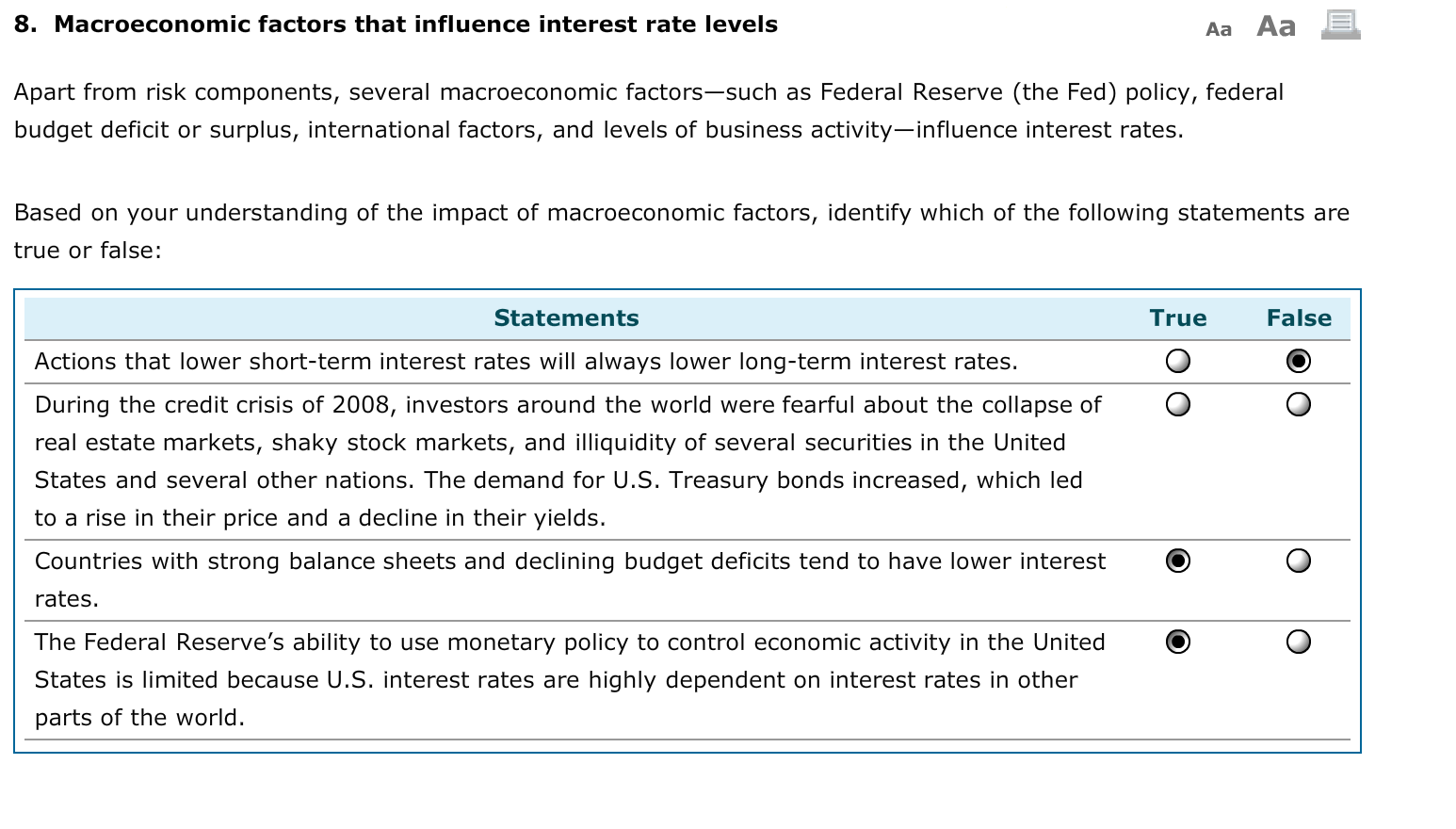

The Federal Reserve's Monetary Policy and Bitcoin's Price

The Federal Reserve's monetary policy significantly impacts Bitcoin's price, primarily through its effects on inflation and interest rates. These policies directly influence investor sentiment and capital flows within the cryptocurrency market.

Inflationary Pressures and Bitcoin's Appeal

The Federal Reserve's actions concerning interest rates and quantitative easing directly impact inflation. High inflation erodes the purchasing power of fiat currencies, driving investors towards assets perceived as inflation hedges, such as Bitcoin.

- Correlation between inflation rates and Bitcoin's price: Historical data suggests a positive correlation between inflation rates and Bitcoin's price, indicating its potential as an inflation hedge.

- Investor behavior during periods of high inflation: During periods of high inflation, investors often seek assets that preserve their purchasing power, leading to increased demand for Bitcoin.

- Analysis of Bitcoin's role as a store of value during inflationary periods: Bitcoin's limited supply and decentralized nature make it an attractive store of value during inflationary periods when traditional currencies lose their value.

Interest Rate Hikes and Bitcoin Volatility

Changes in interest rates influence Bitcoin's volatility. Higher interest rates can initially lead to capital flight from riskier assets like Bitcoin as investors seek higher returns in safer investments. However, the long-term effects are complex and depend on inflation and overall investor sentiment.

- Examination of Bitcoin price reactions to past interest rate changes: Analyzing Bitcoin's past price reactions to interest rate changes reveals valuable insights into its potential future behavior.

- Discussion of the potential for increased Bitcoin volatility during periods of interest rate adjustments: Interest rate adjustments can create uncertainty, leading to increased volatility in the cryptocurrency market.

- Analysis of the impact of interest rate hikes on investor risk appetite in the crypto market: Interest rate hikes can influence investor risk appetite, affecting the flow of capital into and out of the cryptocurrency market.

Analyzing the Synergistic Effect of Trade and Federal Reserve Actions on Bitcoin's Positive Movement

The recent positive movement in Bitcoin is not solely attributable to one factor but rather a confluence of global trade uncertainty and Federal Reserve policies. These forces interact synergistically to shape investor behavior and market dynamics.

- A comparative analysis of Bitcoin’s performance during different periods of trade uncertainty and monetary policy shifts: Comparing Bitcoin's performance across various macroeconomic scenarios reveals the interplay between these factors.

- Identification of key inflection points in Bitcoin’s price movement and their relation to macroeconomic events: Identifying these key inflection points helps establish causal links between macroeconomic events and Bitcoin's price movements.

- A forecast of potential future scenarios based on current macroeconomic trends: Analyzing current trends allows for potential future scenarios to be forecast, providing informed perspectives on Bitcoin's trajectory.

Conclusion

Bitcoin's positive movement is a multifaceted phenomenon shaped by global trade uncertainty and Federal Reserve actions. This analysis underscores Bitcoin's growing role as a safe-haven asset and a potential hedge against inflation. Understanding the complex interplay of these macroeconomic forces is crucial for navigating the evolving landscape of digital assets. To stay informed about the ongoing impact of trade and Federal Reserve actions on Bitcoin's positive movement, continue to follow reputable market analyses and news sources. Keep abreast of developments related to Bitcoin's positive movement and its underlying drivers to make informed investment decisions.

Featured Posts

-

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Problem

Apr 24, 2025

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Problem

Apr 24, 2025 -

Hudsons Bay 65 Leases Attract Significant Interest

Apr 24, 2025

Hudsons Bay 65 Leases Attract Significant Interest

Apr 24, 2025 -

The Bold And The Beautiful Liams Promise Lunas Gamble And Hopes Upcoming Trouble

Apr 24, 2025

The Bold And The Beautiful Liams Promise Lunas Gamble And Hopes Upcoming Trouble

Apr 24, 2025 -

Brett Goldstein Compares Ted Lasso Revival To A Miracle A Thought Dead Cat

Apr 24, 2025

Brett Goldstein Compares Ted Lasso Revival To A Miracle A Thought Dead Cat

Apr 24, 2025 -

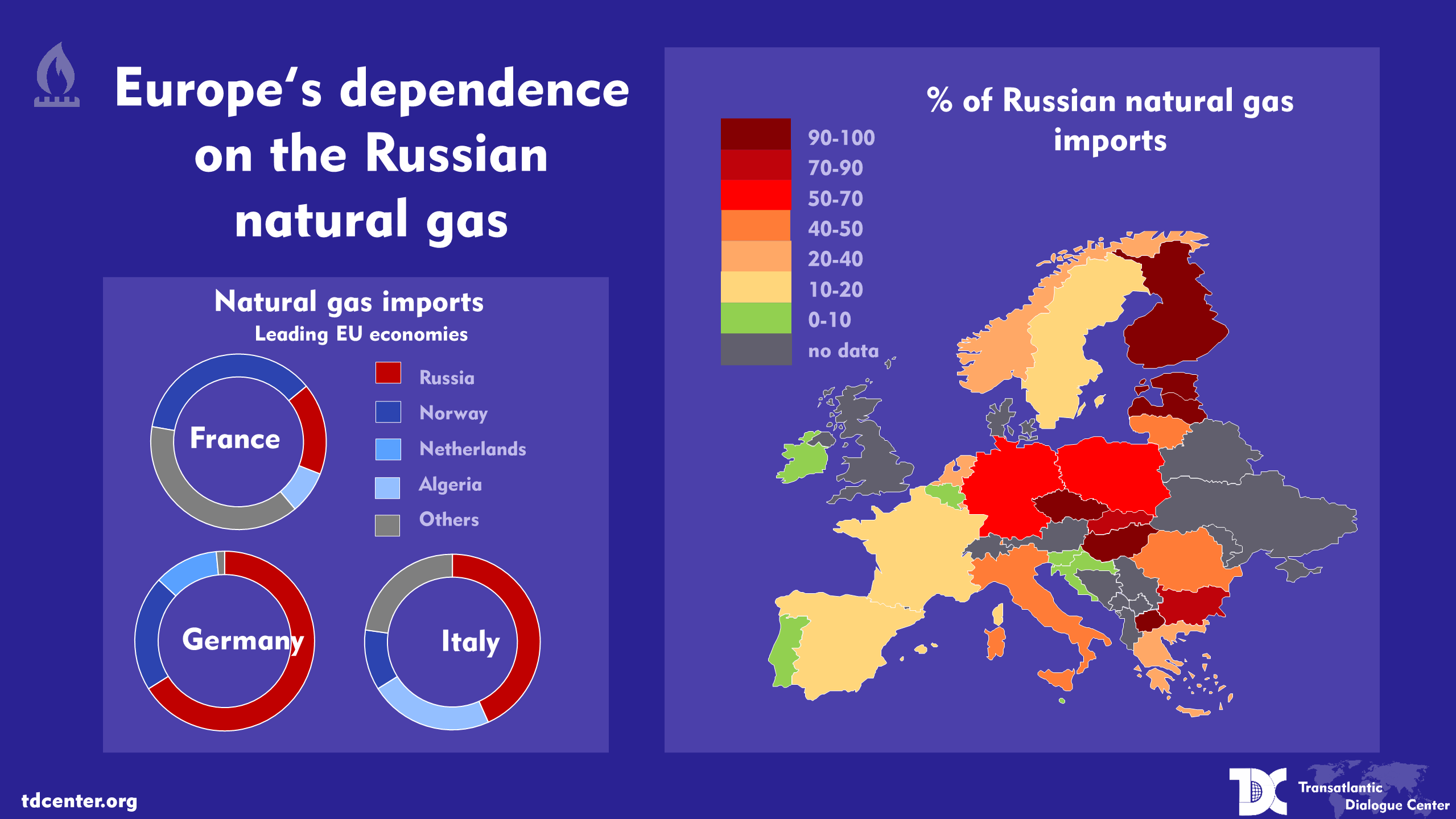

Russian Natural Gas Eus Discussion On Spot Market Restrictions

Apr 24, 2025

Russian Natural Gas Eus Discussion On Spot Market Restrictions

Apr 24, 2025