Broadcom's VMware Acquisition: AT&T Highlights Extreme Price Increases

Table of Contents

AT&T's Public Statement on Price Increases Following the Broadcom VMware Acquisition

AT&T, a major telecommunications company heavily reliant on VMware's virtualization technology, has publicly acknowledged experiencing significant price increases following Broadcom's acquisition. While AT&T hasn't released specific, detailed public breakdowns of every price hike, internal communications and industry reports indicate substantial increases across various services. The lack of transparent public communication from AT&T regarding the specifics underscores the concern surrounding the deal's impact on pricing transparency.

- Specific examples of increased pricing for AT&T services: While precise figures remain undisclosed publicly, reports suggest double-digit percentage increases in certain areas, particularly in services heavily reliant on VMware's infrastructure.

- Quotes from AT&T press releases or statements: Direct quotes regarding the Broadcom VMware acquisition's price impact are scarce in public AT&T statements. This lack of transparency fuels speculation and concern among industry analysts and customers.

- Links to relevant news articles and official statements: [Insert links to relevant news articles and official statements here, if available. If unavailable, remove this bullet point].

Analysis of the Impact of the Broadcom VMware Acquisition on Pricing

The price increases reported by AT&T and potentially other businesses aren't surprising given the implications of the Broadcom VMware acquisition. Several factors contribute to this concerning trend:

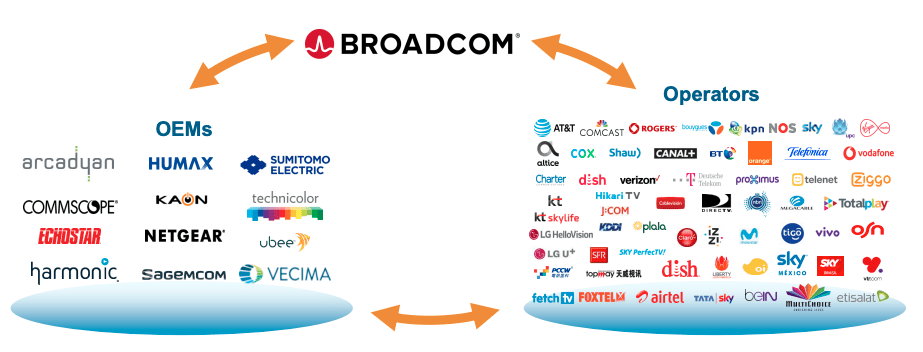

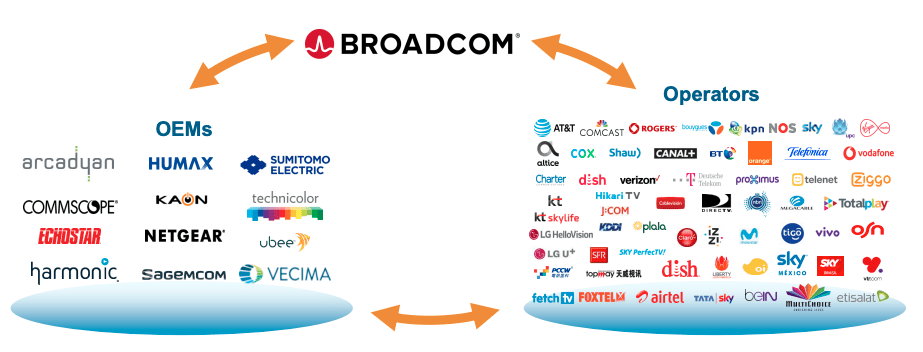

- Decreased competition in the market: Broadcom's acquisition of VMware significantly reduces competition in the virtualization market, allowing Broadcom to potentially leverage its newfound market dominance to increase prices.

- Broadcom's potential for leveraging VMware's technology for price increases: Broadcom now controls a critical piece of infrastructure for many businesses. This control gives them considerable leverage to negotiate higher prices for their services and associated VMware products.

- Impact on different customer segments: The impact isn't uniform. Companies heavily reliant on VMware's technologies are likely experiencing the most significant price increases, forcing them to either absorb higher costs or seek costly alternatives. Smaller businesses could be particularly vulnerable.

Concerns about Monopoly and Antitrust Implications of the Broadcom VMware Deal

The Broadcom VMware deal has faced significant regulatory scrutiny globally. Antitrust concerns are paramount, as the combination of two industry giants creates a potential monopoly, stifling innovation and competition.

- Summary of ongoing regulatory investigations: Several regulatory bodies are investigating the potential anti-competitive implications of the merger, examining whether it will harm consumers and reduce innovation.

- Potential penalties Broadcom may face: Depending on the findings of these investigations, Broadcom could face substantial fines or even be forced to divest certain assets to mitigate the anti-competitive risks.

- Discussion on potential impact on innovation within the industry: Reduced competition could stifle innovation, as Broadcom may have less incentive to invest in developing new technologies or improve existing ones when facing little to no competition.

Alternatives and Mitigation Strategies for Businesses Facing Price Increases

Businesses facing price increases related to the Broadcom VMware acquisition need to explore alternatives and develop mitigation strategies:

- List of alternative virtualization technologies: Several alternative virtualization technologies exist, including solutions from companies like Citrix, Microsoft (Hyper-V), and open-source options like Proxmox. Careful evaluation of these alternatives is crucial.

- Tips for negotiating with vendors: Companies should leverage their negotiating power and explore alternative pricing models to mitigate the impact of price increases. Transparency and a willingness to explore options are crucial.

- Strategies for cost reduction and optimization: Implementing cost-saving measures within IT infrastructure and operations is paramount. This could involve optimizing resource utilization, consolidating workloads, and streamlining operations.

Conclusion

The Broadcom VMware acquisition has already resulted in significant Broadcom VMware acquisition price increases for some businesses, notably AT&T, highlighting the potential for monopolies and negative market impacts. Regulatory scrutiny is ongoing, but the immediate consequences are undeniable. The lack of transparency from some vendors regarding these price hikes further exacerbates concerns. Understanding the intricacies of this deal and its pricing implications is crucial for informed decision-making. Stay informed about the ongoing developments and their implications for your business. Monitor pricing changes closely and explore alternative solutions to mitigate potential price increases associated with the Broadcom VMware acquisition. Proactive planning is crucial in navigating this evolving landscape.

Featured Posts

-

At And T Slams Broadcoms V Mware Price Hike A 1 050 Increase

Apr 23, 2025

At And T Slams Broadcoms V Mware Price Hike A 1 050 Increase

Apr 23, 2025 -

Broadcasters Scathing Mariners Comment Creates New York Seattle Rivalry Buzz

Apr 23, 2025

Broadcasters Scathing Mariners Comment Creates New York Seattle Rivalry Buzz

Apr 23, 2025 -

Reds Scoring Drought Ends In Loss To Milwaukee

Apr 23, 2025

Reds Scoring Drought Ends In Loss To Milwaukee

Apr 23, 2025 -

Tigers Vs Brewers Milwaukee Takes Series With 5 1 Win

Apr 23, 2025

Tigers Vs Brewers Milwaukee Takes Series With 5 1 Win

Apr 23, 2025 -

Nine Home Runs Propel Yankees To Win Judge Leads The Charge In 2025

Apr 23, 2025

Nine Home Runs Propel Yankees To Win Judge Leads The Charge In 2025

Apr 23, 2025