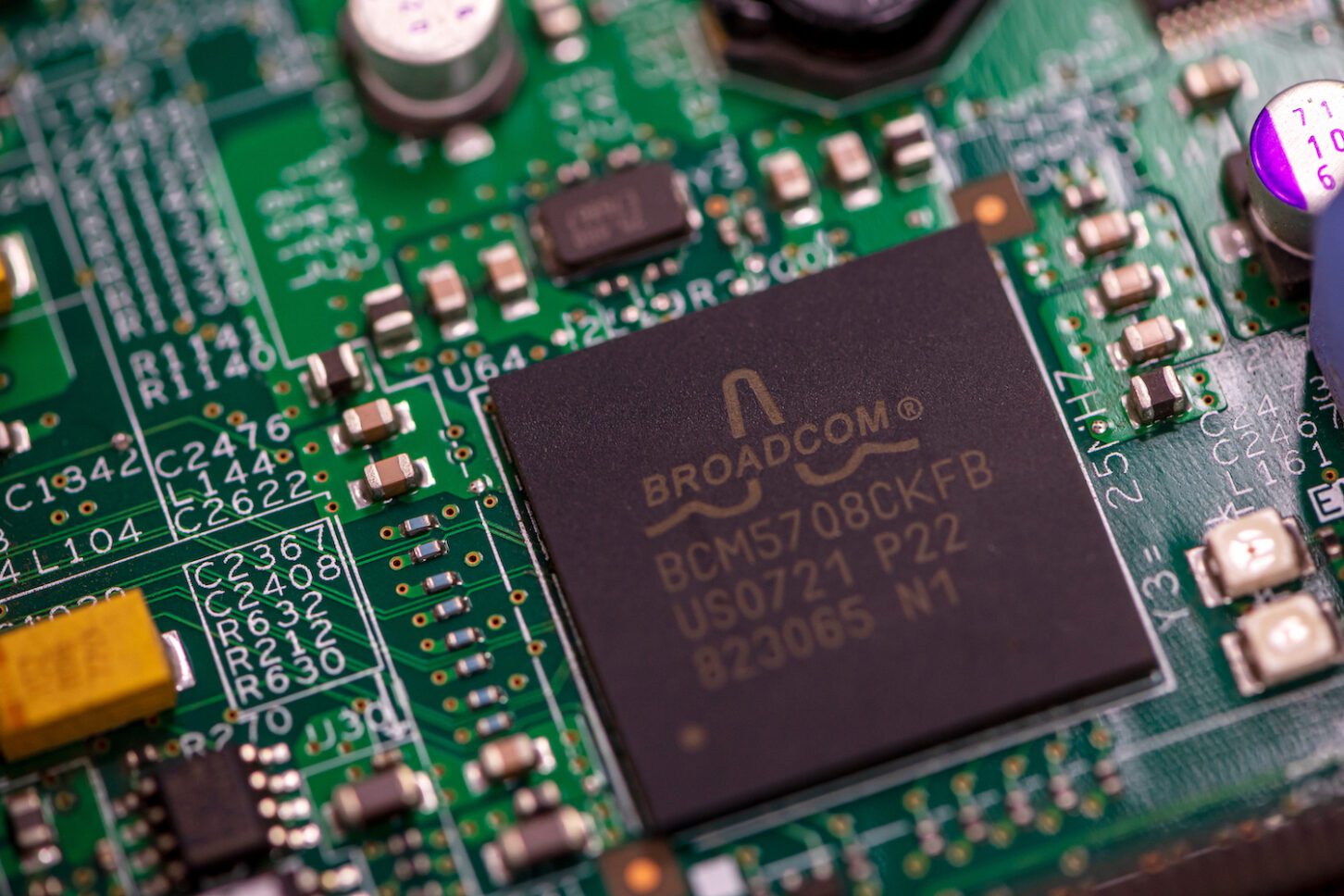

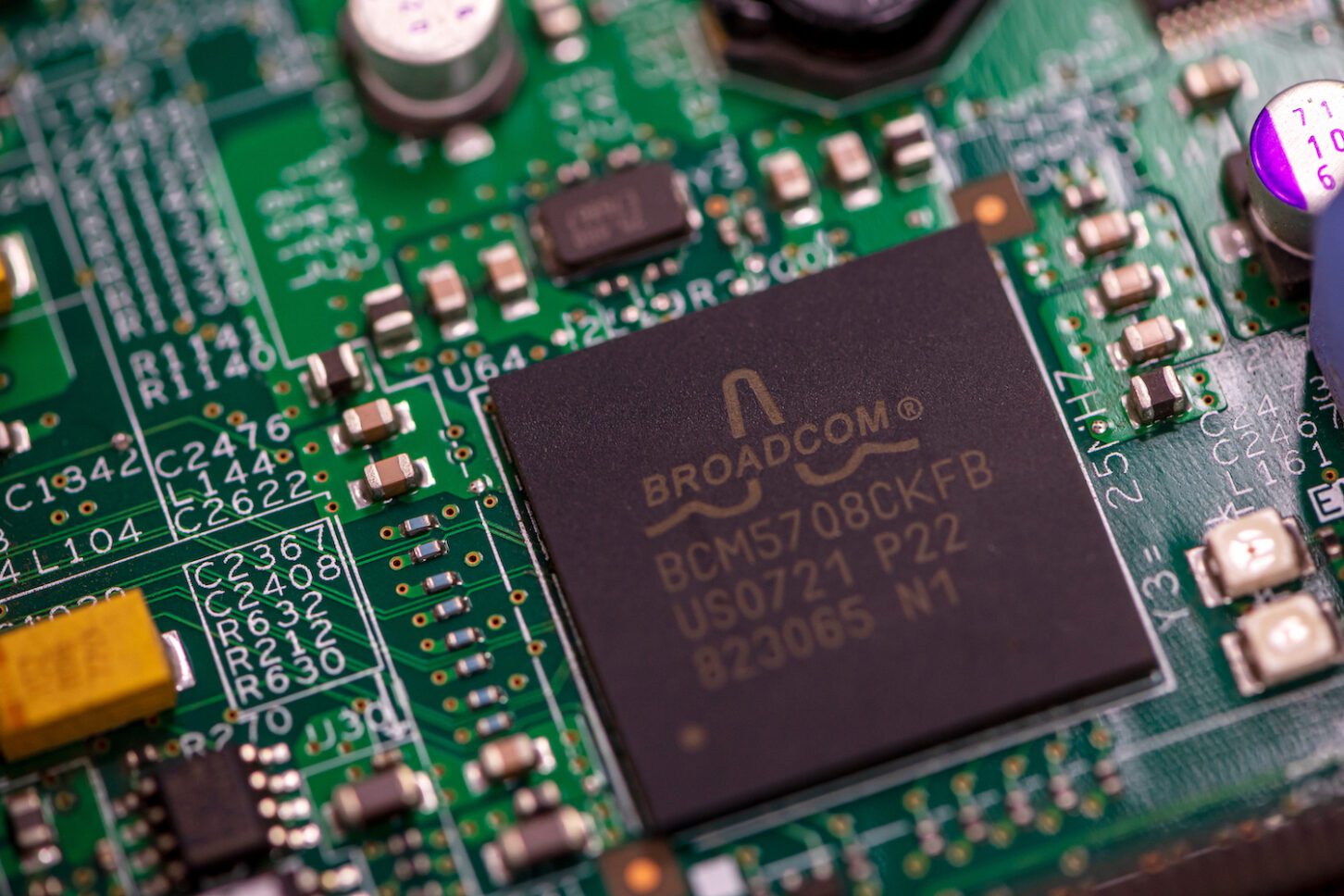

Broadcom's VMware Deal: AT&T Details Extreme Cost Implications

Table of Contents

AT&T's Public Concerns Regarding VMware Licensing Costs

AT&T, a major user of VMware's virtualization and cloud solutions, has publicly voiced concerns about the potential financial repercussions of Broadcom's takeover. These concerns are shared by many other large enterprises heavily invested in the VMware ecosystem.

Increased Licensing Fees

AT&T, like many other VMware clients, is expressing anxieties about potential price hikes following Broadcom's takeover. This concern stems from Broadcom's history of aggressive pricing strategies in the enterprise software market, a strategy that has historically impacted the cloud computing sector.

- Expect significant increases in licensing costs for existing VMware products and services. This could include substantial increases for core virtualization products, as well as add-on services and support contracts.

- Potential for renegotiation of existing contracts becomes challenging and costly. AT&T and other large organizations may find it difficult and expensive to renegotiate existing contracts, potentially locking them into unfavorable terms.

- Pressure on IT budgets due to unforeseen cost increases. The uncertainty surrounding future VMware pricing is creating significant budgetary pressure for IT departments, forcing them to re-evaluate their spending plans.

Lack of Transparency in Future Pricing

AT&T's concerns extend to the lack of clear communication from Broadcom regarding future licensing models and pricing structures. This uncertainty creates significant budgeting and planning difficulties.

- Difficulty in forecasting IT expenditure for the next fiscal year. The lack of transparency makes it extremely challenging for AT&T to accurately forecast its IT expenditure, leading to potential budget overruns.

- Uncertainty regarding product roadmaps and potential feature limitations. Concerns exist that Broadcom might prioritize profitability over innovation, potentially leading to slower product development or limitations in future features.

- Risk of vendor lock-in due to lack of viable alternatives. The uncertainty and potential cost increases raise concerns about vendor lock-in, making it difficult for companies to switch to alternative virtualization and cloud solutions.

Broader Implications for the Enterprise Software Market

The Broadcom-VMware merger has far-reaching implications that extend beyond AT&T's specific concerns. It dramatically reshapes the competitive landscape and raises significant antitrust questions.

Impact on Competitive Landscape

The Broadcom-VMware merger significantly alters the competitive landscape, potentially leading to less innovation and higher prices for enterprise software.

- Reduced competition could stifle innovation in virtualization and cloud technologies. With less competition, there's a risk that innovation in virtualization and cloud computing will slow down.

- Potential for consolidation within the enterprise software market leading to fewer choices for businesses. This merger could trigger further consolidation, ultimately reducing the number of choices available to businesses.

- Increased bargaining power for Broadcom leading to less favorable terms for customers. Broadcom's increased market share will give it greater bargaining power, potentially resulting in less favorable terms and pricing for customers.

Regulatory Scrutiny and Antitrust Concerns

This mega-merger is facing intense regulatory scrutiny worldwide due to potential antitrust issues and concerns about market dominance.

- Ongoing investigations by regulatory bodies in various countries. Antitrust regulators in several countries are currently investigating the deal, raising concerns about potential monopolistic practices.

- Potential for legal challenges and delays in the merger completion. Legal challenges could delay or even prevent the merger from being completed.

- Uncertainty regarding the final outcome of the regulatory review process. The uncertainty surrounding the regulatory outcome adds another layer of complexity and risk for businesses.

Strategies for Businesses to Mitigate the Impact of the Broadcom-VMware Deal

Businesses need to proactively develop strategies to mitigate the potential negative impacts of the Broadcom-VMware deal.

Contract Negotiation and Review

Thoroughly review existing VMware contracts and explore options for renegotiation before the terms are impacted by the acquisition. Seek better terms and pricing before the changes take effect.

Budgetary Planning and Forecasting

Adjust IT budgets to account for potential cost increases. Plan for higher licensing fees and factor in potential disruptions during the transition.

Exploring Alternative Solutions

Begin evaluating alternative virtualization and cloud solutions to reduce dependence on VMware. Diversifying your technology stack can help mitigate the risks associated with vendor lock-in.

Monitoring Regulatory Developments

Keep abreast of the regulatory review process and its potential impact. Stay informed about any legal challenges or decisions that may affect VMware pricing and licensing.

Conclusion

The Broadcom acquisition of VMware presents significant cost implications, particularly for major players like AT&T. The lack of transparency regarding future pricing strategies and the potential for increased licensing fees pose substantial challenges for businesses relying on VMware technologies. Understanding the broader implications of this merger and proactively implementing mitigation strategies is crucial for enterprises to navigate this rapidly changing landscape. Stay informed about the ongoing developments in the Broadcom-VMware deal and actively monitor the impact on your organization's IT infrastructure and budget. Don't let the implications of the Broadcom VMware deal catch you off guard – prepare for potential cost increases and explore alternative solutions now.

Featured Posts

-

Cy Young Winners Dominant April Performance 9 Run Lead Strikeouts And Undying Fire

Apr 23, 2025

Cy Young Winners Dominant April Performance 9 Run Lead Strikeouts And Undying Fire

Apr 23, 2025 -

Guardians Manager Terry Francona Ill Misses Game Vs Brewers

Apr 23, 2025

Guardians Manager Terry Francona Ill Misses Game Vs Brewers

Apr 23, 2025 -

Michael Lorenzen Stats Highlights And Career Analysis

Apr 23, 2025

Michael Lorenzen Stats Highlights And Career Analysis

Apr 23, 2025 -

Royals Dominant 11 1 Victory In Brewers Home Opener

Apr 23, 2025

Royals Dominant 11 1 Victory In Brewers Home Opener

Apr 23, 2025 -

Historic Night For Yankees 9 Home Runs 3 By Aaron Judge

Apr 23, 2025

Historic Night For Yankees 9 Home Runs 3 By Aaron Judge

Apr 23, 2025