Bundestag Elections And The Dax: Analyzing The Correlation

Table of Contents

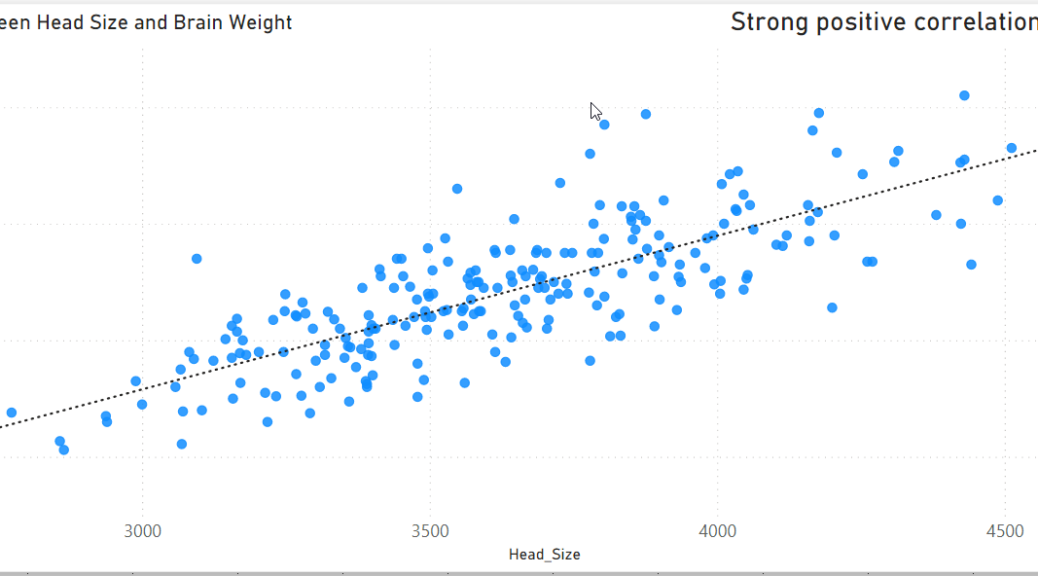

Historical Performance of the DAX Around Bundestag Elections

The DAX's behavior surrounding Bundestag elections reveals interesting patterns. Analyzing historical data helps investors anticipate potential market movements during and after these significant political events.

Pre-Election Volatility

The months leading up to a Bundestag election often witness increased volatility in the DAX. This pre-election uncertainty stems from several factors:

-

Policy Uncertainty: The lack of clarity regarding the future government's economic policies creates an environment of speculation and hesitation among investors. Different parties propose varying approaches to fiscal policy, taxation, and regulation, making it difficult to predict the market's future direction.

-

Coalition Negotiations: The formation of a coalition government after the election can be a lengthy and unpredictable process. This protracted uncertainty further contributes to market fluctuations as investors anxiously await clarity on the future political landscape.

Consider the 2017 Bundestag election. In the months preceding the vote, the DAX experienced significant swings, reflecting the uncertainty surrounding the potential outcomes and the ensuing coalition negotiations. This period highlighted the increased risk aversion among investors during such times. Visual representations, such as charts showcasing the DAX performance in the lead-up to previous elections, clearly demonstrate this pre-election volatility.

- Increased market uncertainty: Investors become hesitant, leading to reduced trading volume and potential price corrections.

- Potential for short-term corrections: Market participants may take profits or reduce exposure, causing temporary dips in the DAX.

- Opportunities for informed investors: Those who accurately anticipate market movements can potentially benefit from short-term trading strategies.

Post-Election Market Reactions

Post-election market reactions depend heavily on the election results and the subsequent formation of the government.

-

Influence of Election Results: A clear victory for a particular party generally leads to greater market stability compared to a close race or a coalition government requiring extensive negotiations. A decisive mandate often translates into quicker policy implementation and reduced uncertainty, boosting investor confidence.

-

Government Formation and Policy Announcements: Once a new government is formed, its policy announcements significantly shape the DAX's trajectory. For example, announcements regarding fiscal stimulus packages, tax reforms, or regulatory changes can have a substantial impact on investor sentiment and market valuations.

Case studies of previous Bundestag elections reveal the diverse impacts of different election outcomes. A government committed to pro-business policies typically results in positive market reactions, while a government pursuing significant regulatory changes or increased taxation might lead to negative short-term impacts.

- Market stabilization: After the election dust settles, the market generally stabilizes as investors gain a clearer understanding of the government's plans.

- Potential for growth or decline: The direction of the DAX depends significantly on the new government’s economic policies.

- Long-term investment strategies: Investors should consider long-term growth prospects rather than reacting solely to short-term volatility.

Factors Influencing the Correlation Between Bundestag Elections and the DAX

Several factors intertwine to determine the relationship between Bundestag elections and DAX performance.

Policy Uncertainty and Investor Sentiment

Uncertainty surrounding the election outcome directly affects investor decisions.

-

Risk Aversion: During periods of political uncertainty, investors tend to adopt a more risk-averse approach, shifting their investments towards safer assets like government bonds. This flight to safety can lead to decreased investment in the stock market and depress the DAX.

-

Impact of Political Platforms: The economic policies proposed by different parties significantly influence market expectations. For instance, a party advocating for increased social spending might lead to concerns about higher taxes and potentially dampen investor enthusiasm. Conversely, pro-business policies might boost investor confidence and positively impact the DAX.

-

Role of Media Coverage: Media coverage plays a substantial role in shaping investor sentiment. Negative news or speculation surrounding the election can negatively impact investor confidence, while positive news can have the opposite effect.

-

Decreased investment: Investors may postpone investment decisions until political uncertainty clears.

-

Flight to safety: Investors move funds from riskier assets (like stocks) to safer options (like government bonds).

-

Potential for increased volatility: Fluctuations in investor sentiment lead to greater price swings in the DAX.

Economic Policies and Market Outlook

The economic policies of the new government directly influence the DAX's long-term performance.

-

Fiscal Policy: Government spending and taxation policies significantly impact the overall economy and, consequently, the stock market. Expansionary fiscal policies (increased government spending) can stimulate economic growth, while contractionary policies (reduced spending) can have the opposite effect.

-

Monetary Policy: The European Central Bank's monetary policy, including interest rate decisions, also plays a crucial role. Interest rate changes influence borrowing costs for businesses, impacting investment decisions and affecting corporate profits.

-

Regulatory Changes: Changes in regulations impacting specific sectors can have a disproportionate effect on those sectors' performance within the DAX.

-

Potential for economic growth or contraction: The new government's economic policies directly impact the country's economic trajectory.

-

Impact on specific sectors: Certain sectors are more sensitive to specific policy changes than others.

-

Long-term implications for investors: The chosen economic direction significantly shapes the long-term outlook for the DAX.

Strategies for Navigating the Bundestag Elections and the DAX

Navigating the complexities of Bundestag elections and their impact on the DAX requires a strategic approach.

Risk Management and Diversification

Mitigating political risk is crucial for investors.

-

Diversification: Diversifying investment portfolios across different asset classes (stocks, bonds, real estate, etc.) helps reduce the overall impact of negative market fluctuations.

-

Hedging Strategies: Employing hedging strategies, such as options or futures contracts, can help protect against potential losses caused by market volatility during periods of political uncertainty.

-

Long-Term Investment Horizon: Maintaining a long-term investment horizon allows investors to ride out short-term market fluctuations caused by political events.

-

Diversified portfolio: Spreading investments across various asset classes reduces exposure to any single market risk.

-

Hedging strategies: Using financial instruments to offset potential losses from market downturns.

-

Long-term investment horizon: Focusing on long-term growth rather than reacting to short-term market fluctuations.

-

Professional financial advice: Seeking guidance from financial experts can significantly improve investment outcomes.

Opportunities for Informed Investors

Election-related market fluctuations can present opportunities for informed investors.

-

Fundamental Analysis: Thorough fundamental analysis of companies listed on the DAX can help identify undervalued assets with strong long-term growth potential.

-

Market Research: Staying informed about the political landscape and potential policy changes allows investors to anticipate market movements and make well-timed investment decisions.

-

Strategic Investment Timing: Capitalizing on market corrections caused by election-related uncertainty can generate attractive returns for those with a well-defined strategy.

-

Identifying undervalued assets: Political uncertainty can temporarily depress the prices of fundamentally strong companies.

-

Capitalizing on market corrections: Short-term price drops can be excellent buying opportunities for long-term investors.

-

Long-term growth potential: Focusing on companies with strong fundamentals ensures sustained growth regardless of short-term political events.

Conclusion

The relationship between Bundestag elections and the DAX is multifaceted and influenced by a range of intertwined factors, including policy uncertainty, economic forecasts, and investor sentiment. Historically, increased volatility surrounds election periods, followed by market responses determined by election outcomes and the new government's policies. Understanding this dynamic is key for investors aiming to effectively navigate the German stock market. By carefully analyzing historical trends, economic policies, and market sentiment, investors can make informed choices and potentially leverage the opportunities that arise from these significant political events. Stay informed about upcoming Bundestag elections and their potential effects on your DAX investments.

Featured Posts

-

Exec Office365 Breach Crook Makes Millions Feds Say

Apr 27, 2025

Exec Office365 Breach Crook Makes Millions Feds Say

Apr 27, 2025 -

Is The Cdcs New Vaccine Study Hire Spreading Misinformation

Apr 27, 2025

Is The Cdcs New Vaccine Study Hire Spreading Misinformation

Apr 27, 2025 -

Pfc Revokes Gensols Eo W Following Submission Of Fake Documents

Apr 27, 2025

Pfc Revokes Gensols Eo W Following Submission Of Fake Documents

Apr 27, 2025 -

1 050 V Mware Price Hike At And T Sounds The Alarm On Broadcoms Proposal

Apr 27, 2025

1 050 V Mware Price Hike At And T Sounds The Alarm On Broadcoms Proposal

Apr 27, 2025 -

Real Time Analysis How A Canadian Travel Boycott Affects The American Economy

Apr 27, 2025

Real Time Analysis How A Canadian Travel Boycott Affects The American Economy

Apr 27, 2025