Canadian Dollar's Complex Forex Performance: A Current Overview

Table of Contents

Influence of Commodity Prices on the CAD

The Canadian dollar's value has a strong correlation with commodity prices, primarily oil and natural gas. Canada is a major exporter of these resources, making the CAD a classic example of a "commodity currency." This means that the CAD's strength is intrinsically linked to the performance of the commodity market.

-

The CAD is often referred to as a "commodity currency." This direct link means that when oil and natural gas prices rise, so does the demand for the CAD, strengthening its value in the foreign exchange market. Conversely, a downturn in commodity prices typically weakens the Canadian dollar.

-

Rising oil prices typically strengthen the CAD. Increased global demand for oil translates to higher Canadian exports and increased revenue, boosting the CAD's value. This positive feedback loop makes the CAD a particularly interesting currency to trade during periods of energy market volatility.

-

Conversely, falling oil prices weaken the CAD. Reduced demand and lower export revenues directly impact the CAD's exchange rate, causing it to depreciate against other major currencies. Understanding these price fluctuations is crucial for navigating the Canadian dollar exchange rate.

-

Diversification of the Canadian economy is lessening, but not eliminating, this dependence. While Canada is striving to diversify its economy beyond natural resources, the significant contribution of these commodities to the nation's GDP means that their influence on the CAD remains substantial. This makes staying informed about the commodity market essential for any investor interested in the CAD.

Impact of Interest Rate Decisions on CAD Forex Trading

The Bank of Canada's monetary policy and its interest rate decisions are pivotal in influencing the CAD's value in forex trading. Interest rates significantly affect the attractiveness of the Canadian dollar to international investors.

-

Higher interest rates generally attract foreign investment, strengthening the CAD. Higher returns incentivize investors to move their capital to Canada, increasing the demand for CAD and thus strengthening its value. This makes the CAD a sought-after currency during periods of increased interest rate hikes.

-

Lower interest rates can weaken the CAD as investors seek higher returns elsewhere. When interest rates are lower in Canada compared to other countries, investors may move their funds to markets offering better returns, decreasing the demand for the CAD and consequently weakening its value.

-

Market anticipation of future interest rate changes also influences the CAD. The forex market often reacts to expectations and speculation regarding future interest rate adjustments, causing the CAD to fluctuate even before official announcements.

-

Analysis of the Bank of Canada's statements is crucial for predicting CAD movements. Careful study of the Bank's communications, including press releases and monetary policy reports, can provide valuable insights into future interest rate decisions and their potential impact on the CAD. This kind of fundamental analysis is key for making informed trading decisions.

Geopolitical Factors and their Effect on the Canadian Dollar

Geopolitical risks and global uncertainty significantly impact the Canadian dollar's performance. Events unfolding on the international stage can cause significant volatility in the CAD's exchange rate.

-

Global economic slowdowns can negatively impact the CAD. A downturn in the global economy can reduce demand for Canadian exports, leading to a weakening of the CAD. This highlights the interconnectedness of the global economy and its effects on national currencies.

-

Political instability in major trading partners can cause CAD volatility. Political upheaval or economic sanctions imposed on key trading partners can negatively affect Canadian trade and investment, subsequently impacting the CAD's value.

-

Changes in trade agreements significantly influence the CAD. Negotiations and revisions of international trade agreements, such as the USMCA, can substantially impact the Canadian economy and thus the CAD's exchange rate.

-

Monitoring global news is vital for understanding CAD fluctuations. Staying informed about global developments through reputable news sources is essential for understanding the forces driving CAD volatility and making sound investment choices.

Analyzing Current CAD Exchange Rates and Future Predictions

Currently, the CAD is trading at [insert current CAD exchange rates against major currencies like USD, EUR, GBP]. However, predicting future movements in the CAD exchange rate involves a degree of uncertainty. Both technical and fundamental analysis are used to forecast potential movements.

-

Provide current CAD exchange rates against major currencies. [Insert current exchange rates from a reliable source.] Real-time tracking of these rates is crucial for making timely trading decisions.

-

Mention factors considered in short-term and long-term CAD forecasts. Short-term forecasts often focus on recent market events and technical indicators, while long-term predictions consider broader economic factors.

-

Highlight the limitations of forecasting currency movements. Currency markets are notoriously complex and volatile. Forecasts should always be viewed with caution, acknowledging the inherent uncertainties involved.

-

Suggest resources for tracking real-time exchange rates. Reliable sources for tracking exchange rates include reputable financial news websites, forex trading platforms, and central bank websites.

Conclusion

The Canadian dollar's forex performance is a complex tapestry woven from the threads of commodity prices, interest rate decisions, and geopolitical events. Understanding the interplay of these factors is crucial for anyone involved in trading or investing in the CAD. The strong correlation between the CAD and commodity prices, particularly oil, highlights the vulnerability of the currency to global energy market fluctuations. Interest rate changes by the Bank of Canada profoundly influence investor sentiment, while geopolitical events inject significant uncertainty into the market. By staying informed about these factors and leveraging various analytical tools, investors and traders can make more informed decisions regarding the Canadian dollar. Stay updated on the latest developments impacting the Canadian Dollar's forex performance to make informed decisions regarding your currency trading and investments. Continue learning about the complexities of the Canadian dollar (CAD) in the forex market.

Featured Posts

-

Brett Goldstein Compares Ted Lasso Revival To A Miracle A Thought Dead Cat

Apr 24, 2025

Brett Goldstein Compares Ted Lasso Revival To A Miracle A Thought Dead Cat

Apr 24, 2025 -

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025 -

Navigating The Complexities Automakers Face Headwinds In The Chinese Market

Apr 24, 2025

Navigating The Complexities Automakers Face Headwinds In The Chinese Market

Apr 24, 2025 -

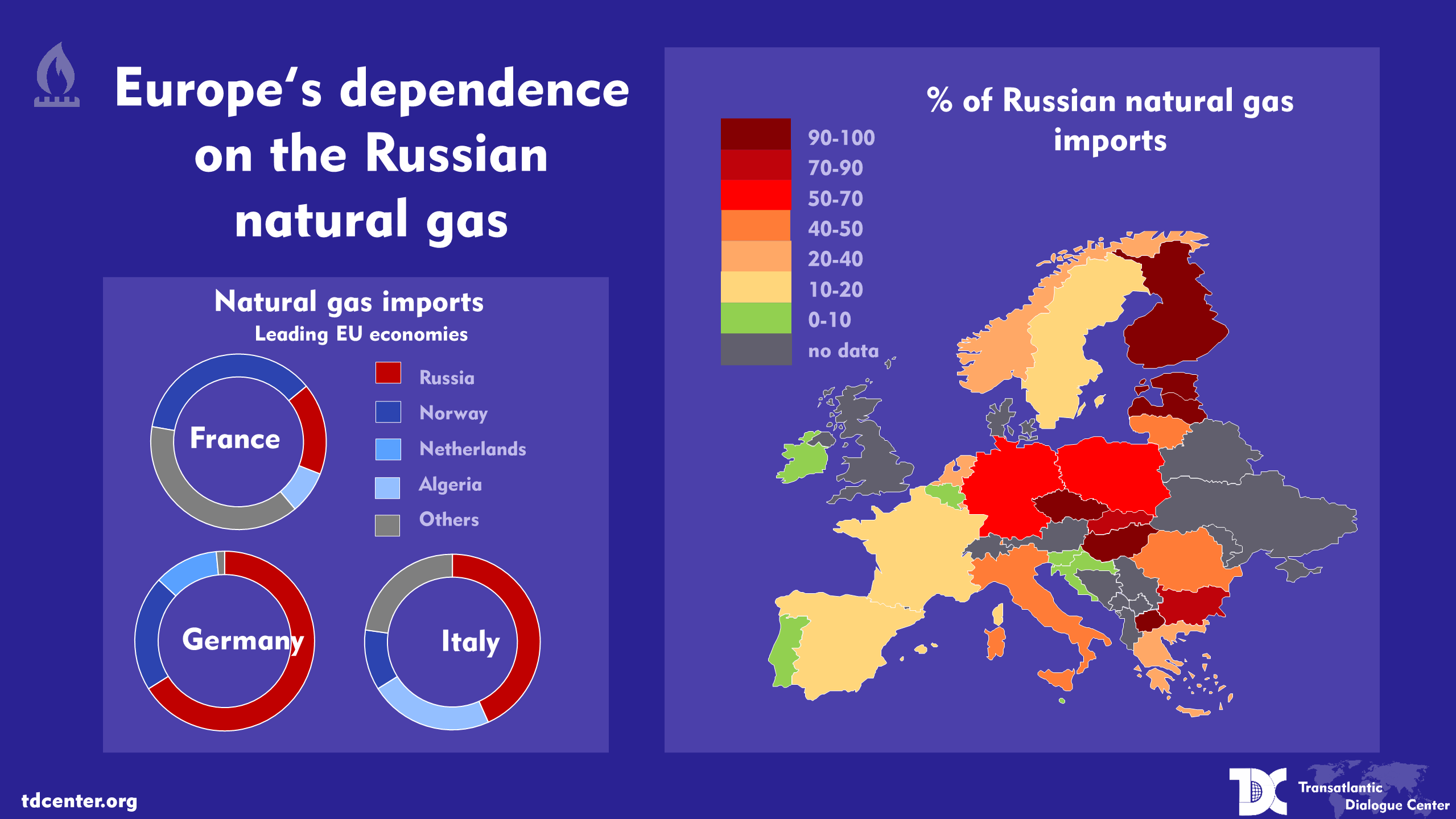

Russian Natural Gas Eus Discussion On Spot Market Restrictions

Apr 24, 2025

Russian Natural Gas Eus Discussion On Spot Market Restrictions

Apr 24, 2025 -

Update John Travolta Comments On Shared Photo From Luxurious Family Home

Apr 24, 2025

Update John Travolta Comments On Shared Photo From Luxurious Family Home

Apr 24, 2025