Canadian Dollar's Recent Fluctuations: Understanding The Market Dynamics

Table of Contents

Impact of Commodity Prices on the Canadian Dollar

Canada's economy is heavily reliant on commodity exports, creating a strong correlation between commodity prices and the Canadian dollar. Fluctuations in the prices of oil, natural gas, lumber, and other key exports directly influence the CAD's value. This relationship is often referred to as the "commodity currency" effect.

-

Fluctuating Oil Prices and the CAD: As a major oil producer, Canada's economy is particularly sensitive to oil price swings. When oil prices rise, the demand for the CAD increases, strengthening its value. Conversely, falling oil prices weaken the CAD. This direct correlation is a significant factor in understanding short-term Canadian dollar fluctuations.

-

Other Commodity Influences: Beyond oil, other commodities such as lumber, natural gas, and various metals play a crucial role. For example, increased global demand for lumber can boost the Canadian dollar, while a decline in metal prices could negatively impact its value. These diverse commodity influences contribute to the overall CAD exchange rate fluctuations.

-

Global Commodity Demand: Global economic growth and demand for commodities are key factors. Strong global growth generally leads to higher commodity prices and a stronger CAD, while a global economic slowdown can have the opposite effect. Analyzing global economic indicators is essential for predicting Canadian dollar volatility.

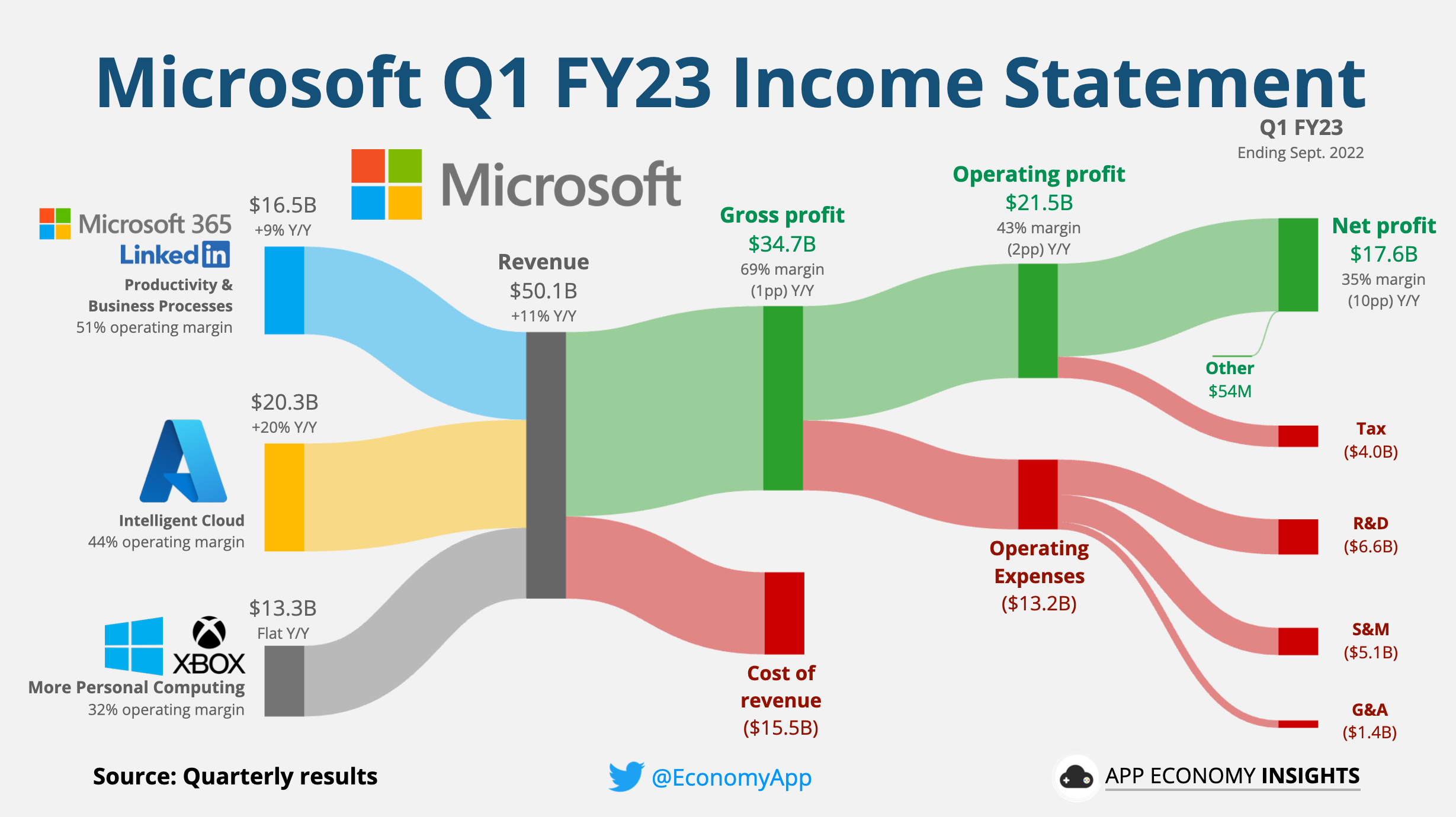

[Insert chart/graph here showing correlation between commodity prices (e.g., oil price) and CAD exchange rate over a specific period.]

Influence of Interest Rate Differentials on CAD Exchange Rates

The Bank of Canada (BoC)'s monetary policy significantly influences the CAD's exchange rate. Interest rate decisions directly impact the attractiveness of the Canadian dollar to foreign investors. Higher interest rates in Canada relative to other major economies tend to attract foreign investment, increasing demand for the CAD and strengthening its value. This is known as the "carry trade," where investors borrow in low-interest-rate currencies and invest in high-interest-rate currencies like the CAD to profit from the interest rate differential.

-

BoC's Monetary Policy and the CAD: The BoC's interest rate decisions are a key driver of Canadian dollar fluctuations. Rate hikes generally lead to a stronger CAD, while rate cuts tend to weaken it. Understanding the BoC's rationale behind these decisions is therefore crucial.

-

Canadian vs. Global Interest Rates: Comparing Canadian interest rates with those of major economies like the US and the EU helps gauge the attractiveness of the CAD for investors engaging in carry trades. A higher interest rate differential relative to these major economies can attract significant foreign capital, boosting the CAD's value.

-

Carry Trade and CAD Demand: The carry trade is a significant mechanism influencing CAD exchange rate fluctuations. Investors actively seek higher returns, making the CAD attractive when interest rates are comparatively high. However, this effect can be reversed if global economic conditions change, causing investors to unwind their carry trades.

[Insert table or chart here showing recent BoC interest rate decisions and their subsequent impact on the CAD exchange rate.]

Geopolitical Factors and Their Impact on Canadian Dollar Fluctuations

Global political events and economic uncertainty significantly impact the Canadian dollar. The CAD is considered a relatively safe haven currency, but its value can still be influenced by external shocks and geopolitical risks.

-

US-China Trade Relations: Given Canada's close economic ties with the US, developments in US-China trade relations directly influence the CAD. Trade tensions or escalating conflicts can increase global uncertainty, impacting investor confidence and potentially weakening the CAD.

-

Global Economic Slowdowns: Global economic slowdowns or recessions significantly impact commodity demand and investor sentiment, leading to Canadian dollar volatility. During periods of global uncertainty, investors often seek safer havens, which can sometimes benefit the CAD, but not always.

-

Canadian Political Stability: Political stability within Canada also plays a role. Periods of political uncertainty or instability can negatively impact investor confidence, potentially leading to a weaker CAD. Stable political leadership and clear policy directions generally support a stronger Canadian dollar.

[Provide examples of specific geopolitical events and their corresponding short-term and long-term impact on the CAD's value.]

The Role of the US Dollar in Canadian Dollar Fluctuations

The US dollar (USD) is the world's reserve currency, and its performance significantly influences the CAD. The USD/CAD exchange rate is a key indicator of the relative strength of both currencies. A strong USD generally translates into a weaker CAD, while a weak USD can strengthen the CAD.

-

USD Strength/Weakness and the CAD: The correlation between the USD and CAD is very close, often exhibiting an inverse relationship. When the USD strengthens, investors may sell CAD for USD, leading to a weaker CAD. Conversely, a weaker USD often boosts the CAD.

-

US Economic Data Releases: The release of key US economic data (e.g., employment reports, inflation data) significantly influences both the USD and, consequently, the CAD. Positive economic news tends to strengthen the USD and weaken the CAD; negative news can lead to the opposite effect.

-

USD/CAD Exchange Rate Forecasting: Accurately forecasting the USD/CAD exchange rate is complex but crucial for businesses, investors, and individuals involved in international transactions. Various analytical methods are used, including technical analysis and fundamental analysis, to predict future movements.

[Insert chart comparing USD and CAD performance over a specific period, highlighting their correlation.]

Conclusion: Navigating the Complexities of Canadian Dollar Fluctuations

Understanding Canadian dollar fluctuations requires considering several interacting factors: commodity prices, interest rate differentials, geopolitical events, and the performance of the US dollar. These intertwined elements create a complex and dynamic environment impacting businesses, investors, and individuals. By staying informed about these influences, stakeholders can mitigate risks and potentially capitalize on opportunities arising from Canadian dollar volatility. Regularly monitoring reliable financial news sources, consulting with financial advisors, and utilizing forecasting tools are crucial for effectively navigating Canadian dollar trends and making informed decisions concerning investments and currency exchange. Keep a close eye on CAD exchange rate fluctuations and the key indicators outlined in this article to make the best decisions for your financial future.

Featured Posts

-

Breast Cancer Awareness The Story Of Tina Knowles And Missed Mammograms

Apr 24, 2025

Breast Cancer Awareness The Story Of Tina Knowles And Missed Mammograms

Apr 24, 2025 -

Village Roadshows 417 5 Million Deal Approved Alcons Stalking Horse Bid Wins

Apr 24, 2025

Village Roadshows 417 5 Million Deal Approved Alcons Stalking Horse Bid Wins

Apr 24, 2025 -

1 050 V Mware Price Hike At And T Details Broadcoms Proposed Increase

Apr 24, 2025

1 050 V Mware Price Hike At And T Details Broadcoms Proposed Increase

Apr 24, 2025 -

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025 -

Chat Gpt Creator Open Ai Under Federal Trade Commission Investigation

Apr 24, 2025

Chat Gpt Creator Open Ai Under Federal Trade Commission Investigation

Apr 24, 2025