China's Automotive Market: A Deep Dive Into The Difficulties Faced By Premium Brands

Table of Contents

Intense Competition from Domestic Brands

The rise of Chinese domestic brands is nothing short of phenomenal. Once synonymous with low-quality, inexpensive vehicles, these brands have undergone a dramatic transformation, delivering increasingly sophisticated and affordable cars that directly compete with established premium players. Companies like BYD, Geely, and NIO are not just surviving; they're thriving, capturing significant market share and challenging the dominance of long-standing foreign competitors in the premium segment.

- Technological Advancements: Domestic brands are rapidly adopting cutting-edge technologies, including electric vehicle (EV) powertrains, advanced driver-assistance systems (ADAS), and sophisticated infotainment systems, often at competitive price points.

- Aggressive Pricing Strategies: Chinese brands frequently employ aggressive pricing strategies, undercutting premium imports and making their vehicles more attractive to budget-conscious yet quality-seeking consumers.

- Strong Marketing Campaigns: Targeted marketing campaigns, leveraging social media and understanding nuanced cultural preferences, effectively reach Chinese consumers and build brand loyalty.

- Government Support: Significant government support and incentives for domestic automakers further bolster their competitiveness against international rivals in China's automotive market.

Understanding Unique Consumer Preferences in China

The Chinese automotive market isn't just big; it's complex. Consumer preferences differ significantly from Western markets, demanding a nuanced understanding from premium brands aiming to succeed. Brand perception and social status play a crucial role in purchasing decisions, particularly within the luxury segment. It's not just about the car itself; it's about the image and experience associated with owning it.

- Technological Focus: Chinese consumers exhibit a strong preference for advanced technology and innovative designs, often prioritizing features over traditional luxury hallmarks.

- EV and Hybrid Preference: The rapid adoption of electric vehicles and hybrid models in China presents both an opportunity and a challenge for premium brands.

- After-Sales Service: Exceptional after-sales service and a positive overall brand experience are critical factors influencing purchase decisions and loyalty.

- Social Media Influence: Online reviews, social media discussions, and influencer marketing hold significant sway, shaping consumer perceptions and influencing purchase choices.

Navigating Regulatory Hurdles and Import Tariffs

China's automotive regulatory landscape is notoriously complex. Navigating import/export processes, complying with stringent emission standards, and overcoming fluctuating import tariffs represent significant hurdles for premium brands. These complexities directly impact profitability and necessitate strategic planning and significant investment.

- Stringent Emission Standards: Meeting increasingly stringent emission standards requires substantial investment in research and development and can significantly impact vehicle pricing.

- Complex Certification: The intricate certification process adds time and cost to market entry, delaying the launch of new models and increasing operational expenses.

- Tariff Fluctuations: Unpredictable changes in import tariffs create instability and make it challenging to forecast profitability accurately.

- Distribution Network Challenges: Establishing a reliable and efficient distribution network across China's vast and diverse regions presents logistical challenges and necessitates significant investment.

Adapting Marketing and Sales Strategies for the Chinese Market

Success in China's automotive market demands a tailored approach. Generic strategies adopted from Western markets are unlikely to yield the desired results. Premium brands must adapt their marketing and sales strategies to resonate with unique cultural nuances, leveraging digital channels and building relationships with key influencers.

- Influencer Marketing: Collaborating with influential figures on social media and leveraging their reach to build brand awareness and credibility is paramount.

- Digital Marketing Prowess: Mastering digital marketing channels, including WeChat, Weibo, and other popular platforms, is crucial for reaching target demographics effectively.

- Targeted Campaigns: Crafting targeted marketing campaigns based on specific consumer demographics and preferences ensures that messaging resonates with the intended audience.

- Pricing Strategy Adaptation: Developing pricing strategies that reflect local market conditions, competition, and consumer expectations is crucial for securing market share.

Conclusion: Success in China's Automotive Market Requires Strategic Adaptation

The Chinese automotive market presents both immense opportunities and significant challenges for premium brands. Intense competition from domestic brands, unique consumer preferences, regulatory hurdles, and the need for localized marketing strategies all demand strategic adaptation. However, the long-term potential remains considerable. Understanding these complexities, adapting to the unique nuances of the market, and investing strategically are key to succeeding in China's automotive market for premium brands. Further research into consumer behavior, regulatory changes, and competitive landscapes is crucial for any brand aiming to establish or strengthen its position within the premium automotive brands in China. Don't just enter the Chinese automotive market; conquer it with insightful planning and strategic execution.

Featured Posts

-

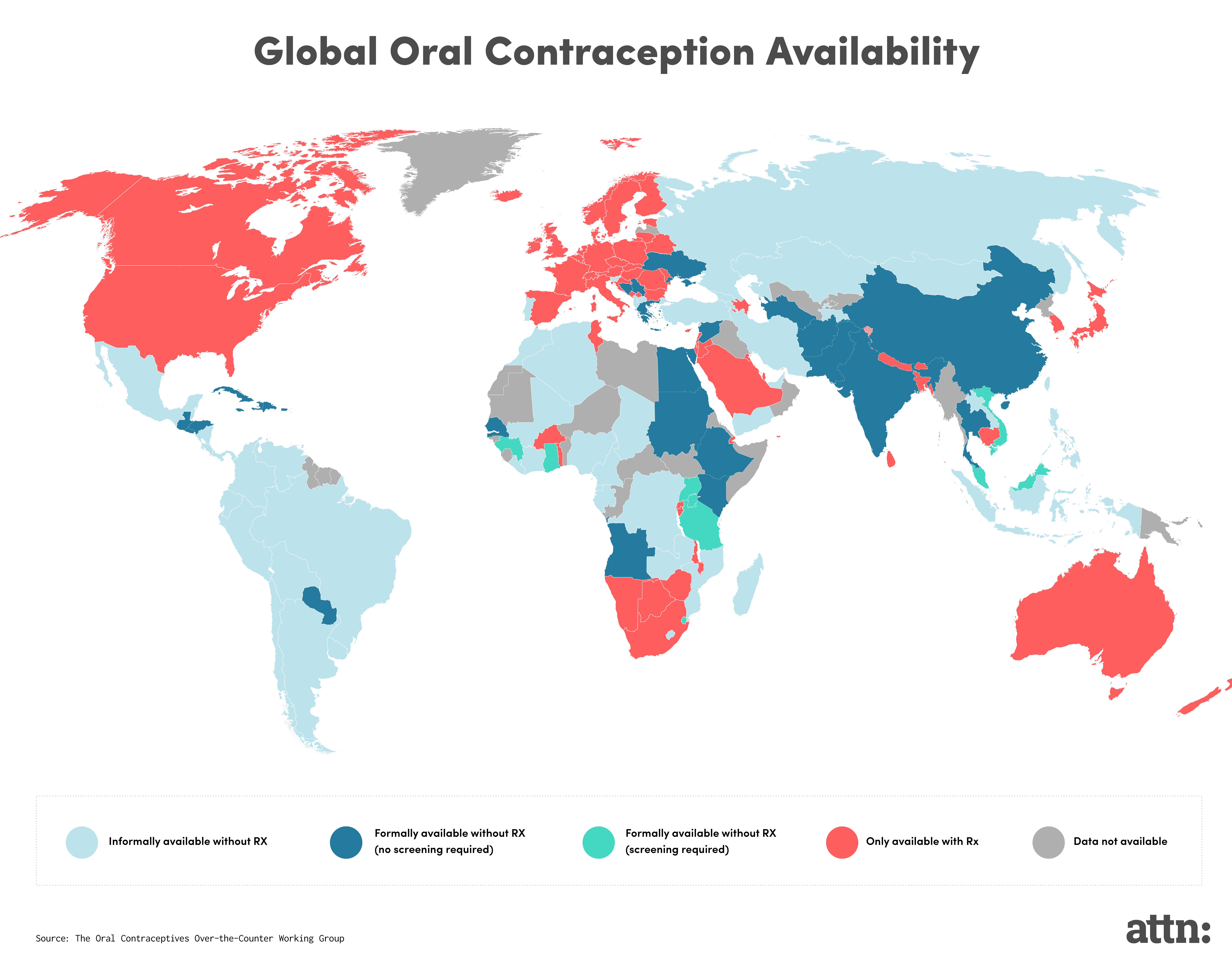

Access To Birth Control The Impact Of Over The Counter Options Post Roe

Apr 22, 2025

Access To Birth Control The Impact Of Over The Counter Options Post Roe

Apr 22, 2025 -

Blockchain Analytics Leader Chainalysis Integrates Ai Startup Alterya

Apr 22, 2025

Blockchain Analytics Leader Chainalysis Integrates Ai Startup Alterya

Apr 22, 2025 -

Overcoming The Challenges Of Robotic Nike Shoe Production

Apr 22, 2025

Overcoming The Challenges Of Robotic Nike Shoe Production

Apr 22, 2025 -

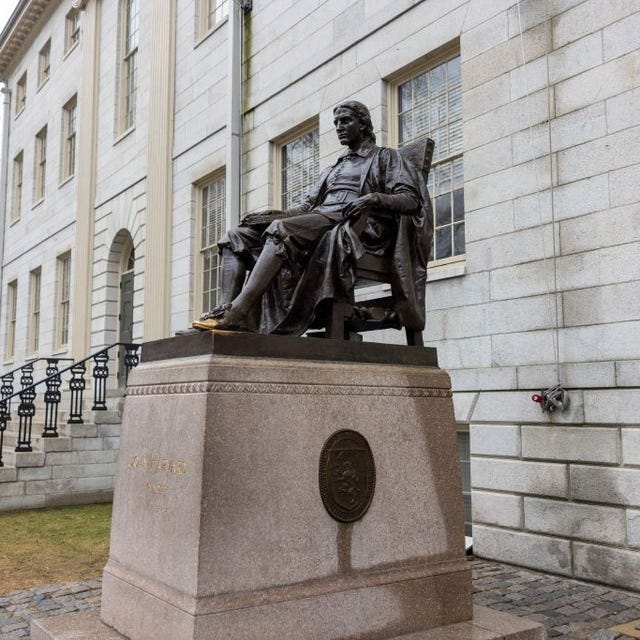

Harvard And The Trump Administration A 1 Billion Funding Cut And Growing Conflict

Apr 22, 2025

Harvard And The Trump Administration A 1 Billion Funding Cut And Growing Conflict

Apr 22, 2025 -

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 22, 2025

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 22, 2025