China's Energy Strategy: Increased LPG Reliance On The Middle East

Table of Contents

Rising Domestic LPG Demand in China

China's burgeoning energy consumption is a key factor behind its increased reliance on LPG imports. This demand is fueled by both economic growth and evolving environmental policies.

Economic Growth and Industrialization

China's rapid economic expansion has significantly increased its energy needs. LPG plays a crucial role, serving diverse sectors.

- Increased urbanization: The rapid migration from rural areas to cities fuels the demand for residential heating and cooking fuels, with LPG increasingly favored over traditional options.

- Booming manufacturing sector: Many industrial processes utilize LPG as a fuel source, contributing significantly to the overall demand. The manufacturing sector's continuous expansion directly translates into higher China LPG consumption.

- Rising disposable incomes: Increased disposable income leads to higher energy consumption across all sectors, further boosting the demand for cleaner-burning fuels like LPG for residential use.

This surge in demand necessitates a robust and reliable LPG supply chain, with the Middle East emerging as a critical partner. Understanding the nuances of China LPG consumption across various sectors is essential for market analysis.

Environmental Considerations and Policy Shifts

While coal remains a significant energy source in China, the government's commitment to cleaner energy and stricter environmental regulations are driving a transition towards LPG.

- Government initiatives to reduce air pollution: China's ambitious goals to curb air pollution have led to policies that incentivize the use of cleaner fuels, like LPG, in both residential and industrial settings.

- Stricter emission standards favoring cleaner fuels like LPG: The implementation of stricter emission standards makes LPG a more attractive alternative to dirtier fuels, further contributing to the increased demand for China LPG consumption.

These environmental regulations indirectly, yet significantly, increase the demand for LPG, shaping China's energy policy and its relationship with Middle Eastern LPG suppliers. Analyzing China clean energy policy and its impact on LPG demand is key to understanding this evolving energy landscape.

Middle East's Role as a Major LPG Supplier to China

The Middle East has become a pivotal LPG supplier to China, driven by geographical proximity, abundant resources, and strategic partnerships.

Geographical Proximity and Abundant Resources

The Middle East possesses vast LPG reserves and enjoys a geographically advantageous location for exporting to the Chinese market.

- Reduced shipping costs and transit times compared to other sources: The shorter distance between Middle Eastern LPG producers and Chinese consumers leads to lower transportation costs and faster delivery times, making the region a highly competitive supplier.

- Key exporters: Saudi Arabia, Qatar, and other GCC nations are major exporters of LPG to China, solidifying the Middle East's position as a key player in the China LPG Middle East energy trade.

This geographical advantage, coupled with abundant resources, makes the Middle East a natural partner for China in meeting its growing LPG demand.

Strategic Partnerships and Investment

China has proactively invested in building strong relationships and infrastructure to secure a steady supply of LPG from the Middle East.

- Joint ventures: Numerous joint ventures between Chinese and Middle Eastern energy companies are fostering closer collaboration and securing long-term LPG supply contracts.

- Infrastructure projects: China has invested significantly in pipeline and terminal infrastructure projects to facilitate the seamless transportation of LPG from the Middle East to China.

- Long-term supply agreements: Long-term supply agreements ensure a stable and reliable flow of LPG, mitigating some of the risks associated with market volatility.

These strategic partnerships reflect China's commitment to securing its energy future and the significant role the Middle East plays in its energy strategy. Analyzing China Middle East energy investment reveals a significant commitment to this relationship.

Challenges and Risks Associated with Increased LPG Reliance

While the partnership between China and the Middle East offers significant benefits, it also presents several challenges.

Geopolitical Instability

The inherently volatile geopolitical landscape of the Middle East poses risks to China's LPG supply chain.

- Potential disruptions caused by conflicts, political instability, and sanctions: Regional conflicts and political instability can lead to supply disruptions, impacting China's energy security.

- Diversification strategies: To mitigate these risks, China is pursuing strategies to diversify its LPG import sources, reducing dependence on any single region.

Understanding geopolitical risks LPG and their potential impact on China's energy security is critical for assessing the long-term sustainability of this energy strategy.

Price Volatility and Market Fluctuations

The global LPG market is subject to price fluctuations, posing challenges to China's energy cost management.

- Impact of global supply and demand dynamics on LPG prices: Global market forces can significantly influence LPG prices, impacting China's energy costs and economic planning.

- Hedging strategies and risk management techniques: To mitigate the impact of price volatility, China is employing hedging strategies and risk management techniques to stabilize its energy costs.

The ability to manage LPG price volatility is crucial for China's economic stability and underscores the importance of carefully managing this aspect of China LPG Middle East energy trade.

Conclusion

China's growing reliance on Middle Eastern LPG signifies a crucial shift in its energy strategy. This strategic reliance, driven by burgeoning domestic demand and environmental goals, presents opportunities for both China and the Middle East. However, challenges related to geopolitical instability and price volatility demand careful management. China's continued investment in infrastructure, diversification of supply sources, and robust strategic partnerships with Middle Eastern countries will be crucial for ensuring a secure and stable supply of LPG. A deep understanding of China LPG Middle East dynamics is essential for navigating the complexities of the global energy market. Staying informed about the latest developments in China LPG Middle East relations is critical for all stakeholders.

Featured Posts

-

Anchor Brewing Companys Closure A Legacy In San Franciscos Brewing History

Apr 24, 2025

Anchor Brewing Companys Closure A Legacy In San Franciscos Brewing History

Apr 24, 2025 -

Experiencing The Lg C3 77 Inch Oled A User Perspective

Apr 24, 2025

Experiencing The Lg C3 77 Inch Oled A User Perspective

Apr 24, 2025 -

Nintendos Action Forces Ryujinx Emulator To Cease Development

Apr 24, 2025

Nintendos Action Forces Ryujinx Emulator To Cease Development

Apr 24, 2025 -

Market Analysis How Trump And The Fed Are Affecting The Bitcoin Price Btc

Apr 24, 2025

Market Analysis How Trump And The Fed Are Affecting The Bitcoin Price Btc

Apr 24, 2025 -

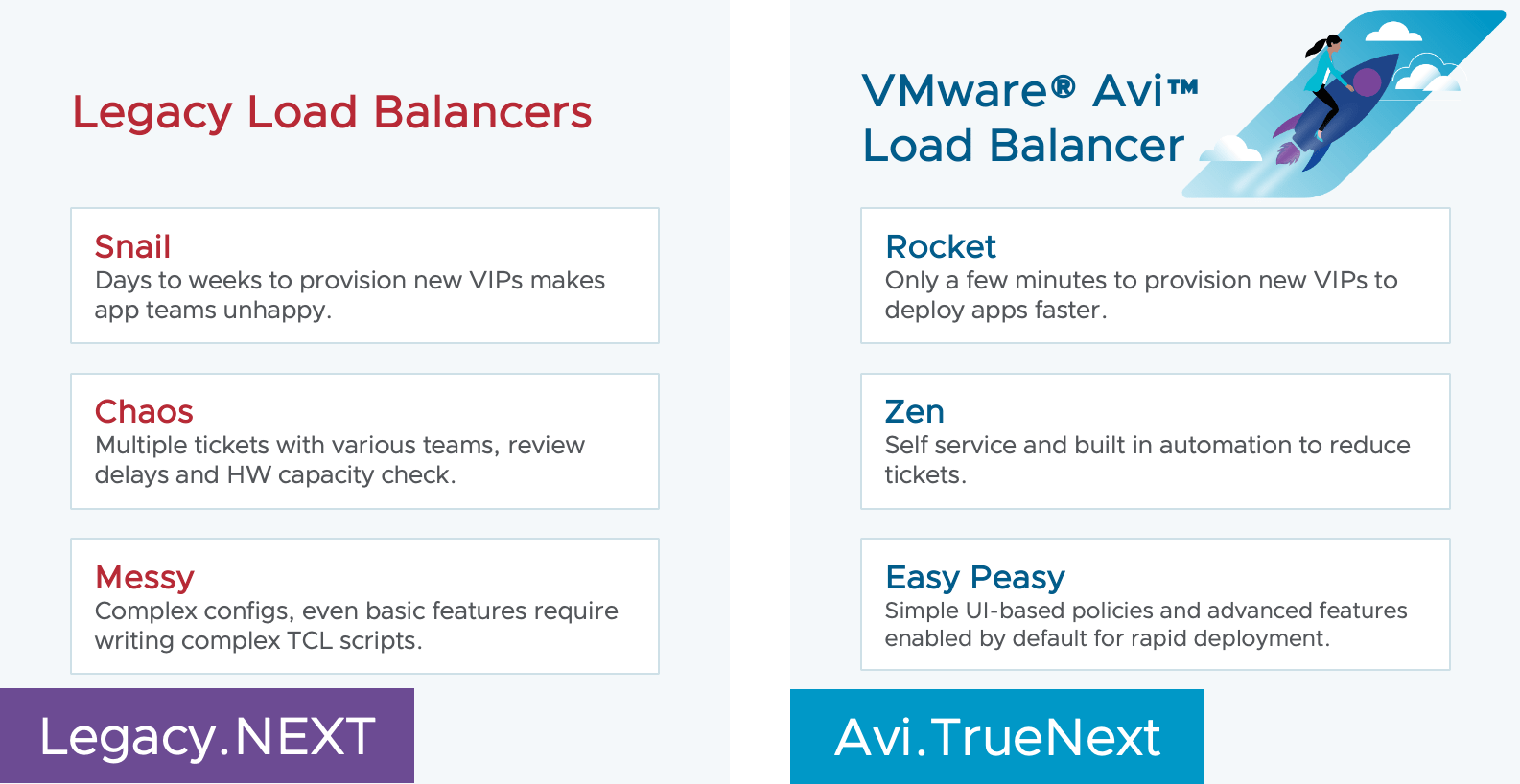

V Mware Costs To Skyrocket 1 050 At And Ts Reaction To Broadcoms Price Hike

Apr 24, 2025

V Mware Costs To Skyrocket 1 050 At And Ts Reaction To Broadcoms Price Hike

Apr 24, 2025