Crack The Code: 5 Do's And Don'ts To Land A Private Credit Role

Table of Contents

Do's to Secure Your Private Credit Role

Master the Fundamentals of Private Credit

A solid foundation in private credit is non-negotiable. You need more than just theoretical knowledge; you need practical application.

- Private Credit Structures: Develop a comprehensive understanding of various private credit structures, including senior secured loans, mezzanine debt, unitranche loans, and preferred equity. Knowing the intricacies of each structure, including their risk profiles and associated returns, is paramount.

- Financial Modeling & Valuation: Proficiency in financial modeling and valuation techniques specific to private credit is essential. This includes discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and understanding key valuation metrics like EBITDA and IRR.

- Legal Aspects: Familiarize yourself with the legal aspects of private credit transactions, including loan agreements, security documents, and regulatory compliance. Understanding the legal framework ensures you can navigate the complexities of deal structuring and risk management.

- Industry Knowledge: Stay updated on current market trends, regulatory changes, and emerging investment strategies within the private credit industry. Subscribing to relevant industry publications and attending webinars is a great way to maintain your knowledge.

Network Strategically Within the Private Credit Industry

Networking is paramount in the private credit world. Building genuine relationships can open doors to unadvertised opportunities.

- Industry Events: Attend industry conferences and networking events specifically focused on private credit. These events provide excellent opportunities to meet professionals, learn about new trends, and expand your network.

- Leverage LinkedIn: Actively engage on LinkedIn and other professional platforms. Connect with professionals in private credit, participate in relevant group discussions, and share insightful articles to establish yourself as a thought leader.

- Informational Interviews: Don't underestimate the power of informational interviews. Reaching out to professionals in the field to learn about their experiences and gain insights is invaluable. These conversations can lead to unexpected opportunities.

- Referrals: Leverage your existing network to explore potential opportunities. A referral from a trusted contact can significantly increase your chances of getting your resume noticed.

Craft a Compelling Resume and Cover Letter

Your resume and cover letter are your first impression. They need to showcase your skills and experience effectively.

- Highlight Achievements: Quantify your accomplishments whenever possible. Use action verbs and numbers to demonstrate your impact in previous roles. Instead of saying "Managed a portfolio," say "Managed a $50 million portfolio, exceeding performance targets by 15%."

- Tailor Your Application: Don't use a generic resume and cover letter. Each application should be tailored to the specific requirements and culture of the private credit firm and the specific private credit role. Research the firm's investment strategy and highlight relevant experience.

- Showcase Understanding: Demonstrate your understanding of private credit investment strategies, market trends, and the firm's specific focus areas. Show, don't just tell.

- Keywords: Incorporate relevant keywords from the job description into your resume and cover letter to improve your chances of getting noticed by Applicant Tracking Systems (ATS).

Don'ts That Can Sink Your Private Credit Job Application

Avoid Generic Applications

A generic application shows a lack of interest and effort. Private credit firms look for individuals who are genuinely passionate about the industry.

- Personalized Approach: Each application should demonstrate a genuine understanding of the specific firm and the private credit role you're applying for. Research the firm's investment philosophy, recent transactions, and team members.

- Tailored Content: Your resume and cover letter must be specifically tailored to each opportunity. Generic applications are easily identified and often discarded.

Underestimate the Importance of Due Diligence

Thorough research is crucial. You need to demonstrate a deep understanding of the firms you are applying to.

- Firm Research: Go beyond the company website. Research their investment strategies, portfolio companies, recent transactions, and key personnel. Understanding their approach to private credit investing is key.

- News & Publications: Stay updated on news and publications related to the firm and the private credit industry to demonstrate your knowledge and interest.

Neglect Your Soft Skills

Technical skills are important, but soft skills are equally crucial in a collaborative environment.

- Communication: Highlight your communication skills, emphasizing your ability to articulate complex financial information clearly and concisely.

- Teamwork: Showcase your teamwork and collaboration skills, demonstrating your ability to work effectively within a team environment to achieve common goals.

- Problem-Solving: Demonstrate your analytical and problem-solving abilities, highlighting your capacity to identify and resolve challenges effectively.

Unlock Your Private Credit Career

Securing a private credit role requires a strategic approach. By mastering the fundamentals, networking effectively, crafting compelling application materials, and avoiding common pitfalls, you'll significantly increase your chances of success. Remember to tailor your approach to each specific firm and opportunity. By following these do's and don'ts, you'll significantly increase your chances of cracking the code and landing your dream private credit role. Start applying these strategies today and begin your journey into the exciting world of private credit!

Featured Posts

-

Fox News Faces Defamation Lawsuit From Ray Epps Over Jan 6th Reporting

Apr 24, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Over Jan 6th Reporting

Apr 24, 2025 -

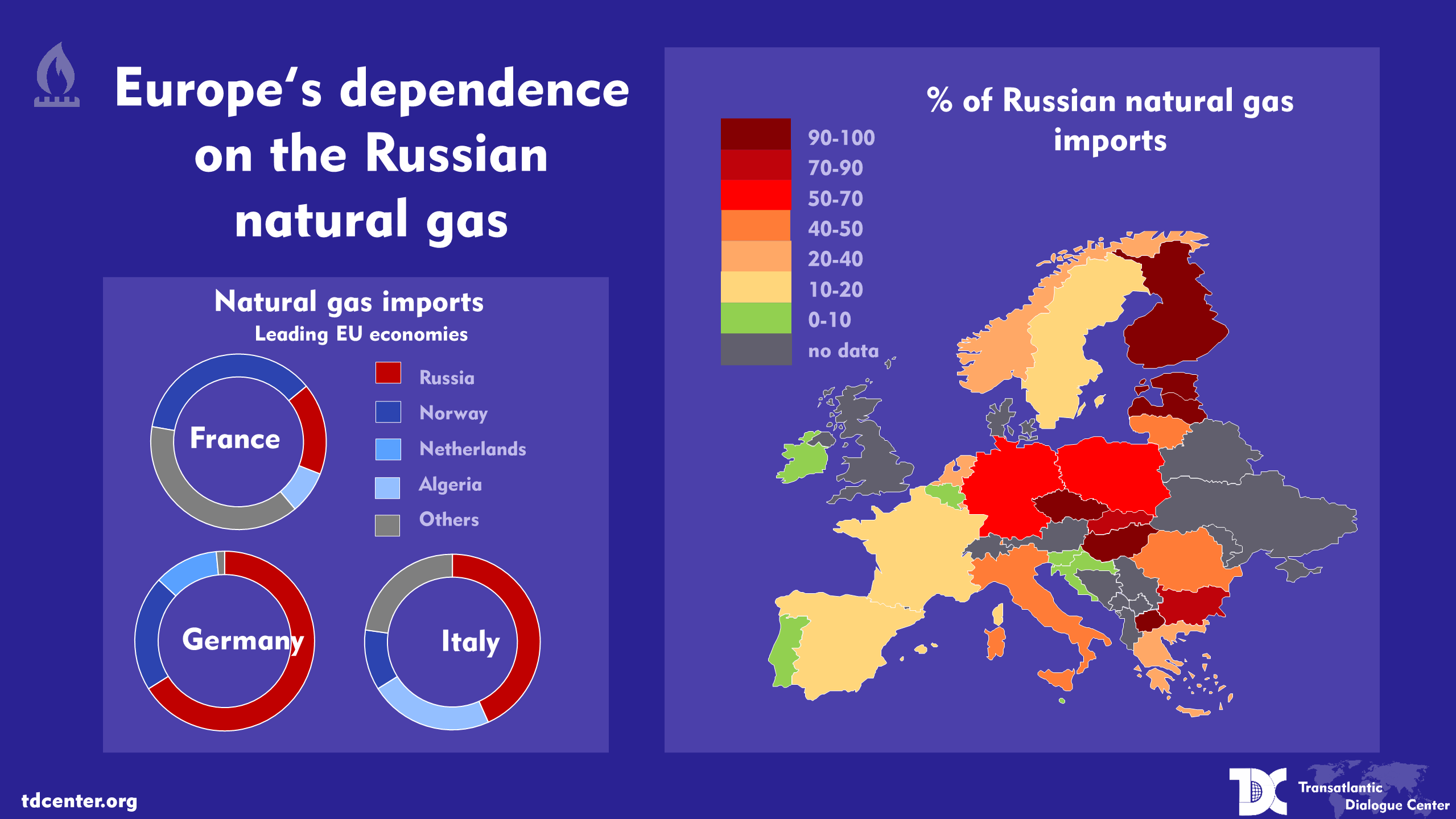

Russian Natural Gas Eus Discussion On Spot Market Restrictions

Apr 24, 2025

Russian Natural Gas Eus Discussion On Spot Market Restrictions

Apr 24, 2025 -

Open Ai Faces Ftc Investigation Concerns Regarding Chat Gpts Data Practices

Apr 24, 2025

Open Ai Faces Ftc Investigation Concerns Regarding Chat Gpts Data Practices

Apr 24, 2025 -

Ella Bleu Travoltas Stunning Transformation A Fashion Magazine Debut

Apr 24, 2025

Ella Bleu Travoltas Stunning Transformation A Fashion Magazine Debut

Apr 24, 2025 -

Judge Abrego Garcias Warning Stonewalling In Us Lawsuits Must End

Apr 24, 2025

Judge Abrego Garcias Warning Stonewalling In Us Lawsuits Must End

Apr 24, 2025