Deloitte Predicts Considerable Slowdown In US Growth

Table of Contents

Key Factors Contributing to the Predicted Slowdown

Several interconnected factors contribute to Deloitte's prediction of a significant slowdown in US economic growth. Understanding these factors is crucial for navigating the uncertain economic landscape.

-

Soaring Inflation: Persistent high inflation, currently hovering around [insert current inflation rate]%, continues to erode consumer purchasing power. This dampens demand for goods and services, impacting overall economic growth. The impact is particularly acute on lower-income households, who spend a larger proportion of their income on essential goods and services whose prices have risen disproportionately. Analyzing inflation data across different income brackets reveals a stark disparity in the ability to absorb these price increases.

-

Aggressive Interest Rate Hikes: The Federal Reserve's aggressive monetary policy, characterized by multiple interest rate hikes in 2023, aims to curb inflation. However, this policy simultaneously increases borrowing costs for businesses and consumers, potentially leading to reduced investment and spending. The effectiveness of these hikes in controlling inflation while minimizing economic harm remains a subject of debate among economists, with some questioning whether the Fed's actions are sufficiently targeted.

-

Weakening Consumer Spending: Reduced consumer confidence, fueled by inflation and economic uncertainty, is leading to decreased spending. Consumer spending is a critical driver of US economic growth, and any significant decline has considerable repercussions. Data from the latest consumer confidence index [cite source] indicates a downward trend, reflecting growing anxieties about the future. Changes in spending patterns show a shift towards essential goods and a decrease in discretionary spending.

-

Supply Chain Disruptions: Lingering supply chain issues, although improving from their peak in 2021, continue to contribute to inflationary pressures and constrain production. Global events and geopolitical tensions continue to create bottlenecks, hindering the smooth flow of goods and services and impacting businesses' ability to meet demand. The impact is felt across multiple sectors, from manufacturing to retail.

-

Tightening Labor Market: While a tight labor market often signals economic strength, the current situation presents a paradox. Rapid wage growth, while benefiting workers, fuels inflation. Furthermore, potential labor shortages in key sectors could negatively impact productivity and constrain overall economic expansion. The complexity of this dynamic requires careful consideration.

-

Geopolitical Uncertainty: Global instability, particularly the ongoing war in Ukraine, contributes significantly to economic uncertainty. The conflict drives up energy prices, disrupts global supply chains, and increases uncertainty among businesses, further dampening investment and economic growth. This external shock exacerbates existing domestic challenges.

Potential Implications of the Slowdown

Deloitte's forecast carries significant implications for the US economy and its citizens.

-

Increased Recession Risk: The projected slowdown substantially increases the probability of a recession in 2024 or early 2025. Deloitte's analysis suggests a [percentage]% chance of a recession based on current trends and projected economic indicators. The severity and duration of any potential recession remain uncertain.

-

Rising Unemployment: A significant economic slowdown could lead to job losses and a rise in the unemployment rate. Deloitte's report projects an increase in unemployment to [projected unemployment rate]%, impacting household incomes and further depressing consumer spending.

-

Reduced Business Investment: Uncertainty surrounding the economic outlook could cause businesses to curtail their investment plans, potentially delaying or canceling projects and further hindering growth. This creates a vicious cycle, as reduced investment leads to slower economic growth, reinforcing the uncertainty.

-

Market Volatility: The forecast is likely to trigger increased volatility in financial markets as investors react to the changing economic landscape. Stock prices and bond yields are expected to fluctuate significantly, creating uncertainty for both individual and institutional investors.

-

Government Policy Response: The government's policy response to the slowdown will be crucial in mitigating the negative impacts. Fiscal and monetary policy decisions will play a significant role in shaping the trajectory of the economy. Options range from further interest rate adjustments to fiscal stimulus measures.

Deloitte's Recommendations for Businesses

Deloitte advises businesses to adopt proactive strategies to navigate the potential economic slowdown:

- Develop robust contingency plans: Businesses should prepare for reduced demand and potential revenue shortfalls by implementing cost-cutting measures and diversifying revenue streams.

- Strengthen risk management practices: Thorough risk assessments, including stress testing scenarios, are crucial to identify and mitigate potential vulnerabilities.

- Focus on operational efficiency: Streamlining operations and improving productivity can help businesses maintain profitability in a challenging economic environment.

- Invest in innovation and technology: Investing in research and development, adopting new technologies, and improving efficiency can enhance competitiveness and resilience.

- Enhance customer relationships: Maintaining strong customer relationships is crucial for retaining existing customers and attracting new ones during periods of economic uncertainty.

Conclusion

Deloitte's prediction of a considerable slowdown in US economic growth underscores the significant challenges facing the US economy in 2024. A confluence of factors, including inflation, interest rate hikes, and geopolitical uncertainty, contribute to this pessimistic outlook. Understanding the potential implications, including increased recession risk and potential job losses, is crucial for both individuals and businesses. Proactive planning, prudent financial management, and effective risk management strategies are essential to navigate this period of economic uncertainty. Stay informed about the evolving Deloitte predictions and other economic forecasts to effectively manage your financial future and prepare for a potential US economic slowdown. Download Deloitte's full report on the US economic growth forecast for a deeper dive into their analysis and recommendations.

Featured Posts

-

New Werner Herzog Film Bucking Fastard Stars Real Life Sisters

Apr 27, 2025

New Werner Herzog Film Bucking Fastard Stars Real Life Sisters

Apr 27, 2025 -

Brazil Bound Justin Herbert And The Chargers Open 2025 Season Overseas

Apr 27, 2025

Brazil Bound Justin Herbert And The Chargers Open 2025 Season Overseas

Apr 27, 2025 -

Thueringens Amphibien Und Reptilien Der Neue Atlas Ist Da

Apr 27, 2025

Thueringens Amphibien Und Reptilien Der Neue Atlas Ist Da

Apr 27, 2025 -

Your Guide To The Grand National 2025 Runners At Aintree

Apr 27, 2025

Your Guide To The Grand National 2025 Runners At Aintree

Apr 27, 2025 -

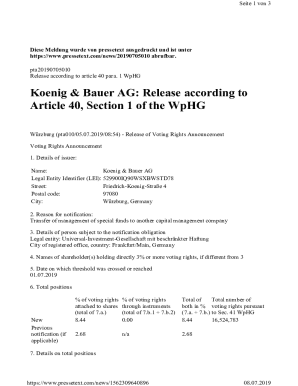

Offenlegungspflicht Pne Ag Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025

Offenlegungspflicht Pne Ag Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025