Deloitte's Forecast: A Significant Slowdown In US Economic Growth

Table of Contents

Key Factors Contributing to the Slowdown According to Deloitte

Deloitte's forecast points to a confluence of factors driving the predicted US economic growth slowdown. Let's examine the key elements contributing to this concerning outlook:

Inflation and Interest Rate Hikes

Persistent high inflation continues to erode consumer purchasing power. Deloitte's analysis highlights how rising prices are forcing consumers to curtail spending on non-essential goods and services, impacting business investment and overall economic activity. The Federal Reserve's response, through aggressive interest rate hikes, aims to curb inflation but simultaneously increases borrowing costs for businesses and individuals. This makes expansion more difficult and can trigger a reduction in investment and hiring.

- Deloitte's report likely emphasizes the delicate balance the Fed faces: controlling inflation without triggering a sharp economic recession.

- The impact on consumer spending is expected to be substantial, particularly in sectors sensitive to interest rate changes like housing and durable goods.

- Increased borrowing costs will likely impact business investment, leading to slower growth and potentially job losses in some sectors.

Geopolitical Uncertainty and Supply Chain Disruptions

The ongoing war in Ukraine and other geopolitical tensions significantly contribute to economic uncertainty. Deloitte's assessment likely incorporates the impact of disrupted global supply chains, energy price volatility, and increased geopolitical risk on the US economy. Lingering supply chain disruptions continue to fuel inflation and constrain production, further hindering economic growth.

- Deloitte's analysis likely highlights the cascading effects of the war in Ukraine, including energy price spikes and food shortages, impacting global markets.

- The ongoing challenges in global supply chains, exacerbated by geopolitical instability, are expected to persist, creating headwinds for economic growth.

- Increased geopolitical risk adds to uncertainty, making it difficult for businesses to plan for long-term investments and expansion.

Labor Market Dynamics and Potential Recession

Deloitte's forecast likely incorporates a detailed analysis of the US labor market. While unemployment might remain relatively low, wage growth may not keep pace with inflation, leading to a decline in real wages. This, coupled with other factors, raises the specter of a potential economic recession. The analysis will likely weigh the strength of the labor market against the risks of a significant economic downturn.

- Deloitte's report will likely provide specific data points on unemployment rates and wage growth, offering insight into the health of the labor market.

- The interplay between inflation, interest rates, and labor market dynamics is crucial in determining the likelihood and severity of a potential recession.

- The forecast likely discusses the potential for a soft landing versus a more severe economic recession.

Deloitte's Forecast: Specific Projections and Implications

Deloitte's economic forecast will provide specific numerical predictions for key economic indicators. Understanding these projections and their implications is crucial.

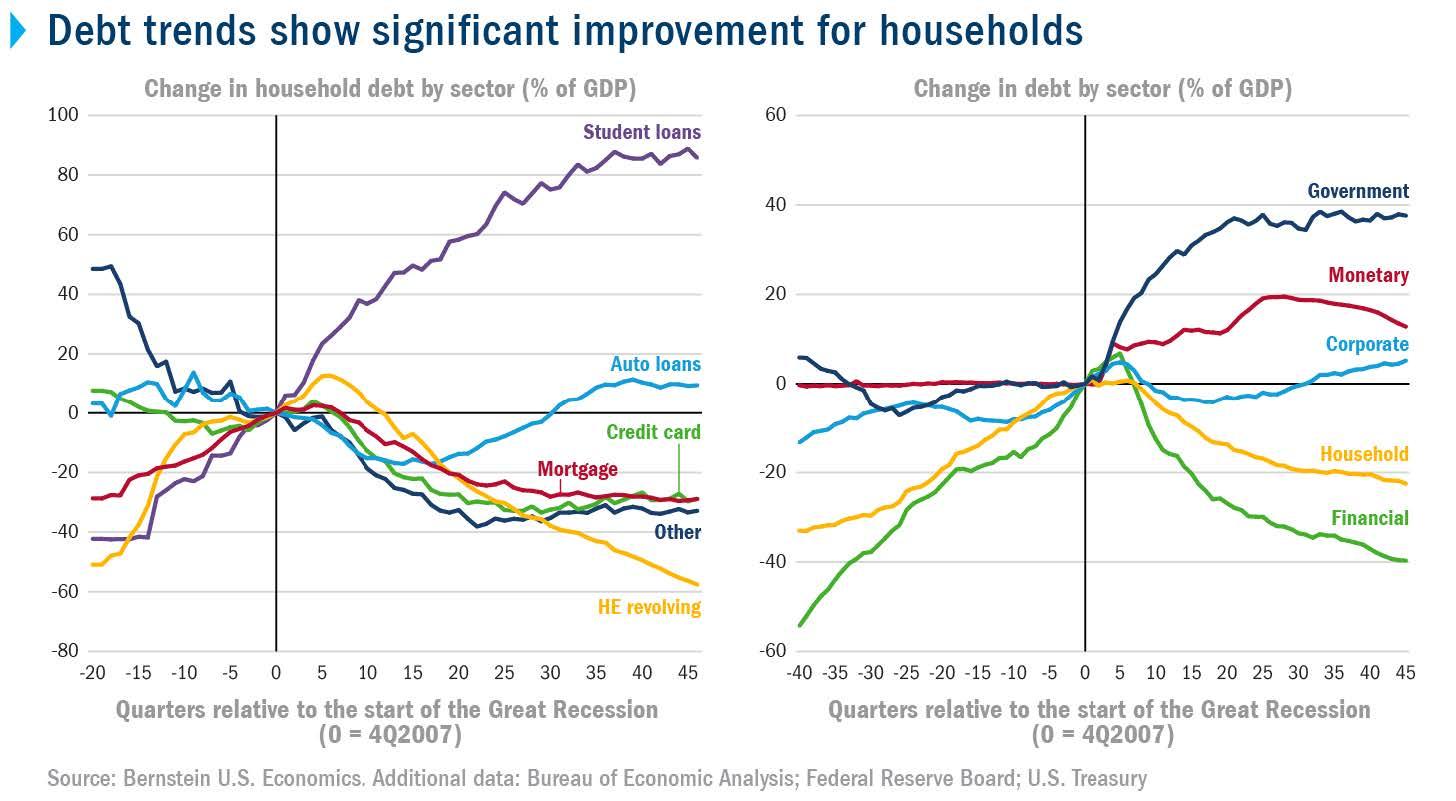

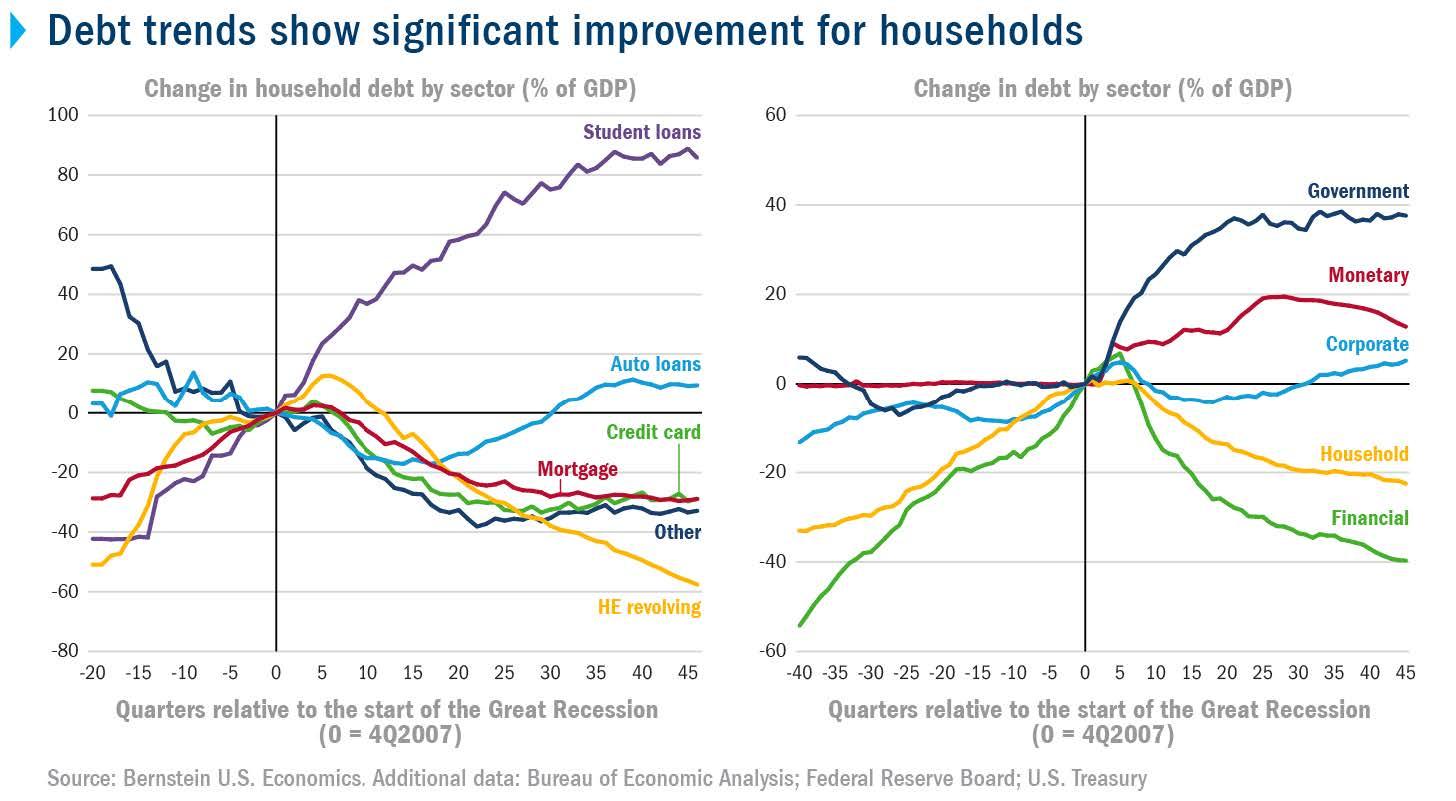

GDP Growth Predictions

Deloitte's report will likely offer specific predictions for GDP growth in the coming quarters and years. These predictions will provide a clear picture of the anticipated severity of the slowdown. Comparing Deloitte's economic projections with those of other forecasters will offer a broader perspective on the likely economic outlook.

- The report will likely present a range of possible scenarios, depending on the evolution of key economic indicators.

- The predicted slowdown in GDP growth will likely be compared to historical data to provide context and assess its severity.

Sector-Specific Impacts

Deloitte's analysis will likely delve into the sector-specific impacts of the predicted slowdown. Certain sectors will undoubtedly be more vulnerable than others. The specific sector analysis will provide valuable insights for businesses operating within these industries.

- Sectors like technology, manufacturing, and real estate might be disproportionately impacted, as they are often sensitive to changes in interest rates and consumer spending.

- The report's industry impact assessment will likely highlight the challenges and opportunities facing businesses within each sector.

Advice for Businesses and Consumers

Deloitte's forecast will likely include recommendations for businesses and consumers on how to navigate the predicted economic slowdown. This consumer advice and business strategy guidance will provide valuable insights for making informed financial decisions.

- Businesses might need to re-evaluate their investment strategies, tighten budgets, and focus on efficiency.

- Consumers might need to prioritize debt management, increase savings, and be cautious in their spending.

Conclusion: Understanding Deloitte's Forecast for US Economic Slowdown

Deloitte's forecast highlights a significant risk of a US economic slowdown, driven by a potent combination of inflation, interest rate hikes, geopolitical uncertainty, and supply chain disruptions. The severity of the predicted slowdown and its sector-specific impacts require careful consideration by both businesses and individuals. Understanding Deloitte's findings is crucial for developing appropriate strategies to mitigate potential risks and capitalize on emerging opportunities. To gain a complete understanding of the challenges and potential solutions, explore Deloitte's full report on the US economic forecast. Proactive planning based on Deloitte's Economic Slowdown Prediction is key to navigating the anticipated economic headwinds and building economic resilience. Don't miss the opportunity to prepare effectively—learn more about Deloitte's US Economic Forecast today.

Featured Posts

-

Meldung Gemaess Artikel 40 Absatz 1 Wp Hg Pne Ag

Apr 27, 2025

Meldung Gemaess Artikel 40 Absatz 1 Wp Hg Pne Ag

Apr 27, 2025 -

Pne Groups Wind Energy Portfolio Expansion Two New Projects Added

Apr 27, 2025

Pne Groups Wind Energy Portfolio Expansion Two New Projects Added

Apr 27, 2025 -

Discover Great Free Movies And Tv Shows On Kanopy

Apr 27, 2025

Discover Great Free Movies And Tv Shows On Kanopy

Apr 27, 2025 -

Two New Wind Farms Join Pne Groups Growing Portfolio

Apr 27, 2025

Two New Wind Farms Join Pne Groups Growing Portfolio

Apr 27, 2025 -

Ariana Grandes Stunning Hair And Tattoo Transformation Seeking Professional Help

Apr 27, 2025

Ariana Grandes Stunning Hair And Tattoo Transformation Seeking Professional Help

Apr 27, 2025