ECB Launches Task Force To Streamline Banking Rules

Table of Contents

The Rationale Behind the Task Force

The ECB's decision to create this task force stems from a growing recognition of the significant regulatory burden currently placed on European banks. The sheer volume and complexity of existing rules have led to increased administrative costs, reduced efficiency, and hampered the ability of banks to effectively lend to businesses and consumers – a crucial driver of economic growth. Streamlining these regulations is seen as essential for fostering a more dynamic and competitive European banking sector. The ECB believes that simplification will ultimately benefit the entire European economy.

The current regulatory landscape presents several key challenges:

- High compliance costs: Banks expend considerable resources navigating intricate regulations, diverting funds from core business activities.

- Reduced lending capacity: Complex rules can make it more difficult and expensive for banks to assess and manage risk, leading to reduced lending activity.

- Inhibited innovation: Excessive regulation can stifle innovation within the banking sector, preventing the development of new products and services.

- Uneven playing field: Inconsistencies in regulations across different EU member states create an uneven playing field for banks operating in multiple jurisdictions.

Key Objectives of the Streamlining Initiative

The task force's primary goal is to simplify and clarify existing banking regulations, focusing on areas that impose the most significant burden. This initiative aims to achieve tangible improvements across several key areas:

- Simplification of capital requirements: The task force will review and potentially revise capital adequacy rules to reduce their complexity and improve their proportionality. This could involve simplifying risk-weighting methodologies and harmonizing capital requirements across different types of banks.

- Streamlining of reporting obligations: Banks currently face a plethora of reporting requirements, consuming valuable time and resources. The task force intends to streamline these obligations, reducing duplication and improving the efficiency of reporting processes.

- Clarification of ambiguous regulations: Many existing regulations are open to interpretation, leading to inconsistencies in application. The task force aims to clarify ambiguous rules, ensuring greater consistency and predictability.

- Harmonization of rules across different jurisdictions within the EU: The task force will work to harmonize regulations across different EU member states, creating a more level playing field for banks operating across borders. This will involve identifying and addressing inconsistencies in national implementations of EU-wide regulations.

The Composition and Mandate of the Task Force

The ECB's task force comprises a diverse group of experts, bringing together leading academics, experienced banking professionals, and representatives from various regulatory bodies. While the exact composition may evolve, the key members will bring a wealth of expertise across regulatory compliance, risk management, and financial economics. Their mandate is clear: to analyze current regulations, identify areas for simplification, and propose concrete recommendations to the ECB within a defined timeframe.

- Key Members: [Insert names and affiliations of key members once publicly available].

- Deadlines: [Insert deadlines for the completion of the task force's work and publication of its findings].

- Consultation Process: The task force will engage in extensive consultations with stakeholders, including banks, national regulators, and other relevant parties, to ensure that the proposed changes are practical, effective, and widely supported.

Potential Impacts on European Banks and the Economy

The successful streamlining of banking rules promises significant benefits for European banks and the broader economy. However, it's crucial to consider both the positive and potential negative impacts.

Positive Impacts:

- Increased profitability for banks: Reduced administrative costs and improved efficiency can lead to higher profitability for banks.

- Improved access to credit for businesses and consumers: Simplified regulations may encourage banks to lend more readily, supporting economic growth.

- Enhanced competitiveness of the European banking sector: Streamlined regulations could improve the competitiveness of European banks on the global stage.

Potential Negative Impacts:

- Reduced oversight: Over-simplification of rules could potentially reduce regulatory oversight, increasing systemic risk. Careful consideration is needed to ensure appropriate risk management is maintained.

- Unintended consequences: Any significant regulatory changes can have unintended consequences, which require careful monitoring and mitigation strategies.

Conclusion:

The ECB Launches Task Force to Streamline Banking Rules represents a significant development with the potential to reshape the European banking landscape. By addressing the complexities and burdens of existing regulations, the task force aims to unlock greater efficiency, foster innovation, and support economic growth. While potential risks must be carefully managed, the potential benefits of simplified rules – including increased profitability for banks and improved access to credit for businesses and consumers – are substantial. Stay informed about the progress of the ECB's task force and its impact on the future of European banking regulations. Follow updates on the ECB's streamlining efforts to understand how these changes will affect your business or investments within the context of the ECB Launches Task Force to Streamline Banking Rules.

Featured Posts

-

Gambling On Disaster Examining The Los Angeles Wildfire Betting Market

Apr 27, 2025

Gambling On Disaster Examining The Los Angeles Wildfire Betting Market

Apr 27, 2025 -

Alberto Ardila Olivares Estrategia Y Garantia De Gol

Apr 27, 2025

Alberto Ardila Olivares Estrategia Y Garantia De Gol

Apr 27, 2025 -

Spd Coalition Stability After Bsw Leader Crumbachs Resignation

Apr 27, 2025

Spd Coalition Stability After Bsw Leader Crumbachs Resignation

Apr 27, 2025 -

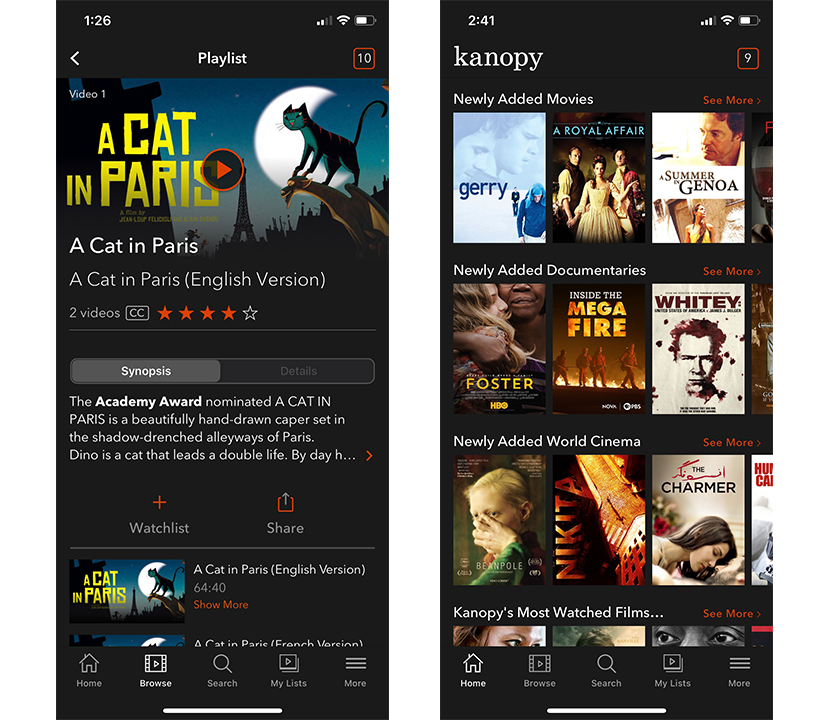

Best Free Movies And Tv Shows Available On Kanopy

Apr 27, 2025

Best Free Movies And Tv Shows Available On Kanopy

Apr 27, 2025 -

Pago De Licencia Por Maternidad Para Tenistas Wta Un Adelanto En El Deporte Femenino

Apr 27, 2025

Pago De Licencia Por Maternidad Para Tenistas Wta Un Adelanto En El Deporte Femenino

Apr 27, 2025