Economic Uncertainty: The Incoming Fed Chair's Trump-Shaped Inheretance

Table of Contents

The Trump Administration's Economic Policies and Their Impact

The Trump administration's economic approach, characterized by significant tax cuts, deregulation, and trade wars, left an indelible mark on the US economy. While proponents argued these policies stimulated growth, their long-term consequences contribute significantly to the current economic uncertainty.

-

Tax Cuts and the National Debt: The 2017 Tax Cuts and Jobs Act dramatically reduced corporate and individual income taxes. While initially boosting economic activity, the cuts contributed to a substantial increase in the national debt, leaving less fiscal space to manage future economic shocks. This increased debt burden adds to economic uncertainty, limiting the government's ability to respond effectively to crises.

-

Deregulation and its Ripple Effects: The Trump administration pursued a policy of deregulation across various sectors, including environmental protection and financial regulation. While intended to reduce burdens on businesses, this approach potentially undermined long-term sustainability and increased risks in certain sectors. The consequences are still unfolding, contributing to the overall economic uncertainty.

-

Trade Wars and Global Disruptions: The administration's initiation of trade wars, particularly with China, disrupted global supply chains and led to increased tariffs. These actions impacted businesses, consumers, and international trade relations, creating further economic instability and contributing to inflationary pressures. The long-term effects of these trade disputes are still being felt.

-

Overall Fiscal Policy Sustainability: The combination of tax cuts and increased government spending under the Trump administration raised concerns about the long-term sustainability of the US fiscal policy. This lack of fiscal prudence adds to the economic uncertainty, making future economic management more challenging.

Inflation and Interest Rate Challenges

The current inflationary environment presents a major challenge for the incoming Fed Chair. Managing interest rates to control inflation without triggering a recession requires a delicate balancing act. Supply chain disruptions exacerbated by the pandemic and geopolitical instability further complicate the situation.

-

Understanding Current Inflation: Inflation rates have surged, driven by factors including supply chain bottlenecks, increased energy prices, and strong consumer demand. This inflationary pressure erodes purchasing power and necessitates decisive action by the Fed.

-

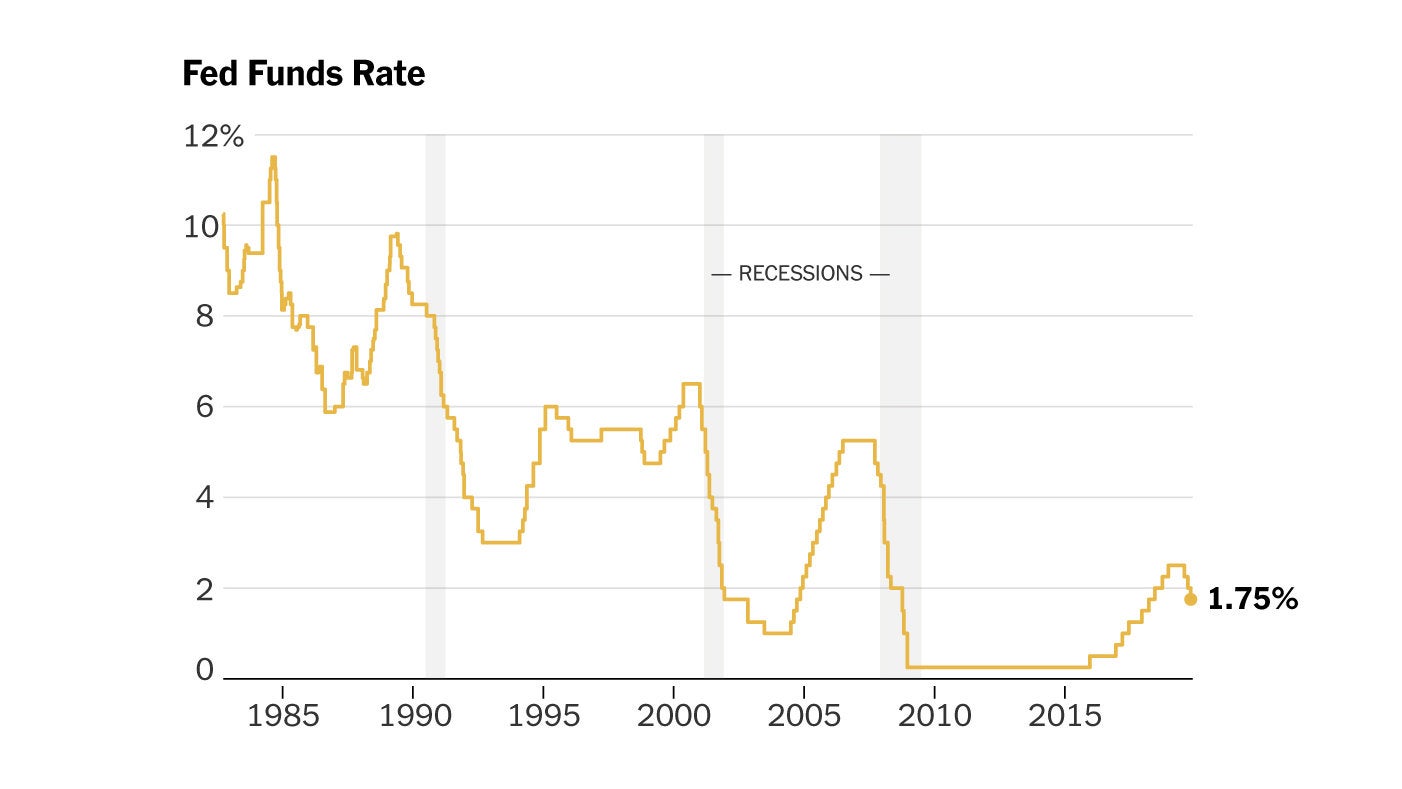

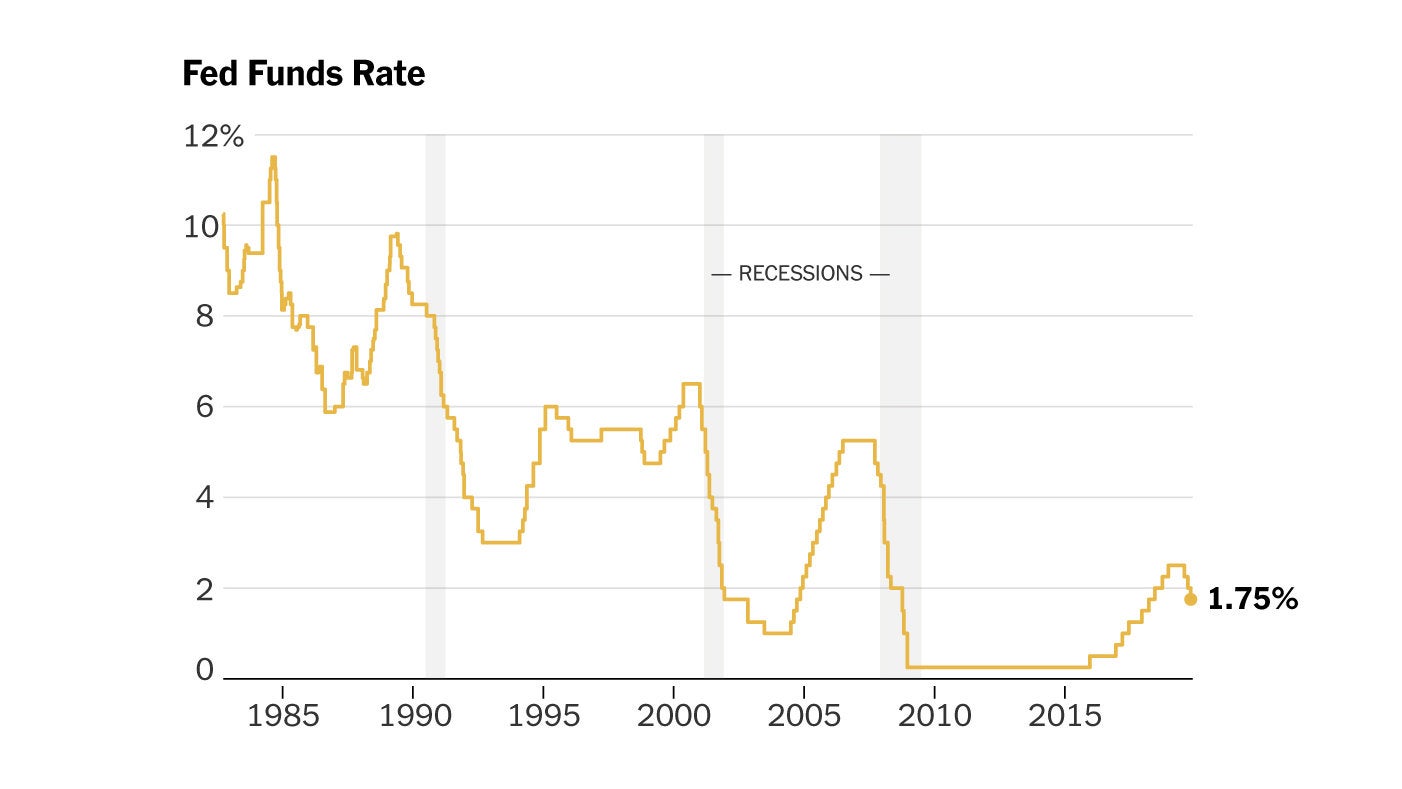

The Fed's Response: The Federal Reserve has begun raising interest rates to curb inflation. However, the optimal pace of increases is highly debated. Raising rates too quickly risks triggering a recession, while raising them too slowly could allow inflation to become entrenched.

-

Risks of Interest Rate Manipulation: A rapid increase in interest rates could stifle economic growth and lead to job losses. Conversely, insufficient increases could fail to control inflation, leading to long-term economic instability.

-

Exploring Alternative Monetary Policy Tools: Besides interest rate adjustments, the Fed can explore other tools, such as quantitative tightening (the opposite of quantitative easing), to manage inflation while mitigating the risk of a recession.

The Legacy of Low Interest Rates and Quantitative Easing

The prolonged period of low interest rates and quantitative easing (QE) implemented in the aftermath of the 2008 financial crisis and continued under the Trump administration created a complex legacy. While these policies helped stabilize the financial system, they also fostered potential risks.

-

QE's Impact on Financial Markets: QE injected massive amounts of liquidity into the financial system, driving up asset prices, particularly in stocks and bonds. This created a booming financial market but also potential asset bubbles.

-

Asset Bubbles and Market Volatility: Low interest rates encouraged borrowing and investment, potentially inflating asset bubbles in various markets. The unwinding of these bubbles could trigger significant market volatility and economic disruption.

-

Unwinding QE: The process of unwinding QE without causing market disruptions is a delicate task. A sudden reduction in liquidity could negatively impact financial markets and economic growth.

-

Long-Term Effects on Savings and Investment: Low interest rates negatively impacted savers while potentially encouraging excessive risk-taking by investors seeking higher returns. The long-term consequences of these trends are still unfolding.

Navigating Geopolitical Uncertainty

Geopolitical risks and international events significantly influence the US economy and add another layer of complexity to the challenges facing the incoming Fed Chair. These uncertainties impact inflation, trade, and financial markets.

-

The War in Ukraine and its Economic Ramifications: The war in Ukraine dramatically increased energy prices and further disrupted global supply chains, adding significant inflationary pressure. This geopolitical event highlights the interconnectedness of the global economy.

-

US-China Relations: Rising tensions between the US and China pose significant challenges to international trade and economic stability. The ongoing trade disputes and geopolitical rivalry add uncertainty to the global economic outlook.

-

International Cooperation: Addressing global economic challenges effectively requires international cooperation. The incoming Fed Chair needs to navigate complex international relations to mitigate the effects of geopolitical risks on the US economy.

Conclusion

The incoming Fed Chair inherits a challenging economic landscape marked by significant uncertainty. The Trump administration's economic policies, coupled with rising inflation, geopolitical risks, and the legacy of low interest rates and quantitative easing, create a complex and volatile environment. Understanding the interplay of these factors is crucial for navigating the path forward. Staying informed about the Federal Reserve's decisions and the evolving economic data is essential. Explore resources that provide updated economic analysis to better understand the continuing effects of this complex inheritance on the US economy and its future. Continued attention to economic uncertainty and its various facets is paramount for informed citizenry and effective economic policymaking.

Featured Posts

-

Ftc Investigates Open Ais Chat Gpt What It Means For Ai

Apr 26, 2025

Ftc Investigates Open Ais Chat Gpt What It Means For Ai

Apr 26, 2025 -

2024 Nfl Draft Green Bays First Round Preview

Apr 26, 2025

2024 Nfl Draft Green Bays First Round Preview

Apr 26, 2025 -

End Of An Era Ryujinx Switch Emulator Ceases Development After Nintendo Contact

Apr 26, 2025

End Of An Era Ryujinx Switch Emulator Ceases Development After Nintendo Contact

Apr 26, 2025 -

Jan 6th Falsehoods Ray Epps Defamation Case Against Fox News Explained

Apr 26, 2025

Jan 6th Falsehoods Ray Epps Defamation Case Against Fox News Explained

Apr 26, 2025 -

Rocket Launch Abort Blue Origin Cites Subsystem Problem

Apr 26, 2025

Rocket Launch Abort Blue Origin Cites Subsystem Problem

Apr 26, 2025