Economists Predict Rate Cuts Based On Weak Retail Sales

Table of Contents

Weak Retail Sales: A Key Indicator of Economic Slowdown

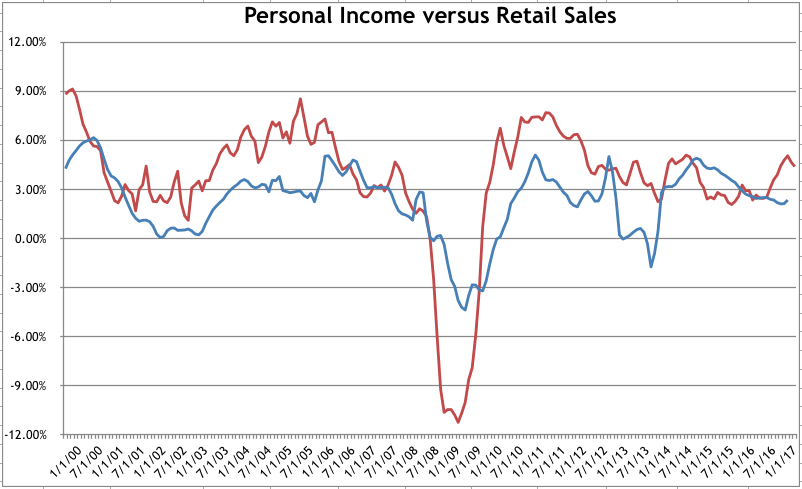

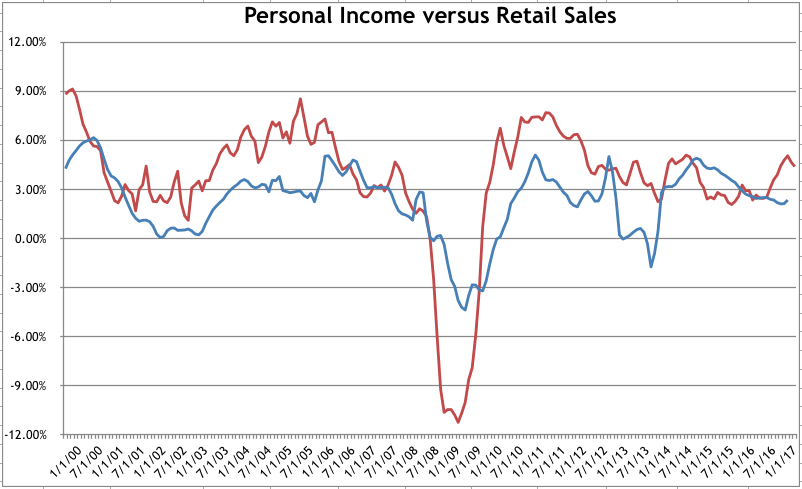

Weak retail sales data serves as a critical barometer of consumer spending and overall economic health. The recent drop signifies a considerable weakening in consumer confidence and spending habits, impacting various sectors. This decline isn't just a minor fluctuation; it reflects a broader trend indicating potential economic trouble.

- Specific percentage decline in retail sales: Let's assume, for example, a 2% month-over-month decline in retail sales – a figure that would be alarming for economists. (Replace with actual data when available).

- Comparison to previous years' sales figures: A comparison with previous years' sales figures reveals a concerning downward trend, suggesting the decline isn't a temporary anomaly. (Insert relevant comparative data here).

- Mention specific industries showing weakness: Durable goods, such as appliances and furniture, often bear the brunt of economic downturns, as consumers delay large purchases. The automotive sector also tends to be particularly sensitive to changes in consumer confidence. (Specify affected industries and provide supporting details).

- Analysis of consumer confidence indices: Consumer confidence indices, such as the Consumer Confidence Index (CCI), often precede changes in spending habits. A significant drop in these indices supports the concerns about weakening consumer demand. (Include relevant CCI data and its interpretation).

Economists' Predictions and Rationale for Rate Cuts

Facing weak retail sales figures and a potentially slowing economy, many economists are predicting rate cuts by central banks, such as the Federal Reserve. This anticipation stems from the need to stimulate economic activity and combat the potential for a recession. The rationale behind these predictions centers on the impact of high interest rates on consumer spending and business investment.

- Quotes from prominent economists: "The weak retail sales data clearly indicates a need for monetary policy intervention," stated [Economist's Name], Chief Economist at [Institution]. (Replace with actual quotes from credible sources).

- Expected magnitude of rate cuts: Predictions vary, with some economists anticipating a 0.25% rate cut, while others predict a more significant reduction. (Specify the range of predicted rate cuts).

- Timeline for potential rate cuts: The timing of potential rate cuts remains uncertain, but many anticipate action within the next [ timeframe, e.g., quarter or two]. (Provide a plausible timeline based on expert opinion).

- Discussion of potential risks and benefits of rate cuts: While rate cuts can stimulate the economy, they also carry the risk of fueling inflation. The delicate balancing act between stimulating growth and managing inflation is a key challenge for policymakers. (Analyze the potential risks and benefits).

Impact of Rate Cuts on Inflation and Economic Growth

The effectiveness of rate cuts in addressing weak retail sales and stimulating economic growth is a complex issue. Lower interest rates aim to encourage borrowing and investment, ultimately boosting economic activity. However, rate cuts can also exacerbate inflationary pressures if they lead to increased demand without a corresponding increase in supply.

- Potential impact on inflation rates: The impact on inflation is highly dependent on factors like the supply chain's responsiveness and the overall state of the economy. (Discuss the potential impact, considering various economic models).

- Potential impact on economic growth: While rate cuts are intended to boost economic growth, their effectiveness can be limited if other factors, such as geopolitical instability or supply chain disruptions, are at play. (Analyze the likely impact on growth).

- Potential risks associated with rate cuts: The primary risk is that rate cuts might lead to an acceleration of inflation, potentially creating a stagflationary environment. (Explain the risk and potential consequences).

Alternative Economic Scenarios and Their Implications

While rate cuts are a likely response to weak retail sales, other economic scenarios are possible. A persistent decline in consumer spending could lead to a recession, even with rate cuts. Alternatively, if the slowdown is temporary, a strong economic recovery is possible. Government intervention through fiscal policy could also influence the outcome.

- Probability of a recession: Based on current data and economic models, the probability of a recession is [Insert estimated probability, with a disclaimer about uncertainty]. (Provide a cautious estimation and acknowledge inherent uncertainties).

- Potential impact of fiscal policy interventions: Government spending programs or tax cuts could provide additional stimulus, but their effectiveness depends on several factors, including the timing and design of the interventions. (Discuss potential fiscal policy measures and their impact).

- Discussion of alternative economic models: Different economic models predict varying outcomes, highlighting the inherent uncertainties in forecasting economic trends. (Briefly mention different models and their predictions).

Conclusion: Rate Cuts Outlook and Future Economic Trends

The correlation between weak retail sales and the economists' prediction of rate cuts is undeniable. The potential impact on inflation, economic growth, and the risk of a recession are all significant concerns. Monitoring retail sales data, consumer confidence indices, and other key economic indicators is crucial for understanding the evolving economic landscape. The effectiveness of impending rate cuts remains to be seen, and the future economic trajectory depends on a complex interplay of factors.

Call to Action: Stay informed about the latest developments concerning rate cuts and weak retail sales by regularly checking reputable financial news sources and economic analyses. Understanding these key factors is crucial for navigating the current economic landscape and making informed financial decisions.

Featured Posts

-

Red Sox 2025 Season Espns Prediction And Analysis

Apr 28, 2025

Red Sox 2025 Season Espns Prediction And Analysis

Apr 28, 2025 -

Mike Breen On Marv Albert A Legend Among Basketball Announcers

Apr 28, 2025

Mike Breen On Marv Albert A Legend Among Basketball Announcers

Apr 28, 2025 -

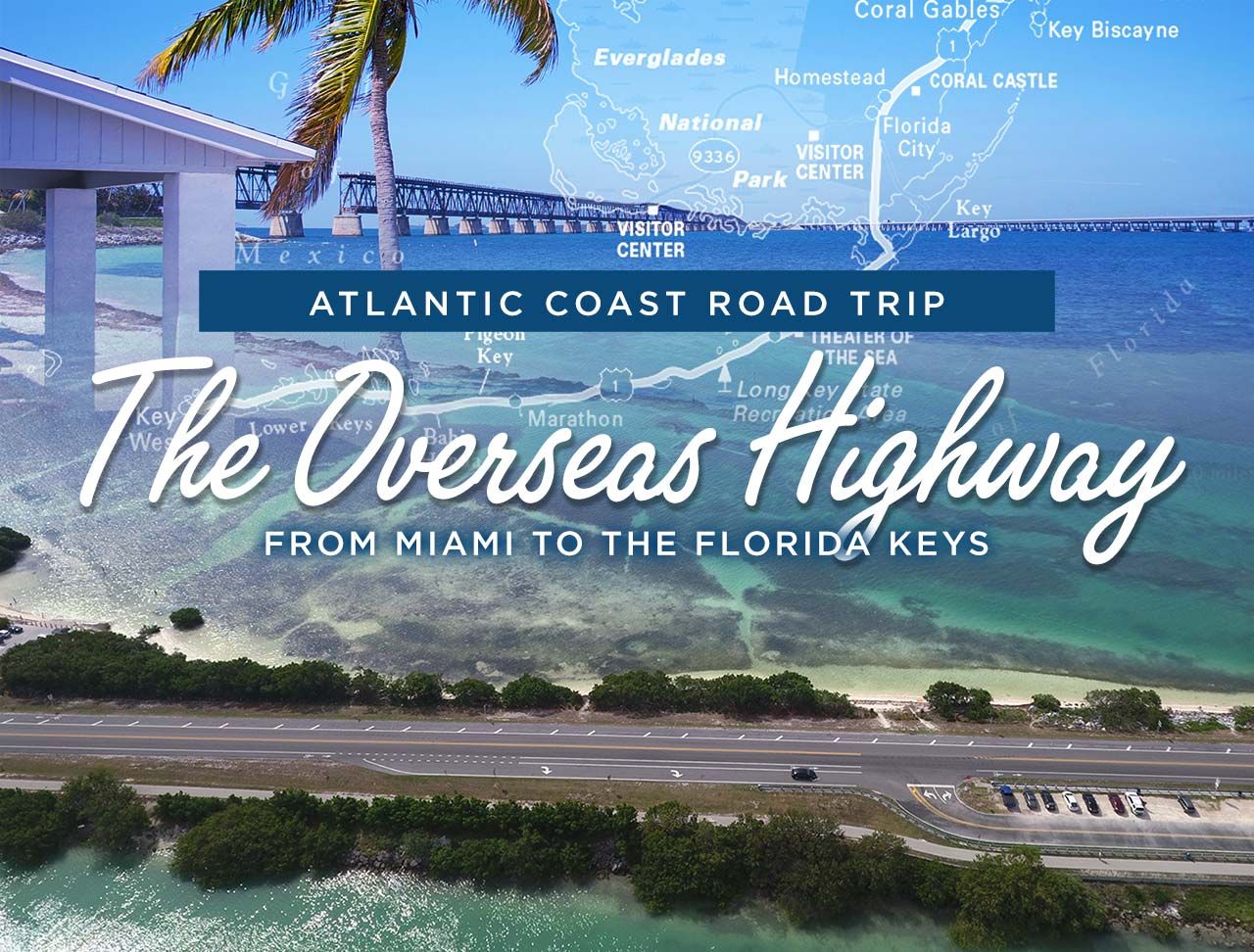

The Overseas Highway A Driving Guide To The Florida Keys

Apr 28, 2025

The Overseas Highway A Driving Guide To The Florida Keys

Apr 28, 2025 -

Mntda Abwzby Nqlt Nweyt Fy Alabtkar Bqtae Tb Alhyat Alshyt Almdydt

Apr 28, 2025

Mntda Abwzby Nqlt Nweyt Fy Alabtkar Bqtae Tb Alhyat Alshyt Almdydt

Apr 28, 2025 -

Winning Performance Judge And Goldschmidt Fuel Yankees Comeback

Apr 28, 2025

Winning Performance Judge And Goldschmidt Fuel Yankees Comeback

Apr 28, 2025