Emerging Market Stock Rebound: Outpacing US Losses

Table of Contents

Why are Emerging Market Stocks Outperforming the US?

Several factors contribute to the surprising resilience and outperformance of emerging market stocks compared to their US counterparts.

Resilience of Emerging Economies

Many emerging economies have demonstrated remarkable resilience in the face of global economic headwinds.

- Stronger GDP Growth: Several emerging markets are experiencing stronger GDP growth compared to developed nations, fueled by domestic consumption and government initiatives.

- Increased Domestic Consumption: A rising middle class in many emerging economies is driving robust domestic consumption, creating a strong internal engine for economic growth. This lessens reliance on volatile global trade.

- Government Stimulus Packages: Targeted government stimulus packages in certain regions are supporting economic activity and bolstering investor confidence.

- Supply Chain Adaptation: Some emerging markets have successfully adapted to global supply chain disruptions, positioning themselves strategically for long-term growth.

For example, India's robust domestic demand and government-led infrastructure projects have significantly contributed to its economic resilience. Similarly, several Southeast Asian nations have benefited from their strategic position in global manufacturing and technology supply chains.

Attractive Valuations

Emerging market stocks often present significantly more attractive valuations than their US equivalents.

- Lower P/E Ratios: Many emerging market companies boast lower Price-to-Earnings (P/E) ratios, suggesting potentially higher returns compared to overvalued US stocks.

- Undervalued Assets: Significant opportunities exist for capital appreciation due to undervalued assets in certain sectors across various emerging markets.

- Higher Return Potential: The potential for higher returns stems from a combination of growth potential and currently lower valuations.

For instance, certain technology and infrastructure sectors in emerging markets show compelling valuations compared to their saturated US counterparts.

Diversification Benefits

Investing in emerging markets offers significant diversification benefits for a globally balanced portfolio.

- Reduced Portfolio Risk: International diversification reduces overall portfolio risk by reducing exposure to a single market's volatility. Emerging markets often have a low correlation to the US market.

- Hedging Against US Downturns: Emerging market stocks can act as a hedge against downturns in the US stock market, providing a buffer during periods of market volatility.

- Exposure to Different Economic Cycles: Diversification across various emerging markets exposes investors to different economic cycles, lessening the impact of regional economic downturns.

Diversification into emerging markets significantly reduces the overall volatility of your investment portfolio, protecting against potential losses in any single market.

Risks Associated with Emerging Market Investments

While the potential returns are significant, investors must acknowledge the inherent risks associated with emerging market investments.

Political and Economic Instability

Political and economic instability is a key risk factor in many emerging markets.

- Geopolitical Risks: Geopolitical risks specific to certain regions can significantly impact investment returns. Political instability, conflicts, and social unrest can create uncertainty.

- Currency Fluctuations: Currency fluctuations and volatility can negatively impact returns, particularly for investors who are not hedging their currency exposure.

- Regulatory Changes: Unpredictable regulatory changes and uncertainty regarding the rule of law can also pose significant challenges.

For example, certain regions in Latin America or Africa may experience political instability that impacts investor confidence and market performance.

Liquidity Concerns

Liquidity, the ability to easily buy or sell assets, is often lower in emerging markets.

- Lower Trading Volumes: Lower trading volumes in some emerging markets can make it difficult to buy or sell assets quickly, potentially impacting investment strategies.

- Difficulty in Transactions: Finding buyers or sellers for certain assets might be more challenging in less liquid markets.

- Market Depth Impact: Limited market depth can significantly affect the price at which you can buy or sell, potentially resulting in losses.

Information Asymmetry

Information asymmetry, where some parties have more information than others, is a significant concern.

- Limited Transparency: Transparency and information availability are often lower compared to developed markets, making thorough due diligence crucial.

- Fraud and Misrepresentation: The potential for fraud or misrepresentation is higher in markets with weaker regulatory oversight.

- Importance of Due Diligence: Careful research, professional advice, and a robust due diligence process are critical to mitigate this risk.

Strategies for Investing in Emerging Markets

Several strategies can help mitigate risks and capitalize on the opportunities presented by emerging markets.

Diversified Emerging Market ETFs

Exchange-Traded Funds (ETFs) offer a convenient and cost-effective way to access emerging markets.

- Lower Cost and Easier Access: ETFs provide broad exposure to multiple emerging markets at a lower cost than individual stock picking.

- Broad Market Exposure: They offer diversified exposure to a range of companies and sectors across numerous emerging economies.

- Reduced Risk Through Diversification: ETFs inherently reduce risk through inherent diversification across multiple companies and sectors.

Examples include the iShares Core MSCI Emerging Markets ETF (IEMG) and the Vanguard FTSE Emerging Markets ETF (VWO).

Region-Specific Investments

Focusing on specific regions with high growth potential can lead to higher returns.

- High-Growth Potential: Concentrating on regions showing robust economic fundamentals can offer targeted exposure.

- Strong Fundamentals: Thorough analysis of specific regions with strong economic indicators is essential.

- Higher Returns, Higher Risk: This approach carries higher risk but also offers the potential for significant gains.

For example, certain regions in Southeast Asia or Africa show strong growth potential in specific sectors like technology or infrastructure.

Professional Investment Advice

Seeking professional advice is crucial when investing in emerging markets.

- Expert Guidance: A financial advisor specializing in international investments can provide valuable insights and guidance.

- Risk Tolerance Assessment: They can help assess your risk tolerance and investment goals.

- Personalized Strategy: A tailored investment strategy aligns with your individual needs and risk profile.

Professional advice is crucial to ensure your investment strategy aligns with your overall financial goals and risk appetite.

Conclusion

The recent emerging market stock rebound, outpacing US losses, presents a compelling investment opportunity. While inherent risks exist, strategies like utilizing diversified emerging market ETFs, focusing on specific high-growth regions, and seeking professional advice can help mitigate these risks. By carefully weighing the factors discussed and understanding your risk tolerance, you can effectively leverage this trend and potentially build a more robust and resilient investment portfolio. Don't miss out on the potential of emerging market stocks; start exploring the possibilities today and build a well-diversified portfolio incorporating emerging market investments.

Featured Posts

-

Chainalysis Acquisition Of Alterya Expanding Ai Capabilities In Blockchain

Apr 24, 2025

Chainalysis Acquisition Of Alterya Expanding Ai Capabilities In Blockchain

Apr 24, 2025 -

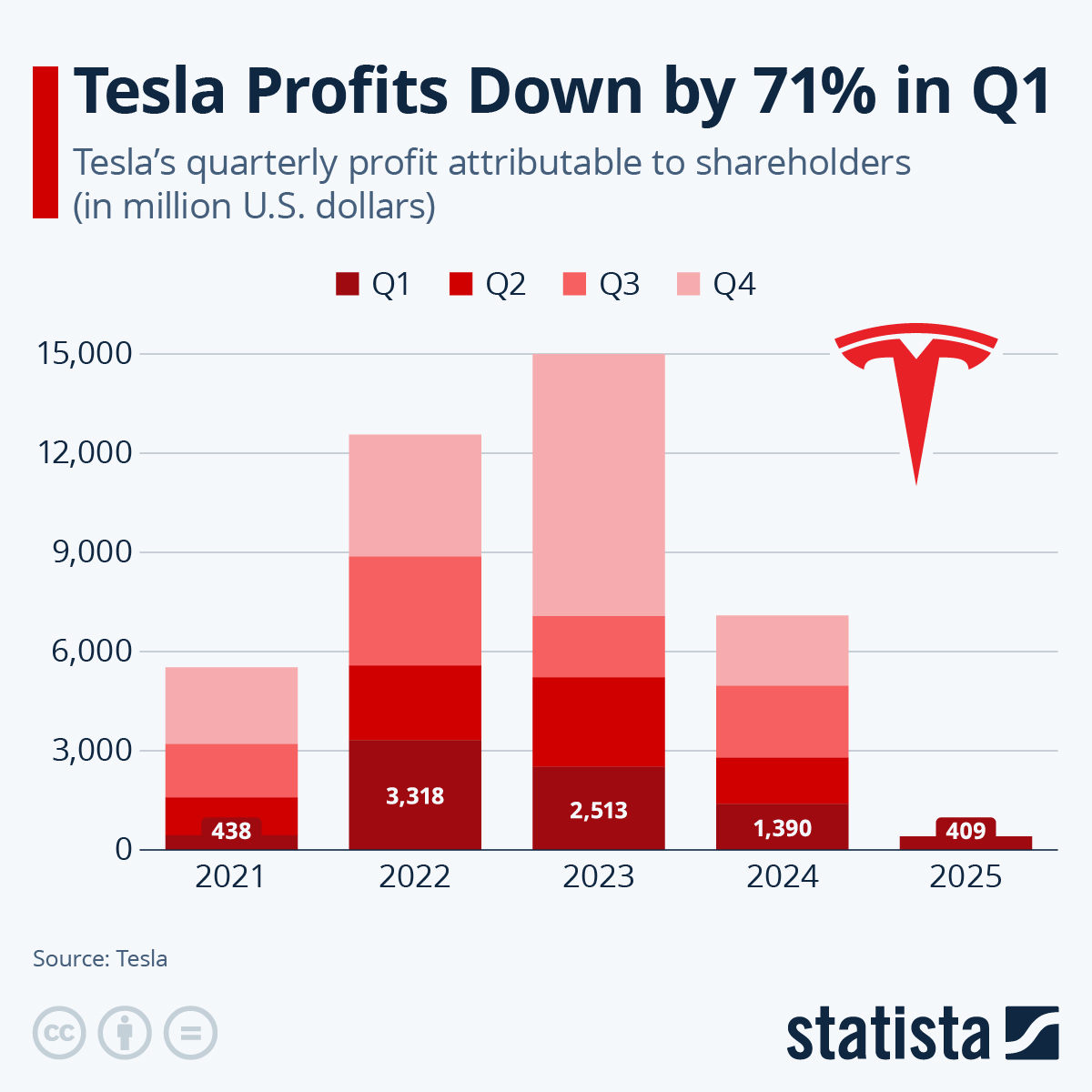

Tesla Q1 Financial Report Analyzing The Impact Of Public Relations

Apr 24, 2025

Tesla Q1 Financial Report Analyzing The Impact Of Public Relations

Apr 24, 2025 -

Alcons 417 5 Million Acquisition Of Village Roadshow Approved

Apr 24, 2025

Alcons 417 5 Million Acquisition Of Village Roadshow Approved

Apr 24, 2025 -

Sharks And A Tragedy A Swimmers Disappearance And Body Found On Israeli Coast

Apr 24, 2025

Sharks And A Tragedy A Swimmers Disappearance And Body Found On Israeli Coast

Apr 24, 2025 -

Ryujinx Emulator Shuts Down Following Nintendo Communication

Apr 24, 2025

Ryujinx Emulator Shuts Down Following Nintendo Communication

Apr 24, 2025