Gold's Record High: Understanding The Trade War Impact On Bullion

Table of Contents

Safe Haven Asset: Why Investors Flock to Gold During Trade Wars

Gold has long held a position as a safe haven asset, a reliable store of value during times of economic and political turmoil. When global markets experience volatility, as is often the case during trade wars, investors seek refuge in assets perceived as stable and less susceptible to market fluctuations. This is precisely why demand for gold increases during periods of trade tension.

- Increased demand during periods of market volatility: Trade wars introduce uncertainty, causing investors to divest from riskier assets like stocks and bonds, driving up demand for gold.

- Gold's lack of correlation with other asset classes: Unlike stocks and bonds, gold often moves independently, offering diversification benefits to a portfolio during times of market stress.

- Portfolio diversification benefits: Adding gold to a portfolio can help mitigate risk and reduce overall volatility.

- Protection against inflation and currency devaluation: Gold is often seen as a hedge against inflation and currency fluctuations, making it particularly attractive during periods of economic uncertainty triggered by trade wars.

Historical data clearly supports this trend. For instance, during the US-China trade war of 2018-2020, gold prices experienced a significant rise, reflecting increased investor demand for this safe haven asset amid heightened global uncertainty.

Currency Devaluation and the Impact on Gold Prices

Trade wars often lead to currency fluctuations and even devaluation. When a country's currency weakens, the price of gold, typically priced in US dollars, increases for investors in that country. This is because they need more of their weaker currency to purchase the same amount of gold.

- Examples of currency devaluation during specific trade wars: The devaluation of the Argentinian Peso during its trade disputes with its neighbors provides a clear example of this correlation.

- Explanation of the mechanics of currency devaluation and its effect on gold: A weaker currency makes imports more expensive, potentially fueling inflation and increasing the attractiveness of gold as an inflation hedge.

- Charts or graphs illustrating the correlation between currency fluctuations and gold prices: (Insert relevant chart here showing the inverse relationship between currency strength and gold price)

This dynamic plays a significant role in the price increases of gold seen during periods of international trade tension.

Inflationary Pressures and Gold's Hedging Capabilities

Trade wars can contribute to inflationary pressures. Tariffs and trade restrictions increase the cost of imported goods, potentially leading to higher consumer prices. Historically, gold has served as a hedge against inflation, as its value tends to rise when the purchasing power of fiat currencies declines.

- Relationship between trade disputes, inflation, and gold prices: Increased inflation erodes the value of paper money, making gold a more attractive investment.

- Examples of how gold has performed during inflationary periods: Throughout history, periods of high inflation have often correlated with significant increases in the price of gold.

- Discussion of alternative inflation hedges and their comparison to gold: While other assets can act as inflation hedges, gold's long history and inherent scarcity often make it a preferred choice.

Geopolitical Uncertainty and its Influence on Gold's Value

Trade wars are rarely isolated events; they often contribute to broader geopolitical uncertainty. The resulting instability can further boost investor demand for safe haven assets like gold.

- Examples of specific trade disputes and their impact on geopolitical stability: The ongoing trade tensions between the US and China, for example, have created significant geopolitical uncertainty, impacting investor confidence globally.

- Analysis of how geopolitical risk affects investor sentiment towards gold: Increased geopolitical risk often translates to increased demand for gold, pushing its price higher.

- Mention of other geopolitical factors impacting gold prices beyond trade wars: Other factors, such as political instability in key regions or global conflicts, can also influence gold prices.

Conclusion

In summary, several factors contribute to gold's record high, with trade wars playing a significant role. Gold's status as a safe haven asset, the potential for currency devaluation, inflationary pressures stemming from trade disputes, and the broader geopolitical uncertainty they create all drive investors towards this precious metal. The significant impact of trade wars on the price of gold bullion is undeniable. Understanding the complex interplay between trade wars and gold's record high is crucial for investors. Learn more about protecting your portfolio against global uncertainty by researching gold investment strategies today.

Featured Posts

-

The Growing Presence Of Chinese Cars A Global Perspective

Apr 26, 2025

The Growing Presence Of Chinese Cars A Global Perspective

Apr 26, 2025 -

Florida A Cnn Anchor Shares His Go To Vacation Destination

Apr 26, 2025

Florida A Cnn Anchor Shares His Go To Vacation Destination

Apr 26, 2025 -

Auto Carrier Faces 70 Million Loss From Us Port Fees

Apr 26, 2025

Auto Carrier Faces 70 Million Loss From Us Port Fees

Apr 26, 2025 -

Navigating The Trump Era The Upcoming Fed Chairs Difficult Path

Apr 26, 2025

Navigating The Trump Era The Upcoming Fed Chairs Difficult Path

Apr 26, 2025 -

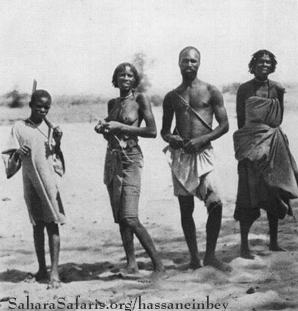

The Ahmed Hassanein Story Will He Become Egypts First Nfl Draft Pick

Apr 26, 2025

The Ahmed Hassanein Story Will He Become Egypts First Nfl Draft Pick

Apr 26, 2025