Higher Bitcoin Prices: Understanding The Connection To Trade And Monetary Policy

Table of Contents

The Impact of Global Trade on Bitcoin Prices

Global trade dynamics play a crucial role in shaping Bitcoin's price trajectory. Fluctuations in international markets and shifts in geopolitical landscapes can directly impact investor sentiment and, consequently, Bitcoin's value.

Increased Global Trade Uncertainty

Geopolitical instability and trade wars often create uncertainty in traditional financial markets, pushing investors to seek safer havens for their assets. Bitcoin, with its decentralized nature and limited supply, frequently emerges as an attractive alternative.

- Examples: The US-China trade war of 2018 saw increased Bitcoin adoption as investors sought to protect themselves from potential market downturns. Similarly, periods of heightened geopolitical tension often correlate with Bitcoin price surges.

- Decentralized Hedge: Bitcoin's decentralized structure makes it resistant to government interference or manipulation, making it a compelling hedge against trade-related risks. This aspect is a key driver of demand during periods of uncertainty.

- Data Points: Numerous studies have shown a positive correlation between increased trade uncertainty indices and Bitcoin price increases. These studies typically analyze data from various sources, including trade conflict indicators and Bitcoin price charts.

The Role of Cross-Border Payments

Bitcoin's potential to revolutionize cross-border payments is another factor influencing its price. Traditional international transactions are often slow, expensive, and subject to regulatory hurdles. Bitcoin offers a faster, cheaper, and potentially more transparent alternative.

- Efficiency Gains: The speed and reduced costs associated with Bitcoin transactions could stimulate international trade, leading to increased demand for Bitcoin.

- Limitations: Currently, Bitcoin faces limitations in handling large-scale commercial transactions due to scalability issues and volatility. However, ongoing developments in Layer-2 solutions and other blockchain technologies are addressing these challenges.

- Future Potential: The ongoing development of blockchain-based cross-border payment systems holds immense promise for boosting international trade and indirectly increasing the demand for Bitcoin.

Monetary Policy and its Influence on Bitcoin's Value

Central bank monetary policies, particularly those related to inflation and quantitative easing (QE), can significantly influence Bitcoin's price.

Inflationary Pressures and Bitcoin as a Hedge

High inflation erodes the purchasing power of fiat currencies, prompting investors to seek alternative stores of value. Bitcoin, with its limited supply of 21 million coins, often gets viewed as "digital gold," a hedge against inflation.

- Store of Value: Investors perceive Bitcoin as a store of value, similar to gold, protecting their wealth from inflation's effects. This perception drives demand during periods of high inflation.

- Examples: Countries experiencing hyperinflation have witnessed a surge in Bitcoin adoption, as citizens seek to preserve their savings. Venezuela and Argentina are prime examples.

- Data Correlation: Numerous charts and studies illustrate a correlation between rising inflation rates in various countries and increased Bitcoin prices.

Quantitative Easing and its Impact

Quantitative easing (QE), where central banks inject liquidity into the market by purchasing assets, can lead to increased money supply and potential currency devaluation. This can indirectly increase Bitcoin's appeal as an alternative asset.

- Weakening Fiat: QE programs can weaken the value of fiat currencies, making Bitcoin a more attractive investment.

- Risks of QE: Excessive QE programs carry risks, potentially leading to inflation and market instability. This instability can, in turn, influence Bitcoin's price volatility.

- Data Analysis: Analyzing past QE programs and their correlation with Bitcoin's price movements reveals complex relationships, highlighting the need for nuanced understanding.

Understanding the Correlation, Not Causation

It's crucial to understand that while global trade and monetary policy significantly influence Bitcoin's price, the relationship isn't always direct or causal.

Other Factors Affecting Bitcoin Prices

Many other factors contribute to Bitcoin's price fluctuations:

- Regulatory Changes: Government regulations and policy decisions can dramatically affect investor sentiment and market behavior.

- Technological Advancements: Improvements in Bitcoin's underlying technology and scalability can boost investor confidence.

- Market Sentiment: News events, social media trends, and overall market sentiment can cause significant price swings.

It is crucial to consider all these factors when analyzing Bitcoin price movements. Attributing price changes solely to trade or monetary policy risks oversimplification and inaccurate conclusions.

Conclusion: Navigating Higher Bitcoin Prices in a Changing Global Landscape

Understanding the complex interplay between global trade, monetary policy, and higher Bitcoin prices is critical for navigating the cryptocurrency market effectively. While these macroeconomic factors exert significant influence, it's crucial to remember that Bitcoin's price is shaped by a multitude of interacting forces. Continued research and careful analysis are necessary to unravel this dynamic relationship. Stay informed about global trade trends, central bank actions, and developments within the Bitcoin ecosystem to better anticipate and manage the potential for higher Bitcoin prices and the opportunities and risks they present. Further reading on topics such as "Bitcoin price prediction," "monetary policy and cryptocurrency," and "global trade and Bitcoin" can enhance your understanding and inform your investment decisions.

Featured Posts

-

Newsom Calls On Oil Industry To Address Soaring California Gas Prices

Apr 24, 2025

Newsom Calls On Oil Industry To Address Soaring California Gas Prices

Apr 24, 2025 -

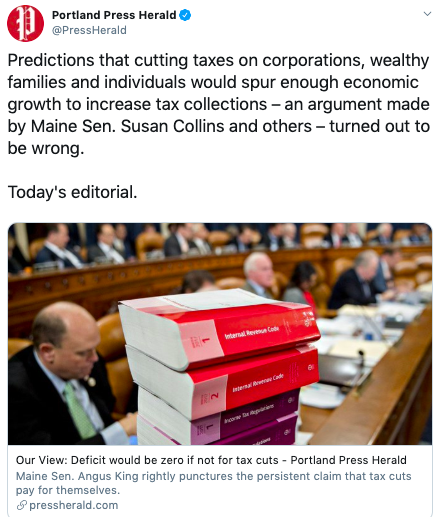

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025 -

Trump Supporter Ray Epps Defamation Suit Against Fox News Jan 6th Falsehoods Allegations

Apr 24, 2025

Trump Supporter Ray Epps Defamation Suit Against Fox News Jan 6th Falsehoods Allegations

Apr 24, 2025 -

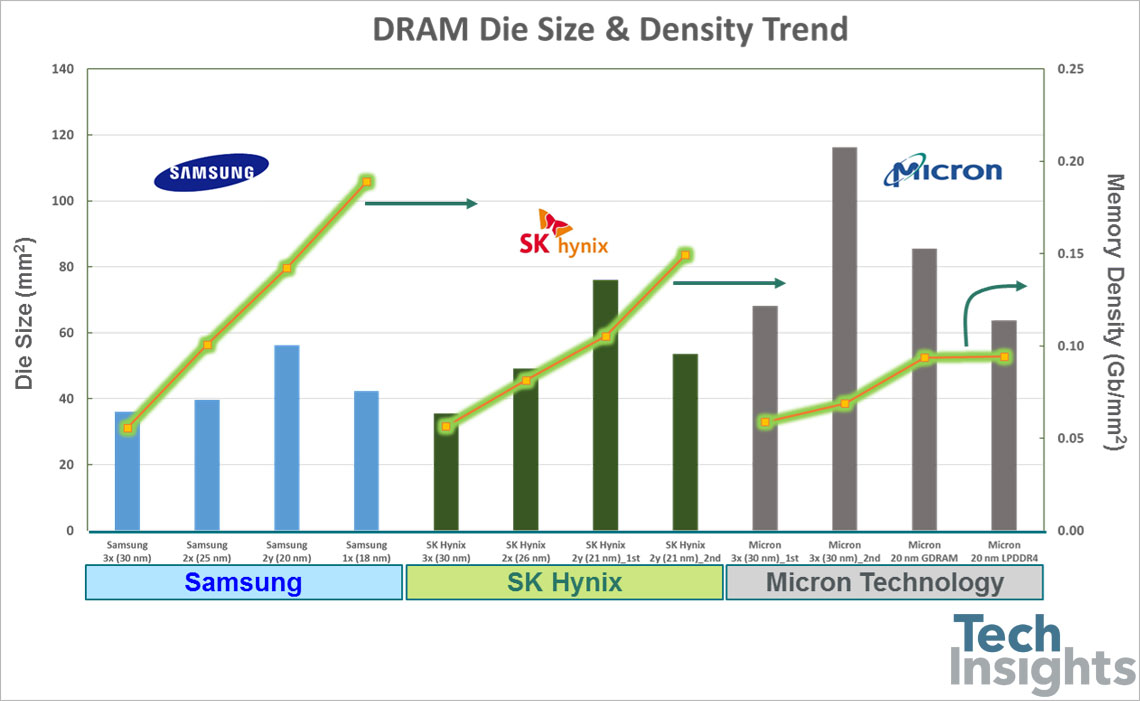

Dram Market Shift Sk Hynixs Ai Powered Rise To The Top

Apr 24, 2025

Dram Market Shift Sk Hynixs Ai Powered Rise To The Top

Apr 24, 2025 -

Ftc Challenges Court Ruling On Microsofts Activision Blizzard Acquisition

Apr 24, 2025

Ftc Challenges Court Ruling On Microsofts Activision Blizzard Acquisition

Apr 24, 2025