How Netflix Is Outperforming Big Tech And Attracting Tariff-Conscious Investors

Table of Contents

Netflix's Resilient Global Streaming Model

Netflix's success is largely attributed to its unique business model, which provides a buffer against the economic volatility impacting many other tech giants. Its digital nature offers significant advantages in the face of global trade complexities.

Reduced Dependence on Physical Goods: Unlike hardware-focused tech companies, Netflix's minimal reliance on physical goods significantly reduces its exposure to import/export tariffs and supply chain disruptions.

- Lower manufacturing costs: Netflix doesn't incur the hefty manufacturing costs associated with producing physical products like smartphones or computers.

- Reduced shipping complexities: The absence of physical product distribution drastically simplifies logistics and minimizes susceptibility to shipping delays and tariff increases.

- Global accessibility advantages: Netflix's digital content is readily accessible across borders, offering a significant advantage over companies reliant on physical distribution networks hampered by tariffs and trade restrictions.

Strong International Growth: Netflix's strategic expansion into diverse global markets acts as a powerful hedge against economic downturns in specific regions. The company's ability to tap into a diverse subscriber base mitigates the impact of localized tariff implementations or economic slowdowns.

- Examples of successful international expansion: Netflix's penetration into markets like South Korea, Japan, and Latin America demonstrates its successful adaptation to various cultural contexts and consumer preferences.

- Strategies for localization and content adaptation: The company invests heavily in localized content and dubbing/subtitling, fostering strong engagement with international audiences.

Subscription-Based Revenue Model: Netflix's subscription-based revenue model ensures a predictable income stream, offering stability in uncertain economic times. This contrasts sharply with advertising-based revenue models that are highly sensitive to market fluctuations.

- Comparison to advertising-based revenue models: Advertising-dependent companies are vulnerable to economic downturns, as advertising spend is often one of the first budget items to be cut.

- Predictable revenue stream: Subscription fees provide Netflix with a consistent and reliable revenue base, regardless of market volatility.

Strategic Content Investments & Differentiation

Netflix's strategic content investments and differentiation further solidify its position as a leading tech company and a favored investment.

Original Content Strategy: Netflix's substantial investment in original programming has created a unique value proposition, attracting and retaining subscribers globally.

- Examples of successful original series and movies: Shows like Squid Game and Stranger Things have achieved global phenomenon status, driving subscriber growth and brand loyalty.

- Impact on subscriber growth: The high-quality original content is a significant driver of new subscribers and encourages existing subscribers to remain engaged.

Diverse Content Library: Netflix offers a vast and diverse content library, catering to a wide range of tastes and preferences across the globe.

- Genre diversity: From documentaries and comedies to action thrillers and international dramas, Netflix offers a broad spectrum of content.

- Language options: Extensive dubbing and subtitling options make Netflix accessible to a global audience.

- Regional content variations: Netflix curates content specific to different regions, enhancing its appeal to local audiences.

Data-Driven Decision Making: Netflix leverages sophisticated data analytics to optimize content creation, marketing, and overall business strategy. This reduces financial risk and enhances return on investment.

- Examples of how data informs content strategy: Netflix uses viewing data to inform decisions about future productions, ensuring alignment with audience preferences.

- Data-driven marketing campaigns: Data analytics optimizes marketing campaigns, maximizing efficiency and ROI.

Attracting Tariff-Conscious Investors

The combination of factors above makes Netflix an attractive investment for those wary of global trade uncertainties.

Lower Tariff Exposure: Netflix’s digital-first business model significantly reduces its exposure to tariffs compared to companies heavily involved in manufacturing and global trade of physical goods.

- Direct comparison to the tariff sensitivity of other big tech companies: Companies reliant on global supply chains for hardware manufacturing face significant tariff risks that Netflix largely avoids.

Stable Revenue & Growth: Netflix's consistent financial performance and growth trajectory instill confidence among investors seeking stability.

- Key financial data points supporting consistent growth and profitability: Netflix’s consistently increasing subscriber numbers and revenue demonstrate its strong financial position.

Long-Term Growth Potential: The streaming industry is poised for continued growth, and Netflix is ideally positioned to capitalize on this trend.

- Future market trends: The increasing shift towards digital entertainment ensures sustained growth for the streaming industry.

- Netflix's plans for continued expansion and innovation: Netflix's ongoing investments in content and technology suggest continued growth and innovation.

Conclusion

In conclusion, Netflix’s exceptional performance stems from its resilient global streaming model, strategic content investments, and minimal exposure to tariffs. These factors make it an attractive alternative for investors seeking to mitigate risk associated with global trade uncertainties. Its unique business model, coupled with consistent growth and a vast content library, positions Netflix as a leader in the streaming industry, outperforming many of its big tech counterparts. Consider the benefits of diversifying your portfolio with a company like Netflix, a leader in the streaming industry that’s demonstrating impressive resilience in the face of global economic uncertainty. Learn more about investing in Netflix and its robust growth potential.

Featured Posts

-

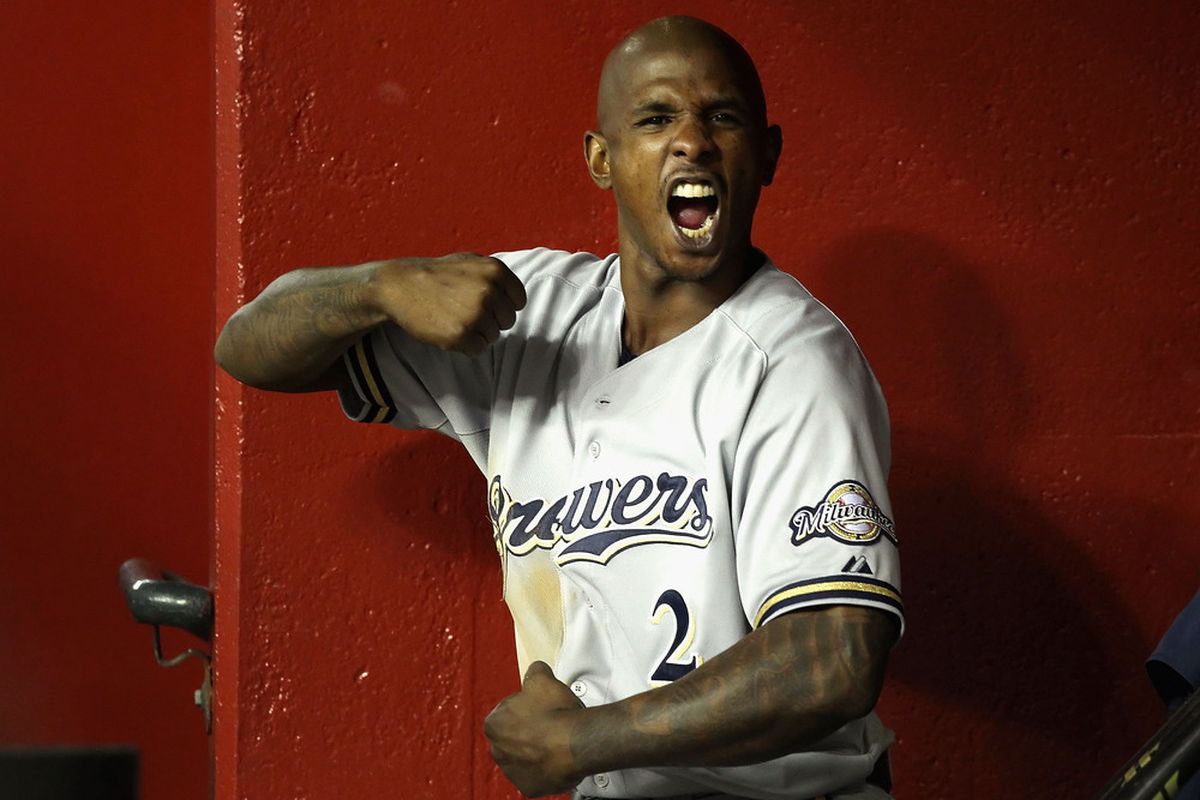

Brewers Vs Diamondbacks Naylors Key Rbi In Diamondbacks Win

Apr 23, 2025

Brewers Vs Diamondbacks Naylors Key Rbi In Diamondbacks Win

Apr 23, 2025 -

Trumps Tariffs A Posthaste Analysis Of The Impact On Canadian Households

Apr 23, 2025

Trumps Tariffs A Posthaste Analysis Of The Impact On Canadian Households

Apr 23, 2025 -

Yankees Record Breaking 9 Homer Game Judges 3 Hrs Lead The Charge

Apr 23, 2025

Yankees Record Breaking 9 Homer Game Judges 3 Hrs Lead The Charge

Apr 23, 2025 -

Yankee Announcer Faces Backlash Over Unnecessary Mariners Jab

Apr 23, 2025

Yankee Announcer Faces Backlash Over Unnecessary Mariners Jab

Apr 23, 2025 -

5 2 Win For Diamondbacks Against Brewers Post Game Analysis

Apr 23, 2025

5 2 Win For Diamondbacks Against Brewers Post Game Analysis

Apr 23, 2025