India Market Update: Tailwinds Driving Nifty's Strong Performance

Table of Contents

Robust Economic Growth Fuels Nifty's Rise

The surge in the Nifty 50 index is inextricably linked to India's robust economic growth. Several factors contribute to this positive momentum:

Increased Consumption & Domestic Demand

Rising disposable incomes are fueling a significant increase in consumer spending across various sectors. This translates into increased demand for goods and services, bolstering the performance of Indian companies listed on the Nifty.

- Rising Disposable Incomes: A growing middle class and increased employment opportunities are leading to higher disposable incomes, boosting consumer spending power.

- Strong Rural Demand: Government initiatives focused on rural development and agricultural growth are contributing significantly to increased rural consumption, a crucial driver of the Indian economy.

- Government Initiatives: Programs like the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) and various rural infrastructure development projects are effectively stimulating rural economies and boosting domestic demand. This positive impact is clearly reflected in the Nifty 50 growth trajectory.

Positive Investment Climate

India's improving investment climate is another key factor contributing to the Nifty's rise. Foreign and domestic investments are pouring into the country, further fueling economic expansion.

- Foreign Direct Investment (FDI): India continues to attract significant FDI, signaling strong investor confidence in the country's long-term growth prospects. This influx of capital is directly contributing to the Nifty index performance.

- Government Reforms: Initiatives aimed at simplifying regulations and improving the ease of doing business are making India a more attractive destination for investors, both domestic and international.

- Infrastructure Development: Massive investments in infrastructure projects, including roads, railways, and ports, are creating numerous job opportunities and stimulating economic activity, ultimately benefiting the Indian stock market.

Positive Global Sentiment and Geopolitical Factors

Beyond domestic factors, positive global sentiment and strategic geopolitical positioning are also contributing significantly to the Nifty's strong performance.

Global Capital Inflows

India's stable macroeconomic fundamentals, coupled with relatively higher returns compared to other global markets, are attracting significant global capital inflows.

- Global Capital Flows: Investors seeking higher returns are increasingly turning to the Indian market, leading to substantial portfolio investments in Nifty 50 constituent stocks.

- Weakening Dollar: The weakening US dollar has made Indian assets more attractive to foreign investors, further boosting capital inflows.

- Macroeconomic Stability: India's relatively stable macroeconomic environment, compared to some other global economies, provides a safe haven for investors, contributing to the sustained growth of the Nifty 50 index.

Geopolitical Shifts

India's strategic geopolitical location and its growing influence on the global stage are further enhancing its attractiveness as an investment destination.

- Geopolitical Stability: India's relatively stable geopolitical position within a volatile global landscape makes it a favored investment destination.

- Global Supply Chain Shifts: The ongoing reshaping of global supply chains presents significant opportunities for Indian businesses, particularly in manufacturing and technology, leading to further growth in the Nifty.

- Diversification Benefits: Investors are increasingly diversifying their portfolios away from other volatile markets, favoring the relative stability of the Indian stock market and thus boosting the Nifty's performance.

Strong Corporate Earnings and Sectoral Performance

Robust corporate earnings and the strong performance of several key sectors are additional factors powering the Nifty's rise.

Improved Profitability

Many Indian companies are reporting strong earnings growth, reflecting increased demand and efficient operations.

- Increased Demand: The strong domestic demand mentioned earlier directly translates into improved sales and profitability for numerous companies listed on the Nifty.

- Technological Advancements: The adoption of new technologies is improving efficiency and reducing costs, contributing to higher profitability for Indian businesses.

- Sustainable Business Practices: A growing focus on environmental, social, and governance (ESG) factors is attracting investors and promoting long-term sustainability for many Nifty 50 companies.

Outperforming Sectors

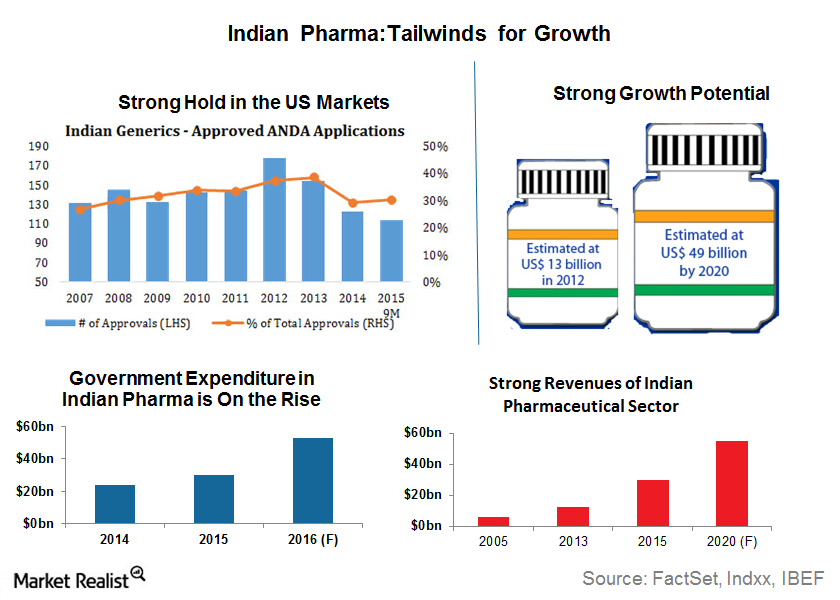

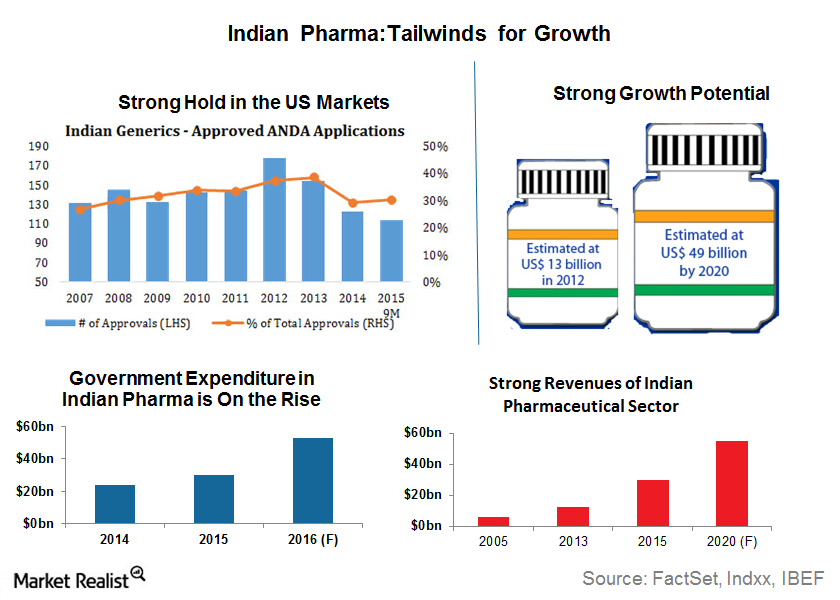

Several sectors within the Nifty 50 are significantly outperforming others. The IT sector, fueled by global demand for technology services, and the pharmaceutical sector, driven by innovation and a growing global healthcare market, are prime examples. The financial services sector is also exhibiting robust growth. Analyzing the specific drivers behind the success of these sectors is crucial for understanding the broader Nifty 50 performance.

Conclusion

The recent strong performance of the Nifty 50 index is a result of a confluence of factors: robust economic growth, a positive global investment climate, and strong corporate earnings. Increased domestic demand, significant FDI inflows, and strategic geopolitical positioning all contribute to the positive outlook for the Indian market. Understanding these tailwinds is crucial for investors looking to capitalize on the opportunities presented by the Indian stock market. Staying informed about the latest India Market Update and monitoring the performance of the Nifty's strong performance is key to navigating this dynamic market successfully. Continue to research and analyze the various factors influencing the Indian stock market for informed investment decisions.

Featured Posts

-

16 Million Penalty For T Mobile Details Of Three Year Data Breach

Apr 24, 2025

16 Million Penalty For T Mobile Details Of Three Year Data Breach

Apr 24, 2025 -

La Fires Price Gouging Accusations Against Landlords Surface

Apr 24, 2025

La Fires Price Gouging Accusations Against Landlords Surface

Apr 24, 2025 -

The Impact Of Reduced Nonessential Spending On The Credit Card Industry

Apr 24, 2025

The Impact Of Reduced Nonessential Spending On The Credit Card Industry

Apr 24, 2025 -

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Say

Apr 24, 2025

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Say

Apr 24, 2025 -

John Travoltas Family Home Addressing The Recent Photo Controversy

Apr 24, 2025

John Travoltas Family Home Addressing The Recent Photo Controversy

Apr 24, 2025