Is The U.S. Dollar Headed For Its Worst Performance Since Nixon's Presidency?

Table of Contents

Inflation and the Weakening Dollar

Persistent inflation is a significant threat to the U.S. dollar's value. High inflation erodes purchasing power, meaning that the same amount of dollars buys fewer goods and services over time. The current inflation rate in the U.S., while showing signs of easing, remains elevated compared to historical averages. This sustained inflationary pressure directly weakens the dollar, making it less attractive to both domestic and international investors.

The Impact of Persistent Inflation:

- Eroding Purchasing Power: Persistent inflation means a dollar today buys less than a dollar yesterday. This reduction in purchasing power directly impacts consumer confidence and spending habits. High inflation also increases the cost of borrowing, potentially hindering economic growth.

- International Comparisons: Many countries are grappling with similar inflationary pressures, leading to currency devaluation across the globe. However, the magnitude of the U.S. dollar's potential decline is a subject of considerable debate among economists. Comparing the U.S. situation to countries with significantly higher inflation rates provides crucial context for understanding the potential scale of the dollar's weakening.

- Federal Reserve Response: The Federal Reserve's monetary policy plays a crucial role in managing inflation. Raising interest rates is a common tool used to curb inflation, but this can also slow economic growth and potentially further weaken the dollar in the short term. The delicate balancing act between fighting inflation and preserving economic stability presents a significant challenge for the Federal Reserve.

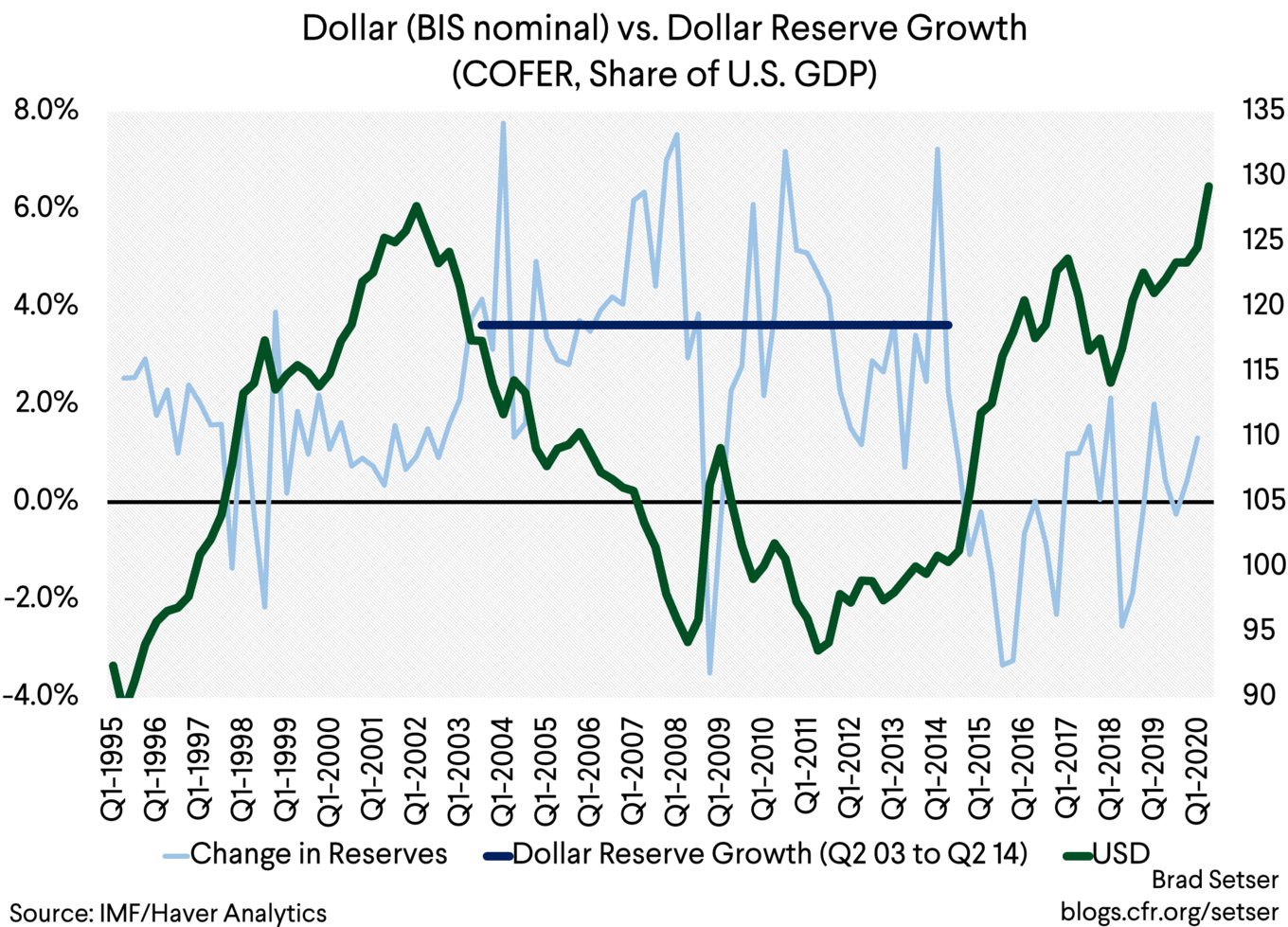

The Rise of Competing Currencies

The U.S. dollar's dominance as the world's reserve currency is increasingly challenged by the rise of competing currencies, such as the Euro and the Chinese Yuan. The growing economic strength and stability of these alternatives, coupled with increased global trade diversification, are significantly impacting the dollar's value and its role in international finance.

The Euro and Other Global Players:

- Economic Strength: The Eurozone, despite its recent challenges, represents a large and relatively stable economic bloc. The Chinese Yuan, while still subject to government control, is increasingly used in international trade, particularly within Asia.

- Diversification Away from the Dollar: Global trade is becoming increasingly diversified, reducing the reliance on the U.S. dollar for international transactions. This reduced demand contributes to a weakening of the dollar's global influence.

- Geopolitical Factors: Geopolitical shifts, including rising tensions between the U.S. and China, are influencing the dynamics of global currency reserves. Countries are increasingly seeking to diversify their holdings away from the dollar to mitigate geopolitical risk.

Geopolitical Instability and its Effect on the Dollar

Geopolitical instability, such as the ongoing war in Ukraine and escalating tensions with China, significantly impacts investor confidence and the demand for the U.S. dollar as a safe haven. This uncertainty can lead to capital flight, as investors seek safer investments in other currencies or assets.

The Role of Global Uncertainty:

- Influence on Currency Markets: Geopolitical events create uncertainty in currency markets, often leading to increased volatility. Investors react to perceived risk by shifting their investments away from riskier assets, including the U.S. dollar.

- Flight to Safety: In times of global uncertainty, the U.S. dollar has historically been seen as a safe haven currency. However, as the dollar's own stability is questioned, this "safe haven" status is diminishing.

- Long-Term Instability: Prolonged geopolitical instability could further weaken the dollar's value as investors lose confidence in its long-term stability and the U.S. economy's resilience.

The National Debt and Fiscal Policy

The growing U.S. national debt and the government's fiscal policy are contributing factors to the potential weakening of the dollar. Increased government spending and borrowing can lead to higher inflation and ultimately, currency devaluation.

The Impact of Government Spending:

- Inflationary Pressures: A large national debt can fuel inflation as the government borrows more money, increasing demand and potentially outpacing the supply of goods and services.

- Fiscal Policy's Role: Effective fiscal policy is crucial in managing the national debt and preventing excessive government spending that could exacerbate inflationary pressures.

- Historical Parallels: Studying historical periods of high national debt and their impact on the dollar's value can offer insights into the potential consequences of the current situation.

Conclusion: Is the U.S. Dollar Headed for its Worst Performance Since Nixon's Presidency? A Look Ahead

The potential for a significant decline in the U.S. dollar's value is a complex issue with several contributing factors. Inflationary pressures, the rise of competing currencies, escalating geopolitical instability, and the growing national debt all pose significant challenges to the dollar's future performance. While a direct comparison to the Nixon shock requires careful consideration of the vastly different global economic landscape, the current confluence of factors certainly warrants serious attention. The question of whether the U.S. dollar is headed for its worst performance since Nixon's presidency remains open to debate among economists, but the risks are undeniable.

Stay informed about the future of the U.S. dollar and its potential performance. Learn more about strategies to protect your portfolio against a weakening U.S. dollar, considering diversification to mitigate potential risks.

Featured Posts

-

Red Sox Injury Report Crawford Bello Abreu And Rafaela Updates

Apr 28, 2025

Red Sox Injury Report Crawford Bello Abreu And Rafaela Updates

Apr 28, 2025 -

Abwzby Wkazakhstan Tyran Alerbyt Ytlq Rhlat Mbashrt

Apr 28, 2025

Abwzby Wkazakhstan Tyran Alerbyt Ytlq Rhlat Mbashrt

Apr 28, 2025 -

2000 Yankees Diary Posadas Homer Silences The Royals

Apr 28, 2025

2000 Yankees Diary Posadas Homer Silences The Royals

Apr 28, 2025 -

Ai Digest Transforming Repetitive Documents Into A Compelling Poop Podcast

Apr 28, 2025

Ai Digest Transforming Repetitive Documents Into A Compelling Poop Podcast

Apr 28, 2025 -

Boone On The Yankees Lineup Addressing Aaron Judges Position

Apr 28, 2025

Boone On The Yankees Lineup Addressing Aaron Judges Position

Apr 28, 2025