Land Your Dream Private Credit Job: 5 Do's And Don'ts To Follow

Table of Contents

5 DO's to Land Your Dream Private Credit Job

Do 1: Network Strategically

Networking is paramount in the private credit industry. Don't underestimate the power of building relationships.

- LinkedIn: Actively engage on LinkedIn. Join relevant groups, connect with professionals in private credit, and participate in discussions.

- Industry Events: Attend industry conferences, seminars, and workshops. These events provide excellent networking opportunities and allow you to learn about the latest trends in private credit lending, distressed debt, and mezzanine finance.

- Informational Interviews: Reach out to professionals for informational interviews. These conversations can provide invaluable insights into the industry and help you build connections. Target specific firms and individuals known for their expertise in your area of interest within private credit.

- Follow Key Players: Follow influential figures on LinkedIn and engage thoughtfully with their posts. This demonstrates your interest and keeps you updated on industry news and perspectives.

Do 2: Tailor Your Resume and Cover Letter

Generic applications rarely succeed. Each private credit job application requires a customized approach highlighting your relevant skills and experience.

- Keyword Optimization: Incorporate keywords from specific job descriptions, such as "underwriting," "due diligence," "financial modeling," "credit analysis," and "portfolio management."

- Quantify Achievements: Instead of simply listing responsibilities, quantify your achievements with concrete data to demonstrate your impact in previous roles. For example, "Increased portfolio yield by 15% through strategic asset allocation."

- Showcase Private Credit Expertise: Clearly demonstrate your understanding of private credit principles, different investment strategies, and relevant regulatory considerations.

- Targeted Approach: Tailor your resume and cover letter to each specific private credit job application, emphasizing the skills and experiences most relevant to the role.

Do 3: Master the Interview Process

Interview preparation is crucial for success. Practice your responses, research the firm, and prepare insightful questions.

- Behavioral Questions: Prepare for common behavioral questions, such as "Tell me about a time you failed," focusing on demonstrating resilience and learning from mistakes.

- Technical Questions: Anticipate technical questions related to private credit, including financial modeling, credit analysis, and valuation techniques.

- Case Studies: Be prepared to tackle case studies that test your problem-solving skills and understanding of private credit markets.

- Ask Engaging Questions: Prepare insightful questions to show your engagement and understanding of the role and the firm's private credit strategies.

Do 4: Showcase Your Financial Modeling Skills

Proficiency in financial modeling is essential for a private credit career. Demonstrate your expertise through your resume, portfolio, and interview performance.

- Software Proficiency: Highlight your skills in Excel, Argus, Bloomberg Terminal, or other relevant financial modeling software.

- Portfolio: Include examples of your financial modeling work in your portfolio, showcasing your ability to analyze financial statements and build complex models.

- Explain Your Process: During the interview, be prepared to clearly explain your modeling process, assumptions, and limitations.

- Advanced Techniques: Demonstrate understanding of advanced techniques like LBO modeling, discounted cash flow analysis, and sensitivity analysis.

Do 5: Highlight Your Understanding of Private Credit Markets

Demonstrate a comprehensive understanding of current market trends, investment strategies, and regulatory landscape within the private credit sector.

- Stay Updated: Regularly read industry publications, follow relevant news sources, and attend industry events to keep your knowledge current.

- Investment Strategies: Demonstrate an understanding of different types of private credit investments (e.g., direct lending, distressed debt, mezzanine finance, unitranche).

- Regulatory Awareness: Show familiarity with relevant regulations and compliance requirements within the private credit industry.

- Risk Assessment: Highlight your ability to assess and manage risk within private credit investments.

5 DON'Ts to Avoid When Seeking a Private Credit Job

Don't 1: Neglect Networking: Relying solely on online applications is insufficient. Active networking is crucial for landing a private credit job.

Don't 2: Submit Generic Applications: Sending the same resume and cover letter to multiple firms without tailoring them is a major mistake.

Don't 3: Underprepare for Interviews: Going into interviews unprepared demonstrates a lack of seriousness and significantly reduces your chances of success.

Don't 4: Overlook the Importance of Financial Modeling: Financial modeling is a core competency. Failing to showcase your skills can be detrimental.

Don't 5: Lack Knowledge of Private Credit Markets: Demonstrating a lack of awareness of current market trends and investment strategies will significantly hurt your candidacy.

Conclusion

Securing your dream private credit job requires a well-rounded approach. By strategically networking, tailoring your application materials, mastering the interview process, showcasing your financial modeling expertise, and demonstrating a deep understanding of private credit markets, you significantly increase your chances of success. Start your private credit job search today by implementing these tips and landing your ideal private credit position – or even secure your dream private credit career!

Featured Posts

-

Blue Origin Scraps Rocket Launch Due To Subsystem Problem

Apr 22, 2025

Blue Origin Scraps Rocket Launch Due To Subsystem Problem

Apr 22, 2025 -

Fsu Security Breach Swift Police Response Fails To Alleviate Student Fears

Apr 22, 2025

Fsu Security Breach Swift Police Response Fails To Alleviate Student Fears

Apr 22, 2025 -

Closer Security Partnership Between China And Indonesia

Apr 22, 2025

Closer Security Partnership Between China And Indonesia

Apr 22, 2025 -

Chainalysis Acquires Alterya Blockchain Meets Ai

Apr 22, 2025

Chainalysis Acquires Alterya Blockchain Meets Ai

Apr 22, 2025 -

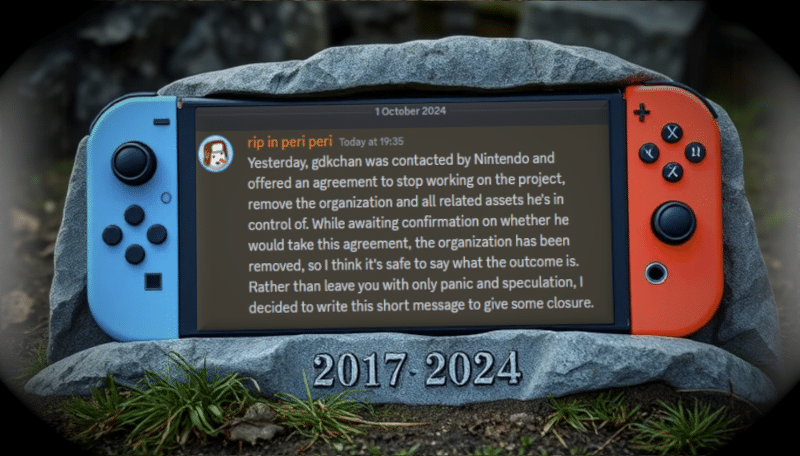

Ryujinx Emulator Project Ends Official Statement On Nintendos Involvement

Apr 22, 2025

Ryujinx Emulator Project Ends Official Statement On Nintendos Involvement

Apr 22, 2025