Market Corrections: Opportunities For Individual Investors?

Table of Contents

Understanding Market Corrections: Causes and Characteristics

A market correction is a significant drop in a broad market index, typically defined as a decline of 10% or more from a recent high. These corrections are a normal part of the market cycle, reflecting the inherent volatility of investments. Several factors can trigger a market correction:

- Economic Slowdown: Recessions or fears of a recession often lead to decreased investor confidence and selling pressure. Economic indicators like GDP growth, unemployment rates, and consumer spending play a crucial role.

- Geopolitical Events: Unforeseen global events, such as wars, political instability, or international trade disputes, can create significant uncertainty and trigger market sell-offs.

- Inflation and Interest Rate Hikes: High inflation erodes purchasing power, and central bank actions to control inflation through interest rate hikes can impact economic growth and corporate profitability, leading to market corrections.

- Unexpected News or Events: Sudden negative news about a major company or industry can also trigger a sell-off, impacting related stocks and potentially the broader market.

The psychology of market corrections is equally important. Fear and panic often drive investors to sell assets en masse, exacerbating the decline. This "herd mentality" can lead to irrational decision-making, creating further downward pressure on prices. It's crucial to differentiate between a correction and a bear market. While a correction is a temporary decline, a bear market represents a more sustained and significant downturn, often lasting longer than a correction.

Key Characteristics of Market Corrections:

- Temporary price declines (typically 10-20%, but can be more severe)

- Often unpredictable timing and duration

- Potential for significant price rebounds following the correction

- Increased volatility and price swings

Identifying Investment Opportunities During a Market Correction

Market corrections present opportunities for value investors – those who focus on identifying undervalued assets. During a correction, fundamentally strong companies may see their stock prices drop disproportionately to their long-term value. This creates an attractive entry point for long-term investors. Fundamental analysis, which involves evaluating a company's financial statements, business model, and competitive landscape, is crucial for identifying these undervalued companies. Thorough due diligence and research are paramount before making any investment decisions. While fundamental analysis forms the core of this strategy, technical analysis (chart patterns and trading volume) can be a supplementary tool to help time your entry points.

Potential Investment Strategies During a Market Correction:

- Dollar-cost averaging: Investing a fixed amount of money at regular intervals, regardless of price fluctuations. This mitigates the risk of investing a lump sum at the bottom of a correction.

- Focus on fundamentally strong companies: Prioritize companies with solid financials, strong competitive advantages, and a history of consistent earnings.

- Diversification across asset classes: Spreading your investments across different asset classes (stocks, bonds, real estate, etc.) to reduce overall portfolio risk.

- Rebalancing your portfolio: Adjusting your asset allocation periodically to maintain your desired risk level and capitalize on market opportunities.

Managing Risk During Market Corrections

Successful investing during market corrections requires a well-defined investment strategy aligned with your risk tolerance. Diversification is crucial in mitigating risk. By spreading your investments across different asset classes and sectors, you reduce your exposure to any single market downturn. Avoid panic selling, one of the biggest mistakes investors make during corrections. Sticking to your long-term investment plan is key. Having a substantial emergency fund will also provide you with financial security and emotional stability to navigate market turbulence without resorting to rash decisions.

Risk Management Strategies:

- Diversify your portfolio across different asset classes.

- Only invest what you can afford to lose.

- Avoid emotional decision-making; stick to your investment plan.

- Have a long-term investment plan.

- Maintain a substantial emergency fund.

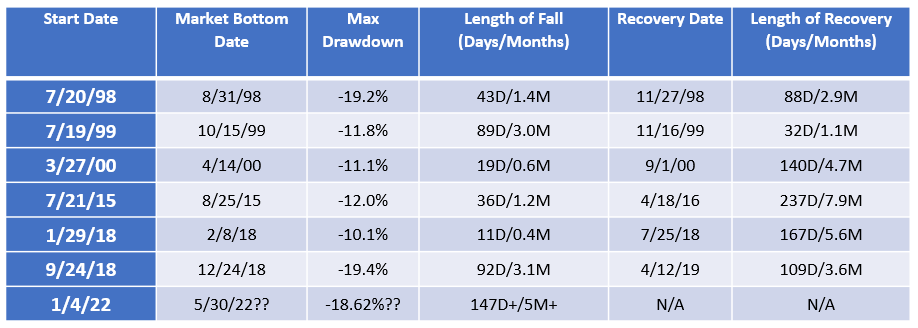

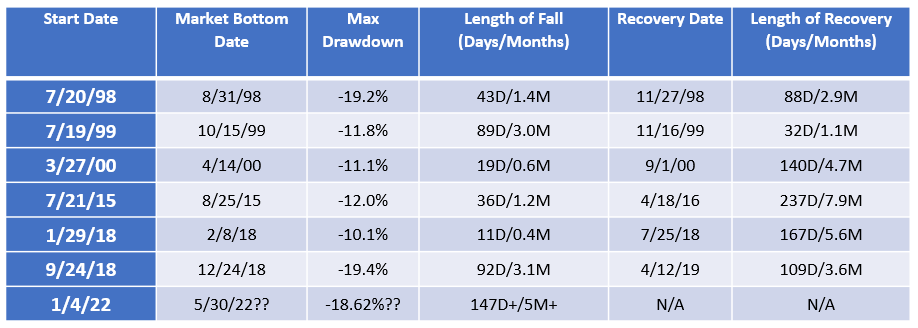

Case Studies: Successful Investing During Past Market Corrections

History provides valuable lessons. The dot-com bubble burst of 2000 and the 2008 financial crisis both presented significant market corrections. Investors who remained disciplined, focused on fundamentally sound companies, and avoided panic selling were able to capitalize on the subsequent market rebounds. For example, investors who bought high-quality stocks at discounted prices during the 2008 crisis significantly outperformed those who remained on the sidelines. (Note: This is for illustrative purposes and not financial advice.) Similarly, patient investors who identified undervalued technology companies following the dot-com crash also reaped significant rewards in the years that followed. Remember that past performance doesn’t guarantee future results, but studying past corrections offers invaluable insights into potential opportunities.

Conclusion: Capitalizing on Market Corrections: A Strategic Approach

Market corrections are an inherent part of the investment cycle, presenting both challenges and opportunities. By understanding the causes and characteristics of corrections, employing a disciplined investment approach, and rigorously managing risk, individual investors can potentially transform these periods of volatility into periods of significant growth. Remember, thorough research, diversification, and a long-term perspective are key to successfully navigating market corrections and identifying lucrative investment opportunities. Don't let fear paralyze you; develop a strategic approach, and learn to view market corrections as potential pathways to building wealth. Learn more about navigating market corrections and identifying lucrative investment opportunities. Start your research on [link to relevant resource] today!

Featured Posts

-

Deportation To Russia Harvard Researchers Case In Louisiana Courts

Apr 28, 2025

Deportation To Russia Harvard Researchers Case In Louisiana Courts

Apr 28, 2025 -

Colorado Qb Shedeur Sanders Joins Cleveland Browns

Apr 28, 2025

Colorado Qb Shedeur Sanders Joins Cleveland Browns

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Highlights A Potential 1 050 Cost Increase

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Highlights A Potential 1 050 Cost Increase

Apr 28, 2025 -

Extra Innings Drama Pirates Edge Yankees With Walk Off

Apr 28, 2025

Extra Innings Drama Pirates Edge Yankees With Walk Off

Apr 28, 2025 -

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025 Free Live Stream

Apr 28, 2025

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025 Free Live Stream

Apr 28, 2025