Navigate The Private Credit Boom: 5 Essential Do's & Don'ts

Table of Contents

Do Your Due Diligence

Thorough investigation is paramount when considering private credit investments. This involves a deep dive into both the borrower and the loan documentation itself.

Understand the Borrower

Analyzing the borrower's financial health is fundamental to assessing the risk associated with a private debt investment. This includes a comprehensive review of various aspects:

- Review audited financial statements: Scrutinize financial statements for at least the past three years, paying attention to revenue trends, profitability, and cash flow. Look for inconsistencies or red flags.

- Assess the borrower's credit history and track record: Investigate the borrower's past borrowing and repayment history. Check credit reports and assess their overall creditworthiness. Look for any instances of default or bankruptcy.

- Evaluate the management team's experience and expertise: Analyze the experience and track record of the management team. A strong and experienced team is crucial for a borrower's success. Assess their industry knowledge and ability to navigate challenges.

- Conduct site visits if possible: Visiting the borrower's facilities provides valuable firsthand insight into their operations and helps verify the information provided in financial statements. This physical due diligence is invaluable.

Scrutinize the Loan Documents

The loan agreement is a legally binding contract. Understanding its intricacies is critical.

- Understand the terms and conditions of the loan, including interest rates, fees, and repayment schedules: Carefully review all aspects of the loan terms, ensuring you fully grasp the financial implications. Negotiate favorable terms where possible.

- Pay close attention to covenants and security packages: Covenants are restrictions placed on the borrower to protect the lender's interests. Ensure these are appropriately structured and enforceable. Understand the collateral securing the loan and its value.

- Consult with legal counsel to ensure the documents are favorable: Before committing to any investment, seek expert legal advice to ensure the loan documents are fair, comprehensive, and protect your interests.

Diversify Your Private Credit Portfolio

Diversification is a cornerstone of effective risk management in any investment portfolio, and private credit is no exception. Don't put all your eggs in one basket.

Spread Investments Across Sectors

Over-concentration in a single industry exposes your portfolio to significant risk should that sector experience a downturn.

- Consider investments across various sectors such as real estate, healthcare, technology, and energy: Spreading investments across diverse sectors mitigates the impact of sector-specific risks. This portfolio diversification is crucial.

- Evaluate the correlation between different asset classes within your portfolio: Analyze how different asset classes in your portfolio move relative to each other. Minimizing correlation helps reduce overall portfolio volatility.

Diversify by Loan Type

Different loan types carry varying levels of risk and reward. A balanced approach is key.

- Understand the risk-return profile of each loan type: Senior secured debt generally carries lower risk, while subordinated and mezzanine debt offer potentially higher returns but with increased risk.

- Consider using different strategies to manage risk: Employ strategies such as hedging or using derivatives to mitigate potential losses in certain market conditions.

Understand the Market Cycle

Private credit markets, like all financial markets, are cyclical. Understanding these cycles is crucial for successful investing.

Monitor Economic Indicators

Macroeconomic trends significantly impact borrowers' ability to repay loans.

- Follow interest rate changes and inflation levels: Changes in interest rates affect borrowing costs and can influence repayment ability. Inflation can erode the real value of returns.

- Analyze overall economic growth and potential recessions: Economic downturns increase the risk of defaults. Understanding the economic outlook is crucial for making informed investment decisions.

Assess Credit Spreads

Credit spreads, the difference between the yield on a private credit investment and a comparable government bond, reflect risk appetite.

- Wider spreads suggest higher risk and potentially higher returns: Investors demand higher returns to compensate for increased risk.

- Narrower spreads might indicate lower risk but potentially lower returns: Lower risk typically translates to lower returns. Monitor these spreads closely.

Don't Neglect Risk Management

A robust risk management framework is essential for success in private credit.

Establish Clear Investment Criteria

Defining your investment strategy and risk tolerance upfront is critical.

- Set specific criteria for borrower selection, loan types, and risk levels: Establish clear guidelines for evaluating potential investments, ensuring they align with your risk profile.

- Regularly review and adjust your investment criteria based on market conditions: Market conditions change; your investment strategy should adapt accordingly.

Monitor Portfolio Performance Regularly

Active monitoring and prompt action are crucial for mitigating potential problems.

- Regularly review the financial health of borrowers: Stay informed about the performance of your borrowers. Look for early warning signs of potential issues.

- Monitor loan repayments and delinquency rates: Track repayment performance closely to identify any delinquencies promptly.

- Actively manage your portfolio to mitigate risks: Take proactive steps to address any potential issues and protect your investment.

Don't Overlook Professional Advice

Navigating the complexities of private credit is best done with expert guidance.

Consult with Legal and Financial Professionals

Seek professional help to ensure you're making informed decisions.

- Engage experienced legal counsel to review loan documents: Legal expertise is crucial to ensure you understand the legal implications of your investments.

- Consult with financial advisors for portfolio diversification strategies: Professional advice helps create a diversified and well-balanced portfolio aligned with your investment goals.

- Consider working with private credit fund managers for access to deal flow and expertise: Fund managers offer access to a wider range of investment opportunities and professional management expertise.

Conclusion

Successfully navigating the private credit boom requires a strategic approach that balances risk and reward. By following these essential do's and don'ts – conducting thorough due diligence, diversifying your portfolio, understanding market cycles, managing risks effectively, and seeking professional advice – you can increase your chances of achieving attractive returns while mitigating potential losses in alternative lending and direct lending. Remember, proactive management and a thorough understanding of the private credit landscape are crucial for long-term success. Start navigating the private credit market wisely today!

Featured Posts

-

U S Dollar Worst Start Since Nixon Analyzing The First 100 Days

Apr 28, 2025

U S Dollar Worst Start Since Nixon Analyzing The First 100 Days

Apr 28, 2025 -

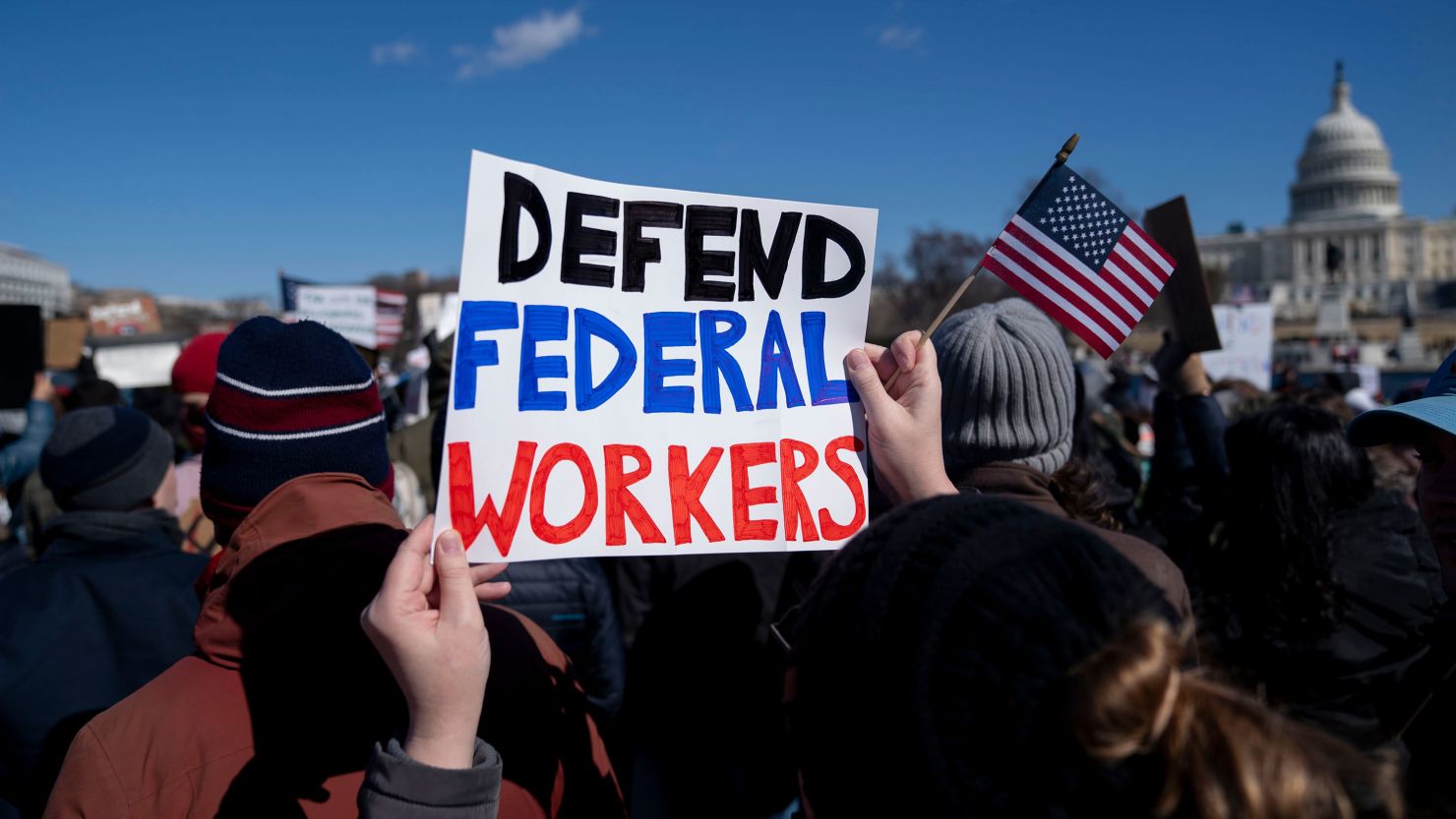

The Difficult Path Laid Off Federal Workers And The Search For State And Local Jobs

Apr 28, 2025

The Difficult Path Laid Off Federal Workers And The Search For State And Local Jobs

Apr 28, 2025 -

Shift In Mets Rotation One Pitchers Rise To Prominence

Apr 28, 2025

Shift In Mets Rotation One Pitchers Rise To Prominence

Apr 28, 2025 -

Are Gpu Prices Out Of Control Again A Detailed Look

Apr 28, 2025

Are Gpu Prices Out Of Control Again A Detailed Look

Apr 28, 2025 -

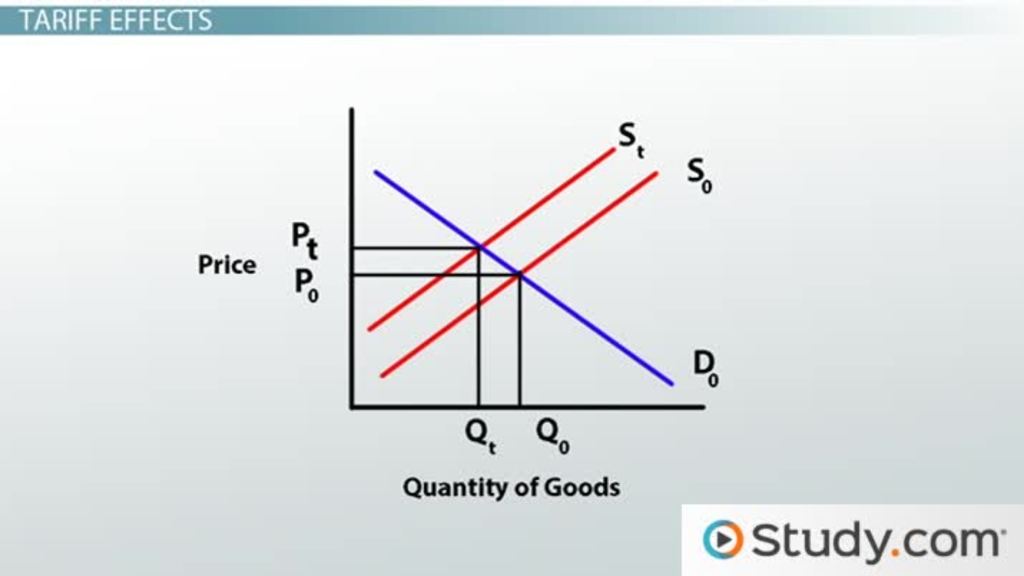

Us China Trade Partial Tariff Relief For American Goods

Apr 28, 2025

Us China Trade Partial Tariff Relief For American Goods

Apr 28, 2025