Navigate The Private Credit Boom: 5 Job-Landing Do's & Don'ts

Table of Contents

Do: Network Strategically within the Private Credit Industry

Building a strong network is paramount in the competitive private credit job market. Don't rely solely on online applications; actively cultivate relationships with professionals in the field.

Attend Industry Events

- Target conferences, seminars, and workshops: Focus on events specifically related to private credit, alternative lending, distressed debt, direct lending, and other relevant finance niches. Look for conferences like the IMN Private Debt events, PEI events, and smaller, more niche gatherings.

- Actively engage: Don't just attend; participate! Ask insightful questions, share your perspectives, and engage in meaningful conversations.

- Follow up: After each event, send personalized connection requests on LinkedIn and follow up with those you've met, reinforcing your interest and sharing relevant information.

Cultivate Relationships

Networking isn't just about collecting business cards; it's about building genuine relationships.

- Seek mentorship: Identify experienced professionals who can guide you and offer valuable insights into the private credit industry.

- Offer value: Don't just take; contribute. Offer to help colleagues, share your expertise, and become a valuable resource within your network.

- Maintain contact: Stay in touch with your contacts regularly, even if you're not actively seeking a job. This builds long-term relationships that can pay off in the future.

Leverage Online Platforms

LinkedIn is your key to unlocking opportunities in the private credit world.

- Optimize your profile: Showcase your skills and experience relevant to private credit, using keywords like "due diligence," "credit analysis," "portfolio management," "leveraged finance," and "structured finance."

- Engage in groups: Participate actively in relevant LinkedIn groups, sharing insightful comments and demonstrating your expertise.

- Follow industry leaders: Stay updated on industry trends by following influential figures and companies within the private credit space.

Do: Highlight Relevant Skills and Experience

Your resume and cover letter are your first impressions – make them count.

Tailor Your Resume

Generic resumes won't cut it in this competitive market.

- Customize for each application: Highlight the skills and experience most relevant to each specific job description.

- Quantify your achievements: Use numbers to demonstrate the impact you've made in previous roles (e.g., "Improved portfolio performance by 10%").

- Use relevant keywords: Incorporate keywords recruiters and hiring managers use when searching for candidates in private credit.

Showcase Your Financial Acumen

Private credit roles demand a strong understanding of finance.

- Demonstrate expertise: Highlight your proficiency in financial statement analysis, valuation techniques (DCF, precedent transactions), and credit risk assessment.

- Show breadth of experience: Mention experience with various asset classes, such as real estate, infrastructure, or private equity.

- Emphasize analytical skills: Demonstrate your ability to analyze complex data, identify trends, and solve problems.

Master the Cover Letter Art

Your cover letter should be a compelling narrative that complements your resume.

- Address specific requirements: Tailor your cover letter to address the specific needs and requirements outlined in the job description.

- Show genuine interest: Express your enthusiasm for the company's mission and the specific role you're applying for.

- Demonstrate market knowledge: Showcase your understanding of current trends and challenges within the private credit market.

Do: Prepare for Behavioral and Technical Interviews

Interviews are your chance to shine. Thorough preparation is key.

Practice Common Interview Questions

Prepare for both behavioral and technical questions.

- Behavioral questions: Practice answering questions about your strengths, weaknesses, and experiences, using the STAR method (Situation, Task, Action, Result).

- Technical questions: Be ready to discuss financial modeling, credit analysis, valuation methodologies, and risk management techniques.

- Prepare insightful questions: Asking thoughtful questions demonstrates your interest and initiative.

Showcase Your Understanding of Private Credit

Demonstrate your knowledge of the industry's nuances.

- Discuss different strategies: Show your understanding of direct lending, mezzanine financing, distressed debt, and other private credit strategies.

- Analyze market conditions: Discuss current market trends, interest rate impacts, and their influence on private credit investments.

- Highlight adaptability: Show your ability to adjust to changing market dynamics and economic conditions.

Show Your Personality

Let your personality and passion shine through.

- Be authentic: Don't try to be someone you're not.

- Show enthusiasm: Express your genuine excitement for the role and the private credit industry.

- Build rapport: Engage in a natural conversation with the interviewer, showing active listening and genuine interest.

Don't: Neglect Due Diligence on Potential Employers

Just as you're being vetted, research your potential employers thoroughly.

Research the Firm's Investment Strategy

Understanding their focus is crucial.

- Investment thesis: Learn about their target investments, sector focus, and investment philosophy.

- Recent transactions: Research their recent deals to understand their approach and performance.

- Competitive landscape: Analyze their position within the market and their competitive advantages.

Investigate the Firm's Culture

Company culture significantly impacts job satisfaction.

- Employee reviews: Check sites like Glassdoor to gather insights into employee experiences.

- Company values: Understand their mission, values, and overall work environment.

- Work-life balance: Assess the firm's approach to work-life balance and employee well-being.

Network to Gather Insider Information

Connect with current and former employees for firsthand perspectives.

- LinkedIn: Reach out to people working at the firm or those who have worked there previously.

- Informational interviews: Schedule informal conversations to learn more about the company culture and day-to-day work.

- Industry events: Use networking opportunities to gather insights from professionals familiar with the firm.

Don't: Underestimate the Importance of Soft Skills

Technical skills are essential, but soft skills can make or break your candidacy.

Communication Skills

Clear and concise communication is vital in any finance role.

- Verbal communication: Practice articulating complex ideas clearly and concisely.

- Written communication: Develop strong written communication skills to prepare reports and emails effectively.

- Active listening: Pay close attention to what others are saying and ask clarifying questions.

Teamwork & Collaboration

Private credit often involves collaborative efforts.

- Teamwork experience: Highlight examples from your past where you worked effectively in a team setting.

- Collaboration skills: Showcase your ability to collaborate with diverse individuals and achieve shared goals.

- Conflict resolution: Demonstrate your ability to navigate disagreements and find constructive solutions.

Problem-Solving Skills

The private credit industry presents complex challenges.

- Analytical skills: Highlight your ability to analyze complex data and identify potential solutions.

- Critical thinking: Show your ability to evaluate information objectively and make informed decisions.

- Creative problem-solving: Demonstrate your ability to think outside the box and develop innovative solutions.

Conclusion

Navigating the booming private credit job market requires a strategic and well-prepared approach. By following these do's and don'ts, focusing on networking, highlighting relevant skills, preparing thoroughly for interviews, and conducting due diligence, you can significantly improve your chances of landing your dream job in this exciting field. Don't delay – start implementing these strategies today and begin your journey towards a successful career in private credit. Start building your network and researching private credit jobs today!

Featured Posts

-

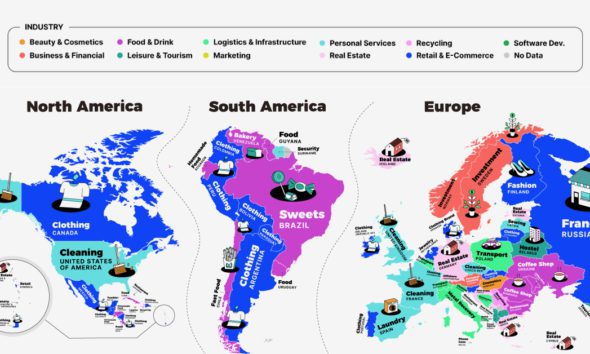

Identifying The Countrys Fastest Growing Business Areas

Apr 22, 2025

Identifying The Countrys Fastest Growing Business Areas

Apr 22, 2025 -

Microsoft Activision Deal Ftcs Appeal And Its Implications

Apr 22, 2025

Microsoft Activision Deal Ftcs Appeal And Its Implications

Apr 22, 2025 -

Hollywood Shut Down The Impact Of The Dual Writers And Actors Strike

Apr 22, 2025

Hollywood Shut Down The Impact Of The Dual Writers And Actors Strike

Apr 22, 2025 -

Analyzing Pope Francis Impact What The Next Conclave Will Decide

Apr 22, 2025

Analyzing Pope Francis Impact What The Next Conclave Will Decide

Apr 22, 2025 -

China Indonesia Security Dialogue A Focus On Enhanced Cooperation

Apr 22, 2025

China Indonesia Security Dialogue A Focus On Enhanced Cooperation

Apr 22, 2025