Netflix: A Tariff Haven Amidst The Big Tech Slump? An Investment Analysis

Table of Contents

Netflix's Resilience in a Challenging Economic Climate

Reduced Dependence on Hardware Sales

Unlike many tech companies heavily reliant on hardware sales, Netflix's primary revenue stream comes from subscriptions. This significantly reduces its exposure to fluctuating hardware sales, supply chain disruptions, and the impact of economic downturns. The global chip shortage, for example, has severely impacted some tech giants, but Netflix remains largely unaffected.

- Minimized Supply Chain Risk: Netflix’s subscription-based model shields it from the volatility experienced by companies reliant on physical product manufacturing and distribution.

- Consistent Revenue Stream: Subscription revenue provides a more predictable and stable income flow compared to hardware sales, which are prone to seasonal fluctuations and economic downturns.

- Strong Subscription Growth: Netflix consistently reports strong growth in its subscriber base, demonstrating the resilience of its core business model. For instance, [Insert recent statistic on Netflix subscriber growth here, citing the source].

Global Reach and Diversification

Netflix's global presence is a key factor in its resilience. Its diversified subscriber base across numerous countries mitigates the risk associated with regional economic slowdowns. If one region experiences a downturn, the impact on overall revenue is lessened by strong performance in other markets.

- Geographic Diversification: Netflix operates in [Number] countries worldwide, ensuring a geographically diverse subscriber base. [Insert data on subscriber distribution across key regions].

- Successful International Expansion: Netflix's successful expansion into new international markets demonstrates its ability to adapt to different cultural contexts and consumer preferences.

- Currency Fluctuation Mitigation: While currency fluctuations can impact revenue, Netflix’s global scale helps mitigate the overall effect. Its diverse revenue streams from multiple countries tend to balance out currency risks.

Analyzing the Impact of Tariffs and Geopolitical Risks

Tariff Implications for Content Acquisition and Production

Trade disputes and tariffs can significantly impact the entertainment industry, affecting Netflix's costs for acquiring international content and filming productions abroad.

- Increased Production Costs: Tariffs on imported goods, such as filming equipment or post-production services, can directly increase Netflix's production costs.

- Mitigation Strategies: Netflix can mitigate these effects by shifting production to countries with favorable trade agreements, negotiating licensing deals more strategically, or increasing reliance on domestically produced content.

- Impact on Licensing Fees: Tariffs on imported shows and movies could lead to higher licensing fees, impacting Netflix's profitability.

Geopolitical Instability and its Impact on Subscriber Base

Geopolitical instability in various regions can impact Netflix's subscriber growth and revenue. Political unrest, censorship, or regulatory changes can affect user acquisition and content availability.

- Regional Market Disruptions: Political instability in certain regions could lead to temporary disruptions in service or difficulties in acquiring new subscribers.

- Content Censorship and Regulation: Government regulations and censorship policies can restrict the availability of certain content, potentially impacting subscriber satisfaction and retention.

- Impact on Investment Decisions: Geopolitical risks need to be considered when assessing the long-term viability of a Netflix investment.

Netflix's Future Growth Potential and Investment Outlook

Continued Subscriber Growth and Expansion into New Markets

Projections for future subscriber growth are positive, but competition and market saturation remain challenges. Netflix's strategies for attracting and retaining subscribers will play a crucial role in its future success.

- Content Strategy: Netflix’s continued investment in original programming, including movies and series, is key to attracting and retaining subscribers.

- New Market Penetration: Untapped markets in developing countries present significant opportunities for future growth.

- Growth Forecasts: Industry analysts predict [Insert growth forecast from reputable sources, citing the source].

Innovation and New Revenue Streams

Netflix is exploring new revenue streams and technological innovations to fuel future growth.

- Gaming and Interactive Content: Investments in gaming and interactive experiences offer diversification beyond traditional video streaming.

- AR/VR Experiences: Future integration of augmented and virtual reality technologies could create immersive viewing experiences and new revenue opportunities.

- Subscription Tiers: Introducing new pricing tiers and subscription models, such as ad-supported plans, could expand the subscriber base and generate additional revenue.

Comparison to Other Tech Stocks and Investment Alternatives

Compared to other Big Tech companies, Netflix presents a unique risk/reward profile. While facing its own set of challenges, its resilience to certain economic downturns and focus on a subscription-based model differentiates it from companies heavily reliant on hardware sales or advertising revenue. A comparison with [mention a few similar investments, e.g., Disney+, Amazon Prime] reveals differences in growth trajectories and market stability. [Provide brief comparative analysis].

Conclusion

This Netflix investment analysis suggests that despite the challenges facing the Big Tech sector, Netflix's unique business model and global reach offer a degree of resilience against economic headwinds. While geopolitical risks and increased competition remain factors to consider, the company's potential for continued subscriber growth and diversification makes a compelling case for its consideration as part of a well-diversified investment portfolio. However, thorough due diligence and a careful assessment of individual risk tolerance are crucial before making any investment decisions regarding Netflix investment. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Reds Score After Shutout Streak Still Lose To Brewers

Apr 23, 2025

Reds Score After Shutout Streak Still Lose To Brewers

Apr 23, 2025 -

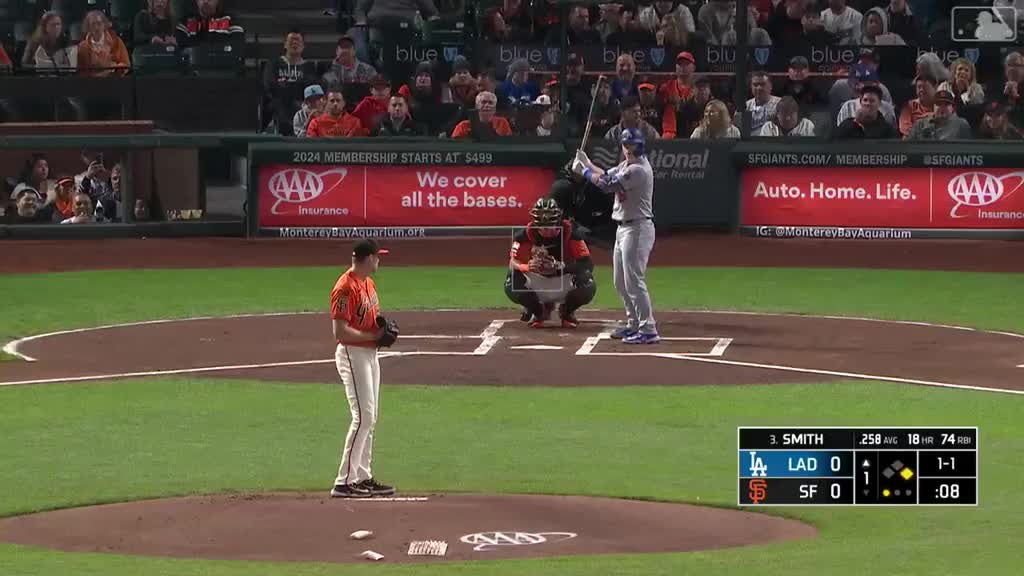

Giants Flores And Lee Power Win Against Brewers

Apr 23, 2025

Giants Flores And Lee Power Win Against Brewers

Apr 23, 2025 -

Key Economic Themes From The English Language Leaders Debate

Apr 23, 2025

Key Economic Themes From The English Language Leaders Debate

Apr 23, 2025 -

Another Win For The Giants Flores And Lees Stellar Performances

Apr 23, 2025

Another Win For The Giants Flores And Lees Stellar Performances

Apr 23, 2025 -

Royals Bullpens Strong Performance Against Brewers Cole Ragans Key Role

Apr 23, 2025

Royals Bullpens Strong Performance Against Brewers Cole Ragans Key Role

Apr 23, 2025