Netflix's Resilience Amidst Big Tech Downturn: A Wall Street Tariff Haven?

Table of Contents

Netflix's Unique Business Model and its Protective Qualities

Netflix's success in weathering the current tech downturn can be largely attributed to its unique business model. Unlike many tech companies heavily reliant on volatile advertising revenue, Netflix enjoys the stability of a predictable subscription-based revenue stream.

H3: Subscription Revenue Stability:

- High subscriber retention rates: Netflix's consistently high subscriber retention demonstrates the strength of its content offering and the stickiness of its subscription model. This predictable income flow cushions the company against economic fluctuations that often impact ad-based revenue.

- Predictable cash flow: Recurring subscription fees provide a stable and reliable cash flow, allowing Netflix to invest in content creation and expansion, even during periods of market uncertainty. This contrasts sharply with the unpredictable nature of advertising revenue, which is highly sensitive to economic downturns and advertising spending cycles.

- Less susceptible to economic downturns: The subscription model proves more resilient during economic downturns. While consumers might cut back on discretionary spending, essential entertainment like streaming services often remain a priority.

H3: Content as a Moat:

Netflix's vast library of original and licensed content serves as a significant barrier to entry for competitors. This "content moat" protects its subscriber base and ensures its continued relevance in a competitive market.

- Original programming investment: Massive investment in original programming, including critically acclaimed shows and movies, creates exclusive content unavailable elsewhere, driving subscriber acquisition and retention.

- Licensing agreements: Strategic licensing agreements secure a diverse range of content, providing viewers with a broad selection that caters to diverse tastes and preferences.

- Global content diversity: Netflix's commitment to offering diverse content localized for various regions strengthens its appeal to a global audience, reducing its dependence on any single market.

- Strong intellectual property: Ownership or exclusive licensing of high-quality content creates a valuable asset that safeguards the company's long-term competitive advantage.

H3: Global Reach and Diversification:

Netflix's geographically diversified subscriber base minimizes its reliance on any single market, providing a significant buffer against regional economic instability or regulatory changes.

- International expansion strategy: Netflix's successful international expansion strategy has created a broad and geographically diverse user base, significantly reducing its vulnerability to regional economic downturns or geopolitical events.

- Localized content: The company's strategy of offering localized content tailored to specific regions further strengthens its market penetration and reduces reliance on any single language or cultural market.

- Reduced vulnerability to regional economic fluctuations: By diversifying its user base across numerous regions, Netflix mitigates the impact of any single region’s economic challenges.

Navigating the Tariff Landscape and its Impact on Netflix

While Netflix operates globally, it's not immune to the complexities of international tariffs. However, its structure offers advantages in navigating these challenges.

H3: Tariff Exposure and Mitigation Strategies:

- Potential impact of data transfer tariffs: International data transfer tariffs could potentially increase Netflix's operational costs, impacting profitability.

- Strategies for minimizing international transaction costs: Netflix likely employs strategies such as optimizing data center placement and leveraging content delivery networks (CDNs) to minimize costs associated with data transfer.

- Impact on content acquisition and distribution: Tariffs could affect the cost of acquiring and distributing content internationally, necessitating adjustments in sourcing and distribution strategies.

H3: Competitive Advantages in a Tariff-Challenged Environment:

Netflix's global infrastructure and content strategy offer significant advantages over competitors more exposed to specific regional tariffs.

- Reduced reliance on specific geographic markets: A diversified global user base allows Netflix to absorb the impact of tariffs affecting a single region more easily than companies heavily reliant on a particular market.

- Flexible content sourcing: The ability to source content from various regions globally enables Netflix to adapt to changes in international trade policies and regulations.

- Agility in adapting to changing regulatory environments: A flexible organizational structure and global reach allow Netflix to adapt to evolving regulatory landscapes more efficiently than less agile competitors.

Investor Sentiment and Wall Street's Perception of Netflix

Wall Street's perception of Netflix, while fluctuating, generally reflects a degree of confidence in its resilience.

H3: Stock Performance Relative to Other Tech Stocks:

- Stock price analysis: A comparison of Netflix's stock performance to other major tech companies during the recent downturn reveals its relative strength and stability.

- Market capitalization changes: Analyzing changes in Netflix's market capitalization offers further insight into investor confidence and market valuation relative to its peers.

- Investor confidence indicators: Various investor confidence indicators, including analyst ratings and trading volume, can provide additional clues about investor sentiment.

H3: Analyst Predictions and Future Outlook:

- Consensus forecasts: Examining consensus forecasts from financial analysts offers an overview of the market's expectations for Netflix's future growth.

- Bullish vs. bearish predictions: Comparing bullish and bearish predictions highlights the range of potential outcomes and the factors driving these differing perspectives.

- Factors influencing future growth: Understanding the key factors influencing Netflix's future growth, such as subscriber acquisition, content investment, and competitive pressures, is crucial for accurate predictions.

Conclusion

Netflix's resilience amidst the broader tech downturn is striking. Its unique subscription-based model, substantial content library, and geographically diversified user base contribute to its stability. While complete immunity to external factors like tariffs is unlikely, its global reach and flexible strategy provide advantages in navigating these challenges. Whether it's a full-fledged "Wall Street Tariff Haven" is debatable, but its resilience is undeniable. Further research into its financial statements and future projections is crucial for informed investment decisions. Continue your exploration of Netflix's resilience by [link to relevant resource/further reading].

Featured Posts

-

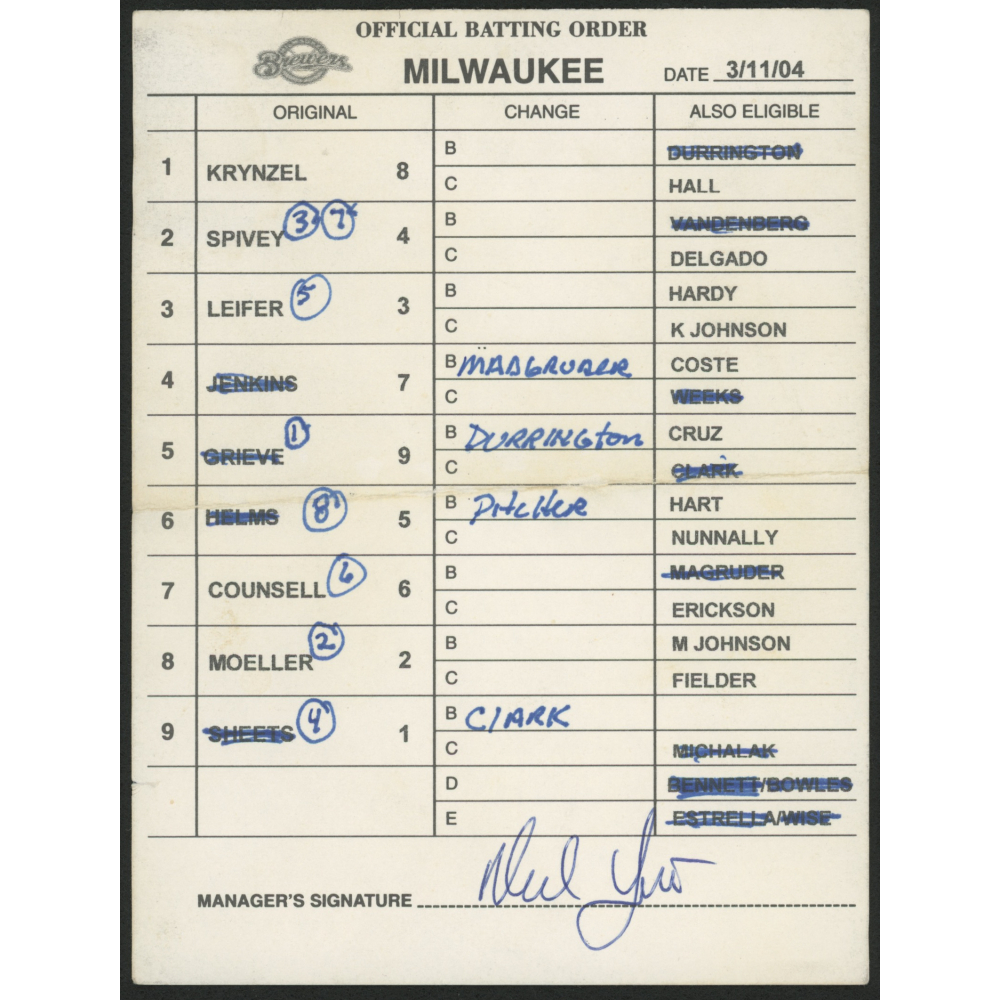

Brewers Batting Order Shakeup Addressing Offensive Inconsistency

Apr 23, 2025

Brewers Batting Order Shakeup Addressing Offensive Inconsistency

Apr 23, 2025 -

New York Yankees Historic Night 9 Home Runs Judges Hat Trick

Apr 23, 2025

New York Yankees Historic Night 9 Home Runs Judges Hat Trick

Apr 23, 2025 -

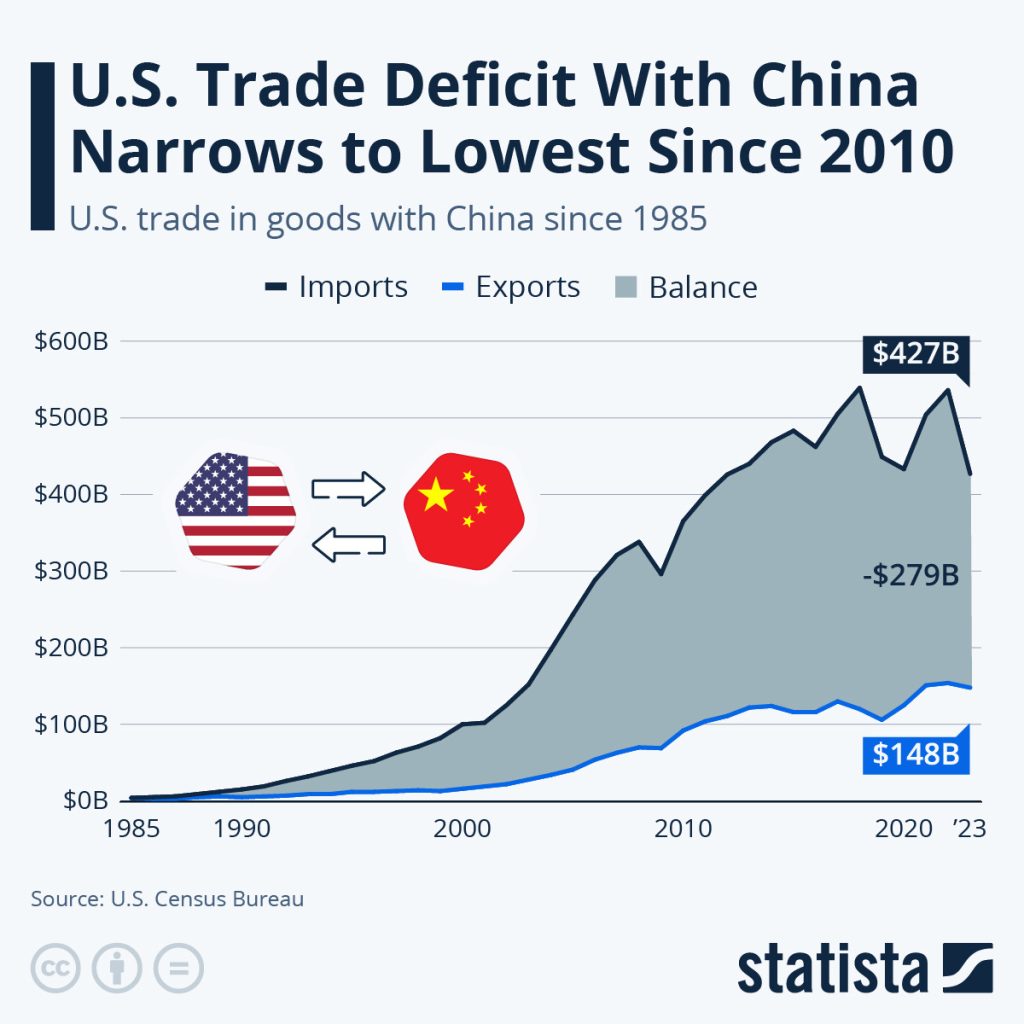

Increased Canadian Oil Exports To China Implications Of Us China Trade Conflict

Apr 23, 2025

Increased Canadian Oil Exports To China Implications Of Us China Trade Conflict

Apr 23, 2025 -

William Contreras Performance And Future With The Brewers

Apr 23, 2025

William Contreras Performance And Future With The Brewers

Apr 23, 2025 -

Millions Stolen Through Office365 Executive Account Hacks

Apr 23, 2025

Millions Stolen Through Office365 Executive Account Hacks

Apr 23, 2025