New X Financials: Debt Sale's Impact On Musk's Company Strategy

Table of Contents

The Debt Sale: Details and Implications

The specifics of X's recent debt sale remain somewhat opaque, but reports suggest a significant amount was secured to bolster the company's financial position. While the exact figures, interest rates, and terms haven't been publicly disclosed, the implications are clear. This new debt burden significantly alters X's financial landscape.

- Increased debt burden and interest payments: The added debt necessitates substantial interest payments, reducing the available capital for other crucial activities. This directly impacts X's profitability and cash flow.

- Impact on X's credit rating: The increased debt load will likely negatively impact X's credit rating, making it more expensive to secure future funding. This could hinder expansion plans and limit access to favorable loan terms.

- Potential limitations on future investments and expansion: With a larger portion of revenue allocated to debt servicing, X may have to curtail investments in new features, technologies, and potential acquisitions. This could stifle innovation and growth.

The reasons behind this debt sale are likely multifaceted. It could be attributed to the substantial costs associated with the acquisition of X itself, ongoing operational expenses, or perhaps investments in new features and technologies like Musk's ambitious plans for integrating payments and other functionalities into the platform.

Impact on Musk's Long-Term Vision for X

Musk's long-term vision for X involves transforming it into an "everything app," encompassing various services beyond social media. However, the debt sale casts a shadow over these ambitious plans.

- Potential delays or scaling back of ambitious projects: The financial constraints imposed by the debt could necessitate delays or even the cancellation of some of Musk's more expansive projects. Prioritizing debt repayment might mean less investment in research and development.

- Focus shift towards profitability and debt reduction: X might shift its focus from rapid expansion to achieving profitability and aggressively reducing its debt load. This could mean a temporary slowdown in the rollout of new features and services.

- Impact on planned feature implementations (e.g., payments integration): The ambitious payments integration project, a key component of Musk's vision, might face delays or budget cuts due to the financial pressures caused by the debt.

The crucial trade-offs involve balancing short-term financial stability with long-term growth. Musk must carefully navigate the delicate balance between debt repayment and investing in future innovation to maintain user engagement and attract new users.

The Role of Advertising Revenue and Subscriptions

X relies heavily on advertising revenue and its subscription model, X Premium, to generate income. The debt sale necessitates a renewed focus on revenue generation.

- Increased advertising sales efforts: Expect to see intensified efforts to boost advertising revenue. This could include more aggressive sales strategies and perhaps changes to advertising policies.

- Potential changes to the subscription pricing and features: X Premium pricing might see adjustments, and new features could be introduced or existing ones enhanced to incentivize more subscriptions.

- Exploration of alternative revenue streams: To lessen dependence on advertising and subscriptions, exploration of new revenue streams, such as partnerships or integration with other services, is highly likely.

The challenges include navigating the competitive social media advertising market, attracting and retaining paying subscribers, and maintaining a positive user experience without alienating users through excessive monetization efforts.

Investor Sentiment and Market Reactions

The market reaction to X's debt sale has been mixed. While some analysts express concern about the increased debt burden, others remain optimistic about X's long-term prospects. Stock price fluctuations (if applicable) reflect this uncertainty.

- Potential for positive investor response to increased profitability: If X can successfully manage its debt and demonstrate improved profitability, investor confidence could rebound, leading to a positive market reaction.

- Negative sentiment leading to decreased investment: However, if the debt proves too burdensome, and profitability remains elusive, investor sentiment could turn negative, potentially leading to decreased investment and lower valuation.

- Impact on future fundraising efforts: The success of future fundraising efforts will hinge on X's ability to demonstrate financial stability and a clear path towards profitability.

The long-term effects on X's valuation and investor relations remain uncertain and heavily dependent on the company's ability to execute its revised strategic plan.

Conclusion

The debt sale's impact on X is multifaceted. It creates short-term financial pressures while potentially hindering Musk's long-term ambitions. The trade-off between immediate financial stability and continued innovation is a critical challenge. The success of X's future depends heavily on its ability to manage its debt, increase revenue, and maintain user engagement.

Understanding the financial implications of this debt sale is paramount for comprehending the future of X. This complex situation necessitates continuous monitoring and analysis.

Call to Action: Stay informed about the evolving financial landscape of X and the impact of this debt sale on Musk's overall strategy. Continue to follow our coverage for further analysis on New X Financials and their influence on the platform's future.

Featured Posts

-

What A Young Mets Starter Needs To Do To Secure A Rotation Spot

Apr 28, 2025

What A Young Mets Starter Needs To Do To Secure A Rotation Spot

Apr 28, 2025 -

2000 Mlb Season Posadas Homer Steals Victory From The Royals

Apr 28, 2025

2000 Mlb Season Posadas Homer Steals Victory From The Royals

Apr 28, 2025 -

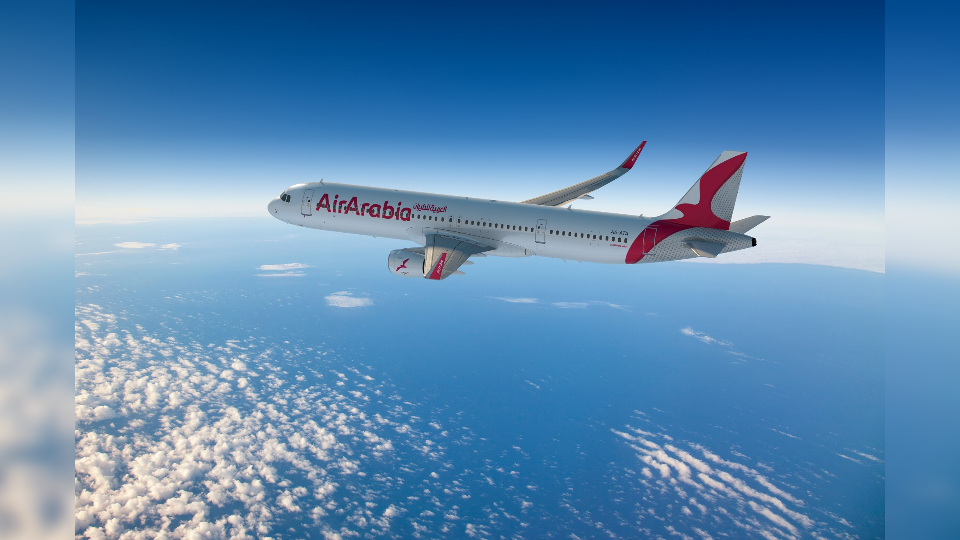

Tyran Alerbyt Abwzby Rhlat Mbashrt Jdydt Ila Kazakhstan

Apr 28, 2025

Tyran Alerbyt Abwzby Rhlat Mbashrt Jdydt Ila Kazakhstan

Apr 28, 2025 -

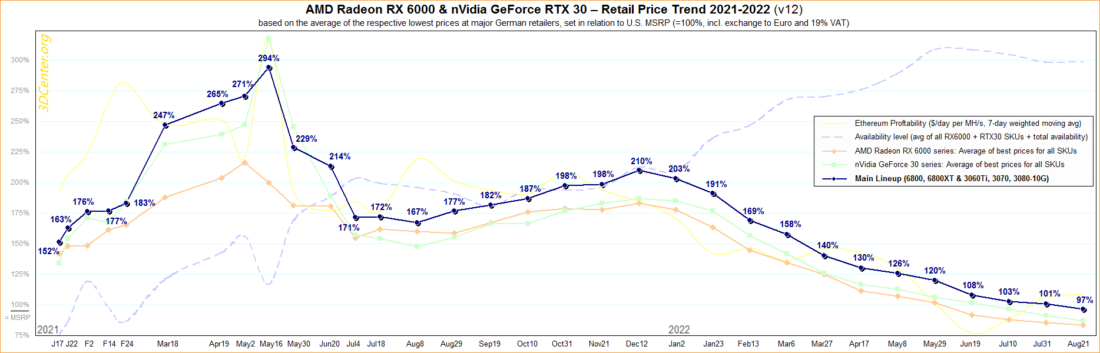

The Return Of High Gpu Prices Whats Causing The Surge

Apr 28, 2025

The Return Of High Gpu Prices Whats Causing The Surge

Apr 28, 2025 -

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025 Free Live Stream

Apr 28, 2025

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025 Free Live Stream

Apr 28, 2025