PFC Dividend 2025: March 12th Announcement Of Fourth Cash Reward For FY25

Table of Contents

Key Details of the PFC Dividend 2025 Announcement (March 12th)

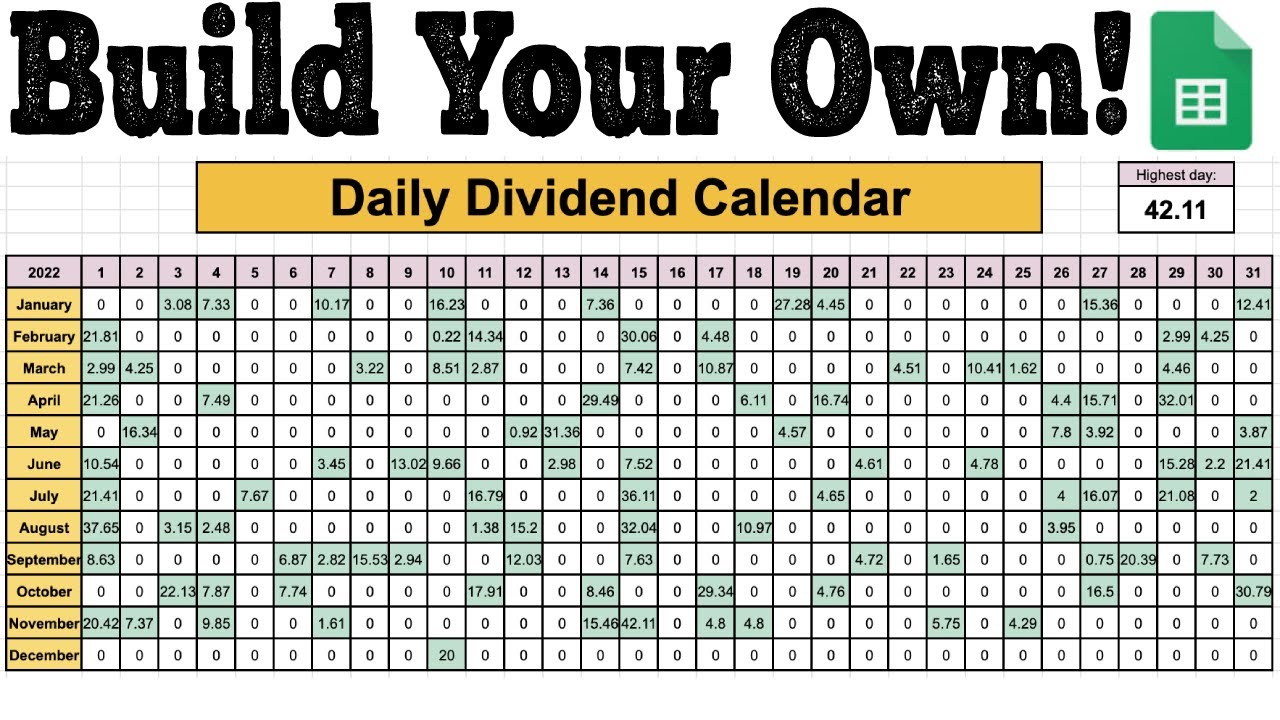

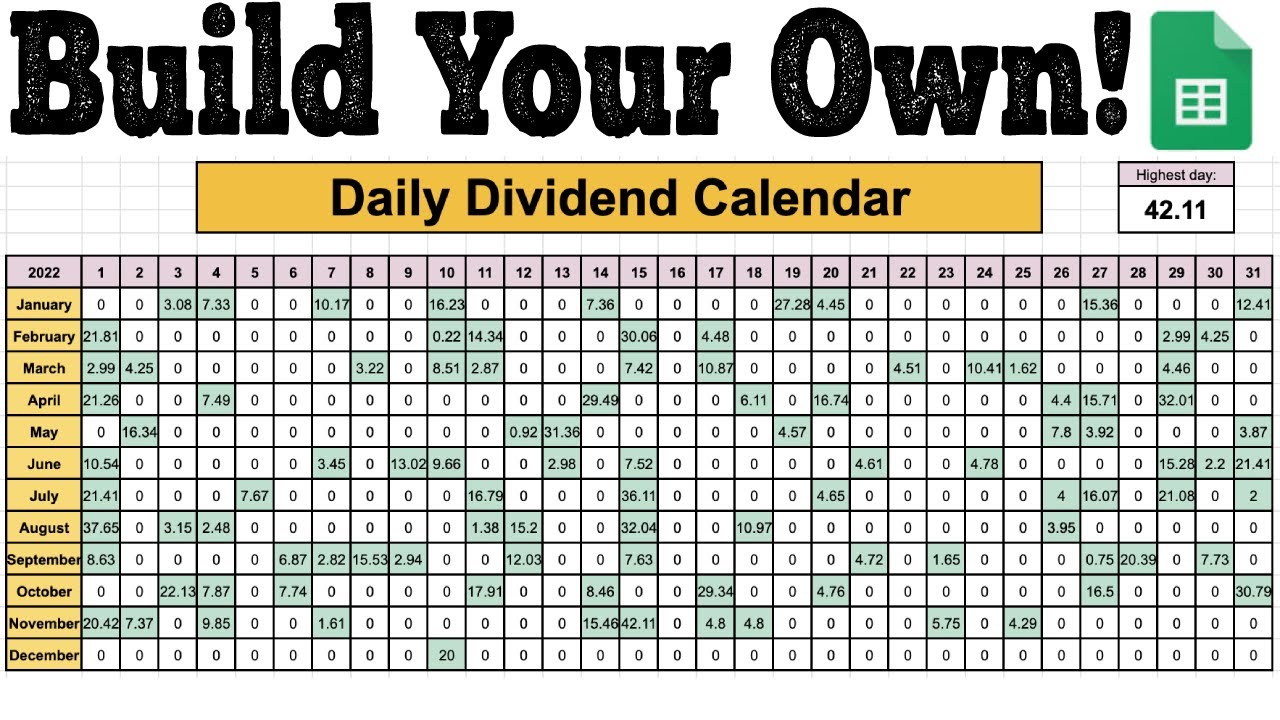

The March 12th announcement revealed the following key details regarding the PFC dividend for FY25:

- Dividend Amount: The announced dividend per share is $X.XX (replace X.XX with the actual amount). This represents a [increase/decrease/continuation] compared to previous years.

- Ex-Dividend Date: [Insert the actual ex-dividend date]. This is the date on which a shareholder must own PFC stock to be eligible for the dividend.

- Payment Date: The dividend payment is scheduled for [Insert the actual payment date].

- Relevance to Financial Performance: This dividend reflects PFC's strong financial performance in FY25, demonstrating the company's commitment to returning value to its shareholders. The robust earnings and profitability of the company underpin this generous payout. The dividend payout ratio stands at [Insert Percentage]%, indicating [explain the significance of this ratio - healthy, conservative etc.]. The dividend yield, calculated as [Formula & Calculation], is currently [Insert Percentage]%.

- Dividend Comparison:

| Fiscal Year | Dividend per Share | Dividend Yield | Dividend Payout Ratio |

|---|---|---|---|

| FY24 | $X.XX | X% | X% |

| FY23 | $X.XX | X% | X% |

| FY25 | $X.XX | X% | X% |

Impact of the PFC Dividend on Investors

The announced PFC dividend has several significant implications for investors:

- Investor Returns: The dividend directly contributes to investor returns, providing a cash inflow and enhancing overall portfolio performance. The higher the dividend, the greater the return for shareholders.

- Tax Implications: Remember that dividend income is generally taxable. Consult with a tax advisor to understand the specific tax implications for your individual circumstances. Tax rates will vary depending on your location and overall income.

- Effect on Stock Price: The market's reaction to the PFC dividend announcement is typically mixed. While a higher-than-expected dividend might initially boost the stock price, the subsequent impact depends on broader market conditions and investor sentiment. Some investors may sell their shares after receiving the dividend, potentially causing a slight decrease in the stock price.

- Reinvestment Options: Many brokerage firms offer dividend reinvestment plans (DRIPs). These plans allow you to automatically reinvest your dividends to purchase more PFC shares, potentially increasing your holdings over time.

Understanding PFC's Dividend Policy and Future Outlook

PFC's dividend policy demonstrates a commitment to returning value to shareholders. Historically, PFC has [describe the pattern - maintained a consistent dividend, increased it annually, etc.]. Factors influencing the company's dividend decisions include:

- Profitability: The company's profitability, as measured by earnings per share (EPS) and overall net income, is a key driver of dividend payouts. Higher profits typically translate to larger dividends.

- Financial Stability: The company's overall financial health and stability are essential. PFC's strong balance sheet and cash flow position support its ability to maintain consistent dividend payments.

- Future Earnings Projections: Analysts' forecasts for future earnings provide insights into the sustainability of PFC's dividend policy. Strong future earnings projections increase the likelihood of continued or even increased dividends.

Predicting future PFC dividend announcements requires analyzing several factors, including future financial performance, economic conditions, and the company's strategic goals. However, based on the current trend and financial outlook, we can reasonably expect [provide cautious and well-informed projection].

Conclusion: Actionable Insights on the PFC Dividend 2025 Announcement

The March 12th PFC dividend announcement highlights a significant cash reward for FY25, reflecting the company's strong financial performance. Understanding the key details of the dividend, its implications for investors, and the company's future outlook is crucial for making informed investment decisions. The dividend yield and payout ratio are important metrics to consider when evaluating the attractiveness of this investment opportunity. Remember to consult with a financial advisor before making any investment decisions.

Stay tuned for further updates on the PFC dividend and other important financial news by subscribing to our newsletter! Learn more about investing in PFC and maximizing your returns by visiting [link to relevant resource].

Featured Posts

-

Fbi Investigating Millions In Losses From Executive Office365 Hacks

Apr 27, 2025

Fbi Investigating Millions In Losses From Executive Office365 Hacks

Apr 27, 2025 -

Ramiro Helmeyer Dedication To Fc Barcelonas Glory

Apr 27, 2025

Ramiro Helmeyer Dedication To Fc Barcelonas Glory

Apr 27, 2025 -

Dax Bundestag Elections And Economic Indicators A Complex Relationship

Apr 27, 2025

Dax Bundestag Elections And Economic Indicators A Complex Relationship

Apr 27, 2025 -

Concerns Raised Discredited Misinformation Agent Hired For Cdc Vaccine Study

Apr 27, 2025

Concerns Raised Discredited Misinformation Agent Hired For Cdc Vaccine Study

Apr 27, 2025 -

Rybakina Edges Jabeur In Three Set Mubadala Abu Dhabi Open Match

Apr 27, 2025

Rybakina Edges Jabeur In Three Set Mubadala Abu Dhabi Open Match

Apr 27, 2025