Phaseout Of Russian Gas: EU's Spot Market Strategy

Table of Contents

The Urgency of Diversification: Reducing Reliance on Russian Pipelines

The geopolitical landscape has dramatically shifted, highlighting the vulnerability of relying heavily on a single energy supplier. The EU's push to diversify its energy sources is not just a matter of economic policy; it's a crucial step toward enhancing energy security and geopolitical stability.

Geopolitical Instability and Energy Security

The war in Ukraine underscored the precariousness of the EU's dependence on Russian gas. Russia's weaponization of energy exports demonstrated the significant geopolitical risks associated with such reliance.

- Increased vulnerability: Over-dependence on a single supplier leaves the EU vulnerable to political pressure and supply disruptions.

- Secure energy supply: Diversification is essential for building a more resilient and secure energy supply chain.

- Political leverage: Russia’s control over gas exports granted significant political leverage, influencing EU policies and actions.

The impact of the war in Ukraine on the EU’s energy security has been profound, triggering an urgent need for diversification and a reassessment of long-term energy strategies. The conflict highlighted the fragility of traditional energy partnerships and the urgent need to secure alternative supply routes.

Exploring Alternative Supply Routes and Sources

The EU is actively pursuing alternative supply routes and sources to reduce its dependence on Russian pipelines. This involves significant investment in several key areas:

- Expansion of LNG terminals: The construction and expansion of liquefied natural gas (LNG) import terminals are crucial for receiving gas from various global suppliers.

- Development of new pipelines: Diversification involves establishing new pipeline connections with countries like Norway and Azerbaijan.

- Increased investment in renewable energy sources: A long-term solution involves accelerating the transition to renewable energy sources to reduce reliance on fossil fuels entirely.

The feasibility and challenges of each alternative vary. While LNG offers flexibility, it's more expensive and requires significant infrastructure investment. New pipeline projects face geopolitical challenges and lengthy development times. The transition to renewables requires massive investment and technological advancements. Careful analysis of both advantages and disadvantages is paramount for informed decision-making.

The Spot Market's Role in Energy Transition

The spot market, characterized by short-term contracts and price flexibility, plays a crucial role in the EU's energy transition. Its dynamic nature allows for agile responses to changing supply and demand conditions.

Understanding the Spot Market Mechanism

The spot market operates on a short-term basis, with contracts typically ranging from a few days to a few months. Prices are determined by the interplay of supply and demand, making it a highly dynamic market.

- Short-term contracts: Flexibility in contract durations allows for adaptation to shifting market conditions.

- Price fluctuations: Prices are volatile, reflecting real-time supply and demand dynamics.

- Role of trading hubs: Trading hubs like the Title Transfer Facility (TTF) in the Netherlands play a central role in price discovery and market transparency.

Unlike long-term contracts, which lock in prices for extended periods, the spot market offers price responsiveness, allowing buyers to adapt to fluctuating prices. However, this flexibility comes with increased price volatility.

Advantages of Spot Market Participation for EU Members

Increased participation in the spot market offers several advantages for EU members:

- Increased price competitiveness: The spot market allows for procurement at competitive prices, reflecting real-time market conditions.

- Ability to adjust procurement: Buyers can adjust their procurement based on real-time demand, optimizing their energy needs.

- Reduced dependence on unreliable suppliers: The spot market enables a more diversified portfolio of suppliers, mitigating reliance on any single source.

However, the inherent price volatility presents a risk. Potential supply shortages and price spikes are challenges that require careful risk management strategies. Hedging mechanisms and strategic reserves are crucial for mitigating these risks.

Challenges and Mitigation Strategies

The transition to a spot market-driven energy strategy involves several challenges that require proactive mitigation strategies.

Price Volatility and Market Manipulation

The spot market's inherent volatility poses significant risks, potentially leading to price spikes that can impact consumers and businesses.

- Potential for price spikes: Sudden changes in supply or demand can trigger sharp price increases.

- Need for robust market regulation: Effective regulation is crucial for preventing market manipulation and ensuring fair pricing.

- Risk management strategies: Hedging, diversification, and strategic reserves are essential risk management tools.

Strategies for mitigating price volatility include hedging instruments, diversifying supply sources to avoid dependence on volatile regions, and building up strategic gas reserves to buffer against supply disruptions. Strong market oversight and regulatory frameworks are crucial to prevent manipulation and ensure market integrity.

Infrastructure Limitations and Capacity Building

A successful transition to a spot market-driven energy system necessitates significant infrastructure upgrades:

- Expansion of LNG import terminals: Increased import capacity is crucial for receiving LNG from diverse suppliers.

- Pipeline upgrades: Modernizing and expanding existing pipeline networks is essential for efficient gas transport.

- Storage capacity improvements: Increased storage capacity is necessary to buffer against supply disruptions and price volatility.

The investment required for these infrastructure upgrades is substantial. Securing funding through both public and private investment will be essential for facilitating the necessary capacity building. This involves coordinated efforts between EU member states and private investors to ensure the timely development of crucial infrastructure.

Conclusion

The EU's phaseout of Russian gas necessitates a strategic shift towards energy independence. While the spot market presents both opportunities and challenges, its flexibility and responsiveness are crucial for navigating the transition. By diversifying supply sources, investing in infrastructure, and implementing robust market regulations, the EU can effectively leverage the spot market to achieve its energy security goals. Continue researching and understanding the intricacies of the EU's spot market strategy to ensure a successful and sustainable energy future. Learn more about the ongoing developments in the Russian gas phaseout and explore the latest updates on the EU spot market for energy procurement.

Featured Posts

-

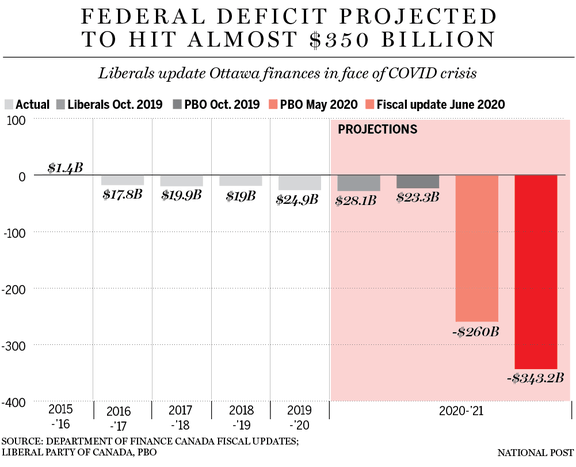

Is Canadas Fiscal Future At Risk Examining The Liberals Spending

Apr 24, 2025

Is Canadas Fiscal Future At Risk Examining The Liberals Spending

Apr 24, 2025 -

Brett Goldstein Compares Ted Lasso Revival To A Miracle A Thought Dead Cat

Apr 24, 2025

Brett Goldstein Compares Ted Lasso Revival To A Miracle A Thought Dead Cat

Apr 24, 2025 -

Double Trouble In Hollywood Wga And Sag Aftra Strike Impacts Film And Tv

Apr 24, 2025

Double Trouble In Hollywood Wga And Sag Aftra Strike Impacts Film And Tv

Apr 24, 2025 -

Nancy Mace Faces Angry Constituent Details Of The Confrontation

Apr 24, 2025

Nancy Mace Faces Angry Constituent Details Of The Confrontation

Apr 24, 2025 -

Ryujinx Emulator Development Halted Nintendo Contact Confirmed

Apr 24, 2025

Ryujinx Emulator Development Halted Nintendo Contact Confirmed

Apr 24, 2025