Positive Market Sentiment: Fueling The Nifty's Bullish Charge In India

Table of Contents

Economic Indicators Pointing Towards a Bullish Outlook

India's impressive economic performance is a cornerstone of the positive market sentiment. Strong GDP growth, falling inflation, and robust corporate earnings all contribute to investor confidence and fuel the bullish charge of the Nifty 50.

Robust GDP Growth

India's GDP growth consistently outperforms many global economies. This strong growth fuels investor confidence, attracting both domestic and foreign investment.

- Growth Rates: India has consistently recorded impressive GDP growth rates in recent quarters, exceeding expectations in several key sectors. For example, [Insert specific GDP growth figures with source citation].

- Sectors Driving Growth: The technology and manufacturing sectors are key drivers of this growth, supported by government initiatives like "Make in India." [Insert data and statistics on sector-wise growth].

- Government Initiatives: Government programs focused on infrastructure development and digitalization further stimulate economic expansion, boosting investor confidence in the long-term prospects of the Indian economy.

Falling Inflation Rates

Decreasing inflation is another significant factor bolstering positive market sentiment. Lower inflation signifies greater price stability, encouraging investment and consumer spending.

- Recent Inflation Figures: Recent inflation figures from the Reserve Bank of India (RBI) show a consistent downward trend, [Insert recent inflation data with source link].

- RBI's Monetary Policy: The RBI's effective monetary policy plays a crucial role in managing inflation and maintaining price stability, contributing to a more predictable and stable investment environment.

- Impact on Market Sentiment: Falling inflation reduces uncertainty, making investors more comfortable allocating capital to the Indian stock market, further strengthening the bullish trend in the Nifty 50.

Strong Corporate Earnings

Positive corporate earnings reports from various sectors indicate a healthy and expanding Indian economy, directly impacting the Nifty 50's performance.

- Sectors with Strong Earnings: [Mention specific sectors, e.g., IT, pharmaceuticals, and FMCG, with strong earnings reports and data].

- Companies Exceeding Expectations: Many prominent companies have exceeded earnings expectations, showcasing the strength and resilience of the Indian corporate sector. [Provide examples with data points].

- Impact on Market Confidence: These strong earnings translate to increased investor confidence and contribute significantly to the current bullish market sentiment driving the Nifty 50's upward trajectory. [Include a chart showcasing strong earnings trends].

Increased Foreign Institutional Investor (FII) Inflows

Significant inflows of foreign institutional investment (FII) are another key driver of the positive market sentiment and the Nifty 50's bullish run.

Reasons for FII Optimism

Several factors attract foreign investors to the Indian stock market. The combination of improving macroeconomic conditions and a positive outlook for long-term growth makes India an attractive investment destination.

- Improving Macroeconomic Conditions: Strong GDP growth, falling inflation, and stable political environment all contribute to the improved macroeconomic conditions.

- Government Reforms: Government initiatives aimed at improving the ease of doing business and attracting foreign investment play a significant role in boosting FII inflows.

- Long-Term Growth Potential: India's young and growing population, coupled with its expanding middle class, presents a massive long-term growth opportunity for investors. [Include data on FII inflows and their impact on Nifty 50].

Impact of Global Market Trends

While domestic factors are crucial, global market trends also influence FII investment in India.

- Impact of Global Events: Global economic events and market trends can impact investor sentiment towards emerging markets like India. However, India’s strong fundamentals often act as a buffer against global headwinds.

- Correlation between Global Indices and Nifty 50: While there is some correlation, the Nifty 50 has demonstrated resilience and decoupling from some global trends, showcasing the strength of the domestic economy.

Positive Government Policies and Reforms

Supportive government policies and reforms significantly contribute to positive market sentiment and investor confidence.

Impact of Government Initiatives

Government initiatives aimed at infrastructure development, ease of doing business, and tax reforms create a favorable environment for investment and growth.

- Infrastructure Development: Major investments in infrastructure projects boost economic activity and create jobs, further strengthening the economy.

- Tax Reforms: Simplification and rationalization of tax policies reduce the compliance burden on businesses, fostering economic growth.

- Ease of Doing Business Initiatives: Government efforts to streamline regulations and reduce bureaucratic hurdles make India a more attractive destination for investment.

Boosting Investor Confidence

Measures aimed at promoting transparency and good governance enhance investor confidence in the Indian market.

- Promoting Transparency: Efforts to increase transparency and reduce corruption are crucial for attracting foreign investment and boosting market sentiment.

- Regulatory Reforms: Improvements in regulatory frameworks create a more predictable and stable investment climate, encouraging long-term investment.

- Combating Corruption: Active measures to combat corruption and ensure a level playing field are vital for maintaining investor confidence.

Technical Analysis Supporting the Bullish Trend

Technical analysis of the Nifty 50 index also supports the bullish trend, providing further evidence of the positive market sentiment.

Chart Patterns and Indicators

Several technical indicators suggest continued upward momentum in the Nifty 50.

- Moving Averages: [Explain the significance of moving averages and their current state for Nifty 50, with supporting chart].

- RSI (Relative Strength Index): [Explain the RSI and its implications for the market, with a chart].

- MACD (Moving Average Convergence Divergence): [Explain the MACD and its current signal, with a supporting chart].

Support and Resistance Levels

Analyzing support and resistance levels helps predict future price movements.

- Support Levels: [Explain support levels and their significance with a chart highlighting key support levels].

- Resistance Levels: [Explain resistance levels and their significance with a chart highlighting key resistance levels].

Conclusion

The remarkable bullish run of the Nifty 50 is not accidental. Strong economic indicators, substantial FII inflows, proactive government policies, and supportive technical analysis all point to a prevalent positive market sentiment. This positive market sentiment, driven by India's robust economic growth, favorable investment climate, and supportive government initiatives, presents exciting opportunities. Capitalize on this positive market sentiment by staying informed about the Indian stock market and considering the potential investment opportunities it offers. Understand the factors driving the Nifty 50's bullish charge and learn more about investing in the Indian equity market during this period of positive market sentiment.

Featured Posts

-

Cantor Fitzgerald In Talks For 3 Billion Crypto Spac With Tether And Soft Bank

Apr 24, 2025

Cantor Fitzgerald In Talks For 3 Billion Crypto Spac With Tether And Soft Bank

Apr 24, 2025 -

The Bold And The Beautiful Thursday April 3rd Liam Bill And Hopes Story

Apr 24, 2025

The Bold And The Beautiful Thursday April 3rd Liam Bill And Hopes Story

Apr 24, 2025 -

T Mobile To Pay 16 Million For Multiple Data Breaches

Apr 24, 2025

T Mobile To Pay 16 Million For Multiple Data Breaches

Apr 24, 2025 -

California Gas Prices Governor Newsom Seeks Industry Collaboration To Lower Costs

Apr 24, 2025

California Gas Prices Governor Newsom Seeks Industry Collaboration To Lower Costs

Apr 24, 2025 -

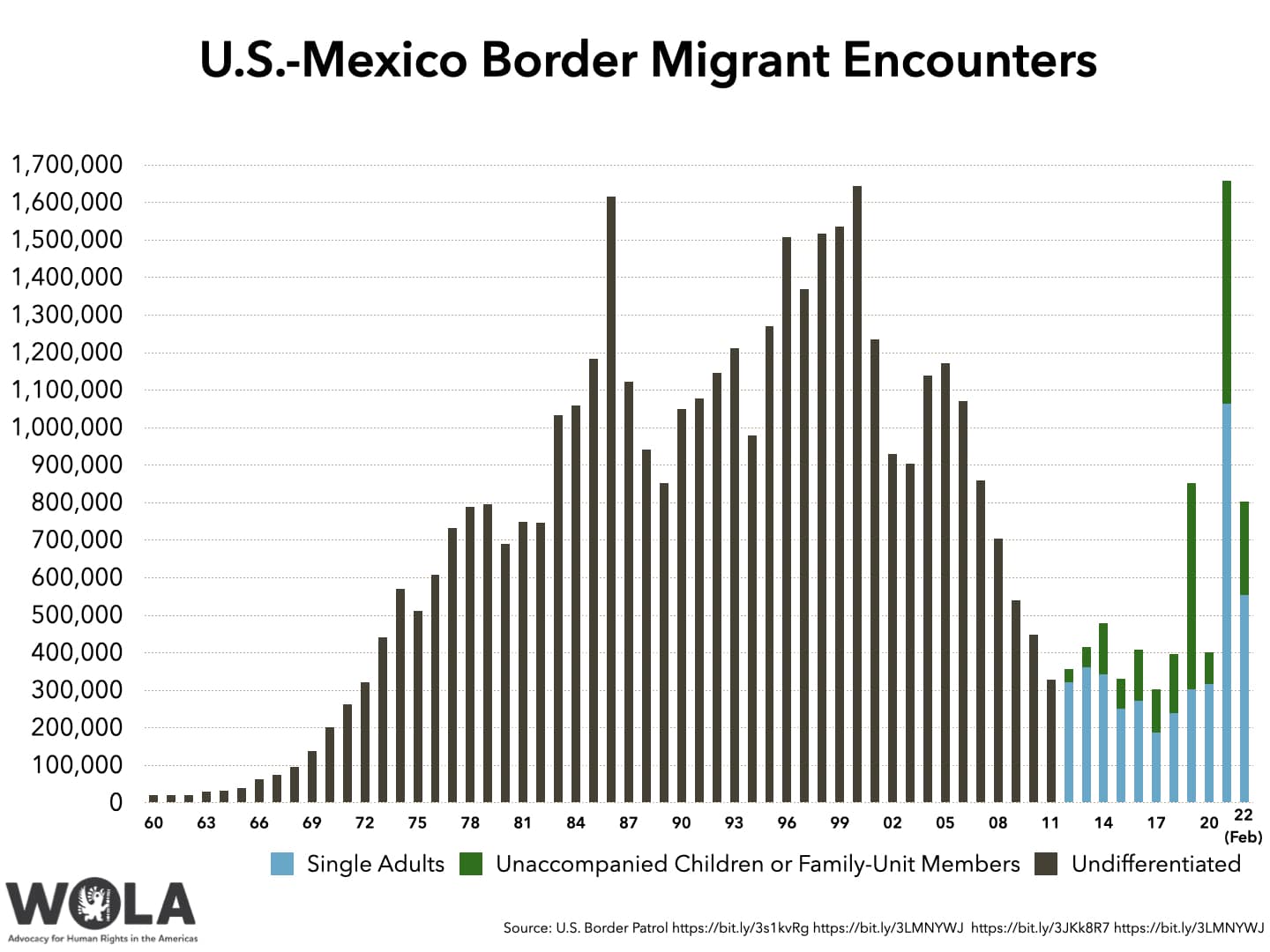

Fewer Border Crossings White House Reports Decline In Canada U S Border Apprehensions

Apr 24, 2025

Fewer Border Crossings White House Reports Decline In Canada U S Border Apprehensions

Apr 24, 2025