Power Finance Corporation (PFC) Dividend 2025: 4th Cash Reward Announcement On March 12th

Table of Contents

Key Details of the PFC Dividend Announcement (March 12th, 2025)

Dividend Amount and Record Date

The specific dividend amount per share for the Power Finance Corporation (PFC) Dividend 2025 will be announced on March 12th, 2025. Once the official announcement is made, we will update this article with the precise figure. However, based on previous announcements and PFC's financial performance, we anticipate a substantial payout. The record date, which determines which shareholders are eligible for the dividend, will also be specified in the official announcement.

- Ex-Dividend Date: The date after which purchasing PFC shares will not entitle the buyer to the declared dividend. This date will be announced alongside the record date.

- Payment Date: The date on which the dividend will be credited to eligible shareholders' accounts. This date will typically fall several weeks after the record date.

- Official PFC Announcement: [Insert Link to Official PFC Press Release or Investor Relations Page Here, once available].

Impact on PFC Share Price

The announcement of the Power Finance Corporation (PFC) Dividend 2025 is likely to have a significant impact on the PFC share price. Several factors will influence the market's reaction, including the dividend amount itself, the overall market sentiment, and investor expectations.

- Short-Term Impact: Typically, a dividend announcement leads to a slight dip in share price immediately after the ex-dividend date, as the share price reflects the value of the dividend that has been separated from it. However, if the dividend is higher than expected, the positive news might outweigh this effect.

- Long-Term Impact: The consistent payment of dividends can contribute to positive long-term investor sentiment, potentially increasing investor confidence and potentially supporting a higher share price over time.

- Analyst Predictions: [Insert links to relevant analyst reports and predictions here, if available].

Comparison to Previous Dividends

Comparing the Power Finance Corporation (PFC) Dividend 2025 to previous payouts helps to identify trends and assess the company's commitment to shareholder returns. Below is a sample comparison table – the exact figures will be updated after the official announcement on March 12th, 2025.

| Year | Dividend per Share |

|---|---|

| 2022 | ₹ [Insert Amount] |

| 2023 | ₹ [Insert Amount] |

| 2024 | ₹ [Insert Amount] |

| 2025 | To be announced on March 12th |

Analyzing this data reveals [Insert analysis of trends - consistent growth, any significant changes, etc.].

Understanding PFC Dividend Policy and its Implications

PFC's Financial Health and Dividend Sustainability

The ability of Power Finance Corporation to sustain its dividend payments hinges on its financial health. A robust financial position, characterized by consistent profitability, manageable debt levels, and healthy cash flow, is crucial for continued dividend payouts.

- Profitability: PFC's consistent profit generation provides the necessary funds for dividend distributions.

- Debt Levels: High levels of debt could restrict the company's ability to distribute dividends.

- Cash Flow: Strong operating cash flow is essential to support dividend payments without jeopardizing other operational needs.

- Potential Risks: Changes in the regulatory environment, economic downturns, or unexpected losses could impact the company's ability to maintain its dividend policy.

Tax Implications of PFC Dividends

Investors receiving the Power Finance Corporation (PFC) Dividend 2025 should be aware of the tax implications. Dividend income is subject to tax in accordance with prevailing tax laws.

- Tax Rates: Tax rates on dividend income vary depending on the investor's income bracket and tax residency status.

- Withholding Taxes: Withholding taxes may be deducted at the source before the dividend is credited to the shareholder's account.

- Tax Regulations: Investors should consult with a qualified tax advisor to understand the specific tax implications relevant to their situation.

Investing in PFC: Long-Term Perspective

Investing in PFC offers long-term growth potential complemented by a history of consistent dividend payouts. However, investors should always consider potential risks.

- Attractiveness: The consistent dividend payouts, along with PFC's position within the Indian power sector, make it an attractive investment for many.

- Risks and Rewards: As with any investment, there are inherent risks. Fluctuations in the power sector, economic conditions, and regulatory changes can affect PFC's performance and, consequently, its dividend payouts.

Conclusion: Maximize Your Returns with the PFC Dividend 2025

The Power Finance Corporation (PFC) Dividend 2025 announcement on March 12th, 2025, is a significant event for investors. Understanding the dividend amount, record date, payment date, and the broader implications for PFC's financial health is crucial for making sound investment decisions. Stay informed about future Power Finance Corporation (PFC) dividend announcements and maximize your returns by understanding the implications of this important cash reward. Remember to consult with a financial advisor before making any investment decisions. [Insert Link to the official PFC investor relations page].

Featured Posts

-

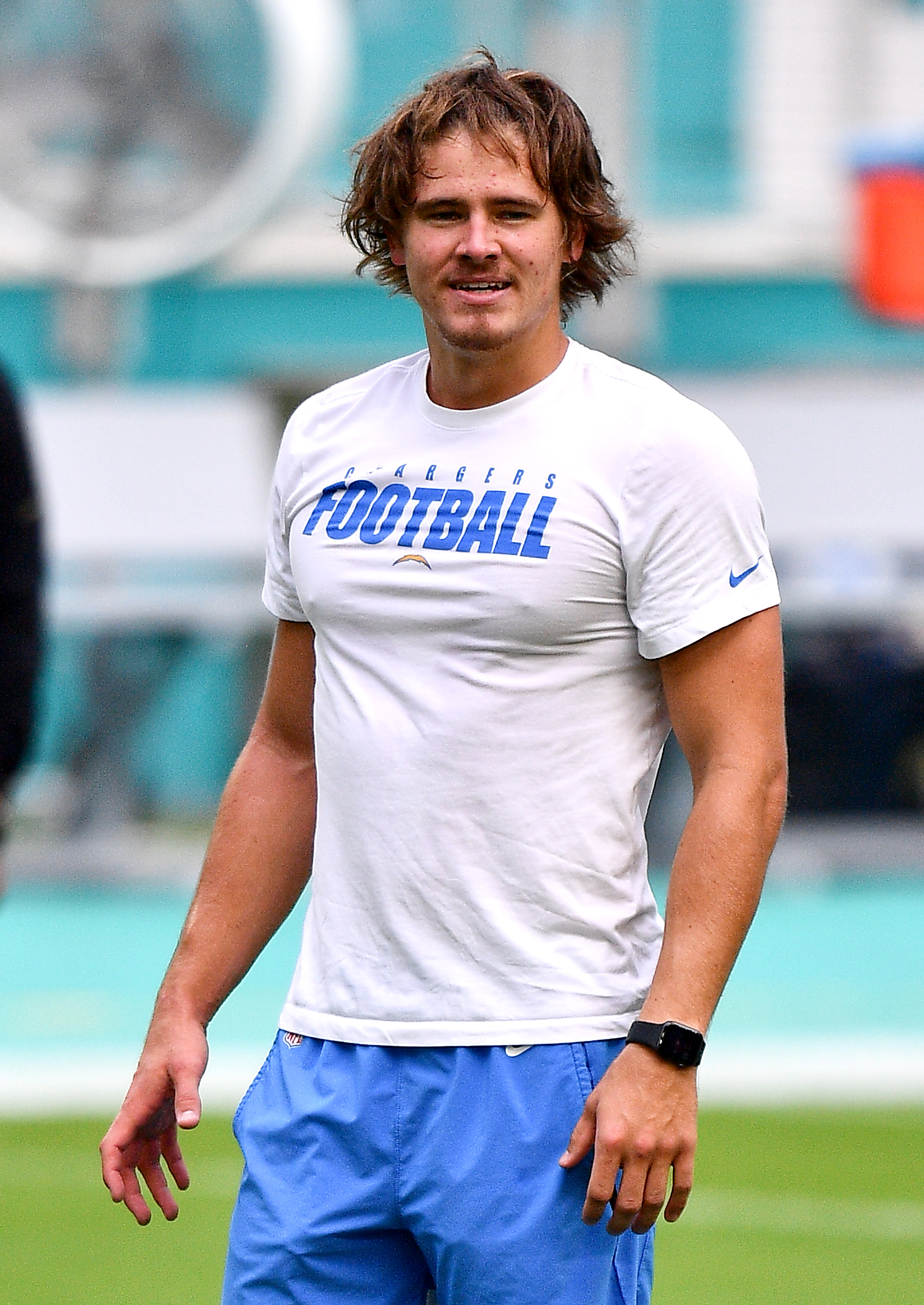

Chargers To Kick Off 2025 Season In Brazil Justin Herberts Role

Apr 27, 2025

Chargers To Kick Off 2025 Season In Brazil Justin Herberts Role

Apr 27, 2025 -

European Central Bank Creates Task Force For Simpler Banking Regulations

Apr 27, 2025

European Central Bank Creates Task Force For Simpler Banking Regulations

Apr 27, 2025 -

Canada Vs Us Why Tourists Are Choosing The Great White North

Apr 27, 2025

Canada Vs Us Why Tourists Are Choosing The Great White North

Apr 27, 2025 -

2025 Nfl Season Justin Herbert And The Chargers Play In Brazil

Apr 27, 2025

2025 Nfl Season Justin Herbert And The Chargers Play In Brazil

Apr 27, 2025 -

Ariana Grandes New Look Hair Transformation And Tattoo Debut

Apr 27, 2025

Ariana Grandes New Look Hair Transformation And Tattoo Debut

Apr 27, 2025