President Trump's Stance On Federal Reserve Chair Powell Remains Unchanged

Table of Contents

Historical Context: Trump's Criticism of Powell's Monetary Policy

President Trump's criticism of Chair Powell stemmed primarily from disagreements over monetary policy, particularly regarding interest rate adjustments and the pace of economic stimulus.

Interest Rate Hikes and Economic Growth Concerns

Trump repeatedly voiced his disapproval of interest rate hikes implemented by the Federal Reserve under Powell's leadership.

- June 2018: Trump publicly criticized the Fed's decision to raise interest rates, tweeting that the Fed was "going loco" and harming economic growth. [Link to relevant news article]

- September 2018: Following another rate hike, Trump stated that the Fed was making a "big mistake" and that its actions were "unnecessary and destructive." [Link to official statement or transcript]

- November 2018: Trump reiterated his concerns, arguing that the rate increases were slowing down the economy and jeopardizing the stock market's performance. [Link to relevant news article]

Trump's concerns were largely based on his belief that higher interest rates would stifle economic growth, curb business investment, and negatively impact the stock market, which he saw as a key indicator of economic health. He advocated for lower rates to fuel economic expansion and maintain the strong economic growth experienced during his early presidency.

The "Too Slow" Narrative: Trump's Desire for More Aggressive Stimulus

Beyond interest rate hikes, Trump frequently expressed frustration with what he perceived as the Fed's insufficiently aggressive approach to monetary stimulus. He argued for lower interest rates and more quantitative easing to further boost economic activity. This desire for a more expansionary monetary policy contrasted with the Fed's focus on maintaining price stability and managing inflation risks. The potential risks associated with Trump's preferred approach included increased inflation and the potential for asset bubbles. Conversely, the benefits he envisioned were accelerated economic growth and a stronger job market. However, many economists argued that such a strategy could lead to unsustainable economic growth and ultimately harm the economy in the long run.

Powell's Response and the Independence of the Federal Reserve

Despite facing intense political pressure, Jerome Powell consistently defended the Federal Reserve's independence and its commitment to making decisions based on economic data rather than political considerations.

Maintaining Independence Despite Political Pressure

Powell's unwavering stance on the Fed's independence was crucial in safeguarding the institution's credibility and its ability to effectively manage the U.S. economy. He repeatedly emphasized that the Fed's decisions are driven by its mandate to promote maximum employment and stable prices, not by political influence. This commitment is vital for maintaining public trust and ensuring the Fed's ability to make difficult decisions without fear of political repercussions. [Cite examples of Powell's public statements defending the Fed's autonomy]

Powell's Justification of Monetary Policy Decisions

Powell consistently justified the Fed's actions by referencing macroeconomic indicators such as inflation rates, unemployment figures, and consumer spending data. He explained the rationale behind interest rate adjustments, arguing that they were necessary to prevent runaway inflation while still fostering sustainable economic growth. [Include links to official Fed statements and press conferences providing this data and justification]. The Fed's decisions were aimed at balancing the risks of inflation and recession, aiming for a "soft landing" for the economy.

Lingering Effects and Current Relevance of Trump's Stance

The controversy surrounding President Trump's stance on Federal Reserve Chair Powell continues to have significant implications.

The Ongoing Debate on Monetary Policy

The intense debate spurred by Trump's criticism continues to inform current discussions on monetary policy. His strong objections highlighted the delicate balance between promoting economic growth and controlling inflation, a central challenge for central bankers worldwide. This debate also affected public perception of the Fed's role and the importance of its independence from political influence.

Potential Impacts on Future Federal Reserve Appointments

Trump's vocal criticism of Powell may also influence future presidential appointments to the Federal Reserve. Future presidents may prioritize candidates whose views align more closely with their own economic philosophies, potentially jeopardizing the Fed's independence. The selection of qualified and independent candidates for these crucial positions remains paramount to ensuring the continued health of the U.S. economy.

Conclusion

President Trump's stance on Federal Reserve Chair Powell represents a significant event with lasting implications for the Federal Reserve and the ongoing debate surrounding monetary policy. His criticisms highlighted the inherent tensions between political pressures and the need for central bank independence. Understanding this historical context is essential for comprehending current economic discussions and the challenges facing the Federal Reserve in balancing economic growth and price stability. To gain a more comprehensive understanding of the complexities involved and its continued impact on the economy, we encourage further research into President Trump's stance on Federal Reserve Chair Powell and the related macroeconomic factors. Explore the archives of the Federal Reserve, reputable economic journals, and news sources for more in-depth analysis.

Featured Posts

-

Canadian Auto Industry Fights Back Five Point Plan Addresses Us Trade Threats

Apr 24, 2025

Canadian Auto Industry Fights Back Five Point Plan Addresses Us Trade Threats

Apr 24, 2025 -

60 Minutes Producers Resignation Loss Of Independence Cited

Apr 24, 2025

60 Minutes Producers Resignation Loss Of Independence Cited

Apr 24, 2025 -

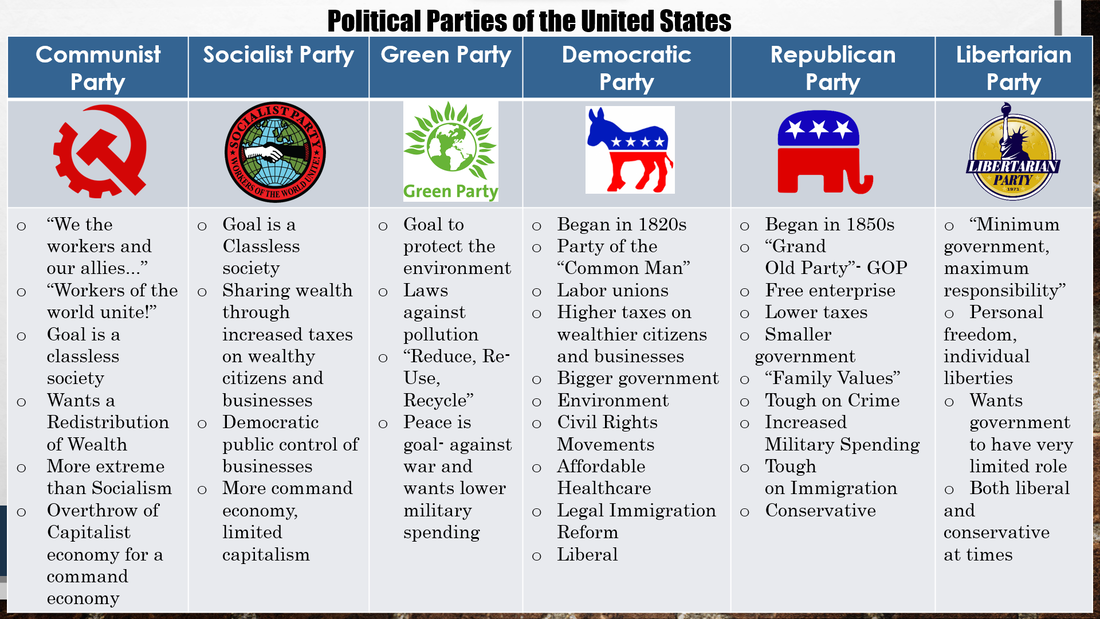

Liberal Party Platform Key Policies And Their Implications

Apr 24, 2025

Liberal Party Platform Key Policies And Their Implications

Apr 24, 2025 -

Is The Lg C3 77 Inch Oled The Right Tv For You

Apr 24, 2025

Is The Lg C3 77 Inch Oled The Right Tv For You

Apr 24, 2025 -

Faa Study Focuses On Las Vegas Airport Collision Risks

Apr 24, 2025

Faa Study Focuses On Las Vegas Airport Collision Risks

Apr 24, 2025