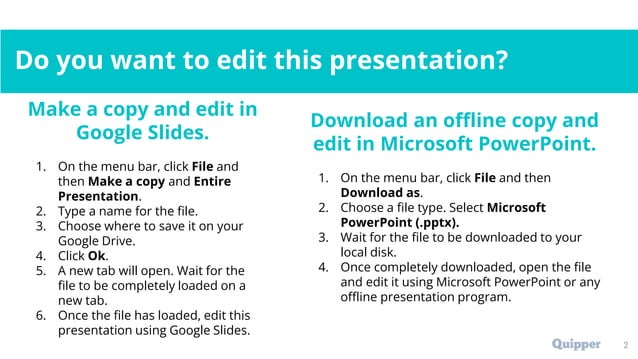

Reduced Tesla Q1 Profits: Exploring The Causes And Consequences

Table of Contents

Price Wars and Reduced Margins

Tesla's aggressive price cuts, initiated to boost sales volume and maintain market share, significantly impacted its profit margins. This strategy, while increasing sales numbers, directly reduced the profitability of each vehicle sold.

- Competitive Landscape: The EV market is becoming increasingly competitive, with established automakers and new entrants aggressively vying for market share. Tesla's price cuts were a direct response to this intensifying competition, particularly from Chinese EV manufacturers offering comparable vehicles at lower prices.

- Volume vs. Profitability: The classic trade-off between sales volume and profit margin is starkly evident in Tesla's Q1 performance. While the price reductions spurred increased sales, the reduced margin per vehicle led to a substantial overall decrease in profit.

- Specific Price Reductions: Examples of price reductions include significant cuts across the Model 3 and Model Y ranges, aiming to attract price-sensitive buyers and compete directly with rivals offering cheaper EVs. Data on the precise percentage reductions and their impact on unit sales are eagerly awaited by analysts. (Note: Insert data here if available from official Tesla reports or reliable financial news sources).

- Margin Changes: The overall impact on margins requires a thorough analysis of the sales figures across all Tesla models and the associated profit margins for each. (Note: Insert data here if available, illustrating the change in margins compared to previous quarters).

Increased Production Costs

Beyond price pressures, Tesla faced increased production costs, further eroding profitability. The rising costs of raw materials crucial for EV battery production are a major factor.

- Raw Material Costs: The prices of lithium, nickel, and cobalt, essential components in EV batteries, have fluctuated significantly, impacting Tesla's manufacturing expenses. This volatile market makes accurate cost projections challenging.

- Supply Chain Disruptions: Ongoing supply chain disruptions caused by geopolitical instability and other factors continue to add to production costs. Securing a reliable and cost-effective supply of raw materials remains a key challenge.

- Mitigation Strategies: Tesla is actively pursuing strategies to mitigate these escalating costs. This includes exploring vertical integration—taking greater control over the supply chain—and investigating the use of alternative battery materials to reduce reliance on price-volatile elements. (Note: Insert data here if available illustrating the percentage increases in raw material costs).

Increased Competition in the EV Market

The EV market is no longer Tesla's exclusive domain. The rapid growth of competitors is significantly impacting Tesla's market share and pricing power.

- Key Competitors: Established automakers like Ford, Volkswagen, and Hyundai, along with ambitious Chinese manufacturers such as BYD and Nio, are fiercely competing with Tesla. Each player employs different strategies, including aggressive pricing, innovative technology, and strong branding.

- Competitive Advantages and Disadvantages: Tesla's strengths lie in its established brand recognition, Supercharger network, and advanced technology. However, competitors are quickly closing the gap in terms of technology and are often offering comparable EVs at lower prices.

- Impact on Sales and Pricing: The increased competition is forcing Tesla to engage in price wars, impacting its pricing power and, consequently, its profitability.

Economic Slowdown and Consumer Demand

Macroeconomic factors also play a role. A potential global economic slowdown or regional recessions can significantly impact consumer spending, especially in the luxury car segment where Tesla vehicles are largely positioned.

- Correlation with Economic Indicators: Tesla's sales figures often correlate with overall economic health. Periods of economic uncertainty generally lead to reduced consumer spending on discretionary items like luxury vehicles.

- Inflation and Interest Rates: High inflation and rising interest rates reduce consumer purchasing power, making high-priced EVs less accessible. This affects demand and potentially impacts sales volume.

- Shift in Consumer Preferences: Economic pressures may shift consumer preferences towards more affordable EV options, putting further pressure on Tesla's pricing strategy.

Consequences of Reduced Tesla Q1 Profits

The reduced Tesla Q1 profits have significant consequences for the company's future plans and investments.

- Impact on Stock Price and Investor Confidence: The lower-than-expected profits have inevitably impacted Tesla's stock price and investor confidence. Negative market sentiment can influence future investments and company valuation.

- Potential Delays or Changes to Projects: Reduced profits may lead to delays or changes in planned projects, including new factory constructions, expansion into new markets, or the development of new vehicle models.

- Adjustments to Long-Term Strategic Goals: Tesla might need to reconsider its long-term strategic goals and potentially adapt its pricing, production, and expansion strategies in light of the current challenges.

Conclusion:

The reduced Tesla Q1 profits are a result of a confluence of factors: intense price wars impacting margins, rising production costs due to raw material prices and supply chain issues, increased competition in the rapidly expanding EV market, and potential macroeconomic headwinds affecting consumer demand. These factors have significant consequences for Tesla's future prospects, impacting its stock price, investment plans, and long-term strategic goals. To stay informed about Tesla's performance and the evolving electric vehicle market, continue following analysis on Reduced Tesla Q1 Profits and related developments. Subscribe to reputable financial news sources and follow leading industry analysts for the latest updates.

Featured Posts

-

Musks Political Involvement Weighs On Teslas Q1 Profits

Apr 24, 2025

Musks Political Involvement Weighs On Teslas Q1 Profits

Apr 24, 2025 -

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Say

Apr 24, 2025

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Say

Apr 24, 2025 -

Microsoft Activision Deal Ftcs Appeal And Its Potential Impact

Apr 24, 2025

Microsoft Activision Deal Ftcs Appeal And Its Potential Impact

Apr 24, 2025 -

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025 -

Sharks Missing Swimmer And A Body Found On Israeli Beach

Apr 24, 2025

Sharks Missing Swimmer And A Body Found On Israeli Beach

Apr 24, 2025