Retail Sales Slump: Could The Bank Of Canada Reverse Course On Rates?

Table of Contents

The Severity of the Retail Sales Slump

Data and Statistics

The recent decline in retail sales in Canada is undeniable. Statistics Canada's latest reports reveal a [insert percentage]% drop in retail sales in [insert month/quarter], marking a significant contraction in consumer spending. This decline isn't uniform across all sectors; some are experiencing sharper drops than others.

- Automotive Sales: A [insert percentage]% decrease, reflecting the impact of higher interest rates on borrowing costs for vehicles.

- Furniture and Home Furnishings: A [insert percentage]% decline, likely influenced by decreased consumer confidence and affordability concerns.

- Clothing and Accessories: A [insert percentage]% drop, highlighting reduced discretionary spending by consumers.

These figures, sourced directly from Statistics Canada [insert link to Statistics Canada data], paint a bleak picture of the current state of retail in Canada. The visual representation below further emphasizes this decline: [insert chart/graph showing retail sales decline].

Underlying Causes of the Slump

Several factors are contributing to this retail sales slump. The most significant is undoubtedly the combination of high inflation and rising interest rates.

- High Inflation & Reduced Purchasing Power: Soaring inflation has eroded consumer purchasing power, leaving less disposable income for non-essential purchases.

- Rising Interest Rates: Increased borrowing costs make it more expensive to finance large purchases like homes and cars, further dampening consumer demand.

- Shifting Consumer Behaviour: Consumers are becoming more cautious with their spending, prioritizing essential goods and services over discretionary items.

- Global Economic Uncertainty: Global economic headwinds, including geopolitical instability and potential recessions in other major economies, are also contributing to the uncertainty and reduced consumer confidence in Canada.

The Bank of Canada's Response to the Retail Sales Slump

Current Monetary Policy Stance

The Bank of Canada's primary mandate is to maintain price stability and full employment. To combat inflation, the Bank has implemented a series of interest rate hikes over the past year. Their current policy stance is [insert current Bank of Canada policy – e.g., a cautious approach to further rate hikes, a wait-and-see approach]. The Bank's recent statements and press releases [insert links to relevant statements] indicate a [insert assessment – e.g., continued concern about inflation, a recognition of the slowing economy].

Potential for a Rate Reversal

The possibility of the Bank of Canada reversing its rate hikes is a complex issue. The decision will depend heavily on several key economic indicators:

- Inflation Rate: A sustained decline in inflation would strengthen the case for a pause or rate cut.

- Employment Data: A significant increase in unemployment could signal a weakening economy, prompting reconsideration of the interest rate policy.

- GDP Growth: Slowing or negative GDP growth would further support arguments for rate cuts to stimulate the economy.

If the retail sales slump continues unabated, coupled with other negative economic indicators, the Bank might consider a rate reversal to prevent a deeper economic downturn. However, this carries risks, including potentially reigniting inflation. A continued slump could lead to rate cuts, while signs of recovery might lead the Bank to maintain its current course or even implement further hikes.

Alternative Economic Strategies to Combat the Retail Sales Slump

Fiscal Policy Options

The Canadian government could implement several fiscal policies to stimulate the economy and alleviate the retail sales slump.

- Tax Cuts or Rebates: Providing tax relief to consumers could boost disposable income and encourage spending.

- Increased Government Spending: Investing in infrastructure projects could create jobs and stimulate economic activity.

- Support for Small and Medium-Sized Businesses: Providing financial assistance or tax breaks to small businesses could help them stay afloat and contribute to job creation.

Other Interventions

Beyond monetary and fiscal policies, other interventions could help address the retail sales slump.

- Targeted Support for Struggling Sectors: The government could provide specific support packages for particularly hard-hit industries, such as automotive manufacturing or tourism.

- Addressing Supply Chain Issues: Though less relevant now than in previous years, persistent supply chain disruptions could warrant government intervention to ensure smoother flow of goods and services.

Conclusion: Navigating the Retail Sales Slump and the Future of Interest Rates

The current retail sales slump in Canada is a serious concern, driven by a combination of high inflation, rising interest rates, and global economic uncertainty. The Bank of Canada faces a difficult decision: whether to maintain its current interest rate policy or reverse course to stimulate the economy. The likelihood of a rate reversal depends heavily on upcoming economic data, specifically inflation rates, employment figures, and GDP growth. While a rate cut could stimulate the economy and potentially alleviate the retail sales slump, it also carries the risk of reigniting inflation. Therefore, a balanced approach considering both the risks and benefits is crucial. To stay abreast of the evolving situation and its impact on your personal finances and investments, it’s important to keep monitoring the Bank of Canada's announcements and economic data releases related to the ongoing retail sales slump and the wider Canadian economy. Stay informed to better understand and navigate this crucial period for the Canadian economy.

Featured Posts

-

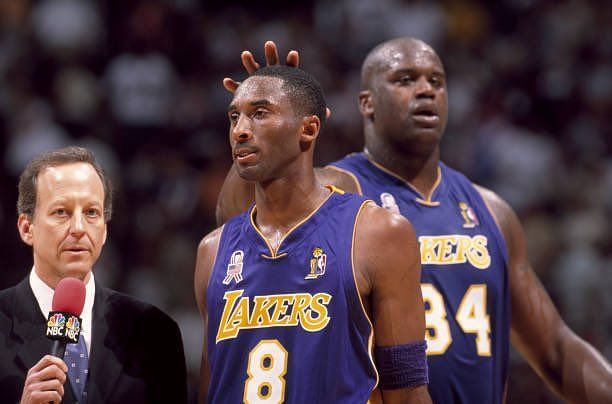

The Latest Richard Jefferson Shaquille O Neal Feud A Breakdown

Apr 28, 2025

The Latest Richard Jefferson Shaquille O Neal Feud A Breakdown

Apr 28, 2025 -

Aaron Judge Welcomes Child With Wife Samantha Bracksieck

Apr 28, 2025

Aaron Judge Welcomes Child With Wife Samantha Bracksieck

Apr 28, 2025 -

Musks X Debt Sale New Financials Reveal A Transforming Company

Apr 28, 2025

Musks X Debt Sale New Financials Reveal A Transforming Company

Apr 28, 2025 -

Boston Red Sox Doubleheader Coras Lineup Decisions

Apr 28, 2025

Boston Red Sox Doubleheader Coras Lineup Decisions

Apr 28, 2025 -

Are High Stock Market Valuations A Concern Bof As Analysis

Apr 28, 2025

Are High Stock Market Valuations A Concern Bof As Analysis

Apr 28, 2025