Securing Financial Stability: Elite Universities' Response To Potential Funding Reductions Under Trump

Table of Contents

Diversifying Revenue Streams

Elite universities recognized the urgent need to reduce their dependence on volatile federal funding. A diversified revenue model became paramount for securing financial stability.

Increased Endowment Management

Sophisticated investment strategies and robust risk mitigation became central to endowment growth. Universities implemented:

- Increased allocation to alternative investments: Moving beyond traditional stocks and bonds to include private equity, real estate, and hedge funds to enhance returns and diversify risk.

- Enhanced due diligence processes: Implementing rigorous research and analysis to ensure prudent investment decisions and minimize potential losses.

- Focus on long-term growth: Shifting from short-term gains to strategies designed for sustainable, long-term endowment growth, crucial for securing financial stability over decades.

- Greater transparency in endowment reporting: Providing clearer and more frequent updates to stakeholders on endowment performance and investment strategies, building trust and accountability.

Growing Private Donations

Targeted fundraising campaigns and strengthened alumni relations became vital for securing financial stability. Universities focused on:

- Personalized donor engagement: Cultivating individual relationships with donors, understanding their philanthropic goals and tailoring solicitations accordingly.

- Enhanced online giving platforms: Developing user-friendly websites and mobile applications to streamline the donation process and encourage online giving.

- Major gift solicitations: Focusing on securing significant donations from high-net-worth individuals and foundations through targeted cultivation and stewardship efforts.

- Cultivating relationships with high-net-worth individuals: Building lasting connections with potential major donors to foster long-term philanthropic partnerships.

Expanding International Student Enrollment

Attracting international students presented a significant opportunity to diversify revenue and bolster financial stability. Universities implemented strategies such as:

- Targeted recruitment in key markets: Focusing recruitment efforts on countries with a high demand for U.S. higher education.

- Offering competitive financial aid packages: Providing scholarships and financial aid to attract top international students.

- Improving international student support services: Creating a welcoming and supportive campus environment to enhance the international student experience.

Implementing Cost-Cutting Measures

While maintaining academic excellence, universities aggressively sought efficiencies to improve their financial stability.

Streamlining Administrative Processes

Improving operational efficiency through technology and restructuring became essential for controlling costs and securing financial stability. Strategies included:

- Implementing new administrative software: Adopting modern software solutions to automate tasks, streamline workflows, and reduce manual processes.

- Centralizing services: Consolidating administrative functions to eliminate redundancies and improve efficiency.

- Reducing administrative staff where possible: Implementing strategic workforce planning to optimize staffing levels without compromising essential services.

- Outsourcing non-core functions: Contracting out non-essential tasks like facilities management or IT support to reduce internal costs.

Optimizing Faculty and Staff Compensation

Controlling rising labor costs was a major factor in securing financial stability. Universities considered:

- Negotiating more favorable contracts with faculty unions: Seeking cost-effective contracts while maintaining fair compensation for faculty.

- Implementing salary freezes or modest raises: Temporarily limiting salary increases to manage payroll expenses.

- Restructuring departments and eliminating redundancies: Streamlining departments to eliminate overlapping roles and reduce personnel costs.

Reducing Spending on Non-essential Programs

Prioritizing core academic missions involved tough decisions to enhance financial stability. Universities focused on:

- Cutting less popular or less impactful programs: Phasing out programs with low enrollment or limited strategic importance.

- Re-evaluating facility usage and reducing energy consumption: Implementing energy-efficient technologies and optimizing building usage to reduce utility costs.

- Renegotiating contracts with vendors: Negotiating better terms with suppliers and vendors to reduce expenses.

Enhancing Transparency and Accountability

Building trust with stakeholders was crucial for securing financial stability during this period of uncertainty.

Public Reporting of Financial Health

Openly communicating financial challenges and strategies was critical to maintaining stakeholder confidence. Universities focused on:

- Detailed annual financial reports: Providing comprehensive and transparent financial reports to the public, alumni, and government agencies.

- Transparent communication with alumni and students: Keeping stakeholders informed about the university's financial situation and the strategies implemented to address challenges.

- Increased interaction with government oversight bodies: Maintaining open communication with regulatory bodies to demonstrate compliance and accountability.

Strengthening Internal Controls

Robust financial management and fraud prevention measures were essential for securing financial stability. Universities prioritized:

- Independent audits: Conducting regular independent audits to ensure the accuracy and integrity of financial statements.

- Robust internal controls: Implementing strong internal controls to prevent fraud and ensure compliance with financial regulations.

- Ethical guidelines for financial practices: Establishing clear ethical guidelines for all financial transactions.

- Employee training on financial regulations: Providing regular training to employees on financial regulations and ethical conduct.

Conclusion

Elite universities responded to the threat of reduced funding under the Trump administration by proactively implementing a range of strategies to secure their financial stability. Diversifying revenue streams, implementing cost-cutting measures, and enhancing transparency were key components of this response. The lessons learned highlight the importance of proactive financial planning and adaptable strategies for all institutions of higher education facing uncertain economic climates. By adopting similar strategies focused on securing financial stability, universities can ensure their long-term viability and continued contribution to society. Investing in diversified funding sources and efficient financial management remains critical for financial stability in the ever-evolving landscape of higher education. Proactive planning for securing financial stability is no longer optional; it's essential.

Featured Posts

-

The Bold And The Beautiful Spoilers Finns Promise To Liam On April 23rd

Apr 24, 2025

The Bold And The Beautiful Spoilers Finns Promise To Liam On April 23rd

Apr 24, 2025 -

77 Inch Lg C3 Oled Performance And Features Review

Apr 24, 2025

77 Inch Lg C3 Oled Performance And Features Review

Apr 24, 2025 -

Ryujinx Emulator Shuts Down Following Nintendo Communication

Apr 24, 2025

Ryujinx Emulator Shuts Down Following Nintendo Communication

Apr 24, 2025 -

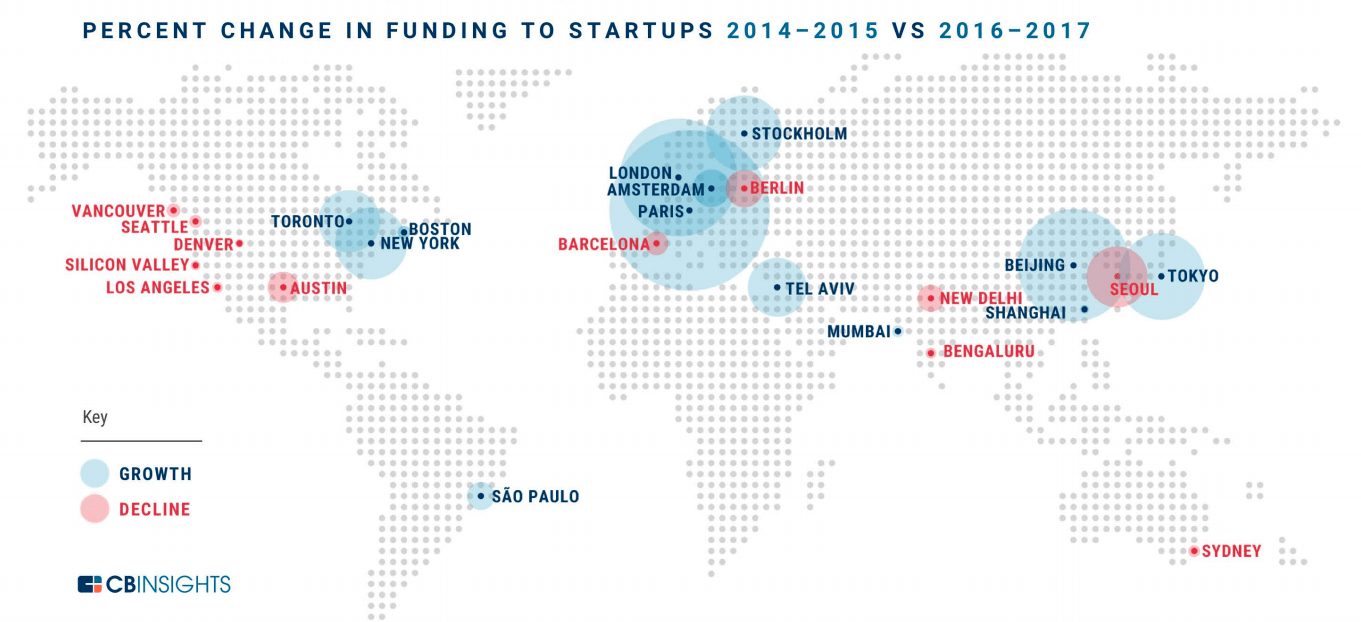

Identifying Emerging Business Hubs A National Map Of Opportunity

Apr 24, 2025

Identifying Emerging Business Hubs A National Map Of Opportunity

Apr 24, 2025 -

Is The Lg C3 77 Inch Oled The Right Tv For You

Apr 24, 2025

Is The Lg C3 77 Inch Oled The Right Tv For You

Apr 24, 2025