SK Hynix Overtakes Samsung In DRAM Market: AI's Impact

Table of Contents

SK Hynix's Strategic Investments and Technological Advancements

SK Hynix's success isn't accidental. It's the result of shrewd investments and groundbreaking technological advancements, perfectly timed to capitalize on the AI boom.

Focus on High-Bandwidth Memory (HBM)

SK Hynix has aggressively pursued High-Bandwidth Memory (HBM) technology, recognizing its critical role in powering AI applications. HBM offers significantly higher bandwidth and capacity compared to traditional DRAM, a crucial advantage for the demanding computational needs of AI.

- Significant Investments: SK Hynix has heavily invested in R&D for successive generations of HBM, including HBM2E, HBM3, and now pushing the boundaries with HBM3E. These advancements allow for exponentially faster data transfer rates, crucial for training sophisticated AI models.

- Strategic Partnerships: Collaborations with key players in the AI hardware ecosystem have helped accelerate the adoption of SK Hynix's HBM solutions. These partnerships have secured crucial supply chains and accelerated product development.

- Superior Performance: HBM's superior performance in handling large datasets and complex calculations makes it the memory solution of choice for AI-accelerated computing, giving SK Hynix a significant competitive edge.

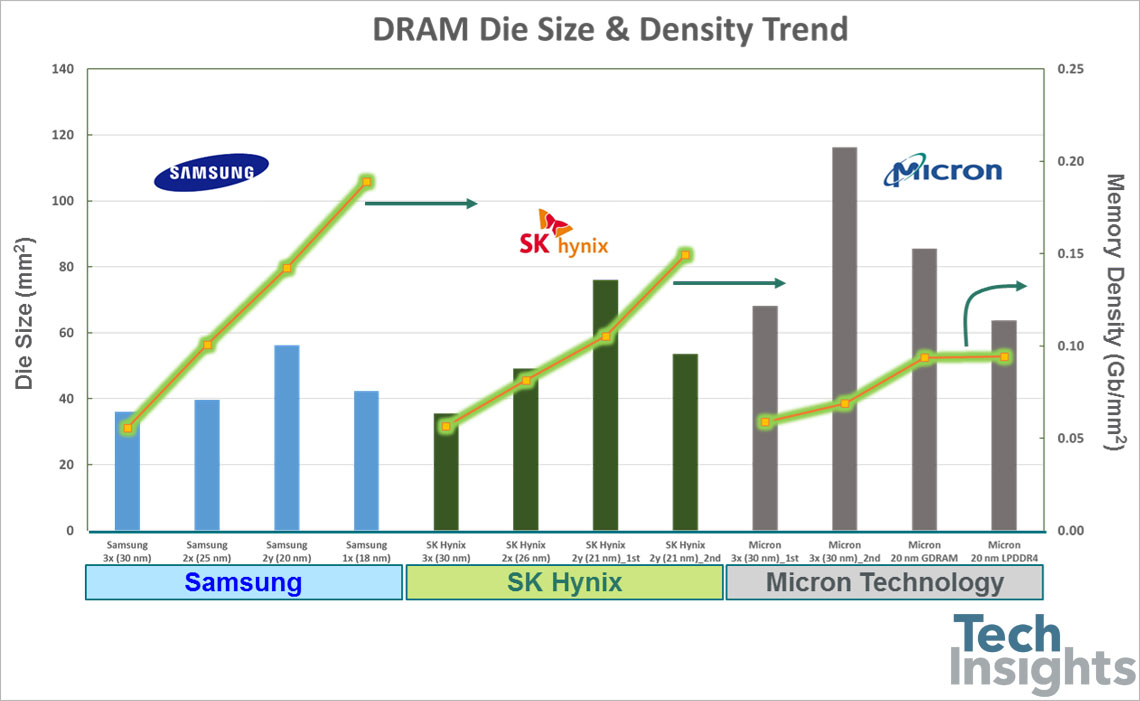

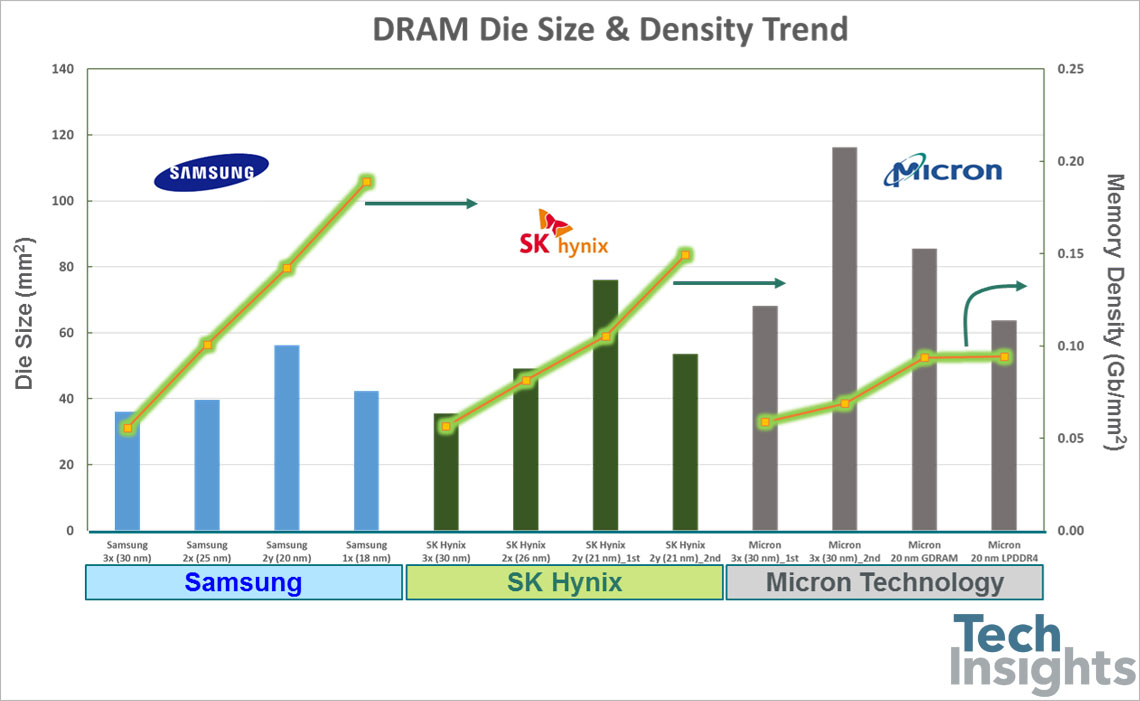

Process Technology Leadership

Alongside its HBM focus, SK Hynix has demonstrated leadership in process node technology. Smaller process nodes translate to higher density, lower power consumption, and ultimately, cost advantages.

- Cutting-Edge Nodes: SK Hynix has consistently pushed the boundaries of process technology, transitioning to advanced nodes like 1α and 1γ nm. These advancements allow them to pack more memory cells onto a single chip, boosting capacity and efficiency.

- Yield Improvements: Improvements in manufacturing yield have been instrumental in reducing costs and ensuring a reliable supply of high-quality DRAM. This improved efficiency allows them to compete effectively on price while offering superior technology.

- Competitive Edge over Samsung: While Samsung remains a formidable competitor, SK Hynix's advancements in process technology have allowed them to narrow the gap, even surpassing Samsung in specific areas of DRAM production.

The Soaring Demand for DRAM Fueled by AI

The explosive growth of AI is the undeniable catalyst driving the increased demand for high-performance DRAM. This demand is not just significant; it's accelerating exponentially.

AI's Growing Appetite for Memory

AI algorithms, particularly those employed in deep learning and machine learning, are incredibly data-hungry. Training sophisticated AI models requires vast datasets and complex computations, demanding unprecedented memory bandwidth and capacity.

- Exponential Growth: The AI market is expanding rapidly, with projections forecasting continued double-digit growth for years to come. This growth directly translates into a proportional increase in the demand for DRAM.

- Diverse Applications: From autonomous vehicles and robotics to advanced medical imaging and personalized medicine, AI applications span various sectors, each contributing to the surging DRAM demand. Each application requires significant memory resources.

- Data Center Reliance: The infrastructure supporting AI is heavily reliant on data centers equipped with powerful servers and substantial memory capacity.

The Role of Data Centers in Driving Demand

Hyperscale data centers are at the heart of AI's infrastructure. These colossal facilities, operated by giants like AWS, Google Cloud, and Azure, house the servers powering AI-driven services.

- Massive Infrastructure: The sheer scale of these data centers requires enormous amounts of DRAM to support the intensive computations needed for AI applications. Their expansion fuels the DRAM market's growth.

- AI-Driven Services: The increasing reliance on AI-powered services, including cloud computing, streaming, and big data analytics, further intensifies the demand for high-performance DRAM.

- Continuous Expansion: Data centers are constantly expanding to accommodate the ever-increasing computational demands of AI, ensuring continuous and growing demand for DRAM in the years to come.

Samsung's Response and Future Market Dynamics

While SK Hynix has made significant strides, Samsung remains a dominant force in the DRAM market. Their response to SK Hynix's gains will shape the future of this competitive landscape.

Samsung's Competitive Strategies

Samsung is unlikely to cede its market leadership without a fight. Their robust R&D capabilities and extensive manufacturing infrastructure will undoubtedly drive counter-strategies.

- Continued R&D Investment: Expect Samsung to invest heavily in process technology and new memory solutions to regain lost ground. Innovations in memory architectures and materials are likely.

- Strategic Partnerships and Acquisitions: Strategic collaborations and acquisitions could reshape the competitive dynamics, potentially bolstering Samsung's position in specific market segments.

- Price Competition: Increased price competition could be a key element of Samsung's response, aiming to recapture market share by offering competitive pricing.

Predictions for the Future of the DRAM Market

The future of the DRAM market is inextricably linked to the continued advancement of AI. The long-term implications are significant.

- Sustained High Demand: The demand for high-bandwidth memory is expected to remain strong, fueled by the continued growth of AI and its applications across diverse sectors.

- Technological Innovation: Expect ongoing innovation in memory technologies, with new architectures and materials emerging to meet the ever-increasing demands of AI.

- Shifting Market Shares: While SK Hynix has made significant progress, the future market share distribution remains uncertain. The competition between SK Hynix and Samsung, and the potential emergence of new players, will continue to shape the market.

Conclusion

SK Hynix's recent success in overtaking Samsung in certain segments of the DRAM market represents a significant shift in the industry landscape. This success is largely attributed to strategic investments in HBM technology, advancements in process node technology, and the surging demand for high-bandwidth memory fueled by the growth of AI. While Samsung's response and future market dynamics remain uncertain, the underlying trend of increasing DRAM demand driven by AI is clear.

Call to Action: Stay updated on the latest SK Hynix DRAM market trends and the continuing impact of AI on this dynamic sector. Learn more about the impact of AI on the SK Hynix DRAM market share by following industry news and exploring resources dedicated to semiconductor technology. Understanding this evolving landscape is crucial for anyone involved in or interested in the future of technology.

Featured Posts

-

Video John Travoltas Pulp Fiction Steakhouse Experience In Miami

Apr 24, 2025

Video John Travoltas Pulp Fiction Steakhouse Experience In Miami

Apr 24, 2025 -

Miami Heats Herro Claims Nba 3 Point Contest Title

Apr 24, 2025

Miami Heats Herro Claims Nba 3 Point Contest Title

Apr 24, 2025 -

Canadian Conservatives Detail Plan For Tax Cuts And Fiscal Responsibility

Apr 24, 2025

Canadian Conservatives Detail Plan For Tax Cuts And Fiscal Responsibility

Apr 24, 2025 -

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025 -

Brett Goldstein Compares Ted Lasso Revival To A Miracle A Thought Dead Cat

Apr 24, 2025

Brett Goldstein Compares Ted Lasso Revival To A Miracle A Thought Dead Cat

Apr 24, 2025