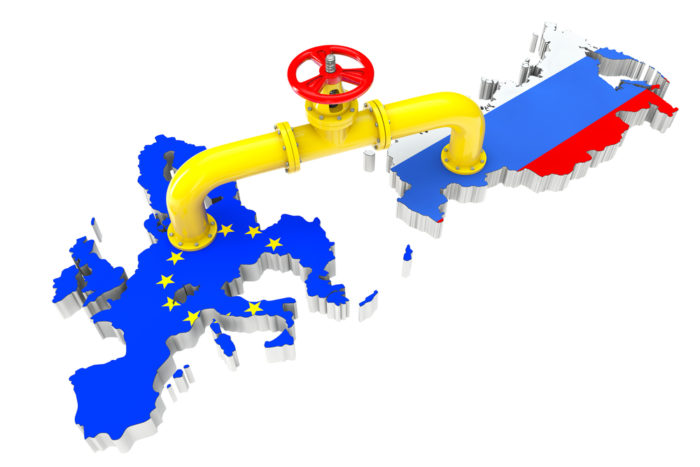

Spot Market For Russian Gas: EU's Planned Phaseout

Table of Contents

The Current State of the Russian Gas Spot Market

Pre-Phaseout Dynamics

Before the war in Ukraine and subsequent sanctions, the EU demonstrated a significant reliance on Russian natural gas, primarily supplied through long-term contracts. These contracts, while providing a degree of price stability, often lacked the flexibility needed to respond to rapidly changing market conditions. The spot market, representing a smaller portion of gas trading, offered more immediate price adjustments but also greater volatility. Prior to the conflict, price manipulation concerns occasionally arose, fueled by Russia's dominant position in the pipeline gas market. The spot market's participation was limited, with fewer players actively trading compared to the established long-term contract system.

- High dependence on pipeline gas: The EU's energy infrastructure was heavily reliant on Russian pipeline gas, limiting options for alternative sources.

- Price manipulation concerns: Russia's control over pipeline supply raised concerns about potential price manipulation and political leverage.

- Limited spot market participation prior to conflict: The spot market for Russian gas was relatively underdeveloped, mainly due to the prevalence of long-term contracts.

Impact of Sanctions and the War in Ukraine

The Russian invasion of Ukraine triggered a wave of unprecedented sanctions, significantly impacting Russian gas supplies to the EU. The immediate consequence was a dramatic spike in natural gas prices across Europe, creating market instability and fueling inflation. The EU responded by implementing a strategy to rapidly reduce its reliance on Russian gas imports, focusing on diversification of supply sources and accelerating its energy transition. The sanctions themselves increased price volatility, as the market struggled to adjust to the sudden reduction in Russian supply.

- Significant reduction in Russian gas imports: The EU has made significant strides in decreasing its dependence on Russian gas, though complete independence remains a long-term goal.

- Increased reliance on alternative suppliers: The EU has actively sought alternative suppliers of natural gas, including Norway, the US, and other LNG exporters.

- Price volatility exacerbated by geopolitical uncertainty: The geopolitical instability has amplified price fluctuations in the European gas market.

EU Strategies for Diversification and Energy Security

Increased LNG Imports

Liquefied natural gas (LNG) has emerged as a crucial tool in replacing Russian pipeline gas. The EU is investing heavily in developing new LNG import terminals to handle the increased volumes, but this involves significant infrastructure investments and faces considerable challenges in securing sufficient LNG supplies globally, considering the increased competition from other countries also seeking to diversify their energy sources.

- Development of new LNG terminals: The EU is rapidly expanding its LNG import capacity to meet rising demand.

- Competition for LNG supplies from global markets: The increased global demand for LNG creates competition among importers, potentially driving prices higher.

- Price fluctuations in the LNG market: LNG prices are subject to their own volatility due to global supply and demand factors.

Promoting Renewable Energy Sources

The EU is accelerating its transition to renewable energy sources as a long-term solution to reduce reliance on natural gas imports. This involves substantial investments in wind, solar, and other renewable technologies, coupled with supportive policies to stimulate growth in the sector. However, scaling up renewable energy production quickly presents significant challenges, including intermittency issues and the need for upgrades to electricity grids.

- Investments in renewable energy infrastructure: The EU is pouring significant funds into renewable energy projects across member states.

- Policy support for renewable energy development: Government policies, including subsidies and tax breaks, aim to accelerate renewable energy adoption.

- Challenges of intermittency and grid stability: The inconsistent nature of renewable energy sources requires substantial grid upgrades and energy storage solutions.

Strengthening Energy Storage Capacity

Effective energy storage is critical to address the intermittency inherent in renewable energy sources. The EU is exploring various storage technologies, including batteries, pumped hydro, and compressed air energy storage, to ensure grid stability and reliability. The deployment of these technologies requires substantial investment to build sufficient storage capacity to match the growing share of renewable energy in the energy mix.

- Battery storage technology: Advanced battery technologies are being developed and deployed for grid-scale energy storage.

- Pumped hydro storage: Pumped hydro remains a mature and effective large-scale energy storage solution.

- Compressed air energy storage: Compressed air energy storage offers a promising alternative for longer-duration energy storage.

The Future of the European Gas Market and the Spot Price of Russian Gas

Long-Term Outlook for Russian Gas Imports

The long-term outlook for Russian gas imports into the EU remains uncertain. While a complete cessation is likely, the extent and timeframe depend on various geopolitical factors. The EU's commitment to energy independence suggests a significant reduction in Russian gas reliance over the next decade, though potential residual imports may occur under specific circumstances. This reduced reliance carries substantial geopolitical implications for both Russia and the EU.

- Potential for limited future imports: Complete elimination of Russian gas imports is a strong possibility, but some limited trade may persist depending on political realities.

- Long-term energy independence goals: The EU's strategic objective is to achieve long-term energy independence and resilience.

- Geopolitical implications for Russia and the EU: The reduced reliance on Russian gas significantly alters the geopolitical dynamics between the EU and Russia.

Price Volatility and Market Dynamics

Future price volatility in the European gas market will depend on numerous factors, including supply and demand dynamics, geopolitical risks, and the pace of the energy transition. The increased diversification of supply sources and the continued expansion of renewable energy capacity are expected to gradually reduce price volatility in the long term. However, unforeseen events, including geopolitical instability or disruptions to supply chains, can still cause significant price fluctuations.

- Fluctuating supply and demand: The interplay of supply and demand will continue to influence gas prices in the European market.

- Geopolitical risk: Geopolitical instability remains a significant factor affecting gas prices and market stability.

- Development of alternative energy sources: The growth of renewable energy and alternative gas sources will impact future price dynamics.

Conclusion

The EU's planned phaseout of Russian gas represents a profound shift in the European energy landscape. Successfully navigating this transition requires a multifaceted approach, encompassing diversification of energy sources, substantial investments in renewable energy and storage, and a strategic focus on enhancing energy security. Understanding the dynamics of the spot market for Russian gas and its evolution is crucial for policymakers, energy companies, and consumers alike. Staying informed about the latest developments in the spot market for Russian gas and its ongoing impact on the EU's energy transition is essential. Continue your research and stay updated on the evolving situation in the spot market for Russian gas.

Featured Posts

-

Experiencing The Lg C3 77 Inch Oled A User Perspective

Apr 24, 2025

Experiencing The Lg C3 77 Inch Oled A User Perspective

Apr 24, 2025 -

Open Ais 2024 Event Easier Voice Assistant Creation

Apr 24, 2025

Open Ais 2024 Event Easier Voice Assistant Creation

Apr 24, 2025 -

All Star Weekend Draymond Green Moses Moody And Buddy Hield In Attendance

Apr 24, 2025

All Star Weekend Draymond Green Moses Moody And Buddy Hield In Attendance

Apr 24, 2025 -

Ted Lassos Revival Brett Goldsteins Resurrected Cat Analogy Explained

Apr 24, 2025

Ted Lassos Revival Brett Goldsteins Resurrected Cat Analogy Explained

Apr 24, 2025 -

The Bold And The Beautiful February 20th Spoilers Steffy Liam And Finn

Apr 24, 2025

The Bold And The Beautiful February 20th Spoilers Steffy Liam And Finn

Apr 24, 2025