Stock Market Gains: Tariff Hopes Fuel Dow, Nasdaq, And S&P 500 Surge

Table of Contents

Tariff Hope as a Catalyst for Stock Market Gains

The current state of trade negotiations is significantly impacting investor sentiment. Positive developments, previously shrouded in uncertainty, are now driving a wave of optimism. This optimism translates directly into higher stock prices as investors become more confident about future corporate earnings and economic growth. This shift is particularly pronounced given the recent period of heightened market volatility caused by trade tensions.

- Progress in trade talks: Recent breakthroughs in negotiations between key global economies have calmed investor fears of escalating trade wars.

- Easing of trade tensions: Reports suggesting a potential de-escalation of trade disputes have greatly reduced uncertainty, leading to increased investor confidence.

- Positive statements from government officials: Reassuring comments from leading political figures have contributed to a more positive market outlook, fueling significant stock market gains.

Reduced trade uncertainty leads directly to increased investor confidence. Companies can now better forecast their future revenue streams, unaffected by the unpredictable costs associated with tariffs. This increased certainty fosters investment and stimulates economic growth. The expectation of reduced tariffs on imported goods directly impacts corporate profits, enhancing future growth expectations and driving up stock valuations.

Sector-Specific Performance and Stock Market Gains

The positive news surrounding tariffs hasn't impacted all sectors equally. Certain industries are experiencing significantly stronger stock market gains than others.

- Technology Sector: The tech sector, heavily reliant on global supply chains, has seen substantial gains as reduced tariff risks boost confidence in future growth. Companies like Apple and Microsoft have seen significant increases in their market capitalization.

- Manufacturing Sector: Companies in the manufacturing sector, particularly those involved in international trade, are experiencing a significant boost as the threat of tariffs diminishes. This sector’s performance is a strong indicator of overall economic health and its response to the easing of trade tensions.

- Import/Export Businesses: Businesses heavily reliant on imports and exports directly benefit from reduced tariffs, leading to increased profitability and positive market response.

Analyzing sector performance provides a granular view of how the overall stock market indices are responding to changes in the global trade environment. The correlation between reduced tariff uncertainty and increased profitability within specific sectors is clearly evident in the recent market surge.

Analyzing the Sustainability of Stock Market Gains

While the current surge in stock market gains is undeniably impressive, it's crucial to acknowledge potential risks that could impact the upward trend. A purely optimistic outlook ignores the complexities of the global economy.

- Unforeseen setbacks in trade negotiations: A sudden reversal in trade talks could trigger a market correction, wiping out some of the recent gains.

- Geopolitical uncertainties: Global instability and geopolitical risks could easily dampen investor enthusiasm and lead to market volatility.

- Economic slowdown in other regions: A slowdown in major global economies could negatively impact corporate earnings and subsequently affect stock prices.

Effective market analysis necessitates a comprehensive risk assessment. While the current tariff optimism is a significant positive factor, relying solely on this factor for investment decisions is unwise. A sound long-term investment strategy considers diverse factors and anticipates potential market fluctuations.

Expert Opinions on Future Stock Market Trends

Leading financial analysts offer a mixed outlook. While many are optimistic about the potential for continued growth based on the current positive momentum in trade negotiations, others caution against overconfidence. Some analysts point to potential market corrections as a likely eventuality, even if tariff issues are resolved. The prevailing sentiment suggests cautious optimism, urging investors to approach the market with a balanced perspective.

Conclusion

The recent surge in stock prices demonstrates the significant influence of tariff-related news on stock market gains. The positive developments in trade negotiations have injected a much-needed dose of optimism into the market, particularly benefitting technology and manufacturing sectors. However, it's crucial to remember that these market growth trends aren't solely determined by tariff expectations. Geopolitical factors and broader economic conditions play a critical role. To capitalize on investment opportunities, stay informed about market trends and consider consulting a financial advisor for personalized strategies tailored to your risk tolerance. While the outlook is currently positive, maintaining a balanced and cautious approach is crucial for navigating the complexities of the stock market and achieving long-term success. The future of the market will depend on a combination of factors, making informed decisions and diversification essential for mitigating risk.

Featured Posts

-

Minnesota Attorney General Sues Trump Over Transgender Sports Ban

Apr 24, 2025

Minnesota Attorney General Sues Trump Over Transgender Sports Ban

Apr 24, 2025 -

The Bold And The Beautiful Next 2 Weeks Hope Liam And Steffys Storylines

Apr 24, 2025

The Bold And The Beautiful Next 2 Weeks Hope Liam And Steffys Storylines

Apr 24, 2025 -

Transgender Sports Ban Minnesota Attorney General Files Lawsuit Against Trump

Apr 24, 2025

Transgender Sports Ban Minnesota Attorney General Files Lawsuit Against Trump

Apr 24, 2025 -

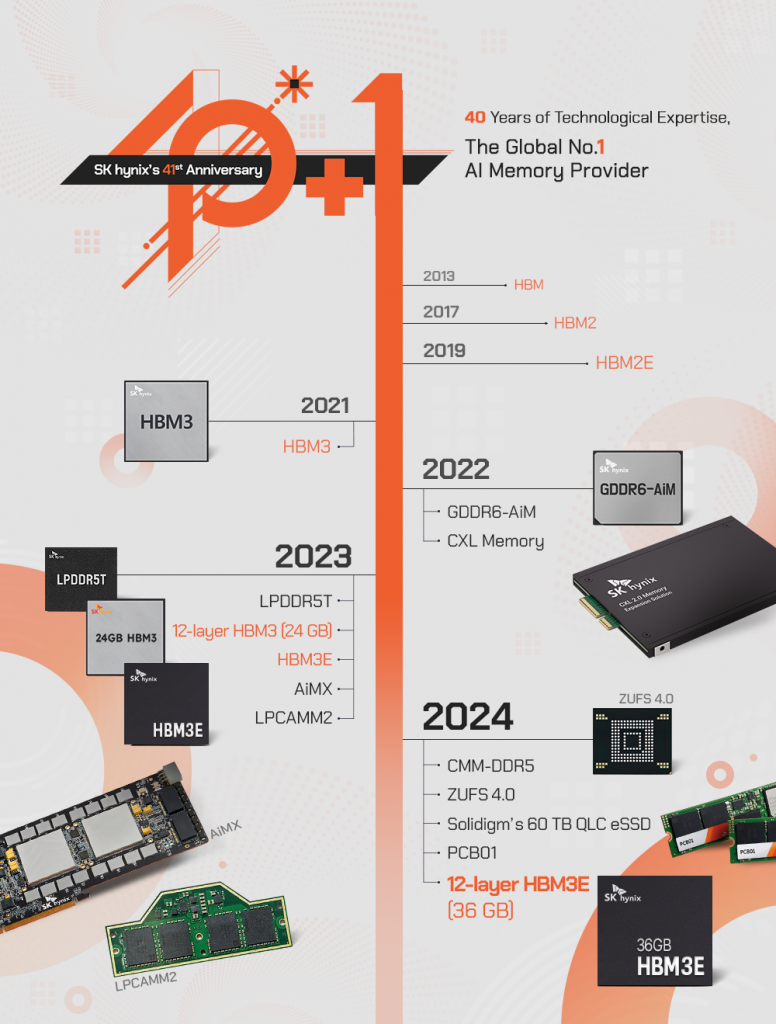

Is Sk Hynix The New Dram Leader The Role Of Artificial Intelligence

Apr 24, 2025

Is Sk Hynix The New Dram Leader The Role Of Artificial Intelligence

Apr 24, 2025 -

Bold And The Beautiful Spoilers Wednesday April 23 Finns Pledge To Liam

Apr 24, 2025

Bold And The Beautiful Spoilers Wednesday April 23 Finns Pledge To Liam

Apr 24, 2025