Stock Market Uncertainty: Investors Buy Despite Potential Losses

Table of Contents

The Long-Term Perspective

Investors often adopt a long-term outlook, viewing short-term market fluctuations as temporary setbacks. This "buy and hold" strategy recognizes that while market volatility is inevitable, historically, the stock market has shown significant growth over the long term. Short-term losses are seen as part of the overall picture, ultimately outweighed by the compounding returns achieved over decades.

- Dollar-cost averaging: This strategy mitigates risk associated with market timing by investing a fixed amount of money at regular intervals, regardless of the price. This means buying more shares when prices are low and fewer when prices are high, smoothing out the average cost per share.

- Historical Market Growth: Despite crashes and corrections, data consistently shows that the stock market has trended upward over the long term. This historical perspective fuels the confidence of long-term investors.

- Compounding Returns: The power of compounding is a key driver of long-term wealth creation. Consistent investment, even through periods of stock market uncertainty, allows for exponential growth over time.

The Search for Yield and Growth

High inflation and persistently low interest rates in savings accounts push investors toward higher-yielding assets, even amidst uncertainty. The stock market, despite its volatility, offers the potential for both capital appreciation and income generation through dividends.

- Dividend Yield: Many companies distribute a portion of their profits to shareholders as dividends, providing a steady income stream that can help mitigate the impact of market fluctuations. Dividend investing is a popular strategy for generating income and mitigating risk.

- Capital Appreciation: The primary goal for many stock investors is capital appreciation – the increase in the value of their investments over time. This potential for significant returns outweighs the risk for many, especially those with a longer time horizon.

- Alternative Investment Risks: It's important to remember that alternative investment options, such as real estate or commodities, may carry even greater risks and uncertainties than the stock market.

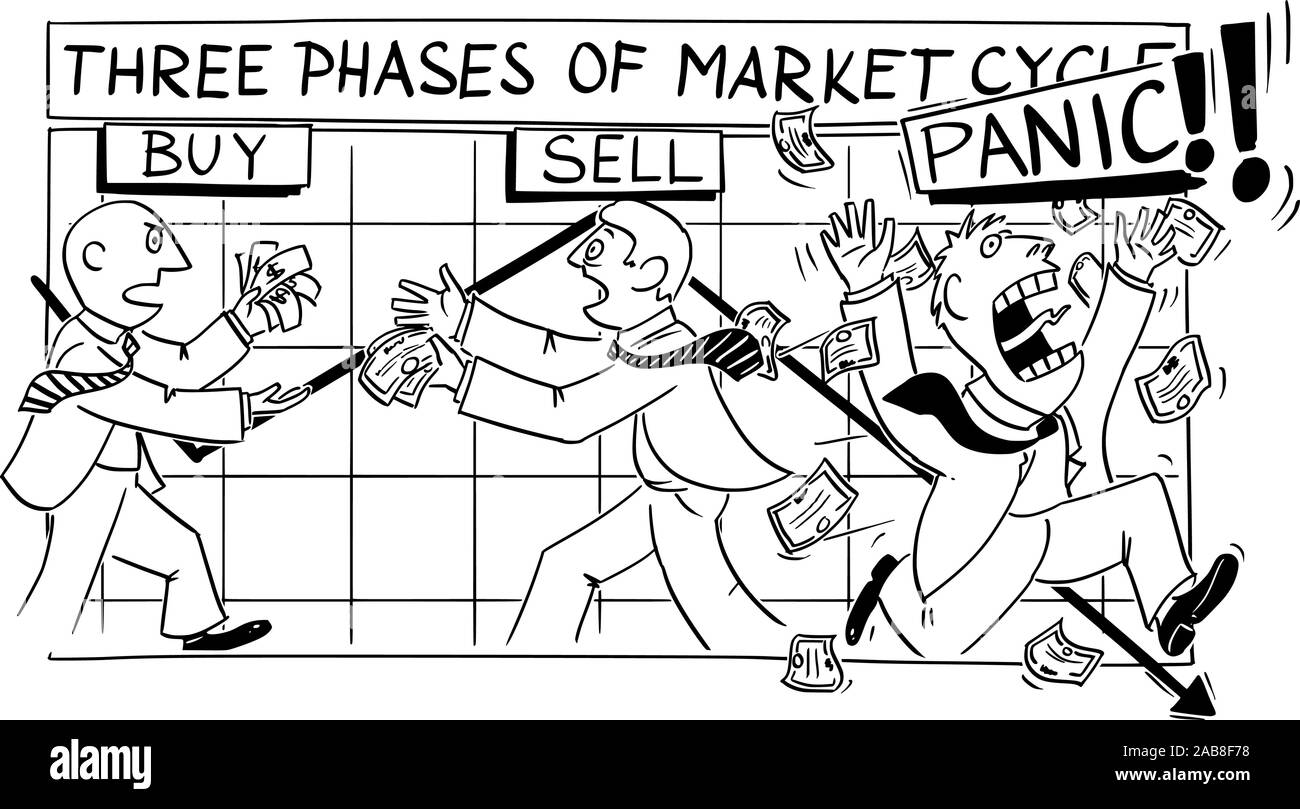

The Herd Mentality and Fear of Missing Out (FOMO)

Psychological factors play a significant role in investor behavior. The actions of others heavily influence individual decisions, often leading to herd mentality and impulsive buying decisions fueled by the fear of missing out (FOMO).

- Fear of Missing Out (FOMO): Seeing others profit from market gains can trigger FOMO, leading investors to make rash decisions without proper analysis. This emotional response can exacerbate market bubbles and contribute to volatility.

- Market Momentum and Self-Fulfilling Prophecies: Positive news and market momentum can create a self-fulfilling prophecy, driving prices higher regardless of the underlying fundamentals. This can lead to overvaluation and increased susceptibility to market corrections.

- Behavioral Finance: The field of behavioral finance studies the psychological biases that influence investor decisions, helping to explain the often irrational behavior observed in financial markets.

Diversification and Risk Management

Smart investors understand that diversification is key to mitigating the impact of stock market uncertainty. By spreading investments across different asset classes (stocks, bonds, real estate, etc.), investors can reduce their overall risk.

- Asset Allocation: Diversification involves carefully allocating your investment capital across various asset classes according to your risk tolerance and financial goals. A well-diversified portfolio is more resilient to market downturns.

- Professional Financial Advice: Working with a qualified financial advisor can help you develop a diversified portfolio that aligns with your individual risk tolerance and investment objectives. They can also provide guidance during periods of stock market uncertainty.

- Risk Tolerance: It’s crucial to assess your personal risk tolerance before making investment decisions. Your age, financial goals, and time horizon will influence how much risk you're comfortable taking.

Conclusion

Stock market uncertainty is a constant reality. However, understanding the motivations behind investor behavior—from long-term strategies to the psychological aspects of market participation—provides valuable insight. While potential losses are undeniably a factor, the pursuit of growth, the quest for yield, and the influence of herd mentality all contribute to investors' continued participation in the market, even during periods of stock market uncertainty. Careful consideration of risk tolerance, diversification, and a well-defined investment strategy are crucial for navigating this challenging environment successfully. Learn more about mitigating risks and building a resilient investment plan by researching strategies to effectively manage your exposure to stock market uncertainty.

Featured Posts

-

Trump Administration To Slash Another 1 Billion In Harvard Funding Amidst Growing Tensions

Apr 22, 2025

Trump Administration To Slash Another 1 Billion In Harvard Funding Amidst Growing Tensions

Apr 22, 2025 -

Joint Nordic Defense The Role Of Sweden And Finlands Military Assets

Apr 22, 2025

Joint Nordic Defense The Role Of Sweden And Finlands Military Assets

Apr 22, 2025 -

Pan Nordic Military Cooperation Examining The Potential Of A Combined Force

Apr 22, 2025

Pan Nordic Military Cooperation Examining The Potential Of A Combined Force

Apr 22, 2025 -

Car Dealers Renew Opposition To Ev Mandates Industry Fights Back

Apr 22, 2025

Car Dealers Renew Opposition To Ev Mandates Industry Fights Back

Apr 22, 2025 -

Office365 Data Breach Leads To Multi Million Dollar Theft

Apr 22, 2025

Office365 Data Breach Leads To Multi Million Dollar Theft

Apr 22, 2025