Stock Market Update: Dow Futures, China's Economic Measures, And Tariff Impacts

Table of Contents

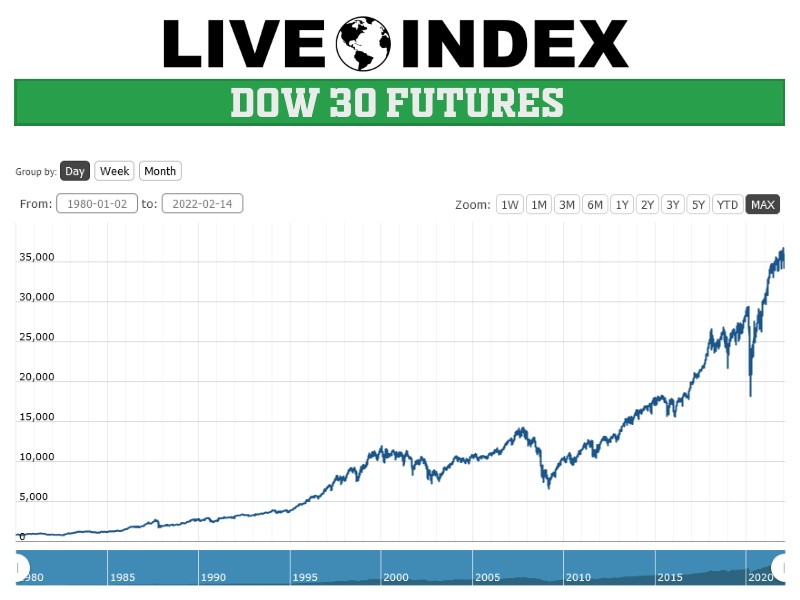

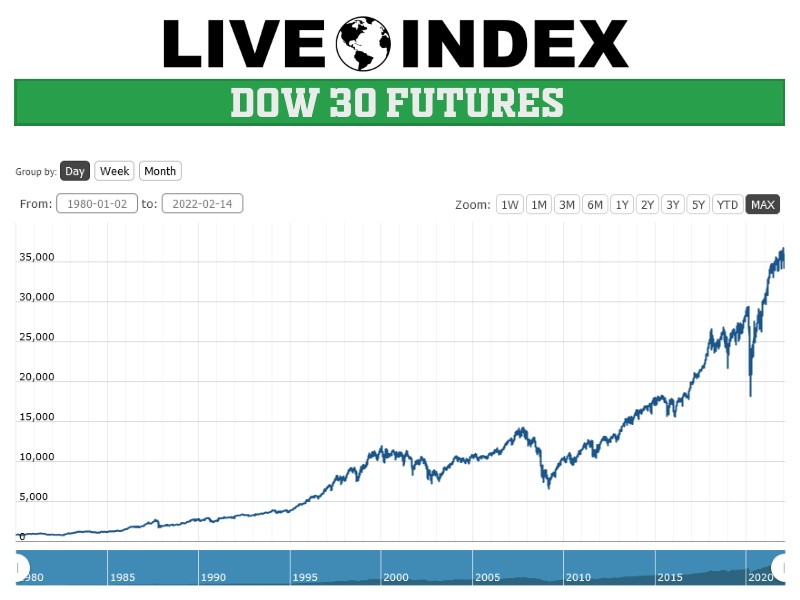

Dow Futures: A Leading Indicator of Market Sentiment

Dow futures are contracts that obligate the buyer to purchase the Dow Jones Industrial Average at a specific price on a future date. They serve as a powerful leading indicator of market sentiment, often providing insights into the anticipated direction of the broader stock market before the actual opening bell. Recent Dow futures trends have shown a degree of volatility, reflecting uncertainty about the economic outlook. While we've seen periods of optimism reflected in upward trends, concerns about inflation and potential economic slowdown have led to periods of bearish sentiment and downward pressure.

Analyzing recent Dow futures trends requires considering several influencing factors:

- Economic data releases: Stronger-than-expected economic data, such as positive GDP growth or robust employment figures, typically boosts Dow futures, indicating bullish sentiment. Conversely, weak economic data can trigger declines.

- Geopolitical events: International conflicts, political instability, and unexpected global events can significantly impact investor confidence and Dow futures prices.

- Corporate earnings reports: Strong corporate earnings reports generally support positive market sentiment, while disappointing results can lead to downward pressure on Dow futures.

Recent Dow futures performance: Over the past week, we’ve witnessed a mixed bag, with initial optimism giving way to concerns about inflation and interest rate hikes.

Key factors driving Dow futures: Inflationary pressures and the Federal Reserve's monetary policy remain central drivers.

Potential impact on the broader market: The volatility in Dow futures is likely to continue impacting the broader market, creating uncertainty for investors.

China's Economic Measures and Their Global Impact

China's recent economic measures, aimed at stimulating growth and addressing challenges in the property sector, have significant implications for the global economy and the US stock market. These measures include targeted stimulus packages, adjustments to interest rates, and efforts to support infrastructure spending. These actions aim to counter slowing growth and bolster investor confidence. However, the effectiveness and the extent of their global impact remain uncertain.

The interconnectedness between the Chinese economy and the US stock market is undeniable. China is a major player in global trade, and its economic performance directly influences supply chains, commodity prices, and overall global growth. Any significant slowdown or instability in the Chinese economy will have ripple effects across global markets.

- Key economic measures taken by China: These include infrastructure investments, tax cuts, and monetary easing measures.

- Impact on Chinese growth and global markets: The immediate impact is yet to be fully ascertained, but it's anticipated to influence global commodity prices and manufacturing output.

- Implications for US-China trade relations: These economic measures could influence the ongoing trade discussions and overall diplomatic relations between the two nations.

The Lingering Impact of Tariffs on Global Trade and Investment

The impact of tariffs on global trade and investment continues to be felt across various sectors. These tariffs, particularly those imposed as part of previous trade disputes, have led to increased costs for businesses, impacting supply chains and consumer prices. Industries heavily reliant on imported goods or exporting products have been disproportionately affected.

The inflationary pressures caused by tariffs are a major concern for investors. Higher costs for businesses translate to higher prices for consumers, reducing purchasing power and potentially slowing economic growth. Supply chain disruptions also increase uncertainty and complicate investment decisions.

- Specific sectors most affected by tariffs: Manufacturing, agriculture, and technology have been significantly impacted.

- Inflationary pressures caused by tariffs: These have added to the existing inflationary pressures and contributed to the overall economic volatility.

- Strategies for navigating tariff-related uncertainty: Diversification, hedging strategies, and careful analysis of industry-specific risks can help investors mitigate the impact of tariffs.

Conclusion: Navigating the Stock Market with Informed Decisions

This stock market update reveals a complex interplay between Dow futures, China's economic policies, and the lingering impact of tariffs. These factors are interconnected and create significant uncertainty for investors. The volatility in Dow futures reflects concerns about inflation, interest rate hikes, and global economic growth, while China's economic measures aim to mitigate slowing growth. The effects of tariffs continue to ripple through global supply chains and contribute to inflationary pressures.

To navigate this dynamic market environment effectively, it's crucial to stay informed about the latest stock market updates, carefully analyze Dow futures trends, monitor China's economic measures, and thoroughly understand the implications of tariff impacts on your investment strategies. Consider seeking professional financial advice to make informed decisions that align with your risk tolerance and financial goals. A well-informed approach to investing is key to mitigating risks and maximizing opportunities in this ever-evolving market landscape.

Featured Posts

-

Getting My Hands On A Switch 2 The Game Stop Method

Apr 26, 2025

Getting My Hands On A Switch 2 The Game Stop Method

Apr 26, 2025 -

Pandemic Fraud Lab Owner Pleads Guilty To Faking Covid Test Results

Apr 26, 2025

Pandemic Fraud Lab Owner Pleads Guilty To Faking Covid Test Results

Apr 26, 2025 -

The Rise Of Chinese Vehicles A Competitive Analysis

Apr 26, 2025

The Rise Of Chinese Vehicles A Competitive Analysis

Apr 26, 2025 -

Discover 7 Exciting Restaurants In Orlando Beyond The Theme Parks 2025

Apr 26, 2025

Discover 7 Exciting Restaurants In Orlando Beyond The Theme Parks 2025

Apr 26, 2025 -

The Ripple Effect A Rural School 2700 Miles From Dc And Trumps Presidency

Apr 26, 2025

The Ripple Effect A Rural School 2700 Miles From Dc And Trumps Presidency

Apr 26, 2025