Stock Market Valuation Concerns: BofA Offers A Balanced View

Table of Contents

BofA's Concerns Regarding Current Stock Market Valuation

BofA's assessment of the current market highlights several key valuation concerns that investors should carefully consider. These concerns, while significant, don't necessarily paint a wholly negative picture, as we'll explore further.

High Price-to-Earnings Ratios (P/E):

BofA highlights elevated Price-to-Earnings (P/E) ratios across various sectors as a primary stock market valuation concern. These ratios suggest that stocks might be overpriced relative to their earnings.

-

What are P/E ratios and how are they calculated? The P/E ratio is calculated by dividing a company's stock price by its earnings per share (EPS). A high P/E ratio generally suggests that investors are willing to pay a premium for each dollar of earnings, potentially indicating high growth expectations or overvaluation.

-

Examples of sectors with particularly high P/E ratios: While specific data from BofA's report may vary depending on the publication date, sectors like technology and consumer discretionary often show higher P/E ratios compared to more cyclical sectors. These higher ratios reflect investor optimism about future growth in these sectors. However, this optimism needs to be tempered with a realistic assessment of future earnings potential.

-

Risks associated with high P/E ratios: High P/E ratios make stocks vulnerable. Interest rate hikes increase borrowing costs for companies, potentially impacting future earnings. Economic downturns can significantly reduce earnings, making highly valued stocks more susceptible to price drops. This sensitivity to economic fluctuations is a crucial aspect of stock market valuation analysis.

The Role of Interest Rates:

Rising interest rates significantly impact stock market valuation. They increase borrowing costs for companies, reducing profitability and potentially hindering future growth. Furthermore, higher rates make bonds a more attractive investment, diverting capital away from stocks.

-

How interest rate hikes affect company profitability and investor sentiment: Higher interest rates increase the cost of debt for businesses, reducing profit margins. This can lead to decreased investment and slower economic growth, impacting investor confidence and stock prices.

-

Potential impact on future earnings growth and its effect on P/E ratios: Reduced profitability due to higher interest rates can directly lower future earnings growth. This negatively impacts P/E ratios, potentially leading to a downward correction in stock prices as valuations become less attractive.

-

BofA's interest rate projections and their influence on valuation assessments: BofA's outlook on future interest rates directly informs their stock market valuation models. If they predict continued rate hikes, it will likely lead to a more conservative assessment of future earnings and overall valuations.

Inflation's Impact on Stock Market Valuation:

Persistent inflation erodes the purchasing power of future earnings, impacting the present value of future cash flows, a critical factor in stock market valuation models.

-

How inflation affects discounted cash flow models: Inflation reduces the real value of future earnings, making them less attractive to investors. Discounted cash flow (DCF) models, commonly used for valuation, directly incorporate inflation rates to adjust for this effect.

-

BofA's inflation forecasts and their impact on valuation models: BofA's inflation projections significantly influence their valuation models. Higher inflation forecasts lead to lower present values of future cash flows, resulting in lower valuations for stocks.

-

Inflation's effect on investor expectations and risk premiums: Higher inflation increases uncertainty and risk, leading investors to demand higher risk premiums. This can further depress valuations, especially for companies with high future earnings expectations.

BofA's Balanced Perspective and Potential Opportunities

While BofA acknowledges the valuation concerns, their analysis isn't entirely pessimistic. They suggest that a balanced approach is necessary, considering both risks and potential opportunities.

Identifying Undervalued Sectors:

Despite overall valuation concerns, BofA might identify specific sectors or individual stocks that they believe are undervalued relative to their fundamentals.

-

Specific sectors identified as potentially undervalued (example): BofA may point to sectors with strong fundamentals but lagging stock performance due to market sentiment. These could include sectors that are less sensitive to interest rate changes or those with strong long-term growth potential.

-

Rationale behind BofA's assessment: The rationale would be based on fundamental analysis, considering factors like earnings growth, cash flow generation, and competitive positioning. Companies with robust fundamentals may offer attractive entry points despite overall market concerns.

-

Potential risks and rewards: Investing in undervalued sectors carries both risks and rewards. While potential returns can be higher, there's a risk that the undervaluation may persist or even worsen depending on broader market conditions.

Long-Term Growth Potential:

BofA might acknowledge the long-term growth potential of the market, suggesting that current valuations may be justified given future prospects.

-

BofA's view on long-term economic growth: Their long-term growth projections play a crucial role in their valuation assessment. A positive long-term outlook might support current valuations, particularly for growth stocks.

-

How the long-term outlook influences valuation assessments: A positive long-term outlook can offset some concerns about current high valuations, justifying premium valuations if future earnings justify them.

-

Implications for long-term investors: Long-term investors might be less concerned with short-term fluctuations and more focused on the long-term growth potential. This perspective can help mitigate concerns about current elevated stock market valuation metrics.

Strategic Investment Approaches:

BofA might recommend specific strategies to navigate the current market, such as diversification or focusing on value stocks.

-

Strategies recommended by BofA: This could include diversifying across different asset classes, sectors, and geographies to reduce overall portfolio risk. Focusing on value stocks—companies trading below their intrinsic value—could be another recommended strategy.

-

Reasoning behind the strategies: Diversification reduces the impact of any single investment underperforming. Value investing aims to capitalize on market mispricings, potentially generating higher returns in the long run.

-

Potential benefits and risks of each approach: Diversification reduces risk but may limit potential returns. Value investing can offer higher returns but requires thorough fundamental analysis and patience.

Conclusion

BofA's analysis of current stock market valuation presents a balanced view, acknowledging legitimate concerns while also highlighting potential opportunities. While elevated P/E ratios and the impact of rising interest rates and inflation warrant caution, a long-term perspective and strategic investment approaches can help investors navigate this complex landscape. Understanding the nuances of these factors, as highlighted by BofA’s insights on stock market valuation, is crucial for making informed investment decisions. To stay updated on the latest market analyses and minimize your stock market valuation concerns, regularly review reputable financial sources and consider consulting a financial advisor.

Featured Posts

-

Microsoft Activision Deal Ftcs Appeal And Its Potential Impact

Apr 24, 2025

Microsoft Activision Deal Ftcs Appeal And Its Potential Impact

Apr 24, 2025 -

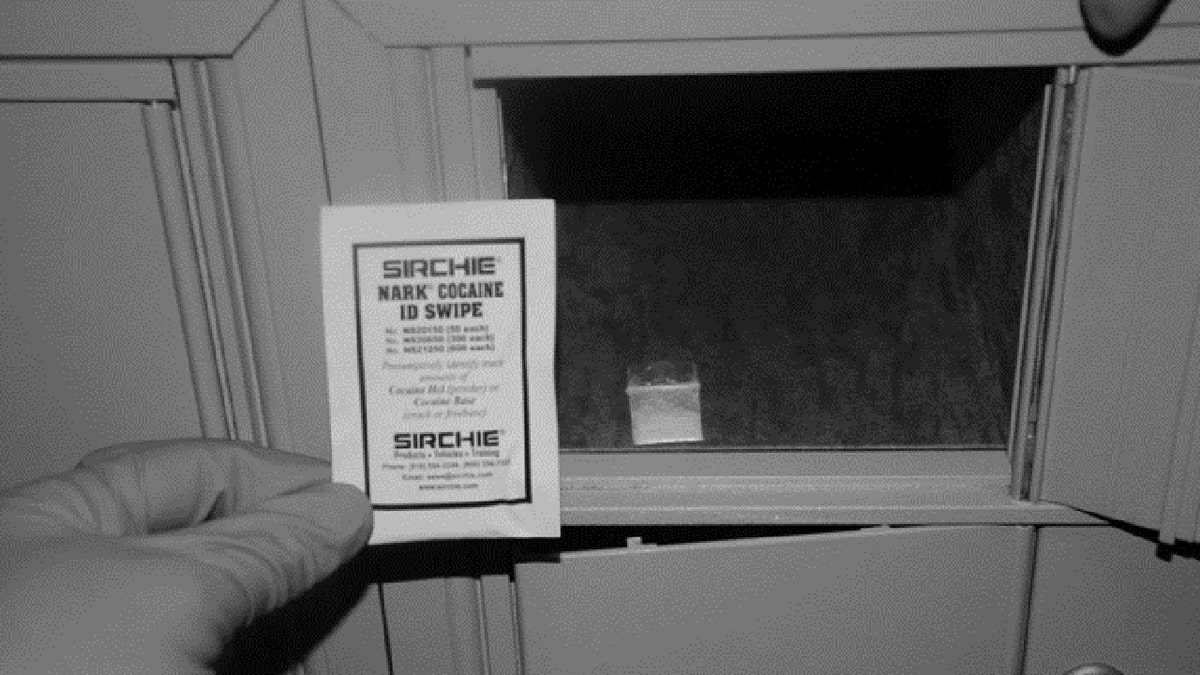

Cocaine Found At White House Secret Service Announces End Of Investigation

Apr 24, 2025

Cocaine Found At White House Secret Service Announces End Of Investigation

Apr 24, 2025 -

Understanding The India Market Rally Factors Driving Niftys Growth

Apr 24, 2025

Understanding The India Market Rally Factors Driving Niftys Growth

Apr 24, 2025 -

The Zuckerberg Trump Dynamic Implications For Social Media And Beyond

Apr 24, 2025

The Zuckerberg Trump Dynamic Implications For Social Media And Beyond

Apr 24, 2025 -

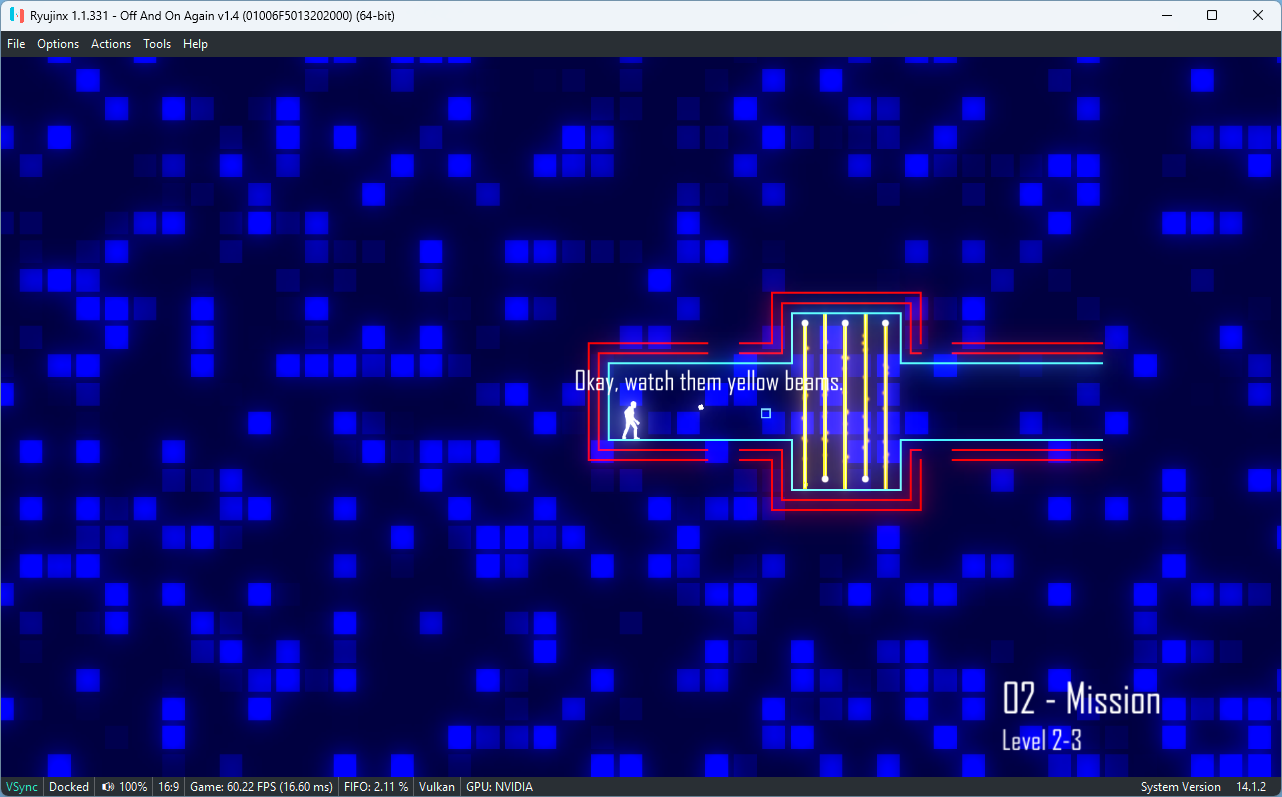

Nintendos Action Forces Ryujinx Emulator To Cease Development

Apr 24, 2025

Nintendos Action Forces Ryujinx Emulator To Cease Development

Apr 24, 2025