Tech Giants Boost US Stocks: Tesla Leads The Charge

Table of Contents

Tesla's Impact on the US Stock Market:

Tesla's recent achievements have been nothing short of extraordinary. Record-breaking earnings in Q3 2023, substantially exceeding analyst expectations, have sent a powerful signal to investors. The company's optimistic outlook for future production and sales, fueled by the anticipated launch of the Cybertruck and continued strong demand for its existing electric vehicles (EVs), further strengthens investor confidence. This success isn't isolated; it's also significantly impacted the broader EV sector.

- Record-breaking Earnings and Positive Investor Sentiment: Strong Q3 2023 earnings, exceeding analyst expectations; positive outlook for future production and sales; increased demand for electric vehicles; successful launch of new product features.

- Tesla's Influence on the broader EV sector: Increased competition and innovation spurred by Tesla's success; substantial investment in EV infrastructure; growing consumer adoption of electric vehicles; supportive government policies accelerating EV adoption.

Other Tech Giants Contributing to Market Growth:

While Tesla's influence is undeniable, other tech behemoths have also contributed substantially to the market's upward trajectory. Their consistent performance and market dominance are key factors driving this growth.

- Apple's Consistent Performance and Market Dominance: Strong iPhone sales and services revenue; growth in wearables and other product lines; expansion into new markets; continuous innovation in software and services. Apple's stock price consistently reflects its strong financial position and market leadership.

- Microsoft's Cloud Computing Success and Enterprise Solutions: Dominance in the cloud computing market (Azure); strong growth in enterprise software and services; expansion into new AI technologies; positive ripple effect on related tech stocks. Microsoft's strategic moves in AI and cloud continue to drive its market value.

- Google's Ad Revenue and Diversification: Strong growth in digital advertising; expanding presence in AI and cloud computing; success in various other segments like YouTube; innovative services boosting investor confidence. Google’s diverse revenue streams make it a resilient player in the tech sector.

- Meta's (Facebook) Rebound and Future Growth Prospects: Recent positive developments in user engagement and advertising revenue; renewed focus on metaverse technologies; growth strategies and potential for future revenue increases; addressing past challenges and investor concerns. Meta's strategic shift is being closely watched by investors.

Factors Contributing to the Overall Market Uptick:

The surge in US stock prices isn't solely driven by the tech sector. Favorable economic indicators have played a significant role in creating this positive market environment.

- Positive Economic Indicators: Stronger-than-expected GDP growth; decreasing inflation rates; improved consumer confidence; positive job market data. These economic fundamentals provide a solid foundation for market growth.

- Investor Confidence and Market Sentiment: Increased investor appetite for risk; positive outlook on future economic growth; influence of media narratives and expert opinions. A positive market sentiment is self-reinforcing and contributes to upward momentum.

Conclusion:

The recent rise in US stock prices is intrinsically linked to the outstanding performance of tech giants, with Tesla’s contribution being particularly noteworthy. Strong earnings, positive economic data, and optimistic investor sentiment have converged to create a robust market environment. This presents compelling investment opportunities. To leverage the growth potential within the tech sector, thorough research into these leading companies is essential. Consider diversifying your portfolio to include strategically selected tech stocks to benefit from this upward trend. The influence of these tech giants on US stock market performance is undeniable, and understanding this dynamic is key to crafting successful investment strategies. Start exploring investment opportunities in the tech sector today.

Featured Posts

-

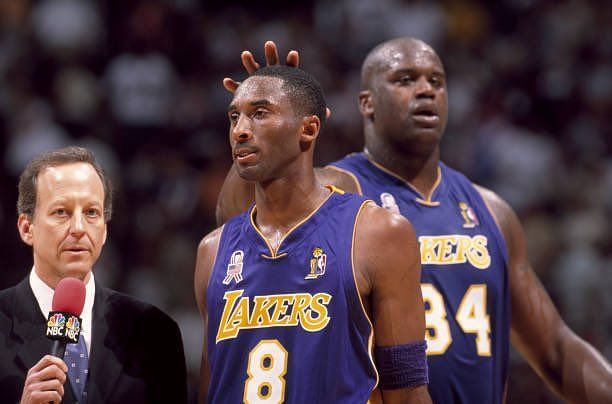

The Latest Richard Jefferson Shaquille O Neal Feud A Breakdown

Apr 28, 2025

The Latest Richard Jefferson Shaquille O Neal Feud A Breakdown

Apr 28, 2025 -

Oppo Find X8 Ultra

Apr 28, 2025

Oppo Find X8 Ultra

Apr 28, 2025 -

Richard Jefferson And Shaquille O Neal A Recent Exchange Explained

Apr 28, 2025

Richard Jefferson And Shaquille O Neal A Recent Exchange Explained

Apr 28, 2025 -

Le Bron James Addresses Richard Jeffersons Espn Interview

Apr 28, 2025

Le Bron James Addresses Richard Jeffersons Espn Interview

Apr 28, 2025 -

The Mets Rotation A Key Pitchers Ascent

Apr 28, 2025

The Mets Rotation A Key Pitchers Ascent

Apr 28, 2025